By Aimee Raleigh, Principal at Atlas Enterprise, as a part of the From The Trenches characteristic of LifeSciVC

“It was the very best of occasions, it was the worst of occasions…”

One other JPM is behind us, and whereas a lot of the small discuss was centered on the attractive climate, spectacular sea of pink in assist of the Biotech CEO Sisterhood, and Monday’s offers (congratulations to ITCI, Scorpion, and IDRx groups!), general sentiment was bifurcated. Whereas many early-stage non-public VCs (and particularly these taking part in latest M&A) are feeling good going into 2025, public traders lamented the poor efficiency of public portfolios and indices. Equally on the corporate facet, just a few megaround darlings have captured a big share of the capital up to now 12 months (almost 100 raises >$100M). In distinction, the temper is extra apprehensive for these firms with knowledge or timing setbacks, particularly on high of one of many highest charges of RIFs in 2024. The previous 12 months has been a blended bag, particularly when factoring in tenuous macro headwinds similar to uncertainty relating to the brand new administration, debate on drug pricing, and persistently excessive rates of interest. You’ll hear from different shops that JPM sentiment ranged from poor to cautiously optimistic – whereas I received’t add extra adjectives to the pile, under are a few of my key takeaways as we begin the brand new 12 months.

Earlier than we dive in, I might be remiss if I didn’t name out the truth that lots of final 12 months’s themes proceed to be entrance and heart, together with M&A and investor {dollars} centered on “sizzling” areas. With out additional ado – my key themes from this 12 months’s JPM as we stay up for one other productive 12 months in biotech…

Courageous New World: China Property are Right here to Keep

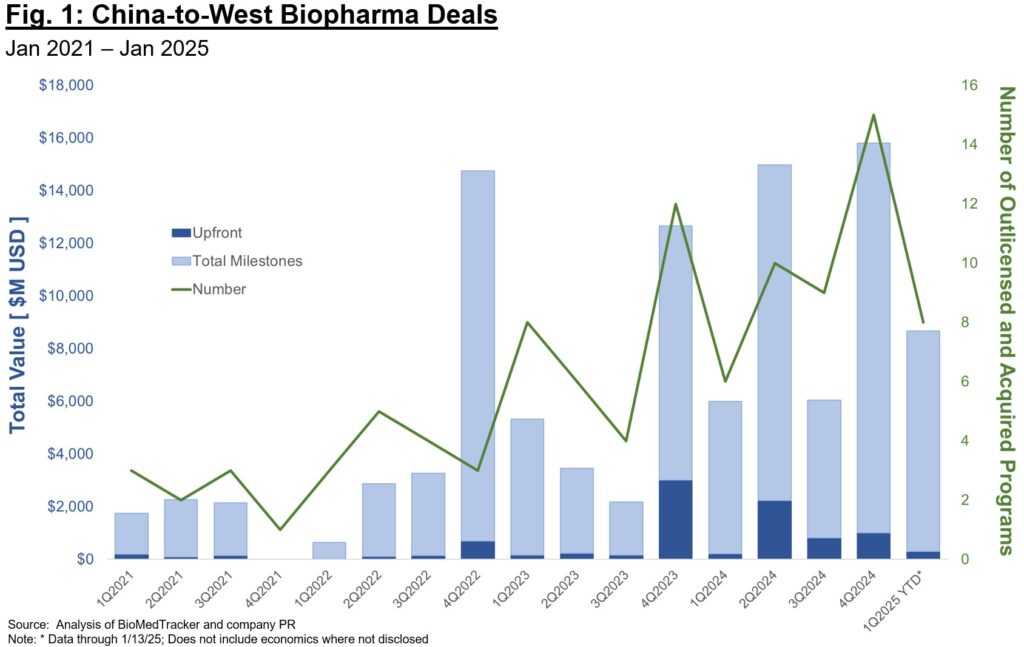

Regardless of grandstanding from Washington, China out-licenses to U.S. and EU-based biotech and Pharma have by no means been extra plentiful than up to now 12 months (Fig. 1). Whereas our business will proceed to debate whether or not the speedy timelines and plentiful applications obtainable in China are a growth or a bust for our biotech financial system, there isn’t any denying the panorama for therapeutic improvement is shifting (and particularly for “validated” targets for “best-in-class” performs). Pharma particularly elevated China-sourced deal quantity considerably final 12 months, a vote of confidence for the robust discovery and improvement expertise there in addition to extra environment friendly timelines to medical proof-of-concept. Stifel lately reported that ~1/3 of Pharma licensing offers in 2024 have been sourced from China, an unbelievable statistic and one which factors to the shifting panorama for asset-centric offers.

A number of questions are high of thoughts for traders when enthusiastic about China-sourced belongings:

- How lengthy will these offers stay aggressive, particularly within the context of quickly rising economics (upfront, complete milestones, royalties, fairness)?

- How can we mannequin evolution of this market – will we proceed to see largely “me-too” or “me-better” performs? Or will the China ecosystem evolve to ship first-in-class applications centered on riskier biology or difficult druggability?

- Associated to the above, what number of impartial applications towards the identical goal can the market fairly assist? In some unspecified time in the future we’ll attain a saturation level in belongings, past which there aren’t sufficient consumers to credibly carry a program by late-stage improvement and commercialization.

The long run right here isn’t all or none – it’s extremely unlikely China will utterly exchange Western nations in drug discovery and improvement, and additionally it is unlikely that future laws will utterly block collaboration. It’s to our profit as an business to work in the direction of a brand new paradigm that leverages cross-geography collaboration, whereas additionally making certain the U.S. and Europe stay aggressive in executing on improvement for first-in-class performs.

There and Again Once more: Traders Tiring of “Me-Too” Performs

Relatedly, investor pleasure for asset-centric performs has performed a task within the rush to supply (largely clinical-stage) belongings from China. As my colleague Bruce wrote in a latest publish (right here), the sentiment in 2024 was overwhelmingly “assets-in, platforms-out.” Corporations elevating cash for first-in-class biology or earlier platforms tended to have a tougher fundraising journey final 12 months, with few standout exceptions. Nevertheless, the pendulum will inevitably shift, and the query is whether or not we as an business can foresee that shift early and modify or whether or not we have now already oversaturated sure indications and targets. Given the motion in the direction of massive indications of the previous 18 months (weight problems, broader cardiovascular, excessive incidence oncology, and huge I&I indications), it’s vital to recollect the big price, experience, and time dedication required to run a number of Section 3 trials and commercialize in these aggressive areas. It’s unlikely that many firms past Pharma and large-cap biotech can pull it off. Thus, when you’re evaluating the 7th antibody program towards Goal X, take into account whether or not the client pool is saturated and what incremental alternative is obtainable by any differentiated options. I’ve little question many extra of those applications will “work” clinically than will be feasibly commercialized.

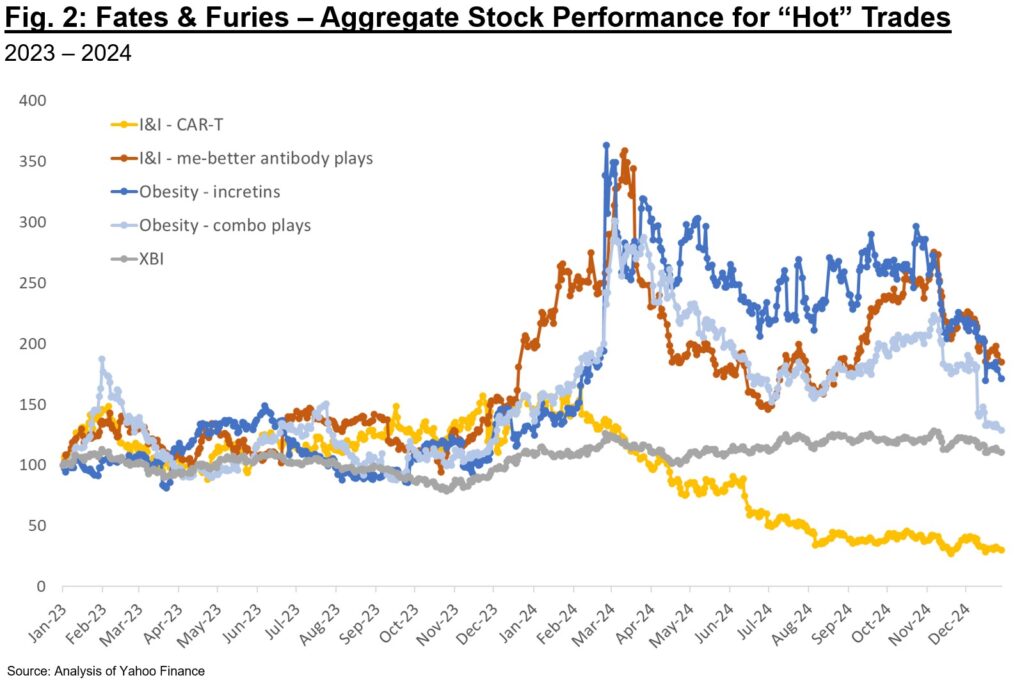

For example, we are able to take into account among the “sizzling” areas in 2024 and the combination inventory efficiency for consultant public firms (Fig. 2). Whereas each I&I and weight problems performs are controversial robust performers, it’s worthwhile to notice that some classes clearly grew to become overhyped final 12 months and subsequently bought off. At occasions the sell-off was as a result of knowledge that, whereas good, fell in need of the perfection priced in. At different occasions, it was associated to aggressive performs rising on the non-public facet. In a market the place there are zero-sum parts, an “apparent” play is simply valued as long as it’s perceived as best-in-class and aggressive in late-stage improvement.

Maybe within the near-future traders will once more admire riskier however doubtlessly higher-reward biology and offers – we could already be beginning to see that in 2025 with among the giant follow-on financings for next-gen modalities. A typical chorus this previous JPM was that of public traders lamenting lack of “originality” within the non-public offers they have been evaluating. There may be an uncanny Catch-22 at play – platform or first-in-class asset performs require appreciable funding and conviction, however firm creation VCs can’t proceed to spend money on these areas if later-stage traders (crossover and publics) don’t take part in financings earlier than these are de-risked in Section 2. If we proceed to pay attention bets in “validated” performs, I frankly fear concerning the novelty of our collective pipelines 5 years from now.

New Alternatives & Headwinds in Scientific Improvement

So the place does an investor or entrepreneur look when some indications really feel saturated? One space of focus may be indications the place trial landscapes are evolving such that chance of success is increased as we speak than beforehand. For example, take into account bronchial asthma – up till the early 2010s bronchial asthma trials didn’t use eosinophil ranges as an inclusion standards or stratifier, however quite some taste of Th2 marker (e.g., periostin). A number of mechanisms that many agree ought to work (e.g., anti-IL13 lebrikizumab) failed beneath this trial design – is {that a} learn on the mechanistic relevance itself, or quite the setting through which it was trialed? Altering improvement paradigms supply a path ahead for brand new or beforehand discarded mechanisms – just a few of my favorites from the previous ~12 months are under:

- COPD: a pure extension of the eos excessive vs. low paradigm in bronchial asthma is the applying of this affected person stratification method in COPD. The Dupixent approval for sufferers with an eosinophilic phenotype final September factors to the success of this method. Will anti-IL33s have the identical success stratifying by smoking standing? We’ll quickly discover out, as quite a lot of these readouts are anticipated this 12 months.

- HFpEF: coronary heart failure is an space the place incretins are radically altering the paradigm, together with the idea that weight reduction can truly be useful in sufferers (in comparison with the “weight problems paradox” notion, i.e., weight problems correlates with higher survival charges, implying shedding weight may very well be detrimental to CV outcomes). Novo and LLY have trialed semaglutide and tirzepatide in each T2D and non-diabetic overweight populations with coronary heart failure and proven beautiful efficacy on CV outcomes, high quality of life, and performance. Virtually as vital because the incretin mechanism, these trials established a brand new paradigm for overweight HFpEF when it comes to affected person choice, approvable endpoints, and therapy length. Hopefully this altering trial panorama for HFpEF, and doubtlessly broader segments of HF, alleviates among the danger for biotechs creating new remedies for these sufferers.

- Urticaria: the outstanding efficacy of KIT inhibitors in CSU has confirmed the function of mast cells in driving pathology, and has additionally ushered within the idea of Xolair naïve vs. refractory as a affected person stratification method. Whereas Xolair is an okay early-line agent for sufferers, potent KIT inhibitors like CLDX’s barzolvolimab have proven to be equally efficacious throughout each Xolair-naïve and refractory sufferers, suggesting that best-in-class efficacy is feasible throughout affected person segments when disabling mast cells. Different applications concentrating on Th2 biology (e.g., dupilumab) have proven mediocre efficacy and solely within the Xolair-naïve inhabitants, implying restricted impression of the mechanism past present standard-of-care.

- Stable tumors: latest FDA steerage on use of ctDNA as an endpoint for remedies with healing intent for stable tumors could also be an early biomarker for a shift within the surrogate endpoint panorama. Whereas extra work is required to harmonize assays and interpretation throughout therapies and trial settings, it’s a promising improvement to expedite sign in search of in these trials.

Whereas these altering paradigms will help drive additional improvement, there are additionally loads of indications the place the trial panorama is in dire want of latest insights on affected person stratification, endpoint choice, and therapy length. Atopic Dermatitis particularly stands out – whereas the pipeline of energetic brokers is rising, so too is the collective uncertainty re: constraining placebo response. Likewise for ALS, we proceed to see failed mechanisms throughout trials (the previous 12 months alone it was ATXN2, eIF2B, RIPK1, 15-Lipoxygenase, and others) and it’s unclear whether or not we’re seeing trial design noise or true unfavorable reads on the biology. At this level it’s unclear whether or not NfL as a surrogate might be related throughout a number of subtypes of ALS (genetic and in any other case) and what timeframe is cheap to see illness modification. That mentioned, with a number of high-conviction applications near the clinic (together with from Hint and others), hopefully 2025 brings extra readability on how you can greatest consider therapies for this devastating situation.

Herculean Scientific Impression: What Can’t Incretins Do?!

Whereas some traders are rising exhausted with the sheer quantity of weight problems newcos, it’s clear T2D and weight problems are solely the tip of the iceberg for indication relevance of this class. The “winners” have potential to command large market share given the enduring metabolic profit established up to now few years for this class. In 2024 we witnessed stellar readouts in HFpEF, MASH, Obstructive Sleep Apnea, Knee Osteoarthritis, Continual Kidney Illness, and T2D prevention. Whereas these datasets are being generated by LLY and NOVO, there may be now a strong clinical-stage pipeline of incretins in quick pursuit.

There may be large alternative for any Pharma with a present or future metabolic illness franchise to construct quickly right here – the market is so giant that no 2 gamers can feasibly nook all market share. Many indications exist the place rising degree of weight reduction (and corresponding enhancements in lipid profiles, glucose management, and so on.) is more likely to drive larger medical profit. Tirzepatide (Zepbound / Mounjaro) is clearly market-leading for these advantages, however there may be nonetheless substantial therapeutic potential for an agent that achieves increased weight reduction (approaching ~25% bar set by bariatric surgical procedure at 1 12 months). Whereas a few of these potential opponents (e.g., CagriSema, MariTide) have dissatisfied when it comes to differentiation vs. tirzepatide, others in late-stage improvement (VKTX, Kailera, choose others) could very nicely obtain the excessive bar required for differentiation.

Along with the broad spectrum of metabolic ailments the place incretins are actually a related first line remedy, there are just a few high-risk however high-reward readouts forward in 2025. Topline readouts from Novo’s research of semaglutide in early Alzheimer’s Illness (EVOKE and EVOKE PLUS) are anticipated by the top of this 12 months. One other trial by Novo will learn out on the efficacy of semaglutide and cagrilintide (amylin) in alcohol-related liver illness – importantly this trial has excessive potential to point out profit on alcohol consumption, doubtlessly paving the way in which for broader improvement in substance use issues. Lastly, we’re beginning to see trials for incretins together with anti-inflammatory brokers for I&I circumstances with a comorbid weight problems inhabitants (e.g., Lilly’s Section 3 trial for tirzepatide together with anti-IL17A ixekizumab in psoriasis).

In the end there are rising “tiers” of mechanistic rationale for incretins in indications past weight problems and T2D:

- Group 1: most “apparent” enlargement of mechanism and associated to impression of weight reduction on physique mechanics. Examples embody Knee Osteoarthritis and Obstructive Sleep Apnea.

- Group 2: much less apparent however doubtless associated to each discount in fats mass & irritation. HFpEF and MASH fall into this class, and whereas not 100% correlated, improved weight reduction profit (a surrogate for therapeutic efficiency) tends to enhance outcomes for these indications.

- Group 3: indications the place incretin efficiency is more likely to impression efficacy however the place knowledge remains to be rising. These indications embody habit / cravings, cognition / dementia, and long-term CV outcomes.

Whereas the urge for food for brand new incretin-based firms is waning, it’s largely a results of the compelling late-stage applications (e.g., from VKTX, Kailera, and others) already in line to compete with LLY and NOVO. It’s additionally clear that incretins as a category have extra to show when it comes to mechanistic relevance and impression on human well being – this might very nicely be the most important therapeutic breakthrough of our lifetimes.

Inside Neuro, Epilepsy Continues to be a Darling for Traders

2024 noticed many good points within the neuro area, together with repurposing anti-amyloid antibodies with TfR1 shuttles for improved mind penetration, the primary approval in Schizophrenia in over 30 years in Cobenfy, and optimistic mHTT and NfL readouts in Huntington’s. Final 12 months was additionally marked by quite a few compelling datasets for epilepsy. Specifically, knowledge in pediatric developmental and epileptic encephalopathies (DEE) and grownup focal epilepsy suggests a paradigm shift to best-in-class exercise with safer profiles. Among the compelling readouts up to now 12 months, and people on faucet for 2025, are under:

- Novel therapies for DEEs could obtain illness modification and thus have a profound impact on infants and youngsters with refractory epilepsy.

- STOK lately obtained Section 3 design alignment from the FDA, EMA, and PMDA (Japan) for the EMPEROR trial of zorevunersen, an revolutionary oligonucleotide to extend SCN1A transcript ranges and thus straight deal with the haploinsufficiency driving illness. Compelling seizure discount (>85%) is annotated for these sufferers on high of standard-of-care (albeit in an open-label setting). As well as, Section 2 knowledge displaying profit on cognitive and developmental scales in addition to inclusion of the Vineland-3 endpoint in Section 3 suggests potential for actual illness modification in these refractory sufferers

- Final 12 months Lundbeck acquired Longboard Prescription drugs largely for its 5-HT2c superagonist small molecule remedy Bexicaserin after studying out compelling Section 1/2 earlier within the 12 months in DEEs. Given >30% seizure discount (placebo-corrected) throughout DEE sufferers, 2025 might be an vital execution 12 months for the Section 3 trial for the mechanism

- Praxis additionally learn out a compelling Section 2 dataset for DEEs final 12 months – relutrigine is a sodium channel inhibitor being trialed in SCN2A and SCN8A DEE sufferers. Topline knowledge confirmed almost 50% seizure discount (placebo-corrected) at 16 weeks in a really extreme inhabitants and 1/3 of sufferers achieved seizure freedom

- Whereas early, Xenon lately printed preclinical knowledge for its Nav1.1 sodium channel openers, which have blockbuster potential for Dravet Syndrome.

- The previous 12 months has additionally seen large advances in therapies for adults with focal epilepsy.

- 2/7.3 potassium channel openers have quickly emerged as one of many highest-potential remedies for focal epilepsy, particularly these with selectivity (and thus security) to allow continual therapy. XENE leads the pack with azetukalner, reaching ~35% seizure discount (placebo-corrected) in a latest Section 2b readout. BHVN’s Kv7 activator BHVN-7000 isn’t too far behind, and these applications could usher in a flood of opponents

- RAPP’s RAP-219, whereas earlier-stage, has potential in focal epilepsy as a extra selective AMPA receptor NAM – Section 2a readouts are anticipated this 12 months, and apparently will present a learn on lengthy episodes (through implanted intracranial EEG) as a possible PD marker

The mechanisms governing hyperexcitability in seizure era might also play a task in different neuro circumstances, and it’s no shock a few of these applications are additionally being developed for psych, motion issues, and associated circumstances. Even with all of the success of this subject, it’s value noting that 2024 wasn’t uniformly optimistic in epilepsy – Ovid and Takeda noticed the Section 3 failure of small molecule inhibitor of ldl cholesterol 24-hydroxylase (CH24H) soticlestat in refractory Dravet syndrome and Lennox-Gastaut syndrome. Whereas not all knowledge has been rosy, the long run has by no means regarded so vivid for epilepsy remedies and 2025 could usher in an actual paradigm shift for brand new (and doubtlessly disease-modifying) medicines.

Closing Ideas – Exits Will Proceed to Dictate Sentiment

In the end traders are judged on their exits, so M&A and public portfolio efficiency will proceed to play an outsized function in sentiment for 2025. On the previous, Pharma patent cliffs proceed to loom giant and thus will doubtless drive sustained acquisitions for medical or near-clinical performs. On the latter, we’re nonetheless seeing robust knowledge being rewarded (e.g., BMPC, DNLI, others final week). Even when shares aren’t at their all-time highs, there may be alternative to select winners and do nicely on this market, particularly contemplating among the undervalued names.

There’s a bimodal distribution in investor and firm sentiment and it’s unlikely to alter within the very near-term. As a substitute of specializing in what’s out of our management (geopolitical agita, pricing stress, cussed inflation), let’s put vitality into what we are able to management: doing all the things in our collective energy to convey medicines to sufferers. Cheers to a productive 2025 for our business.

P.S. For these of you following alongside, sure the callbacks to literature have been intentional and there are 5 in complete!