NO BYLINE, THANK YOU

Trade-traded funds (ETFs), governments and MicroStrategy (MSTR) personal practically one-third of all recognized Bitcoin (BTC) holdings.

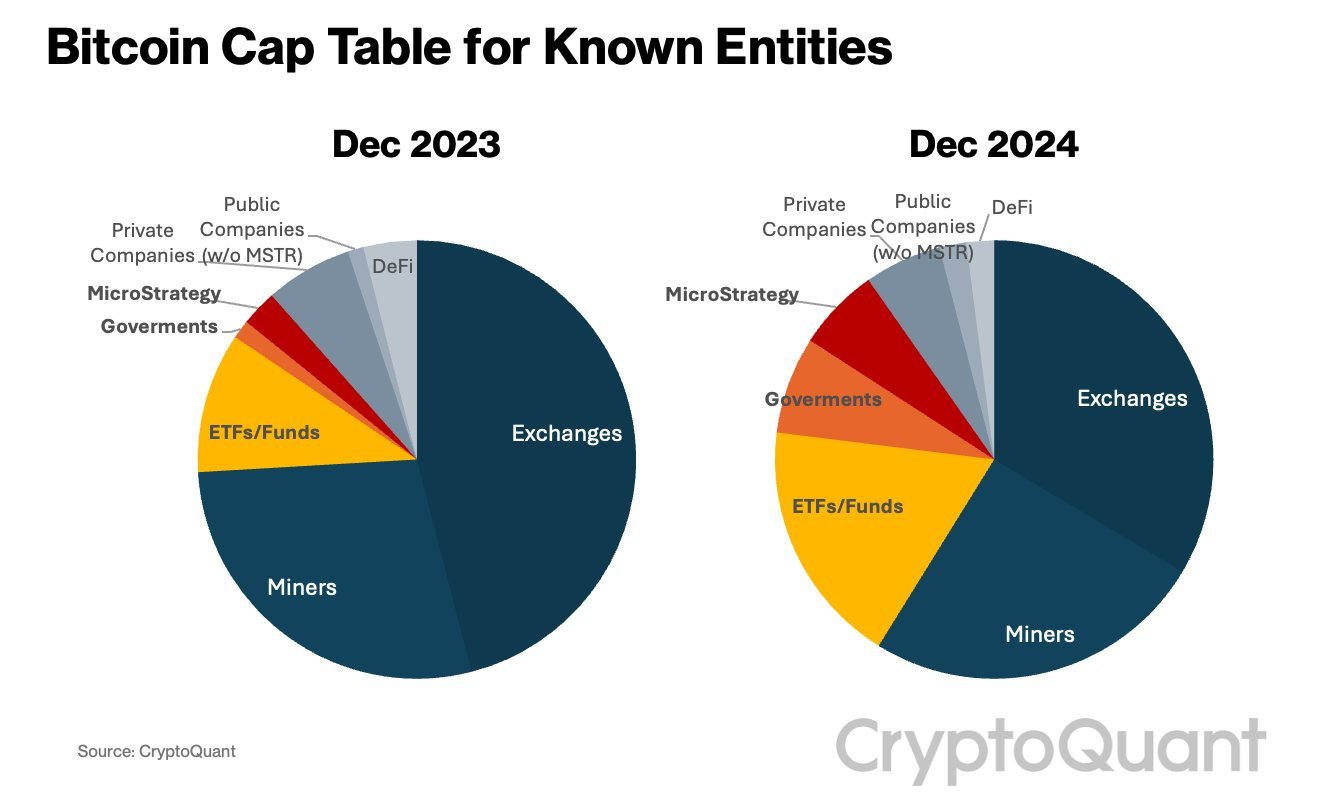

The 31% of recognized BTC holdings owned by ETFs, governments and MicroStrategy represents a 14% enhance from December 2023, in accordance with Ki Younger Ju, the founder and chief govt of the digital asset analytics agency CryptoQuant.

“Bitcoin Cap Desk Replace: ETFs, governments, and MSTR now account for 31% of all recognized Bitcoin holdings, up from 14% final yr.”

Younger Ju additionally mentioned the significance of MicroStrategy’s BTC holdings.

“Completely different types of cash require distinct gateways.

Bitcoiners ought to acknowledge MSTR as a gateway bridging Nasdaq-100 cash to Bitcoin.

I don’t perceive why some Bitcoiners dislike MSTR. They could elevate issues about self-custody, however only a few folks really follow self-custody — simply as just a few care about privateness breaches. MSTR’s Bitcoin financial institution mannequin aligns effectively with the present adoption degree.

If the gateway’s energetic fund administration permits the acquisition of a big quantity of Bitcoin with comparatively little capital, that marks the success of a Bitcoin financial institution.

In fact, there’s at all times the chance of failure, so one ought to view it as entrusting funds to a financial institution with the objective of gaining extra Bitcoin, utilizing Bitcoin itself because the type of cash.”

Bitcoin is buying and selling at $93,895 at time of writing. The highest-ranked crypto asset by market cap is down practically 2% previously 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Don White – Artwork Dreamer/Vladimir Sazonov