Enron Company has introduced its relaunch to deal with world power challenges by leveraging expertise and flexibility for sustainable options, in accordance to DB Information.

The corporate teased the launch of a “token or coin” sooner or later however confirmed that nothing had been launched “but”.

The corporate plans to spend money on renewable power infrastructure, superior power storage, and revolutionary energy distribution programs to reinforce power sustainability, accessibility, and affordability.

In line with Enron’s press launch, the corporate is dedicated to steady innovation and addressing evolving calls for like renewable power integration and local weather resilience. The management emphasizes moral enterprise practices, transparency, and sustainability, aiming to set a excessive normal for company accountability.

Acknowledging its previous, Enron claims its renewed focus is based on integrity and a forward-looking strategy that prioritizes collective progress and studying. The corporate acknowledges developments in decentralized expertise and intends to play a job in its future, aligning with tendencies in permissionless innovation reshaping industries, together with the power sector.

The point out of permissionless innovation suggests potential engagement with blockchain expertise and decentralized programs, which might have important implications for the crypto neighborhood.

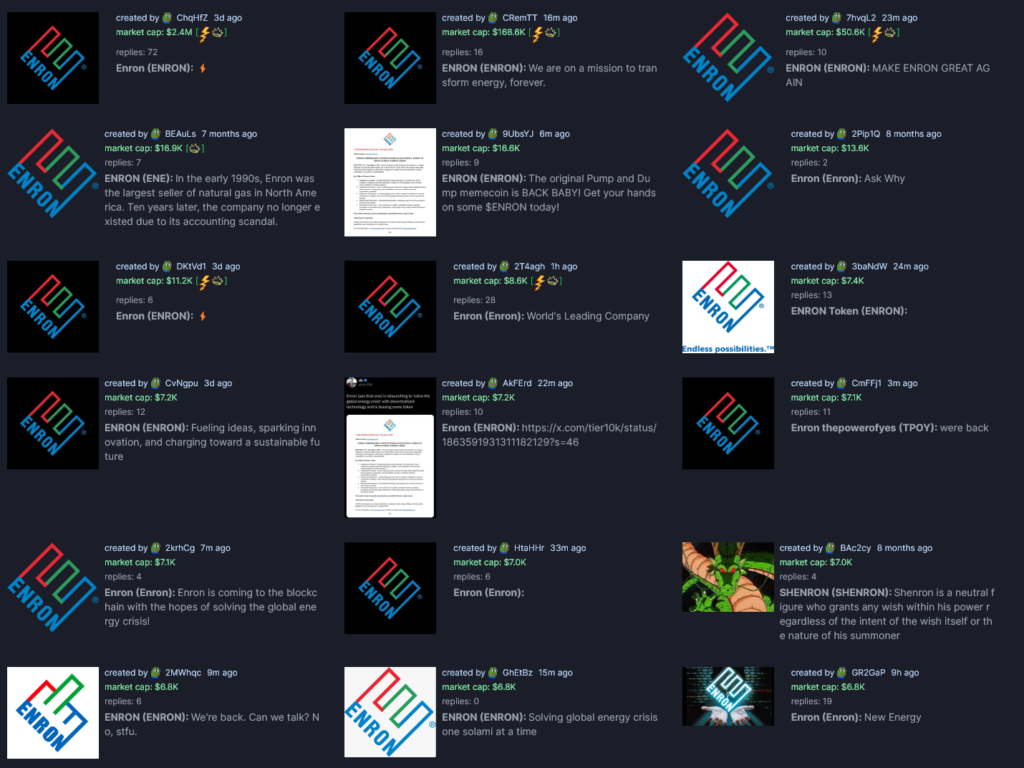

Curiously, a pump.enjoyable token referred to as Enron was launched 3 days in the past stating, “We’re excited to launch one thing particular very quickly. After we enter the market, you’ll know. Announcement Monday, 9am EST.”

The outline seemingly aligns with the announcement, though there are not any ties to the corporate, making it an unofficial memecoin of Enron Company. Additional, the token has simply $6,000 in market cap as of press time.

Nonetheless, many different Enron tokens are additionally being launched on the information, with the largest garnering a market cap of $2 million as of press time.

Enron’s new initiative contains investments in scalable, sustainable options, aiming to handle crucial challenges within the power sector. By specializing in cutting-edge expertise and human ingenuity, the corporate says it seeks to contribute to world efforts to transition to renewable power sources and enhance power effectivity.

What occurred to Enron?

Enron Company was as soon as a number one U.S. power firm that filed for chapter in 2001 following revelations of in depth accounting fraud and company misconduct. The collapse resulted in important monetary losses for traders and workers, changing into one of many largest company bankruptcies in U.S. historical past. The scandal led to widespread company governance and accounting reforms, together with enacting the Sarbanes-Oxley Act, which aimed to reinforce transparency and accountability in publicly traded firms.

After declaring chapter, Enron restructured and reemerged in 2004 as Enron Collectors Restoration Corp., focusing solely on liquidating belongings to repay collectors. Over the subsequent a number of years, the corporate offered its remaining belongings—together with the sale of Prisma Vitality Worldwide in 2006—and distributed over $21.8 billion to collectors by 2011.

Within the scandal’s aftermath, quite a few executives have been indicted and convicted on fraud and company misconduct prices. The collapse led to important monetary losses for workers and shareholders and prompted in depth authorized and regulatory reforms to reinforce company transparency and accountability within the monetary sector.

Enron’s obvious new concentrate on power and decentralization

As reported by Enron, the corporate aspires to now lead within the power sector by embracing progress, transformation, and rebirth.

Enron’s engagement with decentralized expertise could doubtlessly result in integrating decentralized platforms into power infrastructure.

The intersection of the power sector with blockchain expertise has been a rising space of curiosity, exploring peer-to-peer power buying and selling, grid optimization, decentralized grids, and clear monitoring of power sources.

Relying on the precise make-up of the brand new firm, Enron’s involvement would possibly speed up these developments, providing alternatives for the crypto neighborhood and power markets. As of press time, the corporate’s web site has little greater than the press launch in its ‘newsroom‘ part.

Nonetheless, in accordance with the brand new Enron web site, the letter ‘n’ now stands for ‘good.’ The others are Atmosphere, Nature, Repetant, and Alternatives.