Spot Bitcoin exchange-traded funds (ETFs) have reached a powerful benchmark, crossing $100 billion in internet belongings. Based on SoSoValue knowledge, this achievement represents 5.4% of Bitcoin’s whole market worth.

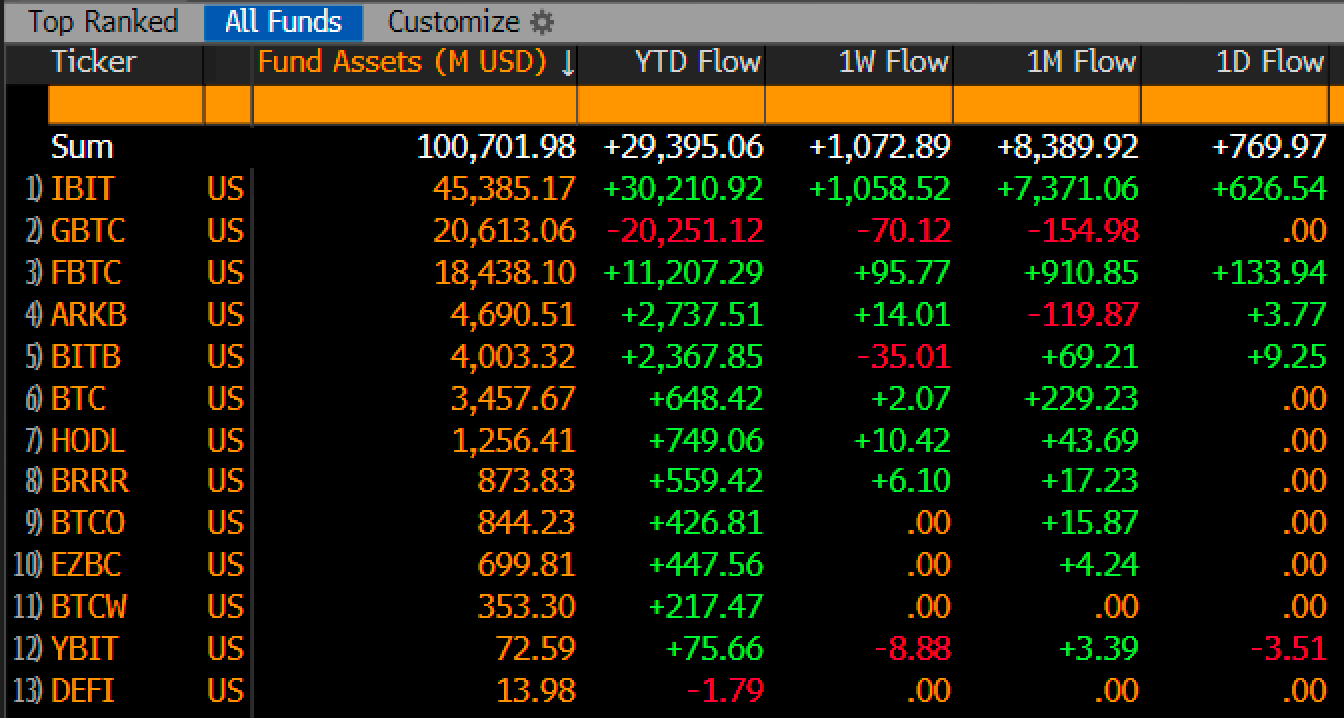

The 12 Bitcoin ETFs, launched by distinguished issuers corresponding to BlackRock and Constancy, have reached this milestone in simply 10 months since their debut in January. Main the pack is BlackRock’s iShares Bitcoin Belief (IBIT), which manages $45.4 billion in belongings.

Grayscale’s GBTC takes the second spot with $20.6 billion, whereas Constancy’s Smart Origin Bitcoin Fund (FBTC) follows in third with $18.4 billion. Different notable contributors embody the Ark 21 Shares BTC ETF (ARKB) at $4.6 billion and Bitwise BITB at $4 billion.

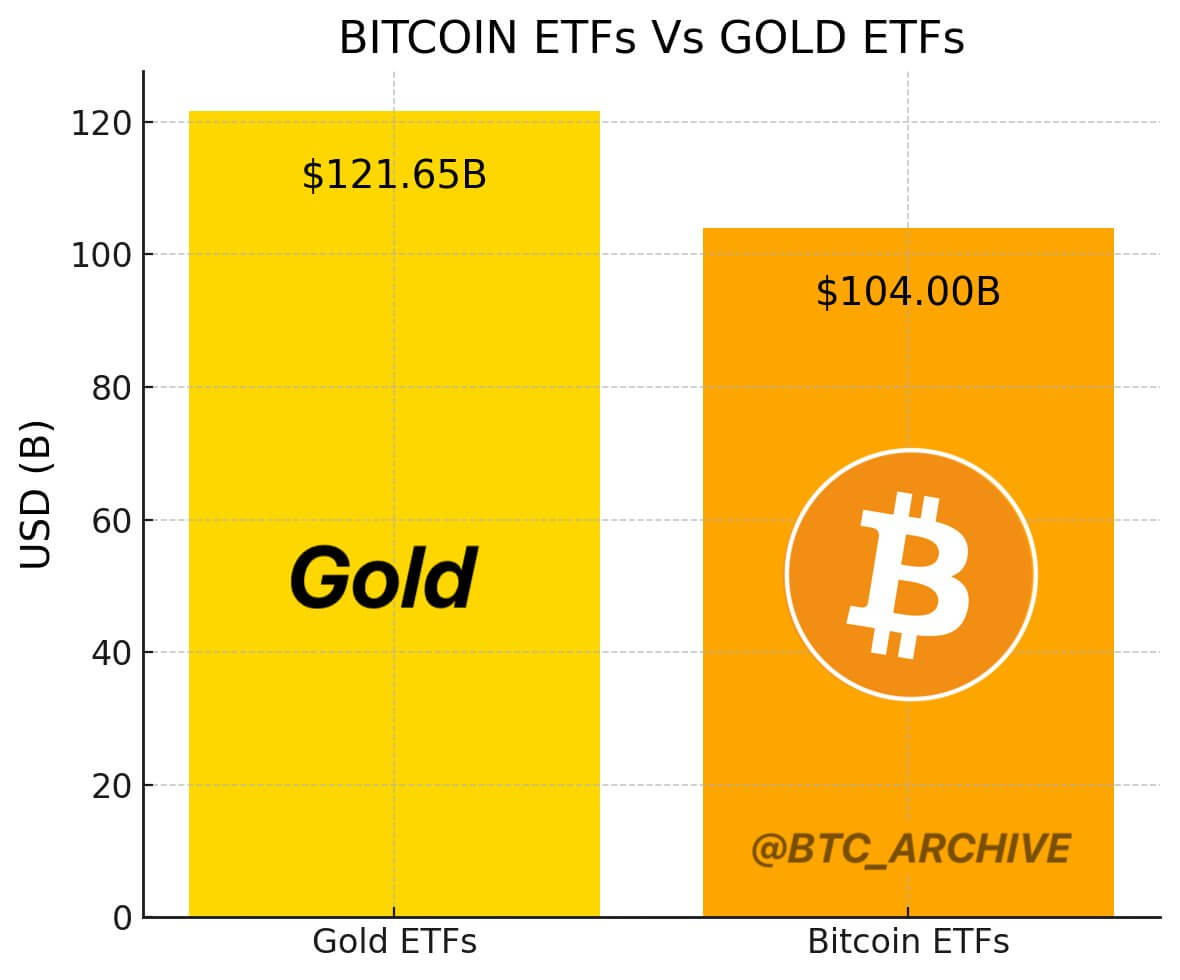

The fast development of spot Bitcoin ETFs makes them one of the vital profitable fund classes thus far. Bloomberg ETF analyst Eric Balhcunas acknowledged that the numbers present that the funds are near overtaking Satoshi Nakamoto as the most important Bitcoin holder whereas advancing steadily towards surpassing gold ETFs in asset worth.