EUR/USD: A Week of Blended Knowledge

● The macroeconomic statistics launched final week had been blended in each america and the Eurozone. Because of this, EUR/USD failed to interrupt by both the 1.0700 assist or the 1.0800 resistance, persevering with to maneuver inside a slim sideways channel.

● The US greenback obtained a robust bullish impulse on Tuesday, February 14, following the discharge of US inflation information. The Greenback Index (DXY) surged by greater than 0.5% and practically reached the 105.00 resistance stage. Consequently, EUR/USD moved downward, in the direction of the decrease boundary of the required sideways vary. In the meantime, the S&P 500 inventory index fell from 5051 to 4922 factors.

It may be stated that the US inflation information caught the markets off guard. Some analysts even described them as stunning. It turned out that the ultimate victory over costs shouldn’t be as shut because it appeared earlier than, and that the Federal Reserve is unlikely to begin decreasing rates of interest anytime quickly.

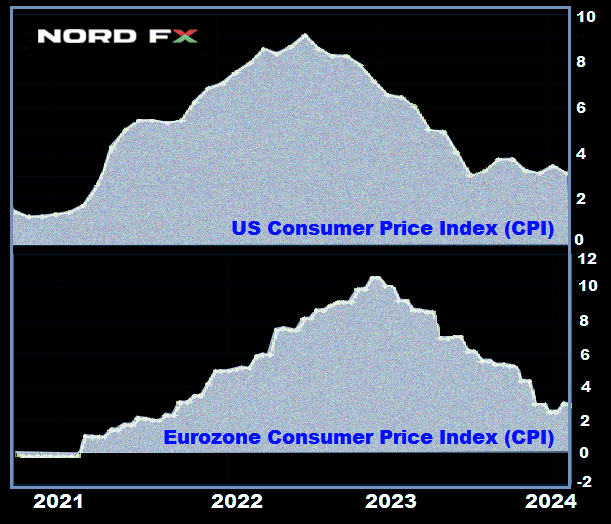

In January, the Client Value Index (CPI) sharply elevated towards the backdrop of a major rise in the price of lease, meals, and healthcare providers. On a month-to-month foundation, the general index accelerated from 0.2% to 0.3%. On an annual foundation, the CPI was 3.1%, which is under the earlier worth of three.4%, however considerably above the forecast of two.9%. Excluding the unstable costs of meals and vitality, inflation in January rose from 0.3% to 0.4% month-on-month, whereas the annual core CPI remained on the earlier stage of three.9%, though analysts had forecast a lower to three.8%. Significantly sharp was the rise in so-called “super-core inflation,” which additionally excludes housing prices. In January, on a month-to-month foundation, it reached 0.8%: the best stage since April 2022.

● Definitely, the Federal Reserve’s achievements in combating inflation are vital. It’s value recalling that in the summertime of 2022, the CPI reached a 40-year peak at 9.1%. Nevertheless, the present inflation charge remains to be virtually twice the goal stage of two.0%. Primarily based on this, the market concluded that the Federal Reserve is now unlikely to hurry into easing financial coverage and can most likely keep excessive rates of interest for longer than beforehand anticipated. At the start of January, in line with the FedWatch Software, the chance of a 25 foundation level (bp) charge reduce in Might was 54.1%. After the inflation report was launched, this determine dropped to 35%. An excellent decrease chance is given by the monitoring device developed by Investing.com. The opportunity of a dovish pivot in March, in line with its readings, stands at 5%, and in Might – round 30% (just some weeks in the past, it was over 90%). As for the start of summer time, the chance of a discount in the price of borrowing by federal funds in June is estimated at 75%.

● The inflation report was a boon for greenback bulls, however their pleasure was short-lived. The information on industrial manufacturing and retail gross sales within the US launched on Thursday, February 16, had been weaker than anticipated. In January, retail gross sales confirmed a decline of -0.8% in comparison with the December enhance of 0.4% and the forecast of -0.1%. Because of this, the greenback was underneath stress, and the EUR/USD pendulum swung in the wrong way: the pair headed in the direction of the higher boundary of the 1.0700-1.0800 channel.

The greenback obtained a slight increase on the very finish of the workweek. On Friday, February 16, the Producer Value Index (PPI) indicated that industrial inflation in January rose simply as client inflation did. In opposition to a forecast of 0.1%, the precise enhance was 0.3% month-on-month, which is 0.4% increased than December’s determine. On an annual foundation, the PPI rose by 2.0% (forecast 1.6%, earlier worth 1.7%). Nevertheless, this assist was quickly offset by a drop within the College of Michigan’s US Client Confidence Index, which, though it elevated from 79.0 to 79.6, was under the forecast of 80.0 factors.

● On the opposite facet of the Atlantic, the information was additionally quite contradictory, ensuing within the European statistics not having the ability to considerably assist its forex. The February Financial Sentiment Index from ZEW in Germany improved greater than anticipated, rising to 19.9 from 15.2 within the earlier month. The financial sentiment indicator for the Eurozone as a complete additionally confirmed progress, transferring from 22.7 factors to 25.0. Nevertheless, the evaluation of the present scenario fell to -81.7, the bottom stage since June 2020.

Preliminary GDP information for This fall 2023, launched on Wednesday, February 14, confirmed that the Eurozone is in a state of stagnation. On a quarterly foundation, the figures remained at 0%, and on an annual foundation, they had been at 0.1%, precisely matching forecasts. This statistic didn’t add optimism, and markets continued to train warning, fearing that the Eurozone financial system may slip into recession.

● Europe faces a considerably sharper alternative between supporting the financial system and preventing inflation in comparison with america. Isabel Schnabel, a member of the Government Board of the ECB and a well known hawk, acknowledged on Friday, February 16, that the regulator’s financial coverage should stay restrictive till the ECB is assured that inflation has sustainably returned to the medium-term goal stage of two.0%. Moreover, Ms. Schnabel believes that persistently low labour productiveness progress will increase the danger that firms could move their increased labour prices on to customers, which may delay the achievement of the inflation goal.

Nevertheless, regardless of such hawkish statements, in line with a ZEW survey, greater than two-thirds of enterprise representatives nonetheless hope for an easing of the ECB’s financial coverage throughout the subsequent six months. The chance of a charge reduce for the euro in April is presently estimated by the markets at about 53%.

● After all of the fluctuations of EUR/USD, the ultimate word of the previous week was struck on the stage of 1.0776. On the time of scripting this evaluation, on the night of Friday, February 16, 55% of consultants voted for the strengthening of the greenback within the close to future and the additional fall of the pair. 30% sided with the euro, whereas 15% took a impartial stance. Among the many oscillators on D1, 60% are colored crimson, 40% in neutral-grey, and none in inexperienced. The ratio amongst development indicators is totally different: 60% crimson and 40% inexperienced. The closest assist for the pair is positioned within the zone of 1.0725-1.0740, adopted by 1.0695, 1.0620, 1.0495-1.0515, 1.0450. Bulls will encounter resistance within the areas of 1.0800-1.0820, 1.0865, 1.0925, 1.0985-1.1015, 1.1110-1.1140, 1.1230-1.1275.

● Among the many occasions of the upcoming week, the minutes from the final assembly of the Federal Open Market Committee (FOMC) of the US Federal Reserve, which will likely be revealed on Wednesday, February 21, are of nice curiosity. The next day, a robust move of information on enterprise exercise (PMI) in Germany, the Eurozone, and the US will likely be launched. Furthermore, on Thursday, February 22, the January determine for the Client Value Index (CPI) within the Eurozone and the variety of preliminary jobless claims within the US will likely be identified. In the direction of the very finish of the workweek, on Friday, February 23, information on Germany’s GDP, the principle engine of the European financial system, will arrive. Moreover, merchants ought to needless to say Monday, February 19, is a vacation in america: the nation observes Presidents’ Day.

GBP/USD: What’s Occurring with the UK Financial system?

● As is thought, following the assembly that concluded on February 1, the Financial institution of England (BoE) introduced the upkeep of the financial institution charge on the earlier stage of 5.25%. The accompanying assertion talked about that “extra proof is required that the Client Value Index will fall to 2.0% and stay at that stage earlier than contemplating charge cuts.”

● On February 15, Catharine Mann, a member of the Financial Coverage Committee (MPC) of the regulator, offered probably the most complete overview of the state of the British financial system, together with features regarding inflation. The important thing factors of her evaluation had been as follows: “The newest GDP information verify that the second half of 2023 was weak. Nevertheless, GDP information is a rearview mirror. Alternatively, the Buying Managers’ Index (PMI) and different main indicators look promising. The unemployment charge within the UK stays comparatively low, and the labour market continues to be tight. Wage progress is slowing, however the tempo stays problematic for the goal Client Value Index (CPI) indicator. Within the UK, items costs could turn out to be deflationary sooner or later, however not on a long-term foundation. Inflation within the UK’s providers sector is rather more persistent than within the EU or the US.” Consequently, Catharine Mann’s conclusion was: “Mitigating the sources of inflation will likely be essential in decision-making” and “Earlier than making a call on additional actions, the Financial institution of England must obtain a minimum of yet one more inflation report.”

● Referring to particular figures, the newest information from the Workplace for Nationwide Statistics (ONS), revealed on February 16, confirmed that retail gross sales within the UK in January elevated by 3.4% towards the anticipated 1.5% and a decline of -3.3% in December (month-on-month). The core determine (excluding automotive gas retail gross sales) rose by 3.2% over the month towards a forecast of 1.7% and -3.5% in December. On an annual foundation, retail gross sales additionally confirmed progress of 0.7% towards the anticipated decline of -1.4% and a December determine of -2.4%.

Labour market information additionally helps the pound. The unemployment charge fell to three.8% from 4.2%, towards expectations of 4.0%. The discount within the variety of lively job seekers within the labour market intensifies competitors amongst employers, which helps keep the next wage progress charge. For the three months to December, wage progress was 5.8%. Such sturdy labour market statistics, complemented by excessive inflation (CPI 4.0% year-on-year, core CPI 5.1% year-on-year), are prone to push again the anticipated date for relieving the Financial institution of England’s financial coverage. Many analysts don’t rule out that in the end, the BoE could also be among the many final mega-regulators to chop charges this 12 months.

● GBP/USD ended the week on the stage of 1.2599. In keeping with economists at Scotiabank, the 1.2500 zone represents sturdy long-term assist for it, and a assured transfer above 1.2610 will strengthen the pound and set GBP/USD on a progress path in the direction of 1.2700. Relating to the median forecast of analysts for the approaching days, 65% voted for the pair’s decline, 20% for its rise, and the remaining 15% maintained neutrality. Among the many oscillators on D1, 75% level south, the remaining 25% look east, with none prepared to maneuver north. The scenario is totally different with development indicators, the place there’s a slight bias in favour of the British forex – 60% point out north, whereas the remaining 40% level south. If the pair strikes south, it’s going to encounter assist ranges and zones at 1.2570, 1.2500-1.2535, 1.2450, 1.2370, 1.2330, 1.2185, 1.2070-1.2090, 1.2035. In case of a rise, the pair will meet resistance at ranges 1.2635, 1.2695-1.2725, 1.2775-1.2820, 1.2880, 1.2940, 1.3000, and 1.3140-1.3150.

● Thursday, February 22 stands out within the calendar for the upcoming week. On today, a batch of information on enterprise exercise (PMI) in varied sectors of the financial system of the UK will likely be launched. The discharge of different vital macroeconomic statistics within the coming days shouldn’t be anticipated.

USD/JPY: The Flight Continues

● On Tuesday, February 13, USD/JPY reached one other native most at 150.88. The Japanese forex retreated once more, this time towards the backdrop of inflation information within the US. The yen additionally continues to be underneath stress as a result of Financial institution of Japan’s (BoJ) constant dovish stance. On February 8, Deputy Governor Shinichi Uchida expressed doubts that the regulator would begin to rapidly increase its benchmark charge anytime quickly. Final Friday, February 16, BoJ Governor Kazuo Ueda spoke in an analogous vein. He acknowledged that the difficulty of sustaining or altering financial coverage, together with the destructive rate of interest, would solely be thought-about “when there’s a probability of sustainable and secure achievement of the worth stage goal.” Ueda declined to touch upon short-term fluctuations within the change charge and the components behind these actions.

● Normally, there’s nothing new. Nevertheless, many analysts proceed to hope that in 2024 the Financial institution of Japan will lastly determine to tighten its financial coverage. “We consider,” write economists on the Swiss monetary holding UBS, “that the normalization of the Financial institution of Japan’s coverage this 12 months will happen towards the backdrop of sturdy negotiations on wage will increase and company profitability. We nonetheless consider that the Japanese yen is probably going at a turning level after vital depreciation from 2021 to 2023. Contemplating that the yield differential between 10-year U.S. and Japanese bonds will slim over the 12 months, we consider the present entry level for getting yen is engaging.”

The same place is held at Danske Financial institution, the place they forecast a sustainable lower in USD/JPY under 140.00 on a 12-month horizon. “That is primarily as a result of we anticipate restricted progress in yields within the US,” say strategists at this financial institution. “Due to this fact, we anticipate the yield differential to turn out to be a tailwind for the yen all year long, because the G10 central banks, aside from the Financial institution of Japan, are prone to begin rate-cutting cycles.”

● Relating to the short-term outlook, specialists at Singapore’s United Abroad Financial institution Restricted consider that the greenback nonetheless has the potential to check 151.00 earlier than weakening. “The chance of the US greenback rising to 152.00 will stay unchanged so long as it stays above 149.55,” UOB states. This place is supported by solely 25% of consultants, with the bulk (60%) already siding with the yen, and the remaining 15% preferring to take care of neutrality. Among the many development indicators and oscillators on D1, all 100% level north, nevertheless, 25% of the latter are within the overbought zone. The closest assist stage is positioned within the zone of 149.65, adopted by 148.25-148.40, 147.65, 146.65-146.85, 144.90-145.30, 143.40-143.75, 142.20, 140.25-140.60. Resistance ranges are positioned on the following ranges and zones – 150.65-150.90, 151.70-152.00.

● No vital occasions associated to the Japanese financial system are scheduled for the upcoming week. Furthermore, you will need to word that Friday, February 23, is a public vacation in Japan: the nation observes the Emperor’s Birthday.

CRYPTOCURRENCIES: Bitcoin Breaks Data

● Final week, the worth of bitcoin rose above $52,790, setting a brand new peak since 2021. In keeping with CoinGecko, the market capitalization of the main cryptocurrency exceeded $1.0 trillion for the primary time in two years, and the overall market capitalization of all the crypto market rose above $2.0 trillion for the primary time since April 2022.

A lot of this bull rally is attributed to the launch of 9 main spot bitcoin ETFs. In keeping with The Block, a month after their launch, their property exceeded 200,000 BTC (about $10 billion). The brand new bitcoin ETFs rose to second place within the rating of US commodity exchange-traded funds by asset quantity, turning into a extra standard funding instrument than silver ETFs. Observers word BlackRock’s assertion that “curiosity in bitcoin amongst traders stays excessive,” therefore the fund is able to purchase much more BTC.

In keeping with Documenting Bitcoin, the online curiosity from ETF issuers exceeds 12,000 BTC per day. Thus, Wall Avenue representatives are presently shopping for 12.5 occasions extra BTC cash every day than the community can produce. Researchers consider this has been a key driver of the worth enhance for the flagship crypto asset.

● Morgan Creek Digital co-founder and accomplice Anthony Pompliano additionally highlighted the success of the newly launched spot BTC-ETFs. In keeping with him, the truth that BlackRock and Constancy managed to draw $3 billion every in document quick occasions was a historic occasion for exchange-traded funds. “Wall Avenue is not only in love with bitcoin,” the financier wrote. “They’re in an lively love affair. The every day provide of bitcoins to funds is proscribed to simply 900 BTC, which corresponds to roughly $40-45 million. In the meantime, the every day internet influx of funds into BTC-ETFs already equals $500 million (max. $651 million). This can be a clear indicator of BTC shortage and its bullish influence on the cryptocurrency’s worth and the market as a complete,” Pompliano acknowledged, noting the imbalance between the market provide of bitcoin and demand from Wall Avenue firms. The billionaire is optimistic about BTC’s future trajectory and asserts that with continued demand from Wall Avenue, particularly contemplating the upcoming halving, the top-capitalization cryptocurrency may considerably exceed its historic highs.

CryptoQuant famous that, along with the demand from BTC-ETFs, the variety of lively wallets can be considerably rising. This too signifies a long-term upward development. “Given the discount in provide, elevated demand, and varied financial and social points, particularly ongoing inflation, bitcoin is prone to strengthen its place as a long-term various funding asset with an upward development,” analysts conclude.

● SkyBridge Capital founder and former White Home senior official Anthony Scaramucci additionally emphasised inflation. Past the launch of spot BTC-ETFs and the halving, Scaramucci pointed to the financial coverage of the US Federal Reserve as a driver for Bitcoin’s progress. “The US Client Value Index (CPI) information launched on Tuesday, February 13, signalled that inflation might not be as underneath management because the Fed would love,” the investor writes. “Primarily based on information revealed by the US Bureau of Labor Statistics, the buyer worth index for January confirmed inflation at 3.1%. The information additionally sparked hypothesis {that a} Federal Reserve rate of interest reduce in March and Might is probably going off the desk.” Delays in charge cuts could cause turbulent buying and selling in the principle market however will function a growth for the crypto world, as Bitcoin is used as a hedge towards inflation. Due to this fact, in line with Scaramucci, the time to take a position profitably in digital gold has not but handed.

Standard blogger and analyst Lark Davis shared an analogous place: he believes traders have about 700 days to get wealthy. Discussing the significance of market cycles and the well timed sale of property, the specialist famous that if merchants are attentive, they will make some huge cash within the subsequent two years. In keeping with the professional, 2024 would be the final probability to purchase digital property, and 2025 would be the greatest time to promote them. The specialist emphasised the significance of not disposing of all the things directly however step by step securing income. Lark Davis additionally warned that in 2026, a “Nice Despair” will start within the world financial system and the cryptocurrency market. And if not bought in time, investments may very well be misplaced.

The onset of the “Nice Despair” can be predicted by the well-known creator of “Wealthy Dad Poor Dad,” financier, and author Robert Kiyosaki. He believes that the S&P 500 index is on the verge of a monumental crash with a possible collapse of a full 70%. He accompanied this assertion along with his constant suggestion to put money into property reminiscent of gold, silver, and bitcoins.

● Ex-CEO of the cryptocurrency change BitMEX, Arthur Hayes, recognized one other driver for Bitcoin’s progress associated to the Federal Reserve’s financial coverage. Final week, the US banking sector was gripped by concern as New York Group Bancorp (NYCB) reported a colossal quarterly lack of $252 million. The financial institution’s whole mortgage losses elevated fivefold to $552 million, fuelled by considerations over business actual property. Following the discharge of this report, NYCB shares fell 40% in at some point, resulting in a decline within the US Regional Banks Index.

Arthur Hayes recalled the Bitcoin rally triggered by the banking disaster in March 2023, when three main American banks, Silicon Valley Financial institution, Signature Financial institution, and Silvergate Financial institution, went bankrupt inside 5 days. The disaster was attributable to a rise within the Federal Reserve’s refinancing charge and, as a consequence, the outflow of deposit accounts. Its greatest victims additionally included Credit score Suisse and First Republic Financial institution. To stop the disaster from affecting much more banks, world trade regulators, primarily the Fed, intervened to supply liquidity. “Yeah… From rock to chapter, that is the longer term. After which there will likely be much more cash, printers… and BTC at $1 million,” the ex-CEO of BitMEX commented on the present NYCB failure.

● Standard analyst on the X platform often called Egrag Crypto believes that by September this 12 months, Bitcoin’s market capitalization will attain $2.0 trillion. Primarily based on this, the worth of the main cryptocurrency at that second will exceed $100,000. “Prepare for the journey of your life,” Egrag Crypto urges his followers. “Maintain on tight, as you’re witnessing a cryptocurrency revolution. Do not blink, otherwise you may miss this historic second in monetary historical past!”

● As of the night of February 16, when this evaluation was written, the BTC/USD pair is buying and selling within the $52,000 zone. The overall market capitalization of the crypto market stands at $1.95 trillion ($1.78 trillion per week in the past). The Crypto Concern & Greed Index stays within the Greed zone at a stage of 72 factors.

– It is value noting that the Greed zone corresponds to a scenario the place merchants are actively shopping for an asset that’s rising in worth. Nevertheless, Glassnode warns that many on-chain indicators have already entered the so-called “threat zone”. The evaluation relies on a gaggle of indicators that contemplate a variety of information relating to investor behaviour. Their mixture covers each short-term and long-term cycles. Specifically, the MVRV indicator, which tracks long-term traders, has approached the important zone. Such a excessive worth (2.06) has not been noticed for the reason that FTX collapse. The same “excessive” and “very excessive” threat standing is presently attribute of six out of the remaining 9 metrics. They document a comparatively low stage of realized revenue contemplating the lively worth enhance in latest weeks. In keeping with observations by Glassnode specialists, a excessive threat indicator is normally noticed within the early phases of a bull market. It’s because, having reached a “vital stage” of profitability, hodlers could begin to safe income, which, consequently, may result in a robust correction downwards.

NordFX Analytical Group

Discover: These supplies are usually not funding suggestions or pointers for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx