“AWS’ AI enterprise is a multibillion-dollar income run price enterprise that continues to develop at a triple-digit year-over-year proportion and is rising greater than 3x sooner at this stage of its evolution as AWS itself grew, and we felt like AWS grew fairly shortly.”

“Our AI enterprise is on monitor to surpass an annual income run price of $10 billion subsequent quarter, which is able to make it the quickest enterprise in our historical past to succeed in this milestone.”

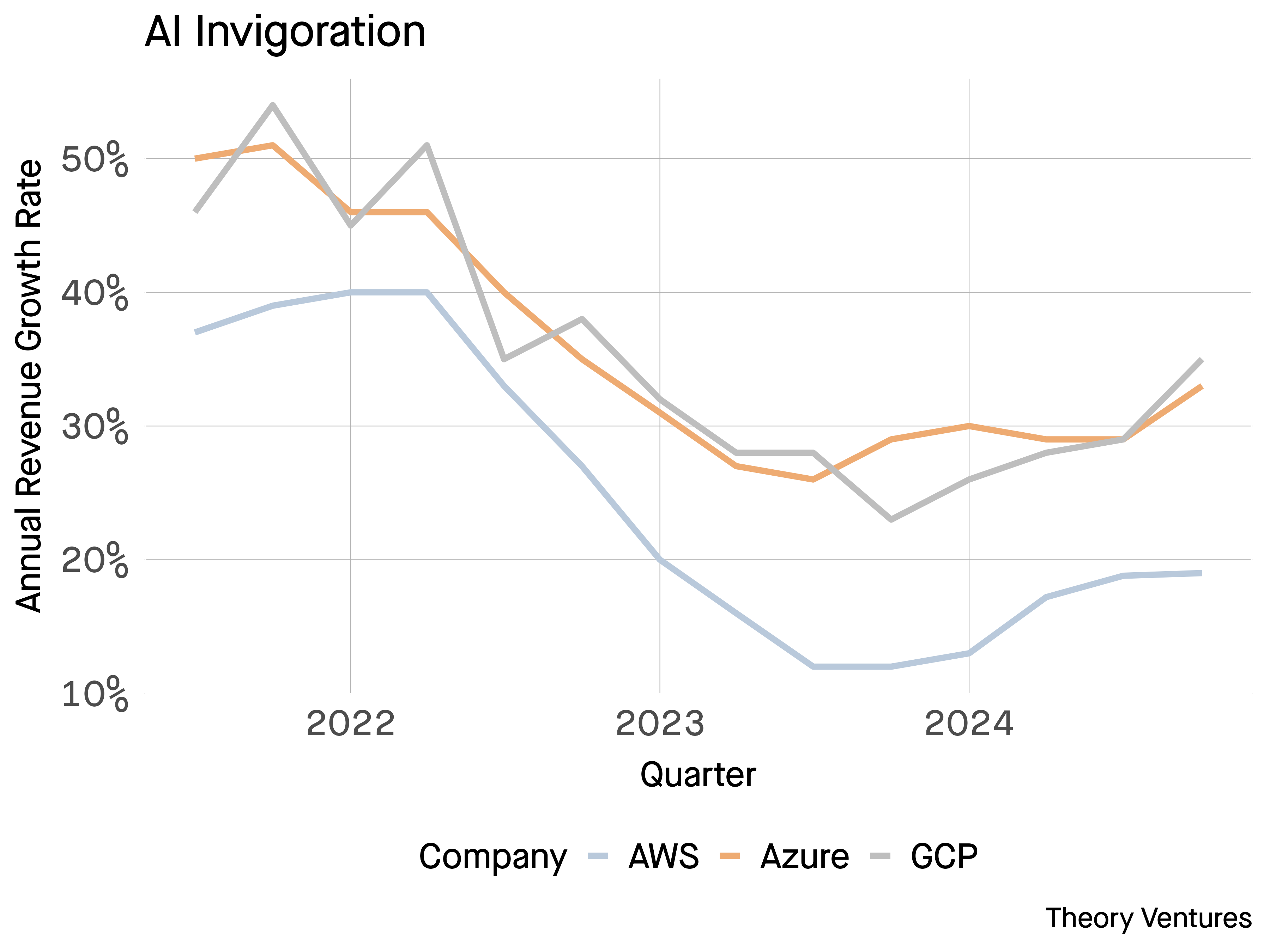

These quotes from Amazon & Microsoft final week underscore the dramatic transformation in cloud development charges.

| Cloud Development Charges | Nadir | This Quarter | % Change |

|---|---|---|---|

| AWS | 12 | 19 | 58.3% |

| GCP | 23 | 35 | 52.2% |

| Azure | 26 | 33 | 26.9% |

Throughout the three main clouds, the expansion charges have elevated between 27% and 58% from their nadir a couple of 12 months in the past. However the companies are 60% greater at present than they have been the final time they touched these development charges.

| Cloud | Working Margin |

|---|---|

| Azure | 44% |

| AWS | 38% |

| GCP | 17% |

Plus the working margins of those firms is huge at round 40% for the highest two. GCP’s is the bottom, however accelerating quickly. It was 3.1% final 12 months.

Microsoft & others have mentioned their development is restricted by GPUs which is able to proceed till late subsequent 12 months. Amazon & Google are creating their very own chips :

“As clients strategy increased scale of their implementations, they notice shortly that AI can get pricey. It’s why we’ve invested in our personal customized silicon in Trainium for coaching and Inferentia for inference. The second model of Trainium, Trainium2, is beginning to ramp up within the subsequent few weeks and can be very compelling for purchasers on worth efficiency.”

And internally, the impacts are actual. Google mentioned 25% of recent code written is AI generated. AWS quantified it additional :

“The workforce has added all types of capabilities in the previous few months, however the very sensible use case just lately shared the place Q Remodel saved Amazon’s groups $260 million and 4,500 developer years in migrating over 30,000 purposes to new variations of the Java JDK.”

All of those advances are costly:

“We count on to spend roughly $75 billion in CapEx in 2024. The vast majority of the spend is to assist the rising want for know-how infrastructure.”

In whole, these hyperscalers invested about $52b final quarter in knowledge facilities & GPUs.

| Firm | Capex This Quarter, $b |

|---|---|

| Azure | 20 |

| GCP | 13 |

| AWS | 19 |

However the chips at the moment are precious for longer than they have been (once more from AWS).

“We made the change in 2024 to increase the helpful lifetime of our servers. This added about 200 foundation factors of margin year-over-year.”

An important metric for these companies can be revenue {dollars} per GPU greenback price.

Which chip design will produce the perfect earnings : Google’s TPUs, Amazon’s Inferentia/Tranium, or Microsoft’s Maia and Cobalt?

It’s onerous to calculate precisely this determine as a result of the general public knowledge isn’t granular sufficient to check throughout the three. However over time we must always be capable of infer main variations.