By Aimee Raleigh, Principal at Atlas Enterprise, as a part of the From The Trenches function of LifeSciVC

Simply in time for brand new years’ reflections and resolutions, this yr’s JPM felt like a refreshing burst of enthusiasm for a sector that has seen its challenges in 2022 and 2023 but additionally some inexperienced shoots. 2023 was a stellar yr for M&A, comeback tales, burgeoning “scorching” areas, and for re-learning the fundamentals of belt-tightening and cautious capital allocation. Regardless of the combined bag of macro traits (pauses on curiosity hikes, however challenges inherent in an election yr), the temper this yr at JPM was considered one of optimism. With that in thoughts, under are some key takeaways rising from the assembly and as we look ahead to one other productive yr in biotech:

Sector-wide optimism is pushed by M&A and is targeted on a number of standout therapeutic areas:

There’s a self-amplifying cycle whereby exits (sometimes IPOs or M&A) affect early biotech investing, which in flip gasoline the pipeline for future development. In lean occasions akin to 2023, we noticed a shift in the direction of a number of “scorching” areas pushed by large business potential, clinically (± commercially) validated mechanisms, and exits that inspired additional investing, even on the early stage. Whereas “bubblicious” in nature (as my colleague Bruce Sales space has coined), in contrast to the highs of 2020, right this moment we’re seeing extra targeted depth round a number of key therapeutic areas: weight problems (projected >$80B world market by 2030), immunology (>$150B), superior modalities in oncology (particularly ADCs and radiopharmaceuticals, >$30-40B), and neuro ($20-30B). These are unbelievable forecasts and CAGRs, which if we assume directionally right, rely not solely on regular development for accredited therapies but additionally a considerable success fee of, and continued funding in, the event pipeline.

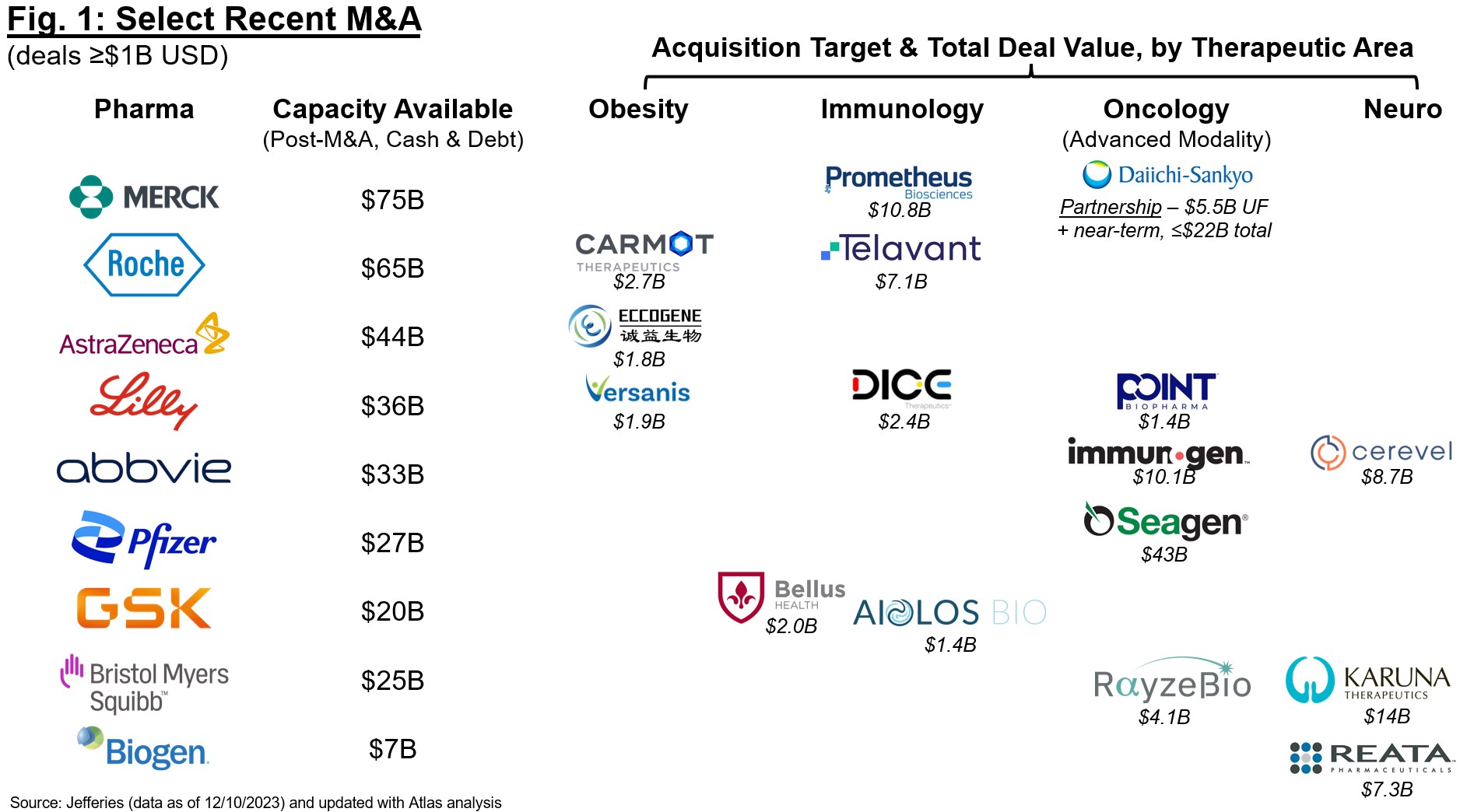

Unsurprisingly, many of those “scorching” areas turned so with engaging valuations and exits by way of M&A or IPOs, additional encouraging enterprise funding in earlier-stage firms. This enthusiasm is stage-agnostic, however most targeted on offers involving clinical-stage property with “de-risked” biology. This shift in the direction of best-in-class slightly than first-in-class is exemplified by this yr’s M&A panorama (Determine 1). The sector has been betting that patent time period expiration for Pharma blockbusters will drive M&A for the previous two years, and we’re beginning to see an actual shift in shopping for patterns, particularly within the again half of 2023. Naturally many of those acquisitions are pushed by enthusiasm for clinical-stage property that will contribute meaningfully to revenues in 2030+, and we’re seeing Pharma construct deeply in a number of key areas (weight problems, immunology, oncology, neuro) as they add on to present franchises or construct new ones. The expectation that Pharma will proceed buy-ups right here helps to gasoline conviction for one more robust yr forward for M&A, particularly for these acquirers who will depend on inorganic acquisition to construct in areas under-represented by inside R&D (e.g., current bulletins from Merck and Sanofi for weight problems and broader metabolic illness).

Rise of the best-in-class biologics performs:

Are you seeking to in-license or put money into “de-risked” biology that’s already within the clinic? Be part of the membership. The previous yr has seen an explosion in “quick follower” approaches to enhance on present goal product profiles for choose mechanisms, and was exceptionally obvious for antibodies and different biologics. There are a number of modality-specific traits driving this enthusiasm, along with the aforementioned engaging valuations within the house:

- Improved administration & dosing:

- Antibody half-life extension know-how is now extensively out there given the unique MedImmune patents overlaying the favored “YTE” mutations have expired, rising use of this validated strategy to attain each 3 months (and even much less frequent) dosing

- Subcutaneous formulations are more and more changing into a requirement to allow extra handy and at-home use. SC formulations profit from the elevated availability of approaches (e.g., from Halozyme) to enhance bioavailability, additional decreasing dose

- Viability of bi- and tri-specifics: elevated know-how on biology and CMC has enabled a variety of scientific multi-specific antibody (or different format akin to nanobody) packages, enabling enhanced efficiency and PK in comparison with historic precedents

- Mental property concerns: the current Amgen vs. Sanofi ruling by the Supreme Courtroom considerably restricted IP for antibodies, limiting claims to particular sequences with enablement assist vs. broad epitope protection. This ruling is nice information for “quick follower” approaches the place sequences may be selectively mutated to attain related (or higher) efficiency whereas nonetheless having freedom to function for a given goal or epitope

- Industrial potential: market analysis for a given indication typically suggests robust business potential for cannibalization of present q2w-q4w therapies if next-gen biologics may be prolonged to q3m+

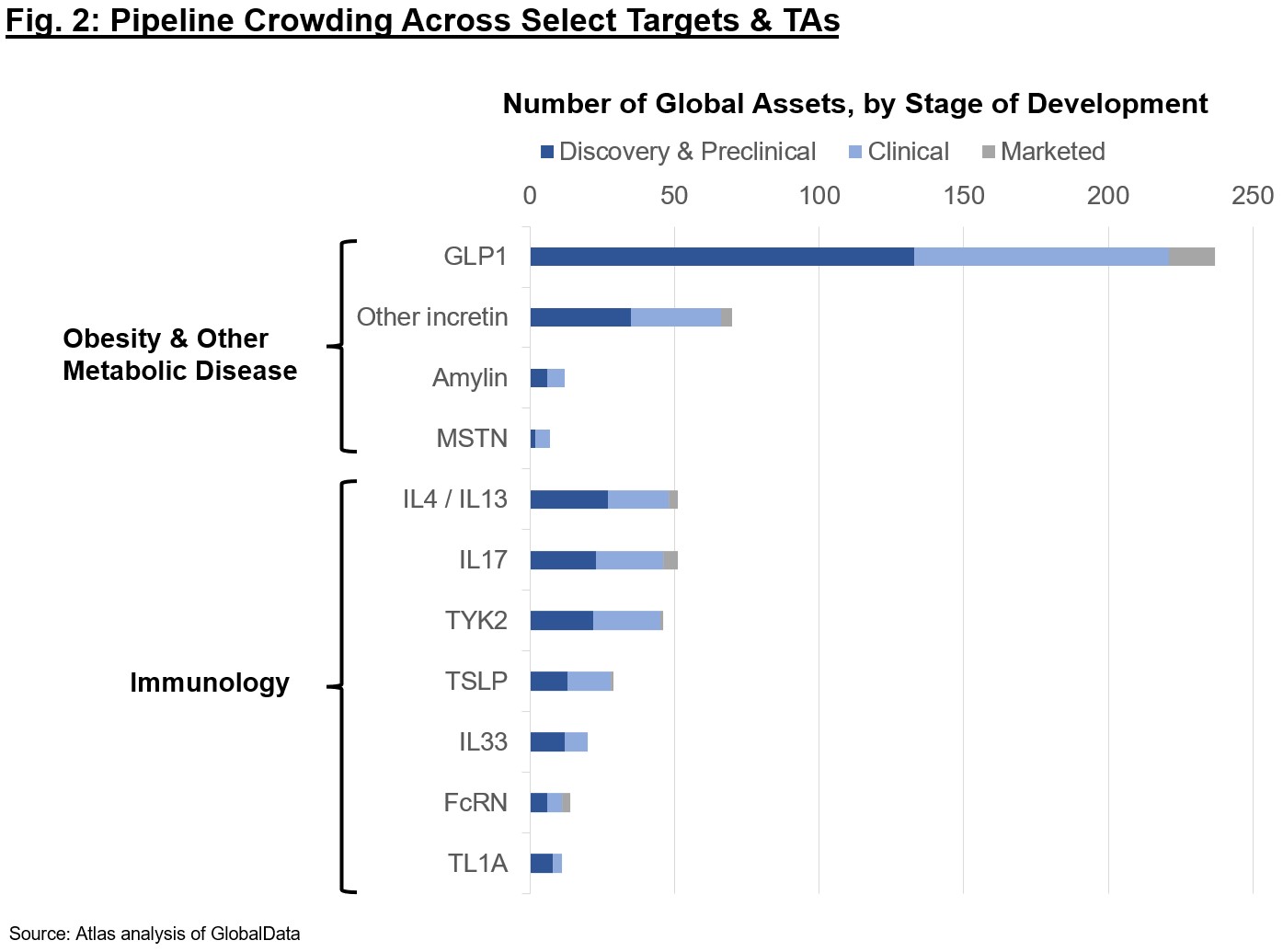

Regardless of these advances, it’s clear the passion could also be going too far. The marketplace for every goal class seemingly asymptotes with the variety of Pharma or giant biotech who can clinically develop and commercialize such property; thus, there’s intense deal with the primary handful of property to market. Determine 2 reveals pipelines throughout modalities for among the aggressive targets right this moment. Should you’re an organization or investor proposing early-stage packages, consider carefully in regards to the final differentiation for the affected person – simply because a program is technically differentiated doesn’t imply it’s price doing. Small molecule GLP1s? Nonetheless could also be some benefit if they’re clinical-stage and may obtain once-daily dosing with out too steep a minimize in efficacy or worsened hostile occasions vs. peptides, however be cautious of the intensely aggressive panorama. A everlasting gene edit to supply a difficult-to-titrate provide of GLP1 within the liver? In all probability difficult given Cmax-driven hostile occasion profile, security necessities, and COGS constraints for an weight problems or associated indications. Whereas firms could entice “momentum” buyers for warm targets and a brand new mechanism, they received’t get far if the TPP is impractical. Lastly, I might be remiss if I didn’t caveat that we nonetheless see many scientific failures even for “de-risked” biology, as nothing is ever actually low-risk in our business. Whether or not trial design, execution, or in any other case, drug growth even the place there’s precedent is a difficult street and shouldn’t be taken with no consideration.

Enthusiasm for weight problems is driving growth in broader metabolic illness:

The weight problems house has seen super development since Wegovy (high-dose formulation of semaglutide, Novo’s GLP1 agonist peptide) was first accredited in mid-2021 and began flying off the cabinets virtually in a single day. Since then, we are actually beginning to see the fruits of a fastidiously deliberate indication growth marketing campaign by Novo and Lilly, most notably the SELECT-CVOT that demonstrated safety from CV-associated mortality and nonfatal MI and stroke in overweight sufferers with pre-existing CV illness. Extra trials (e.g., ongoing tirzepatide CVOT to evaluate head-to-head CV outcomes vs. Trulicity in T2D) will proceed to construct the case for weight reduction (and incretins) in broader metabolic illness and recommend total healthcare system price advantages to anti-obesity therapies.

The incretins as a category additionally look attention-grabbing throughout a variety of follow-on indications, as evidenced by scientific trials in these areas (under). Along with constructing assist for ≥10-15% weight reduction alone as an intervention in these ailments, these information additionally assist set the proof-of-concept trial efficacy bar for future different non-incretin approaches:

- Coronary heart Failure (HF) in Overweight Sufferers: semaglutide lately readout in a Section 2 trial in overweight, nondiabetic sufferers with coronary heart failure with preserved ejection fraction (HFpEF) (right here and right here), exhibiting substantial enhancements within the QoL measure KCCQ-CSS, 6-minute stroll check, and a blood marker for cardiac perform (BNP) over a yr of dosing. Clearly weight reduction alone (± extra helpful CV mechanisms) is having a profound impression on this phase of the HF inhabitants. Tirzepatide can be trialing in a Section 3 overweight HFpEF trial, and top-line readout in 2H 2024 will recommend whether or not the elevated weight reduction achieved with twin GLP1/GIPR modulation additional improves QoL and practical endpoints.

- MASH (previously often known as NASH): weight reduction and liver defatting have confirmed efficient for NASH enchancment with out worsening of fibrosis in overweight sufferers, with rising mechanism involvement (GLP1 plus extra GIPR and / or glucagon receptor modulation) doubtlessly rising magnitude of this profit. Whether or not the incretins can enhance fibrosis continues to be an open query, however key readouts from tirzepatide Section 2 in F2/F3 (1H 2024), semaglutide Section 3 (biopsy information seemingly 2H 2024), amongst others (e.g., ALT) proceed to construct momentum within the indication. Will incretins “remedy” MASH in overweight sufferers? My take is definitively no, although they’ll seemingly more and more be utilized in early levels (F0-F2) and as backbones to mixture remedy.

- Kidney illness: outcomes in CKD are more likely to profit from weight reduction as effectively, with the semaglutide Section 3 FLOW trial stopped early final October after an interim efficacy learn (full information anticipated this yr).

Buyers are bullish on each incretin and different therapies for weight problems and metabolic illness, although I might warning we’re approaching unrealistically excessive valuations for most of the scientific tales rising over the previous quarter.

Small molecules are nonetheless in vogue regardless of IRA headwinds:

We proceed to listen to optimism for the comfort of orals even in indications with high-commercial potential and enriched for CMS protection (more likely to fall in crosshairs of IRA). Whether or not it’s small molecules to focus on the incretins (GLP1R ± GIPR), focusing on well-validated signaling nodes in I&I (e.g., STAT6), or enhancing the TPP by way of next-gen approaches (PROTACs, glues, covalent binders, and so forth.), small molecules proceed to be enthusiastically funded even on the discovery stage. That stated, 2023 has make clear the massive disconnect in how our business is perceived externally and the various methods it’s distorted as a political tactic. Let’s conform to make 2024 the yr we take motion and voice considerations for laws that encumbers the flexibility for biotech to ship on its promise to sufferers and caregivers.

Supply continues to be a bottleneck for novel modality genetic medicines:

Simply as in 2023, extra-hepatic supply continues to dominate discussions for a lot of platform firms. As soon as a pipe dream, we’re beginning to see actual advances in a number of key areas which can be price highlighting…is 2024 the yr extra-hepatic supply lastly begins to hit its stride?

- TfR1 is nearly changing into desk stakes for Pharma and biotech seeking to ship to the mind and / or muscle. Whereas names like DNLI, JNJ, DYN, and RNA have been actual pioneers within the house for supply of antibodies and oligos, increasingly more firms are growing their very own TfR1 shuttles or partnering to usher in the aptitude. Prior to now 6 months alone, TfR1 shuttles have made an look in a number of R&D Day decks, together with for ALNY, ARO, Lundbeck, and IONS (partnering with BCYC for peptide binders), amongst others.

- What comes subsequent? TfR1 took many a long time to crack, particularly for profitable transcytosis throughout the blood-brain-barrier. Extra lately, we’re beginning to see information to recommend that completely different codecs (e.g., Fab vs. mAb) and epitopes could improve the therapeutic window (i.e., scale back on-target anemia). Regardless of these advances, we’re merely scratching the floor in terms of potential ligandable targets for supply of biologic, oligo, or different cargo – 2024 guarantees extra growth on this space of giant unmet want.

- Capsid evolution approaches for AAV are additionally present process an enormous step change, with Voyager’s TRACER platform pioneering the best way and lately enabling a number of high-profile partnerships with Novartis, Neurocrine, and others. Different firms within the house (e.g., Affinia Therapeutics, Capsida) are focusing each on CNS and different ex-liver tissues – 2024 stands out as the yr we see actual progress in the direction of the clinic for these novel capsids.

- Further-hepatic focusing on of LNPs has additionally been making strides in late preclinical pipeline, with advances from ReCode within the lung, GBIO for immune subsets, and Capstan for HSCs and T cells.

All in all, supply of genetic medicines has by no means seemed extra promising, although many buyers are nonetheless cautious of funding and time required for very early discovery performs given historic challenges with translation.

Probably elevated fee of capital deployment in 2024:

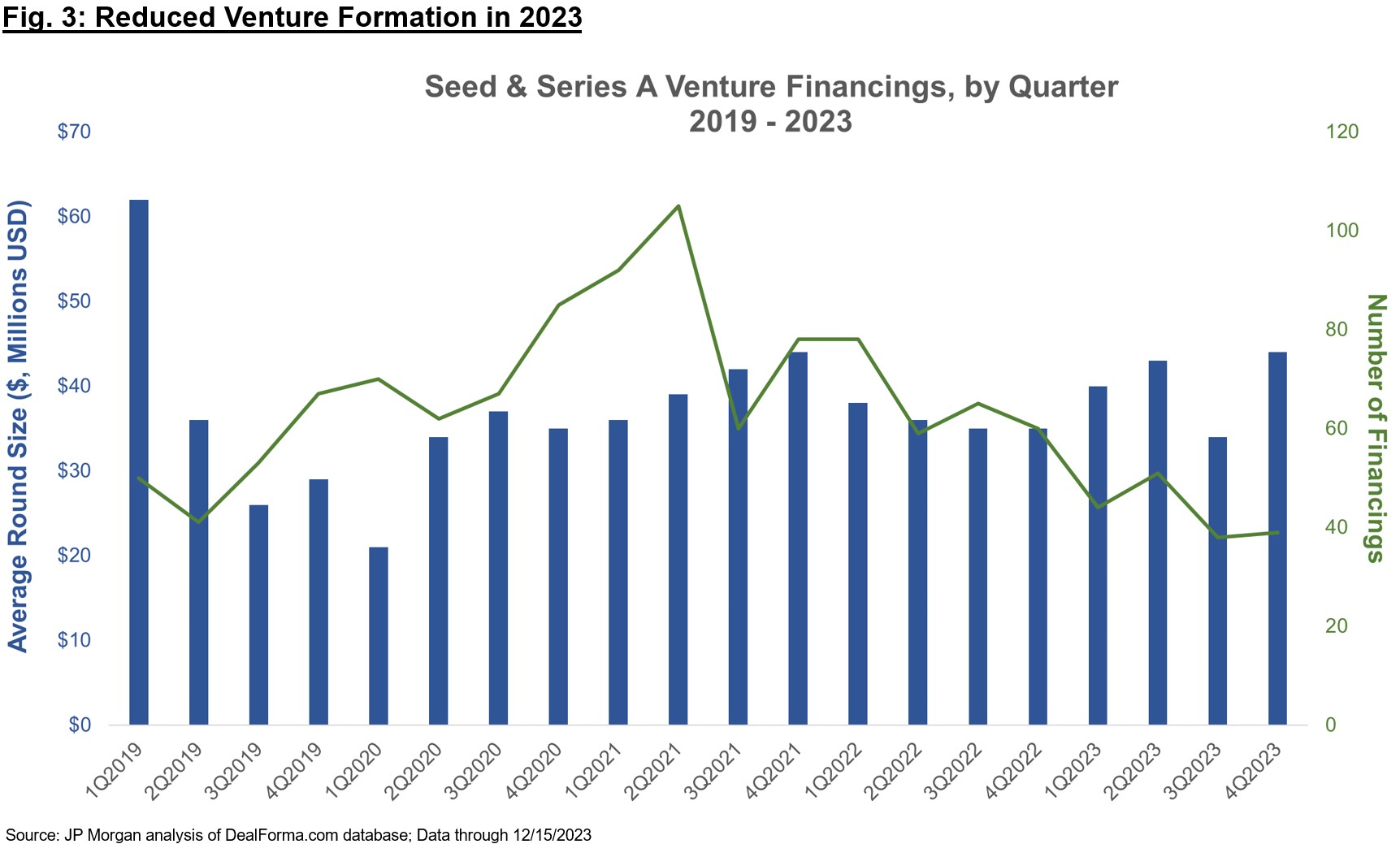

Therapeutics-focused enterprise funds have raised file quantities over the previous two years, and but 2023 noticed a pointy contraction in firm formation by way of Seed and Collection A financings (Determine 3, and in addition commented on in Bruce’s current put up). The “haves” on this atmosphere are nonetheless in a position to elevate capital to fund by essential inflections (that are more and more considered as Ph1b / Ph2a “proof-of-concept” for Collection A firms), however the variety of financings have dipped fairly a bit, suggesting many “have nots” which can be unable to lift in these environments.

Lots of the biotech VCs that raised current funds are sitting on ample capital, and GPs will begin feeling the stress to speculate extra aggressively in 2024 given the “typical” fund deployment lifespan of 4-5 years. The phrase “watchful ready” was steadily cited in conferences with different buyers at JPM to explain the sentiment in 2023, however companies count on to be extra lively this coming yr. As for later-stage financings (Collection B and past), many companies have additionally been contributing meaningfully to insider-only raises, particularly if new buyers are tepid (of stage, valuation, platforms extra broadly, and so forth.). The brand new buyers who cross on these raises are seemingly stretched skinny from persevering with to fund their very own portfolio, serving to to invoke a cycle of insider-only investments throughout many later-stage non-public firms. My guess is that we are going to see sidelined buyers come into early-stage Seed and Collection A financings effectively earlier than we see a return to regular syndication on the Collection B+ levels, given residual risk-off mentality and valuation sensitivity for something deemed to have “clinically unproven” biology.

Gratitude is all the time in fashion:

Typically it takes powerful markets and arduous conversations to understand the optimistic sentiment and altering tides. JPM this yr appeared that our business is popping a nook, with sunnier skies (actually and metaphorically in SF this yr) forward for biotech. There may be a lot to be enthusiastic about for the yr forward, and I’m all the time grateful to work in an business so motivated to enhance the lives of sufferers and households. Cheers to all of the revolutionary medicines we’ll collectively shepherd by discovery and growth in 2024, and may’t wait to debate at JPM in 2025!

Many due to Michelle Levine and Maurizio Fazio for his or her editorial recommendation.