Billionaire enterprise capitalist Chamath Palihapitiya says the US financial system is just not doing so effectively regardless of glowing reviews on the contrary.

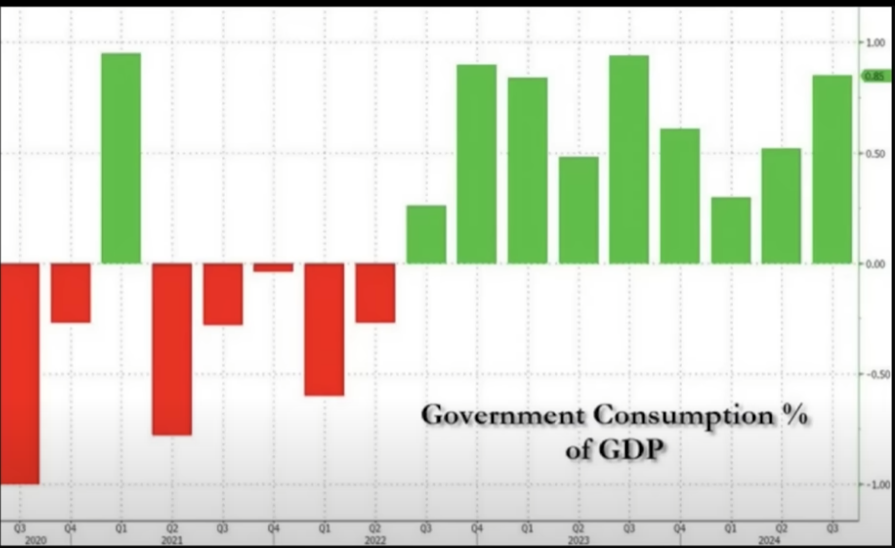

In a brand new episode of the All-in Podcast, Palihapitiya shares knowledge suggesting that authorities consumption accounts for a lot of the expansion witnessed by the financial system in the previous couple of years.

In response to the billionaire, the financial system can be in a dire state if you happen to take away authorities contributions.

“When you again out the proportion of presidency consumption that’s included in GDP, you begin to see a really totally different image which is that during the last two and a half years, the entire financial good points underneath the Biden administration have largely been by means of authorities consumption.

What which means is that personal business has been standing on the sidelines considerably. And that truly maps to numerous this instinct that I’ve had over the previous couple of months after I’ve mentioned, ‘I feel we’re in a low-key recession.’

As a result of what I may by no means determine is why I’d have a look at earnings transcripts of a bunch of firms who would always discuss softening demand… It is a broad-based softening so far as firms expertise the financial system however the high-level quantity is constructive, which might make you assume every part is ok.

However if you have a look at that chart and also you again out the proportion of the constructive information that the federal government is answerable for, what it means is the financial system is flat and the financial system isn’t rising, which signifies that roughly there are a bunch of oldsters which might be seeing contraction.”

Palihapitiya says a rustic can not maintain its financial system afloat by closely counting on authorities consumption. He says the personal sector will ultimately uncover and reject the “distortion” caused by authorities exercise.

“It’s a really dangerous place if the financial system is in the bathroom, however we are able to’t even discuss it as a result of there is no such thing as a structural strategy to get an correct learn as a result of the federal government simply [distorts] the impact it has on the financial system.

You can’t have a nonprofit entity representing the plurality of the financial exercise of a rustic and anticipate the capital markets to operate correctly. Sooner or later, the capital markets will mainly throw their fingers up within the air and puke all of it out and say, ‘No.’”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: DALLE3