Bitcoin’s correlation with gold costs has fallen to its lowest degree in almost a 12 months following Donald Trump’s current election victory on Nov. 5.

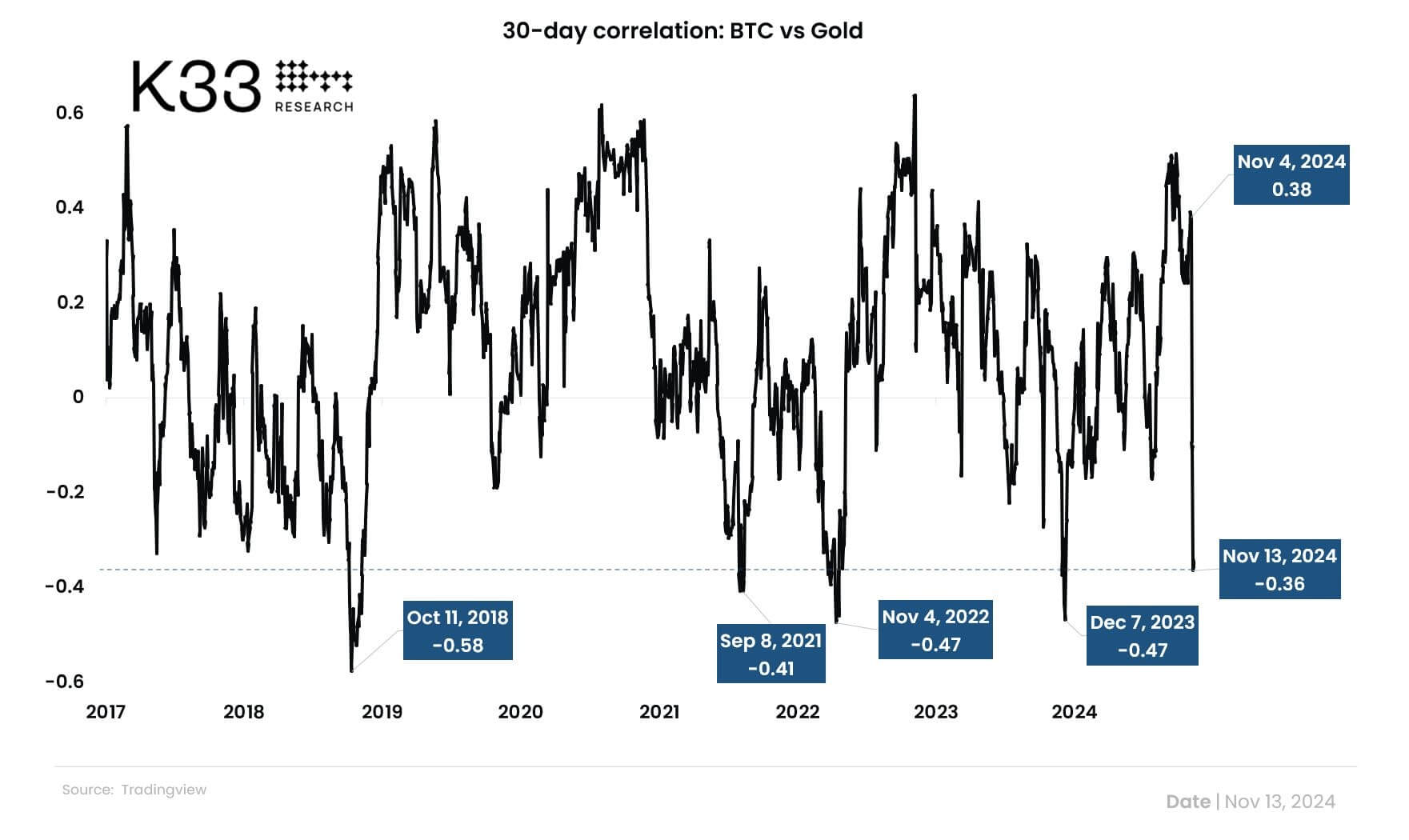

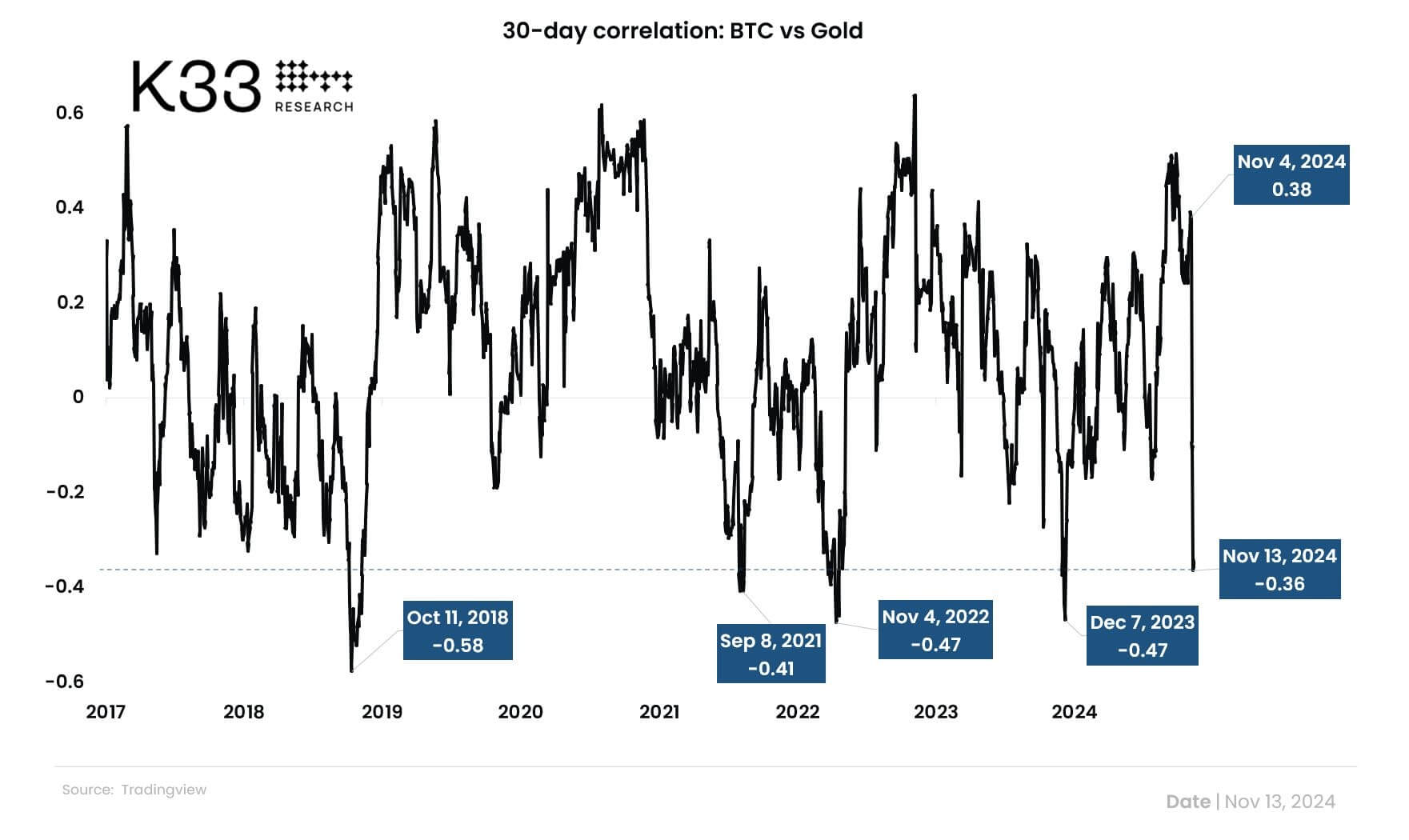

In accordance with K33 Analysis, the 30-day correlation between Bitcoin and gold stands at -0.36, its lowest degree since December 2023. In correlation phrases, a worth of 1 signifies an ideal optimistic relationship, the place each property transfer in tandem, whereas -1 displays an ideal adverse correlation, indicating they transfer in reverse instructions.

Traditionally, Bitcoin and gold have typically moved independently. This lack of constant alignment is obvious in current worth actions, with BTC reaching new highs towards $90,000 as gold costs declined.

This pattern means that buyers favor BTC over conventional safe-haven property like gold. A key driver of this shift is the idea {that a} second time period for Trump may present regulatory readability, fueling progress for Bitcoin and the broader crypto market.

So, as BTC beneficial properties recognition as “digital gold,” its enchantment as a hedge in opposition to inflation and financial uncertainty continues to draw institutional and retail buyers. Gold, in the meantime, could also be dropping traction as some buyers reallocate funds to BTC, drawn by the prospect of upper returns within the burgeoning digital asset house.