In an evaluation shared on X, Kelly Greer, Vice President of Buying and selling at Galaxy Digital, presents a compelling argument for why the Bitcoin value may surge to as excessive as $118,000 by the top of the 12 months. Greer’s insights are grounded in a mix of historic efficiency knowledge, present market dynamics, and broader macroeconomic elements, all of which she believes are aligning to create a extremely favorable surroundings for Bitcoin.

Right here’s Why Bitcoin Might Skyrocket To $118,000

Greer begins by highlighting Bitcoin’s sturdy historic efficiency within the fourth quarter (This autumn) of earlier years. She identified that since 2020, Bitcoin’s common This autumn return to its intra-quarter excessive watermark has been roughly 85%. This determine features a best-case state of affairs the place the return reached a staggering 230%, and a worst-case state of affairs with a 12% decline.

“BTC common This autumn return (to max [intra quarter high watermark, full q return]) since 2020 is +85% (worst -12%, greatest +230%)—press you to discover a stronger asymmetry,” Greer writes. This statistical asymmetry suggests a big potential upside in comparison with the draw back, making This autumn traditionally a interval of strong progress for Bitcoin.

Associated Studying

A merely common This autumn with a value improve of 85% may imply a year-end value of $118,000 for Bitcoin. If the BTC outperforms its file of 230%, the value may even rise effectively above $200,000.

Notably, Greer believes that the present market shouldn’t be totally positioned to benefit from this potential. She attributes this underallocation to a couple key elements. Firstly, there’s apprehension surrounding the upcoming US presidential election scheduled for November 5. Secondly, different belongings equivalent to gold and China’s A-shares are attracting vital consideration and capital, doubtlessly diverting funding away from Bitcoin.

“I nonetheless don’t suppose the market is allotted accordingly—2024 is a novel case the place some portion of the market is underindexing on the This autumn asymmetry attributable to a) Nov 5 US election threat and/or b) different belongings are screaming (gold, China A-shares and so forth.),” Greer remarks.

Key Causes To Be Bullish On BTC

To help her evaluation of the market’s present positioning, Greer cites her interactions with threat managers and famous particular market indicators. She talked about observing “low volatility and contained perp funding,” which means that merchants usually are not aggressively betting on vital value actions.

Past these market dynamics, Greer identifies a number of macroeconomic and industry-specific elements that she believes are making a “broadly very constructive” backdrop for Bitcoin. One vital level is the presence of world stimulus measures in main economies equivalent to the USA and China, excluding Japan.

Greer additionally highlights that BNY Mellon, the world’s largest custodian financial institution, obtained a SAB 121 exemption. This exemption permits the financial institution to supply custody companies for Bitcoin with out the stringent capital necessities that beforehand made such companies much less engaging. Greer describes this growth as “large and underappreciated,” noting that it’ll “loosen financing in our {industry} considerably.”

Associated Studying

Moreover, Greer factors out that ETF flows have turn out to be “very constructive.” Over the previous few days, spot BTC inflows have reaccelerated massively. Final Friday, internet flows have been $494.8 million, making it the best internet influx day of the quarter and the best internet influx day since June 4th.

One other constructive indicator is that Bitcoin miners are coming into agreements with hyperscalers—large-scale cloud service suppliers. These partnerships can improve mining effectivity and scale back operational prices.

Greer additionally mentions that “provide overhangs [are] principally carried out,” suggesting that giant sell-offs that would suppress the value are unlikely within the close to time period. Moreover, she anticipates that “demand from FTX money distros [is] across the nook,” implying that funds distributed from the FTX change may discover their means into Bitcoin investments, additional boosting demand.

Nonetheless, Greer additionally acknowledges potential dangers that would affect Bitcoin’s trajectory. These embrace alerts from the Federal Reserve concerning financial coverage and the opportunity of a pullback in fairness markets. Such occasions may introduce volatility or dampen investor enthusiasm.

Nonetheless, she believes that the general sentiment stays constructive. “There are dangers in fact—Fed signaling, equities pullback, what have you ever—however internet internet vibes are fairly good, and flows are simply getting began,” she remarks.

Greer additionally describes Bitcoin as a “reflexive asset.” She explains, “BTC is the last word reflexive asset: value -> flows -> value.” Because of this as the value of Bitcoin will increase, it attracts extra funding flows, which in flip push the value even larger—a self-reinforcing cycle.

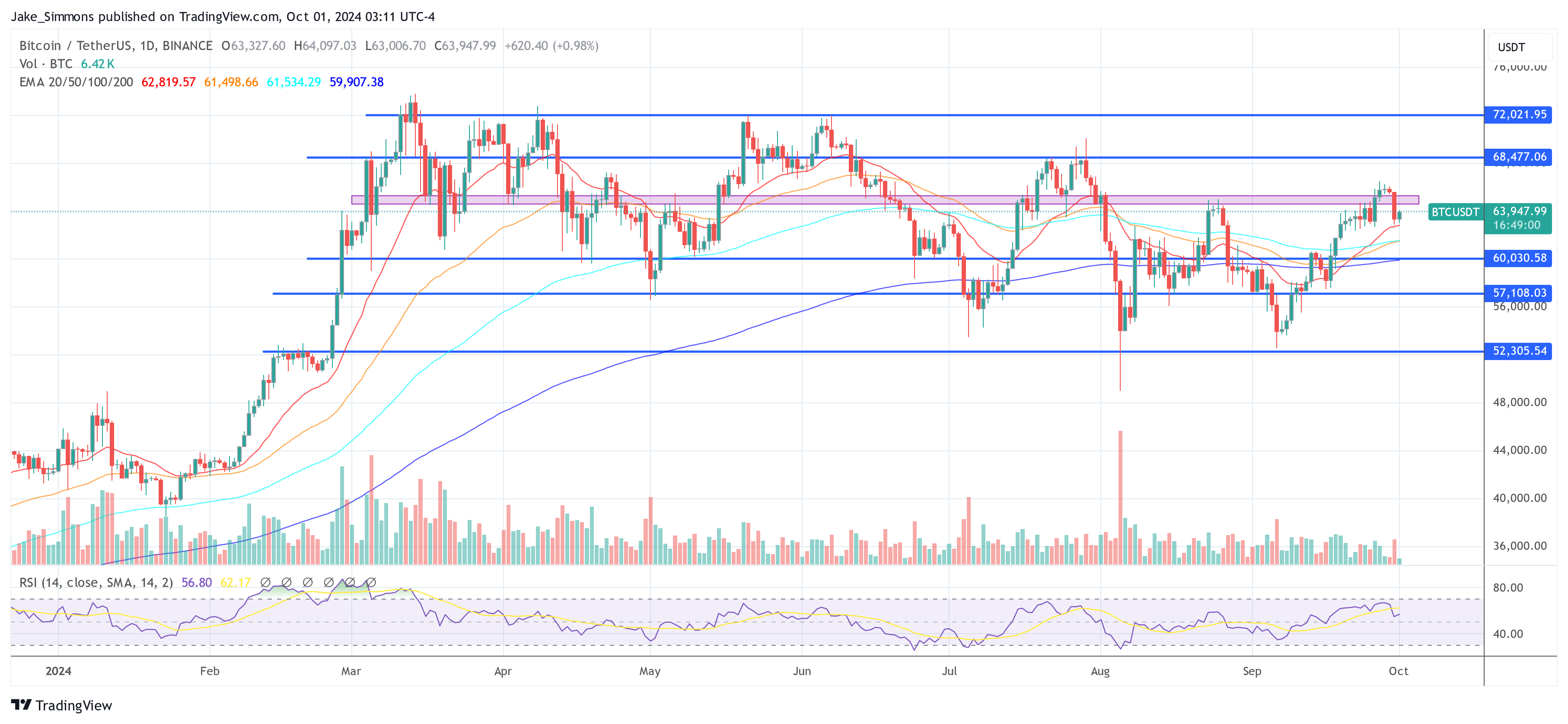

Greer notes that Bitcoin is coming into This autumn after breaking a key value degree at $65,000. If the value have been to reclaim the $70,000 mark, she expects that the inflows would speed up as traders reply to the constructive momentum and recall the sturdy This autumn performances of earlier years.

At press time, BTC traded at $63,947.

Featured picture created with DALL.E, chart from TradingView.com