The crypto market is heating up, with Bitcoin getting ready to all-time highs and anticipating a serious breakout throughout property. Cardano (ADA) can also be at a crucial juncture, displaying hanging similarities to its worth motion in 2020—a yr that noticed ADA skyrocket by over 4,000% in beneath 12 months.

Associated Studying

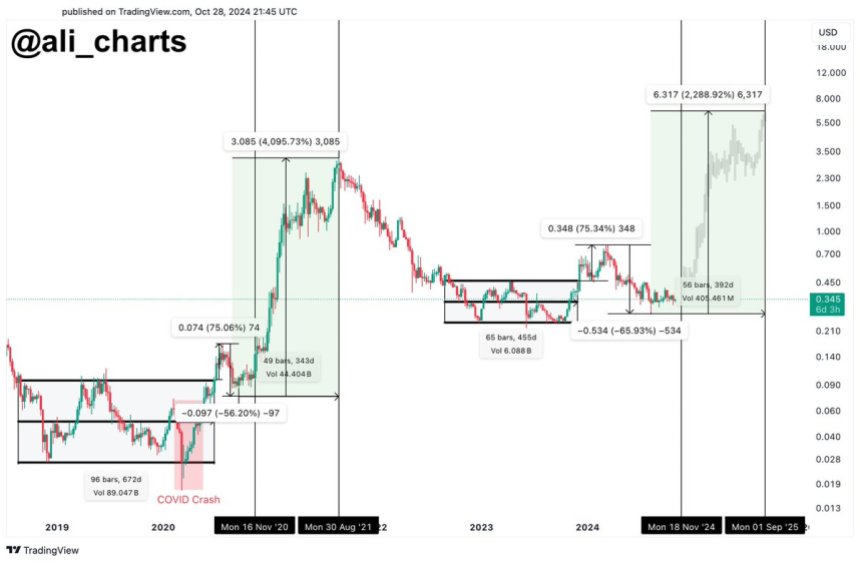

Famend analyst Ali Martinez lately shared a technical evaluation evaluating ADA’s present market construction to November 2020. In keeping with Martinez, ADA’s current consolidation round key ranges might set the stage for a big upward surge, significantly following the upcoming U.S. election.

Martinez’s evaluation highlights Cardano’s sample of explosive development after durations of accumulation and factors to the potential for a powerful rally if Bitcoin breaks new highs. Buyers at the moment are intently watching ADA’s worth motion, desirous to see if it might replicate its historic bull run. Because the market prepares for a attainable shift, Cardano’s efficiency within the coming weeks might provide perception into broader altcoin momentum on this cycle. The following strikes could possibly be decisive, making ADA one to look at within the quickly evolving crypto panorama.

Cardano Following 2020 Bullish Sample

Cardano has captured the eye of analysts and buyers who see its present consolidation as a attainable sign of accumulation, hinting at a powerful transfer up forward. Effectively-known analyst Ali Martinez lately shared a technical evaluation on X, evaluating Cardano’s present worth conduct and its sample in 2020—a yr wherein ADA skilled a unprecedented 4,000% surge.

In keeping with Martinez, Cardano’s worth motion is displaying an analogous setup, suggesting the potential of a breakout round November 18, roughly two weeks after the U.S. elections. This timeline aligns with historic patterns, the place ADA consolidates earlier than explosive upward strikes.

Martinez’s evaluation factors to a long-term bullish goal of $6.30, representing a possible 2,000% improve from present ranges. He anticipates that if it materializes, this rally might result in a market high for Cardano round September 2025. This prediction relies on ADA’s cyclical worth tendencies, the place important rallies have traditionally adopted durations of low volatility and accumulation, pushed by market sentiment and broader crypto adoption.

Associated Studying

Many buyers at the moment are watching ADA intently, as such a rally wouldn’t solely be important for Cardano however might sign a broader bullish momentum throughout altcoins. Cardano’s present worth stage has attracted a mixture of institutional and retail buyers in search of alternatives earlier than what could possibly be a considerable transfer.

With each on-chain knowledge and technical indicators supporting a bullish outlook, ADA’s upcoming worth motion might set the tone for the altcoin market within the coming months. If historical past repeats, Cardano could possibly be primed for considered one of its strongest surges, attracting new curiosity and capital into the ecosystem.

ADA Technical Ranges

Cardano is buying and selling at $0.346 after experiencing a transparent rejection from the 4-hour 200 exponential transferring common (EMA) at $0.351. This key stage has been pivotal, as a break above it and holding it as assist would sign a possible shift towards a short-term uptrend.

For bulls aiming to regain management over ADA’s worth motion, establishing a agency foothold above the 200 EMA is crucial, as it will seemingly appeal to shopping for curiosity and strengthen upward momentum.

Moreover, the $0.37 provide zone presents one other important hurdle for ADA, as bulls have struggled to reclaim this stage since early October. This resistance zone has repeatedly capped worth motion, indicating that substantial shopping for strain is critical to interrupt by way of and maintain good points past this mark. A bullish pattern might acquire traction if ADA breaches the 200 EMA and the $0.37 provide zone.

Associated Studying

Nonetheless, if these ranges stay unclaimed, ADA’s worth is more likely to proceed consolidating sideways within the close to time period. Such a sample would permit the market to stabilize and probably appeal to contemporary demand earlier than trying one other breakout, although it might delay any important upward motion for ADA.

Featured picture from Dall-E, chart from TradingView