The Bitcoin value has had a rocky begin to the brand new week after dropping its footing above $52,000 on Tuesday. Nevertheless, all hope just isn’t misplaced, as indicators nonetheless level to a continuation of this pattern. Crypto analyst Tony The Bull has recognized an necessary pattern within the Bitcoin chart which might set off a continuation of the pattern again above $52,000.

Bitcoin 1-Week Fisher Rework At Essential Level

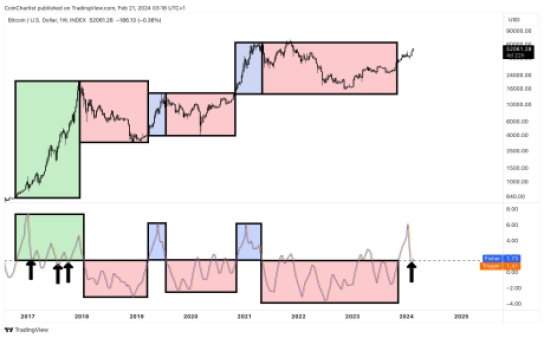

In an evaluation posted on X (previously Twitter), the crypto analyst shared a chart that confirmed the Bitcoin Fisher Rework compared to value. Most significantly, the chart confirmed the 1-week Fisher Rework and the way it has moved since 2017.

The evaluation reveals some similarities between the present pattern and the developments seen in 2017. An identical pattern was additionally seen in 2019 and 2021, the place the Fisher Rework rose quickly earlier than falling. However the significance of this pattern lies in the place the Fisher Rework heads subsequent from right here.

The present necessary degree is the 1.5 Commonplace Deviation, which has been an important level at any time when this pattern has occurred. Now, if the Fisher Rework is ready to keep above this degree, it’s bullish for the value. Nevertheless if it falls beneath this commonplace deviation, it is extremely bearish for the value.

Supply: Tony The Bull on X

“It is a pivotal space primarily based on historic value motion and its exhibiting 2017-like habits not seen in 2019 or 2021,” the crypto analyst explains. “Under it tends to incite bearish developments, whereas holding above provides bulls additional vigor.”

BTC value at $51,100 | Supply: BTCUSD on Tradingview.com

Bears And Bulls Vie For Management Over BTC Value

The curiosity within the subsequent route of the Bitcoin value has seen bulls and bears lock horns over which camp will reclaim management of BTC. This has seen the value of the digital asset fluctuate wildly over the previous couple of days, going from $53,000 to beneath $51,000, earlier than bouncing again up as soon as once more within the early hours of Wednesday.

This tug-of-war continues to carry the value of Bitcoin down, however investor sentiment appears to be climbing even by means of this. In line with the Bitcoin Concern & Greed Index, investor sentiment has reached Excessive Greed for the primary time in a single yr.

Traditionally, the index going into excessive greed has signaled the highest of the market, with costs trending downward not too lengthy after. Nevertheless, Bitcoin remains to be seeing constructive indicators, with its buying and selling quantity rising greater than 40% within the final 24 hours alone.

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal threat.