After the election, the general public markets have roared, however not equally.

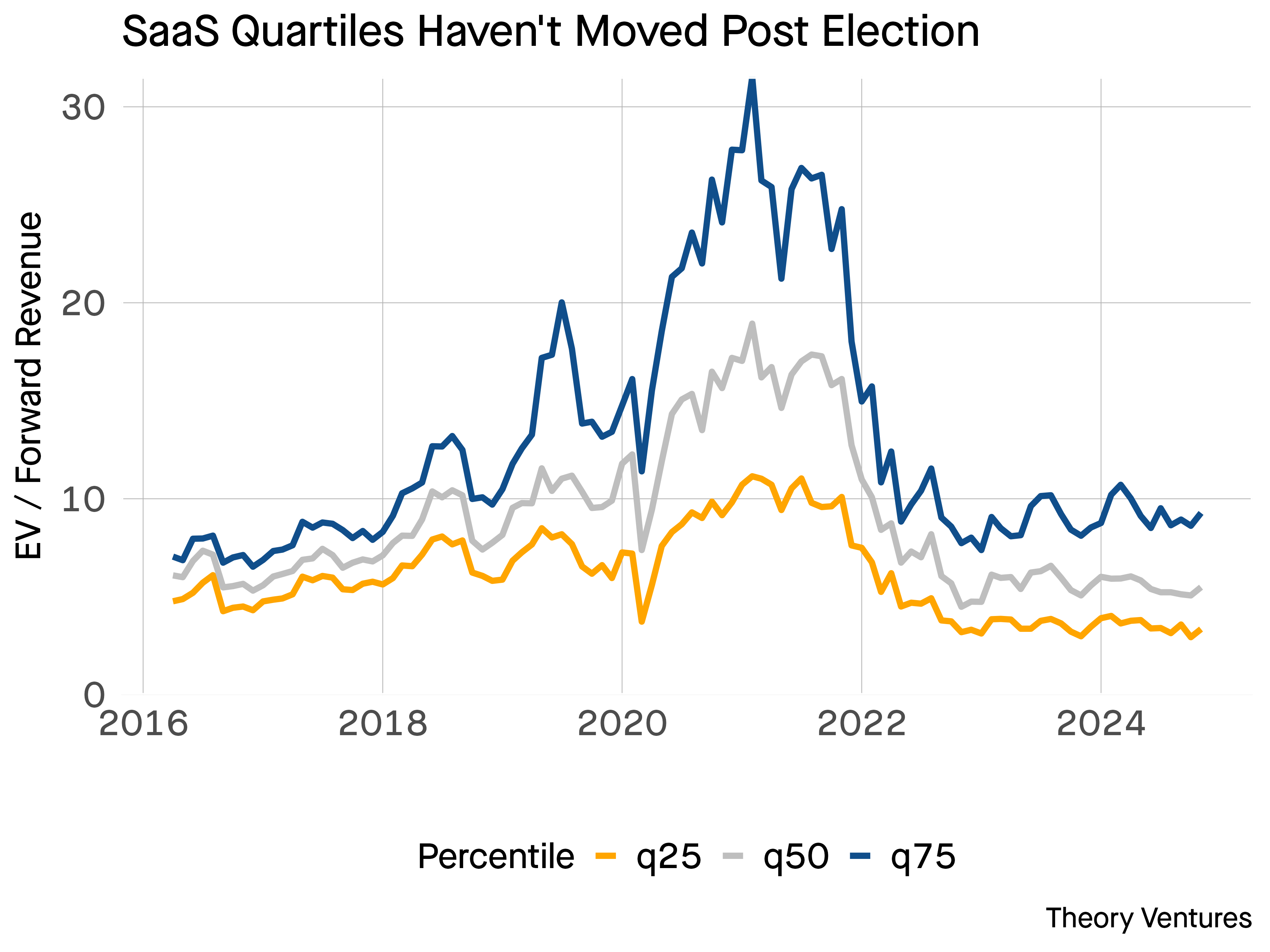

The broad software program ecosystem has seen a comparatively muted change in ahead multiples. There’s no statistically important change within the days after the election in comparison with the month earlier than.

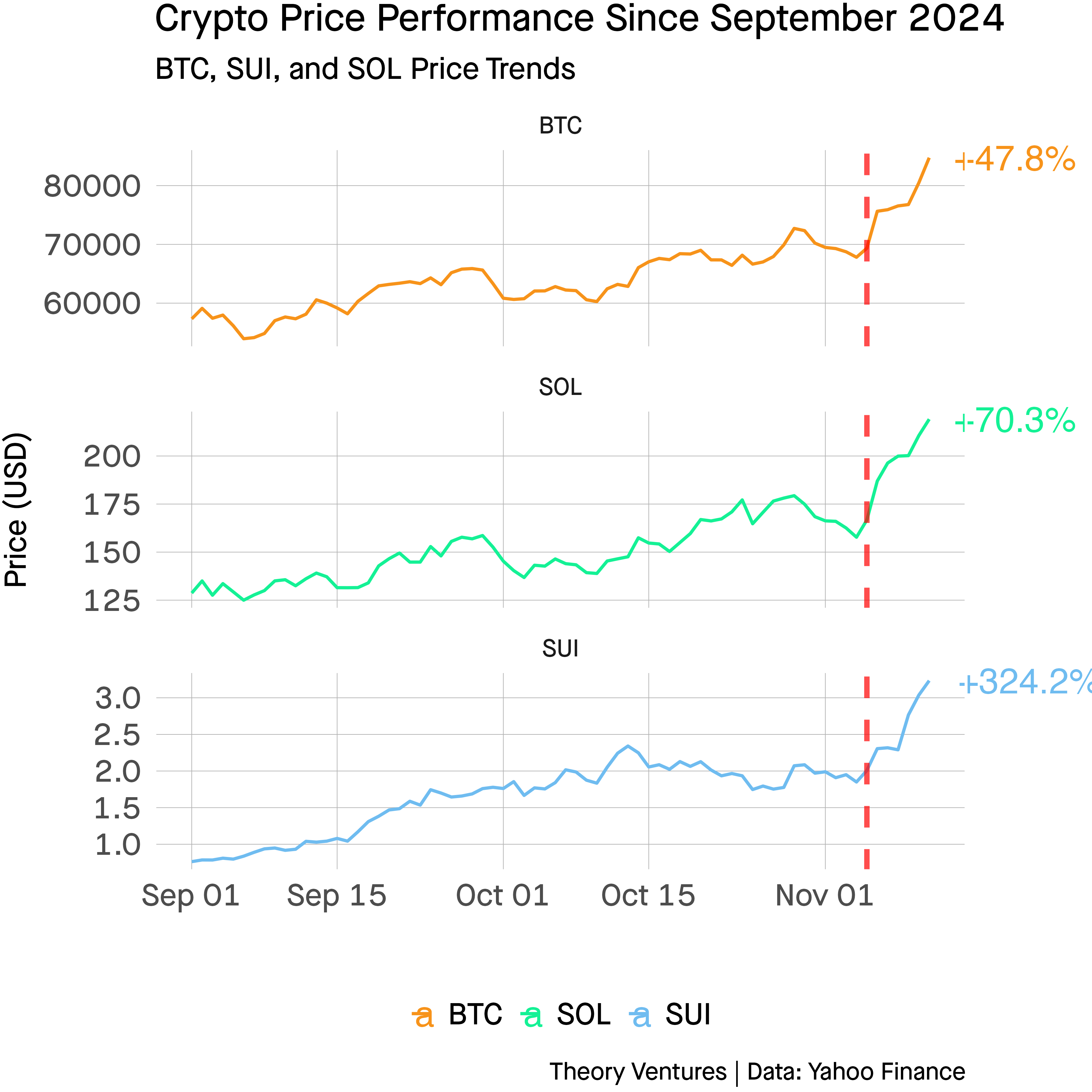

Alternatively, crypto’s high tokens have seen great appreciation. Bitcoin is up 48% ; Solana up 70% ; & SUI up 324% within the few days because the announcenment. All of these ar statistically important adjustments.

The fast appreciation in crypto has been catalyzed by the anticipated readability in crypto regulation & the potential for the Federal Reserve Financial institution to grow to be a big purchaser of Bitcoin.

The sudden rise in prominence of stablecoins & the relief of sure rules might present a lift to the US Greenback as a reserve foreign money paralleling the Eurodollar phenomenon of the late-Fifties & past (a very good topic for a future put up).

When will ahead mulitples in general software program rise once more? An open IPO market ought to introduce extra names with development charges higher than 30%. At this time, there aren’t any publics rising greater than that.

A extra permissive M&A setting ought to improve demand for software program companies; extra demand ought to improve valuations as properly.

Final, the expansion charges of AI-first firms has elevated personal valuations meaningfully, a pattern that ought to spill over to the general public market quickly.

The valuation setting exhibits early indicators of fixing, however the affect of the election isn’t broadly distributed.