The chief government of the digital asset analytics agency CryptoQuant thinks a nationwide strategic Bitcoin (BTC) reserve might offset US debt.

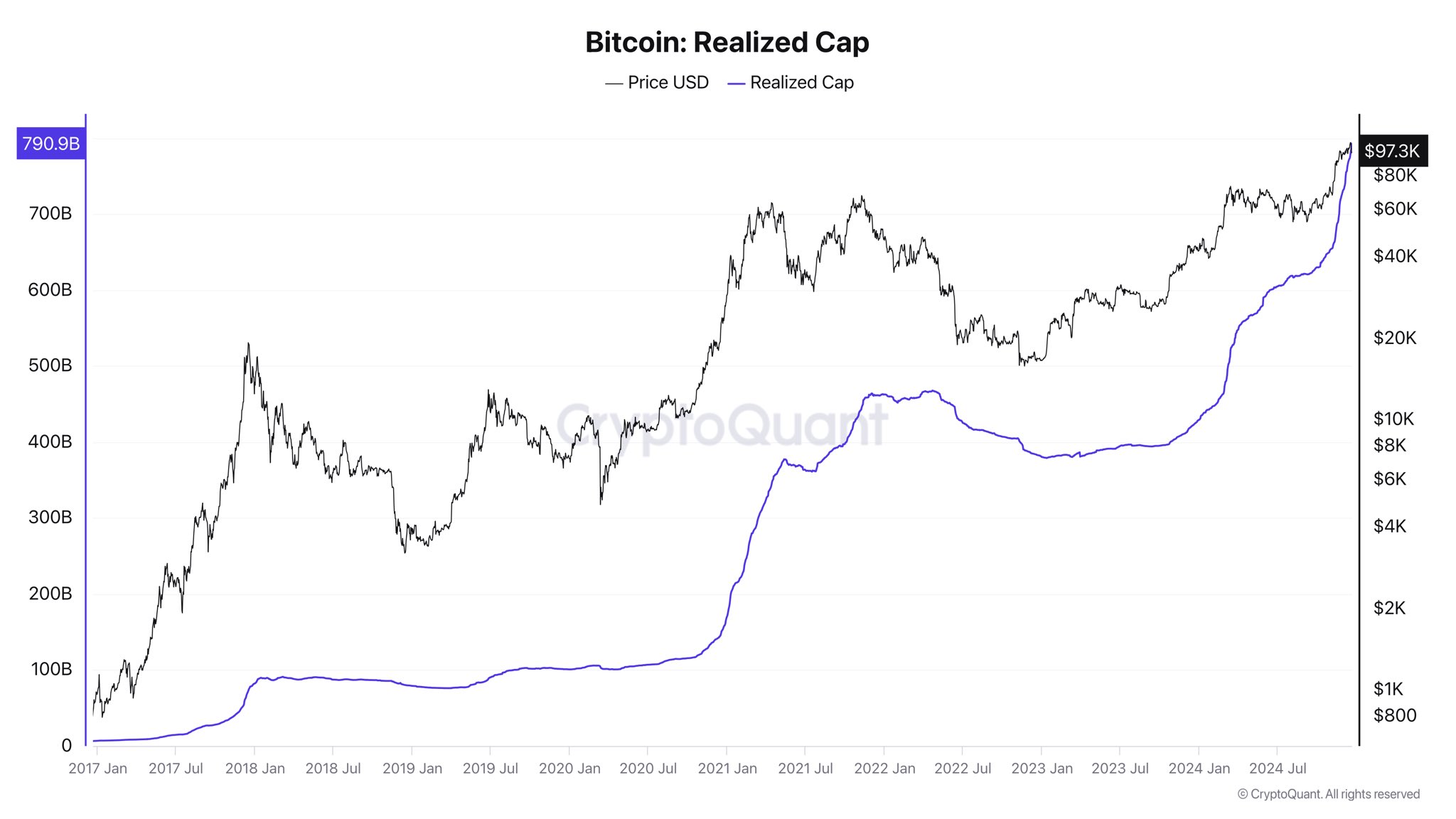

Ki Younger Ju tells his 389,600 followers on the social media platform X that $790 billion in realized capital inflows have ballooned Bitcoin’s market cap to $2 trillion over the previous 15 years.

“This yr alone, $352 billion in inflows have added $1 trillion to its market cap.

Nonetheless, utilizing a pumpable asset like Bitcoin to offset dollar-denominated debt—quite than gold or {dollars}—might make gaining collectors’ consensus difficult. For Bitcoin to attain broader market acceptance, Bitcoin should attain international, nationwide authority on par with gold. Establishing a Strategic Bitcoin Reserve (SBR) might function a symbolic first step.

With 70% of U.S. debt held domestically, offsetting 36% of it by buying 1 million Bitcoin by 2050 turns into possible if the U.S. authorities designates Bitcoin as a strategic asset.”

The CryptoQuant CEO provides that the 30% of debt held by overseas entities may resist that method, however he argues that the technique stays sensible nonetheless.

“If a consensus is reached on Bitcoin’s standing, reaching that is completely attainable.

The one danger can be previous whales dumping BTC to assault the US. Nonetheless, if governments proceed accumulating Bitcoin till 2050 and its worth retains rising, I doubt they might truly dump it.”

Matthew Sigel, the top of digital property analysis at exchange-traded fund (ETF) supplier VanEck, initially outlined how a strategic Bitcoin reserve might offset US debt.

“Assume the US Treasury begins shopping for a million Bitcoin over 5 years at a beginning worth of $200,000.

Assume US debt grows at 5% (vs. final 10 years 8% compound annual development price) and BTC worth compounds at 25%.

In such a state of affairs, the US Strategic BTC Reserve would maintain property equal to 36% of debt by 2050.

In that state of affairs, BTC can be $42 million/coin (identical as Michael Saylor’s goal, coincidentally) and the market cap can be 18% of worldwide monetary property.

However even at a 15% compound annual development price, the BTC stash would nonetheless be fairly helpful.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney