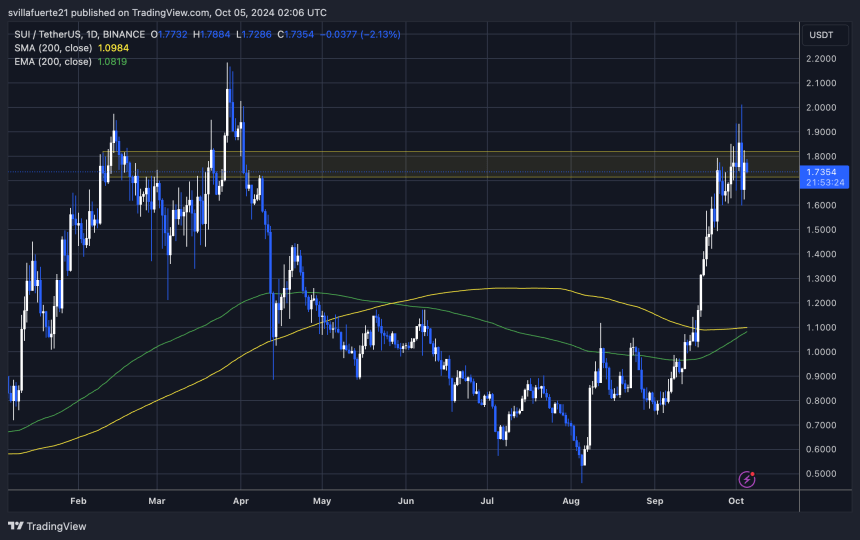

SUI is presently testing a vital provide zone following a large 95% surge triggered by the Federal Reserve’s latest rate of interest minimize announcement. The explosive rally, pushed by important shopping for strain, has led to unstable value motion, elevating questions on whether or not this upward momentum could be sustained.

As SUI hovers close to its present highs, market hypothesis is rising round the potential of a correction to decrease demand ranges, with $1.40 being the important thing goal.

Associated Studying

Key information from Coinglass reveals a decline in market demand, signaling a possible slowdown in shopping for exercise. This has left some traders on edge, as they anticipate a value drop within the coming days. The sudden surge has fueled each optimism and warning as merchants weigh the potential for continued good points in opposition to the danger of a pointy reversal.

With SUI now at a important juncture, the following few days can be pivotal in figuring out whether or not the bullish development can proceed or if the market will retrace to extra secure demand ranges. Traders are watching carefully, prepared to regulate their methods based mostly on the unfolding value motion.

SUI Funding Price Alerts Worth Drop

SUI is at a important level after days of maximum value motion and important good points. Following its spectacular 95% rally for the reason that Federal Reserve’s rate of interest minimize announcement, some traders and merchants are starting to take income, signaling a possible shift in market sentiment. Many now view a correction to $1.40 as inevitable, particularly as shopping for strain cools down.

Key information from Coinglass suggests a cooling demand, with the funding charge turning destructive to -0.067, marking a yearly low. The funding charge is a key indicator in futures buying and selling, representing the periodic cost between merchants in lengthy positions (betting on value will increase) and people in brief positions (betting on value declines).

When an asset’s funding charge turns destructive, it signifies that extra merchants are opening quick positions, anticipating a drop in value. This shift displays rising warning out there as merchants begin positioning themselves for a possible downturn.

Associated Studying

With the funding charge at such a low and demand waning, the market is displaying indicators of cooling off after SUI’s explosive September rally. In consequence, traders and merchants are actually patiently ready for a correction to decrease demand ranges round $1.40, which might current new shopping for alternatives or sign additional declines relying on the broader market circumstances.

Key Ranges To Watch

SUI is presently buying and selling at $1.73 after experiencing days of unstable value motion. The value surged however halted on the essential $2 resistance degree and has since entered a consolidation part slightly below it. This key degree has turn into a barrier for bulls, and a push above $2 is critical for SUI to regain momentum and make sure a bullish development.

Nevertheless, the market stays unsure, and if the worth fails to carry the $1.60 help degree, a deeper correction might observe. Analysts predict {that a} break beneath $1.60 could result in a 20% drop, bringing SUI all the way down to the $1.40 demand zone. This degree is being carefully monitored by traders and merchants as a important help to forestall additional draw back strain.

Associated Studying

Because the market fluctuates, SUI’s value motion stays in a fragile steadiness between potential restoration and additional correction. The following strikes round these key ranges will possible decide whether or not bulls regain management or if bears proceed to push costs decrease within the coming days.

Featured picture from Dall-E, chart from TradingView