KEY

TAKEAWAYS

- Taking a look at Threat ON / OFF by means of BETA

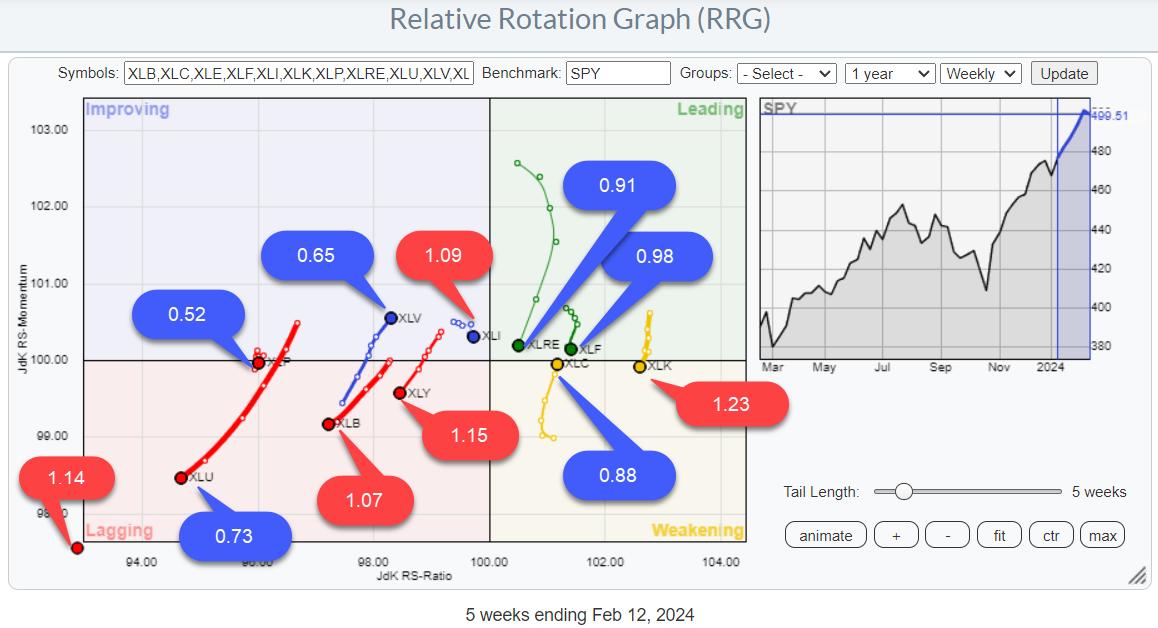

- RRG exhibits blended rotations

- SPY Uptrend intact with restricted draw back danger

BETA

One of many Threat ON/OFF metrics I prefer to control is BETA.

From Investopedia:

Beta (β) is a measure of the volatility—or systematic danger—of a safety or portfolio in comparison with the market as a complete (often the S&P 500). Shares with betas larger than 1.0 may be interpreted as extra risky than the S&P 500.

I’ve up to date my spreadsheet with final 12 months’s information for this text. And I would like to try the present (sector) rotations with the BETA for every sector.

On the Relative Rotation Graph above, you will see that the 12-month BETA values for all sectors.

Earlier than diving into the sector rotation half, a fast have a look at the BETA values. As stated the RRG on the prime exhibits the 12-month BETA values.

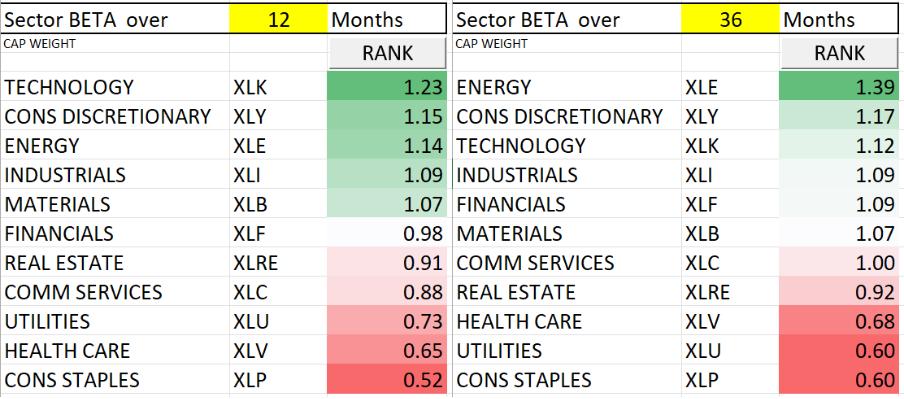

The tables beneath present 12- and 36-month BETAs facet by facet.

Notice that there are solely minimal place switches amongst sectors. There could also be some vital variations in BETA values over time. Most notably, the power sector which has a BETA of 1.39 over 36 months however “solely” 1.14 over 12 months.

Nonetheless, the highest three sectors didn’t change. The identical goes for the underside three sectors.

My expectation concerning rotations is that I’d count on the high-BETA sectors to indicate robust rotations throughout robust intervals for $SPX and robust rotations for low-BETA sectors throughout weak intervals for $SPX.

No Dominance On Both Aspect

Taking a look at that RRG, I don’t see a dominant course for both high-BETA or low-BETA sectors as a gaggle.

The very best BETA sector (1.23) has the very best studying on the RS-Ratio scale and simply dropped into the weakening quadrant, whereas Vitality (1.14) is deep inside, lagging however beginning to curl again up. Discretionary (1.15) is clearly inside, lagging and heading additional into that quadrant.

Within the low-BETA group, we see Utilities (0.73) nose-diving deeper into the lagging quadrant, whereas Staples (0.52) is static at a low RS-Ratio studying. Well being Care (0.65) is the exception right here, with a powerful trajectory into the bettering quadrant at a powerful RRG-Heading.

The RRG picture is blended, with no clear choice for both group.

Bringing that commentary to the SPY chart (each day) helps interpret the index’s current worth motion.

SPY Outlook

Breaking the earlier all-time excessive (January 2022) was clearly a bullish signal. New ATHs aren’t an indication of bear markets, proper?

And so was the rally that adopted after the break. An everyday rhythm of upper highs and better lows took SPY to a brand new ATH at 503.50. Even the shock decline final Tuesday has not broken this up-trend but.

Nonetheless, the blended rotations on the RRG, mixed with a unfavourable divergence increase between SPY and its RSI, sign some hesitation. At the very least one thing to pay attention to.

Draw back danger appears restricted, with the previous resistance at 480 now anticipated to return as strong assist in case of a decline.

Clearly, a push past 503.50 will once more be a bullish sign for the market. On the draw back, I’m watching the decrease boundary of the brand new short-term channel and the earlier low at 490. Breaking these ranges subsequently will very possible set off a decline again to the breakout degree close to 480.

What occurs there will probably be essential for additional growth within the coming months.

In the meanwhile, the uptrend remains to be intact, with restricted near-term danger. (4-5%)

#StayAlert. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll definitely learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra