We have highlighted all of the warning indicators as this bull market section has appeared to close an exhaustion level. We shared bearish market tells, together with the dreaded Hindenburg Omen, and the way main progress shares have been demonstrating questionable patterns. However regardless of all of these indicators of market exhaustion, our growth-led benchmarks have been pounding even increased.

This week, Nvidia’s blowout earnings report appeared to via gasoline on the fireplace of market euphoria, and the AI-fueled bullish frenzy gave the impression to be alive and properly going into the weekend. As different areas of the fairness markets have proven extra constructive worth habits and volatility has remained pretty low, the query stays as to when and the way this relentless market advance will lastly meet its peak.

I’d argue that the bearish implications of weaker breadth, together with bearish divergences and overbought circumstances, nonetheless stay largely unchanged even after NVDA’s earnings report. The seasonality charts for the S&P 500 affirm that March is in truth one of many weakest months in an election yr. So will the Nasdaq 100 comply with the conventional seasonal sample, or will the energy of the AI euphoria push this market to even additional heights into Q2?

By the way in which, we carried out the same train for the Nasdaq 100 again in November, and guess which situation truly performed out?

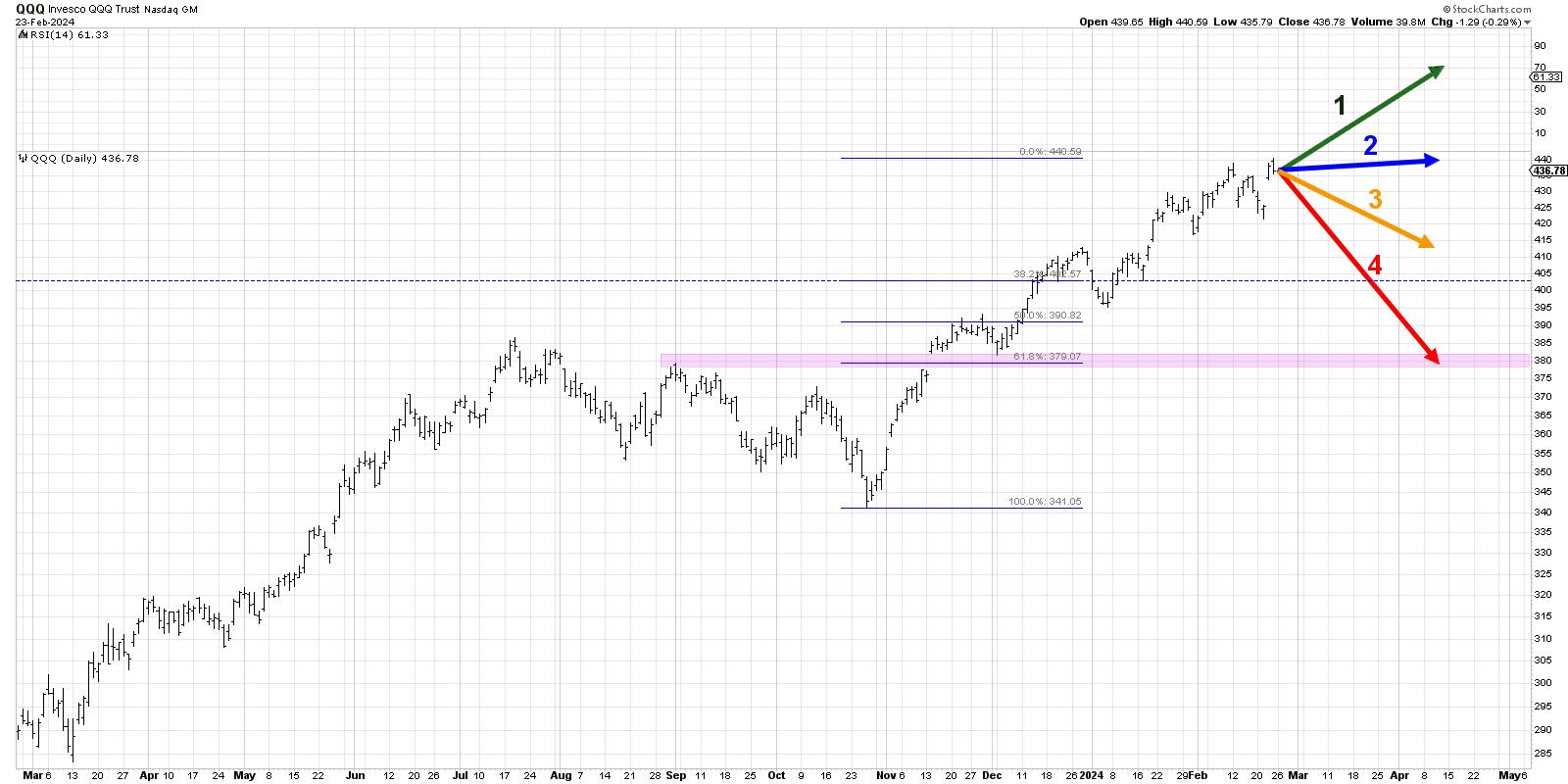

Right now, we’ll lay out 4 potential outcomes for the Nasdaq 100. As I share every of those 4 future paths, I will describe the market circumstances that will possible be concerned, and I will additionally share my estimated likelihood for every situation. And keep in mind, the purpose of this train is threefold:

- Contemplate all 4 potential future paths for the index, take into consideration what would trigger every situation to unfold by way of the macro drivers, and overview what indicators/patterns/indicators would affirm the situation.

- Resolve which situation you’re feeling is most definitely, and why you assume that is the case. Remember to drop me a remark and let me know your vote!

- Take into consideration how every of the 4 eventualities would influence your present portfolio. How would you handle threat in every case? How and when would you are taking motion to adapt to this new actuality?

Let’s begin with essentially the most optimistic situation, involving much more all-time highs over the following six-to-eight weeks.

Possibility 1: The Very Bullish Situation

Essentially the most optimistic situation from right here would imply the Nasdaq mainly continues its present trajectory. That will imply one other 7-10% achieve into April, the QQQ could be threatening the $500 degree, and main progress shares would proceed to guide in an enormous means. Nvidia’s robust earnings launch fuels extra shopping for, and the market would not a lot care about what the Fed says at its March assembly as a result of life is simply that good.

On this very bullish situation, value-oriented shares, together with Industrials, Vitality, and Financials, would in all probability transfer increased on this situation, however would nonetheless in all probability lag the expansion management that will pound even increased.

Dave’s Vote: 15%

Possibility 2: The Mildly Bullish Situation

What if the market stays elevated, however the tempo slows means down? This second situation would imply that the Magnificent 7 shares would take a big-time breather, and extra of a management rotation begins to happen. Worth shares outperform as Industrials and Well being Care shares enhance, however because the mega-cap progress names do not lose an excessive amount of worth, our benchmarks stay fairly near present ranges.

Dave’s vote: 25%

Possibility 3: The Mildly Bearish Situation

Each of the bearish eventualities would contain a pullback in main progress names, and shares like NVDA would rapidly give again a few of their current features. Maybe some financial information is available in means stronger than anticipated, or inflation indicators revert again increased, and the Fed begins reiterating the “increased for longer” strategy to rates of interest via 2024.

I’d consider this mildly bearish situation as that means the QQQ stays above the primary Fibonacci assist degree, simply over $400. That degree relies on the October 2023 low and in addition assumes that the Nasdaq would not get a lot increased than present ranges earlier than dropping a bit. We do not see defensive sectors like Utilities outperforming, but it surely’s clear that shares are taking a critical break from the AI mania of early 2024.

Dave’s vote: 45%

Possibility 4: The Tremendous Bearish Situation

Now we get to the actually scary possibility, the place this week’s upswing finally ends up being a blowoff rally, and shares flip from bullish to bearish with a sudden and stunning energy. The QQQ drops about 10-15% from present ranges and retests the value hole from November 2023, which might characterize a 61.8% retracement of the current upswing. Defensive sectors outperform and traders attempt to discover protected havens because the market tracks its conventional seasonal sample. Maybe gold lastly breaks above $2,000 per ounce, and traders begin to speak about how a break under the October 2023 low could also be only the start of a brand new bearish section.

Dave’s vote: 15%

What possibilities would you assign to every of those 4 eventualities? Take a look at the video under, after which drop a remark there for which situation you choose and why!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means characterize the views or opinions of every other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders decrease behavioral biases via technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor choice making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat via market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra