Funds cuts adopted rate of interest hikes in 2022. By late 2023, greater than a yr of monetary scrutiny had challenged many publicly traded software program firms.

Nonetheless, 2024 has been a tricky yr once more.

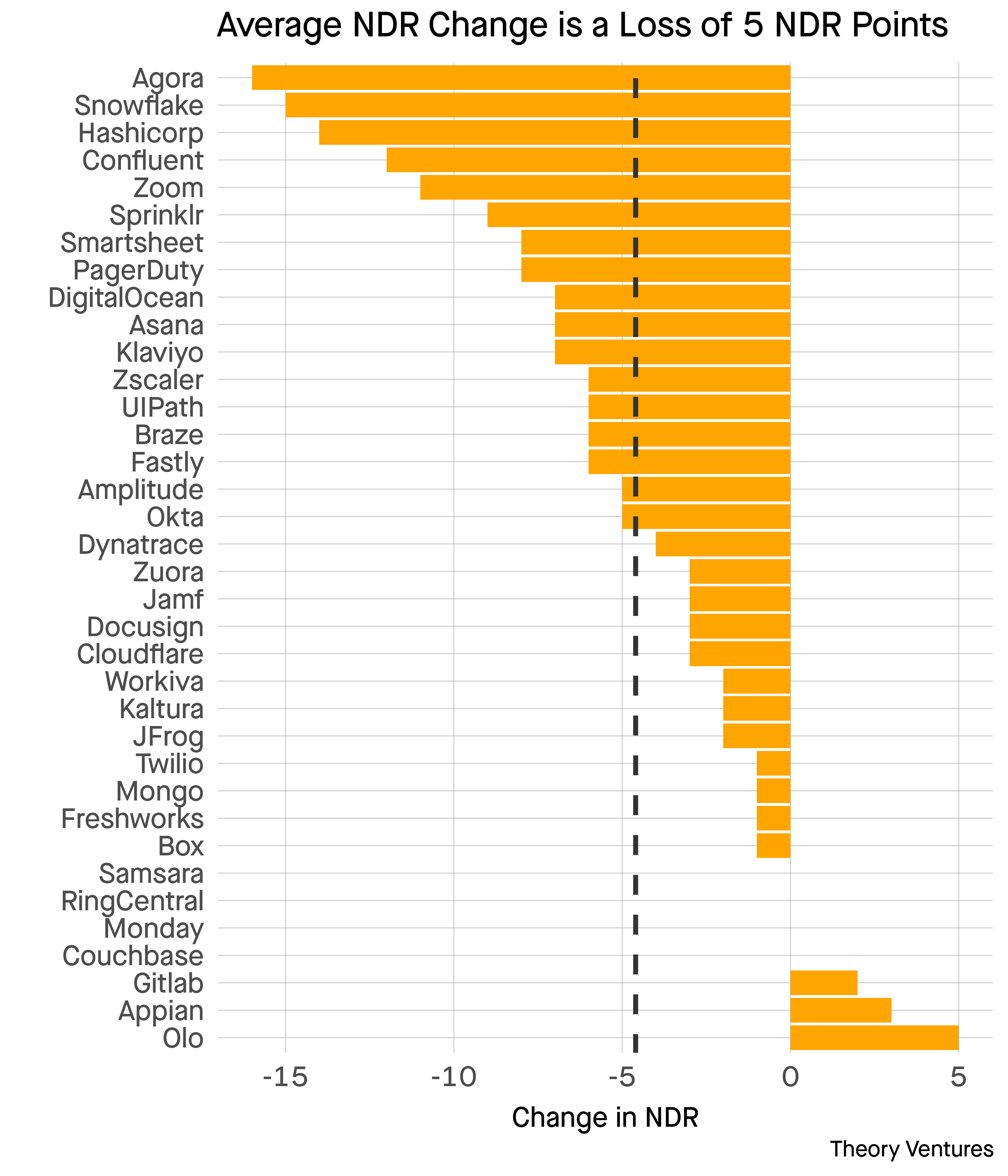

Web greenback retention for publicly traded software program firms fell from 113% on common to 108%, a 5 proportion level drop.1 80% of publicly traded firms noticed their NDR wilt once more in 2024. Total account growth stays roughly 5 proportion factors above inflation.

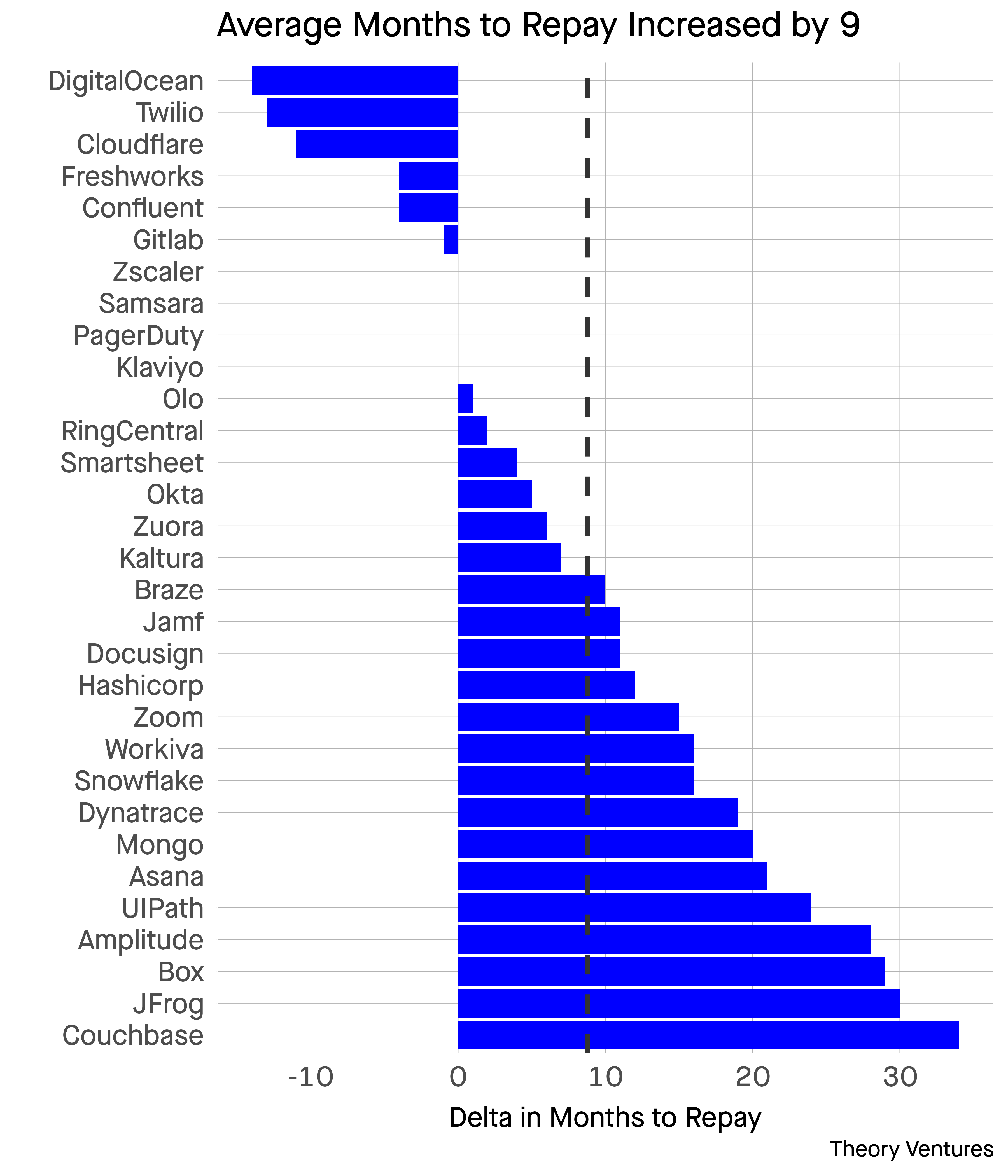

There’s the same story in payback intervals. The typical publicly traded firm noticed paybacks improve by 9 months from 35 months to 44 months. Meaning most software program firms aren’t reaching optimistic contribution margin till the fourth yr of a buyer. Once more, 80% of firms noticed paybacks worsen.2

I’m not a fan of lifetime worth (LTV) in startups (how can one predict a 7 yr buyer lifetime worth if the corporate isn’t but 7 years previous?) However for public software program firms with these sparser economics, LTV turns into an necessary determinant of whether or not & when to take a position extra in progress.

If paybacks are 4.5 years & LTVs are 5 years, that knowledge ought to provoke strategic questions in regards to the firm operations.

1T-test p worth of three.087e-06

2T-test p worth of 0.0002297

3Information supply is Jamin Ball’s Clouded Judgement