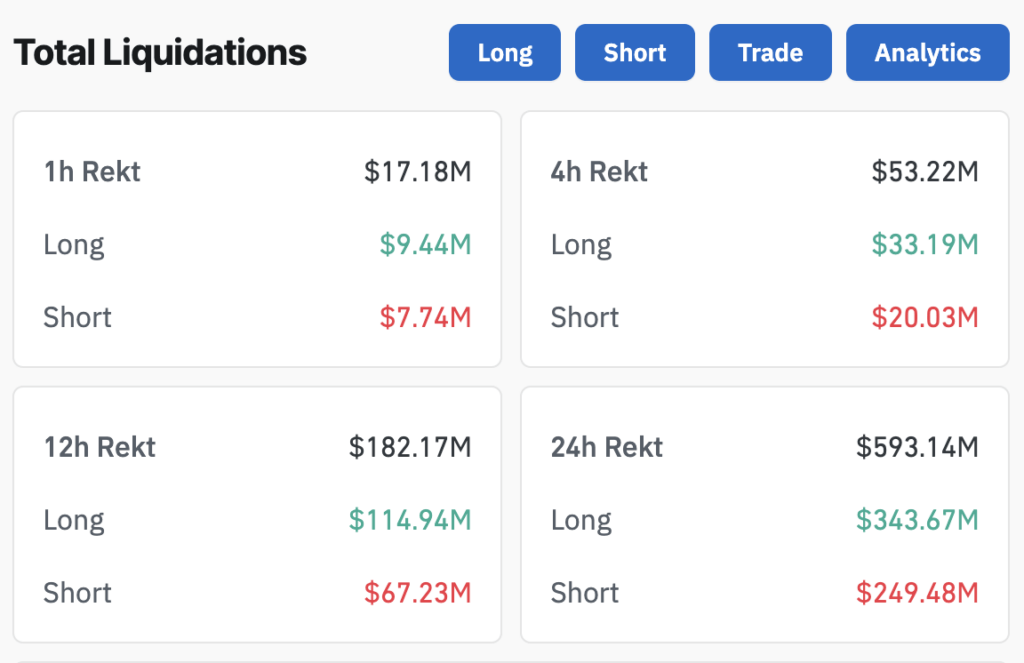

Over $590 million was liquidated within the crypto market over the previous 24 hours, impacting 194,284 merchants, in accordance with information from Coinglass. The most important single liquidation order occurred on OKX’s BTC-USDT-SWAP, valued at $15.56 million.

Lengthy positions bore the brunt, accounting for about $343.67 million of the entire liquidations, whereas brief positions made up $249.48 million. Bitcoin led the liquidations with $122.77 million, adopted by Ethereum with $88.33 million.

Nonetheless, simply $36 million of the liquidated brief positions occurred in Bitcoin-related contracts, indicating that almost all of lengthy liquidations affected altcoins. Throughout a number of exchanges, Ethereum, Doge, XRP, BNB, WIF, TIA, ADA, and others noticed nearly all of liquidations in lengthy contracts. Nearly all of liquidations for Bitcoin and Solana have been in shorts.

Binance skilled the very best trade liquidations at $235.04 million, with 62.24% coming from lengthy positions. OKX and Bybit adopted, registering $169.48 million and $123.41 million in liquidations, respectively.

The surge in liquidations coincides with Bitcoin’s 3.64% worth improve over the previous 24 hours, reaching $82,522.45, in accordance with CryptoSlate information. Ethereum additionally noticed an increase of 0.50%, hitting $3,181.01.

Market evaluation means that merchants might have been overly optimistic amid the bullish pattern, resulting in an imbalance in lengthy positions. Whereas Bitcoin has made 12 new all-time highs previously 7 days, it has additionally seen a number of drops of round 3%. The current information highlights the potential over-eagerness of merchants unable to anticipate even minor volatility inherent within the crypto market, emphasizing the dangers related to leveraged buying and selling.