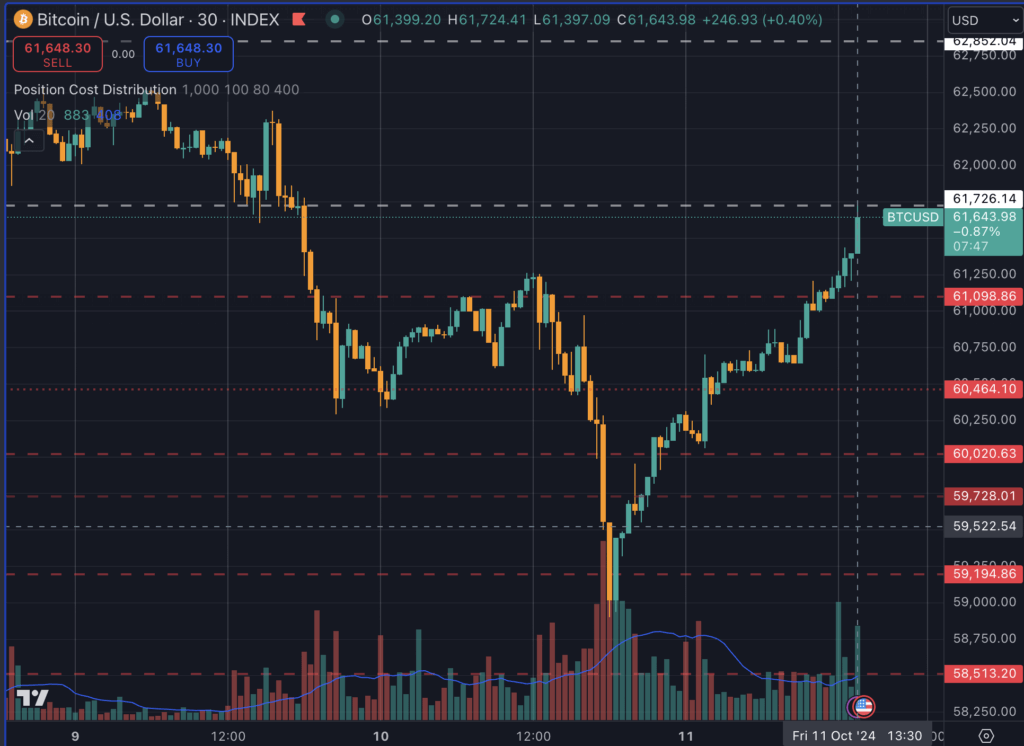

Bitcoin briefly fell beneath $59,000 final evening earlier than rebounding to reclaim the essential $61,000 degree in a speedy V-shaped restoration. Historic knowledge signifies that comparable swift recoveries on a 30-minute decision have persistently led to both greater good points or sideways buying and selling, with few situations of additional declines.

Final week, Bitcoin dropped from $62,000 to round $61,000 earlier than shortly rebounding and buying and selling above $61,000 for a number of days, ultimately reaching $62,800.

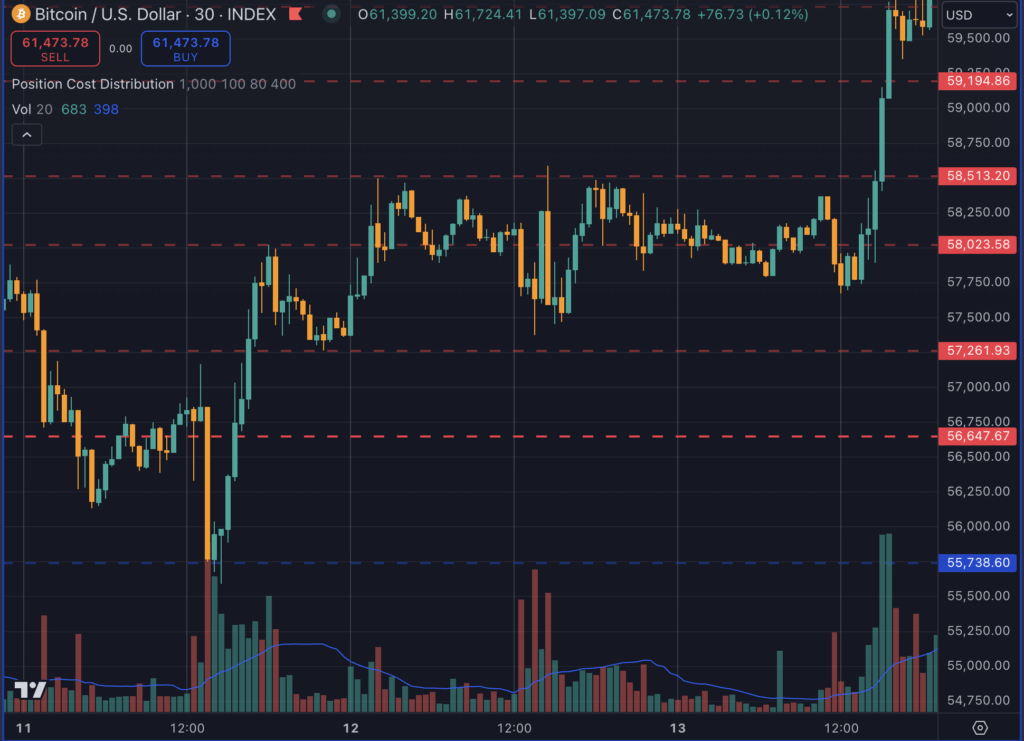

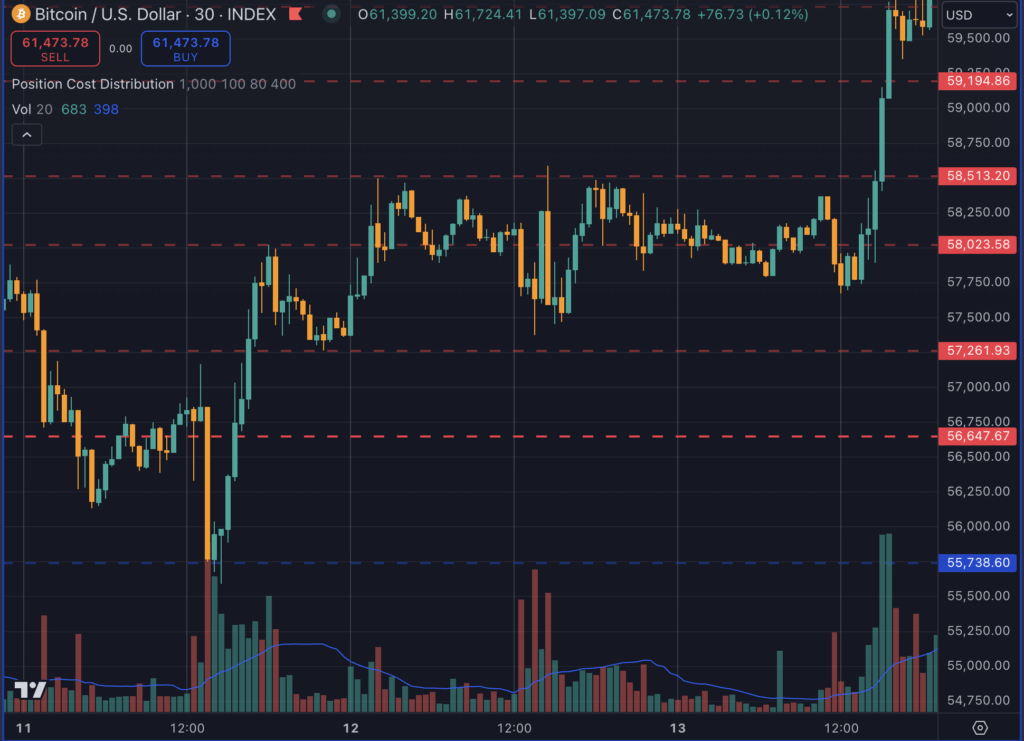

In late September, after an identical drop to $63,800, Bitcoin fashioned a V-shaped restoration, surging to $65,400.

Earlier that month, on Sept. 11, Bitcoin fell from $56,600 to $55,700, solely to get well inside two hours and regain its place close to $60,000 over the next two days.

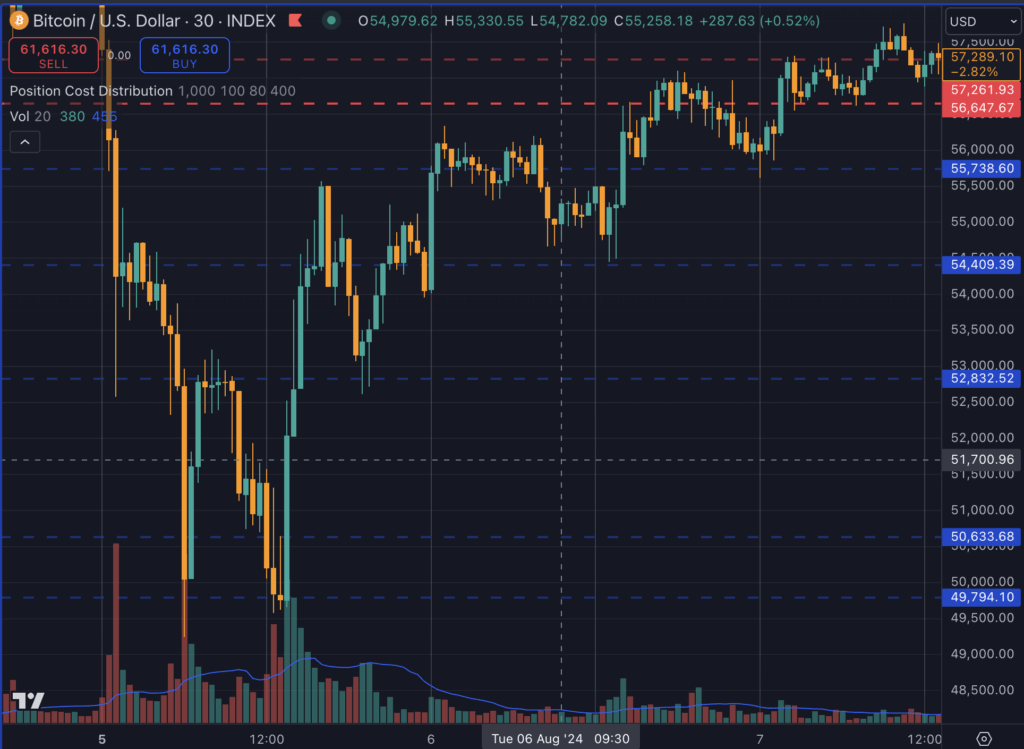

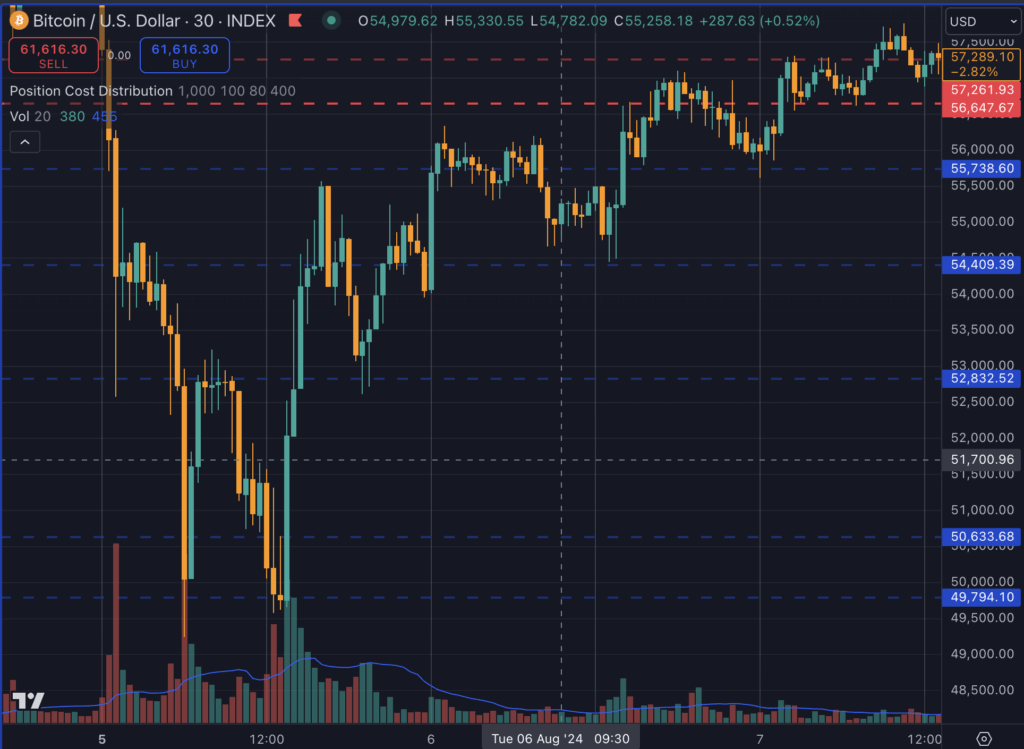

This sample will also be traced again to August, when Bitcoin skilled a major drop from $52,800 to $49,700 on Aug. 5. A V-shaped restoration that afternoon pushed it again to $54,000, with momentum persevering with over the following two days, driving the worth as much as $58,000.

Right now’s dip beneath $59,000, adopted by a possible retest of the $61,700 resistance degree, suggests Bitcoin is as soon as once more following this acquainted sample of speedy restoration and upward motion, reinforcing the importance of those sharp rebounds in signaling future worth motion.

Whereas previous efficiency is just not indicative of future outcomes, the recurring nature of those recoveries indicators potential stability or bullish momentum following such sharp dips. Monitoring Bitcoin’s habits inside this timeframe could present insights into potential market actions within the coming days.

This sample has been noticed since at the least June of this yr, suggesting that the 30-minute decision is a key indicator for assessing Bitcoin’s short-term market strikes, particularly after the launch of Bitcoin spot ETFs.

This knowledge reinforces the concept buyers ought to stay attentive to short-term patterns, notably on decrease timeframes, to gauge Bitcoin’s near-term trajectory.