The newest US inflation knowledge considerably impacted the Bitcoin value and many of the cryptocurrency market, with some exceptions. In response to a report from the Labor Division, inflation rose greater than anticipated in January, pushed by greater shelter costs.

Moreover, the patron value index (CPI), which measures the costs customers face for items and companies throughout the economic system, noticed a 0.3% enhance for the month. On a 12-month foundation, the CPI stood at 3.1%, barely decrease than December’s 3.4%.

Bitcoin Worth Retreats Amid Greater-Than-Anticipated CPI Figures

In response to latest experiences, the higher-than-expected CPI figures might pose challenges for the Federal Reserve (Fed), as officers anticipate inflation to recede and attain their 2% annual goal. The central financial institution goals to regulate financial coverage, which has been tight over 20 years.

Nonetheless, the January enhance in inflation could delay the Fed’s plans to ease charges, as it’s going to require extra knowledge earlier than initiating a rate-cutting cycle. This end result disillusioned those that anticipated inflation to lower and prompted a reassessment of the timing for potential charge changes.

On this matter, market intelligence platform Santiment reported that the three.1% CPI consequence precipitated market cap losses in cryptocurrency and equities markets. The Bitcoin value, which had breached the $50,000 mark for the primary time in over two years, has fallen under $49,000 in response.

In response to the crypto platform’s evaluation, this delicate retrace will possible polarize crowd sentiment, doubtlessly resulting in vital panic gross sales. In such a situation, the justification for dip shopping for turns into extra viable, however sentiment could flip unfavourable.

Bitcoin’s Market Cycle Patterns

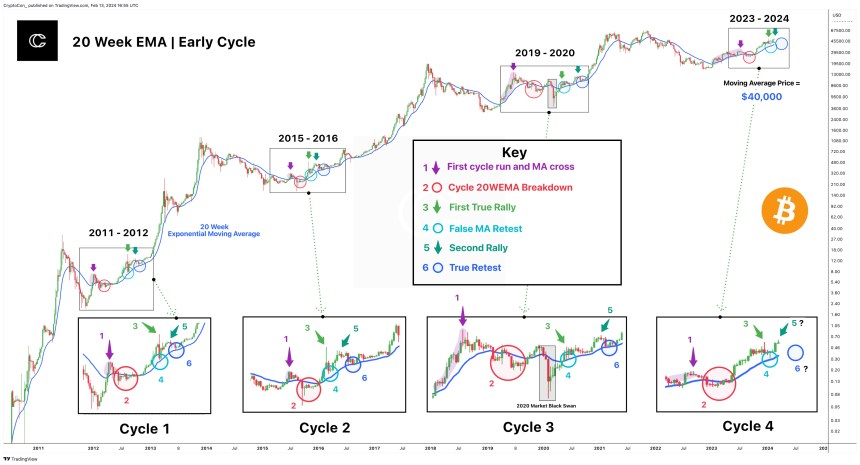

Market knowledgeable Crypto Con has recognized a hanging sample in Bitcoin’s market cycles, particularly in regards to the 20 Week Exponential Transferring Common (EMA). Regardless of mounting considerations concerning inflation knowledge, the evaluation means that the Bitcoin value habits tends to comply with a constant six-step sample, with vital implications for assist and potential correction ranges.

In response to Crypto Con’s evaluation, Bitcoin’s value motion in every market cycle has adhered to an analogous sample involving the 20-week EMA. The sample unfolds as follows:

First, as seen within the chart under, the Bitcoin value breaks above the transferring common, marking the start of a brand new cycle and a notable uptrend. Nonetheless, after the completion of the preliminary run, the value retraces and falls under the transferring common, signaling a short lived shift in sentiment.

Regardless of the short-term setback, Bitcoin’s value then breaks above the transferring common as soon as extra, indicating the beginning of a real rally and resumption of the upward pattern. At this stage, value motion creates a false retest of assist, narrowly lacking the transferring common as a vital assist stage. This false retest is a typical prevalence in Bitcoin’s market cycles.

Following the false retest, Bitcoin embarks on a second run, representing an extra development out there cycle. Bitcoin’s value is at present positioned throughout this section.

In response to the evaluation made by Crypto Con, the complete correction in Bitcoin’s value could not should be as deep, because the transferring common at present sits at roughly $40,000.

Finally, the evaluation’s suggestion that the Bitcoin value could not dip under the $40,000 stage through the ongoing bull run, even within the face of anticipated corrections, is especially encouraging for bullish buyers.

Bitcoin is buying and selling at 48,600, down 3% within the final 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site completely at your individual danger.