There may be by no means a uninteresting second within the Banking-as-a-Service area. Treasury Prime is the newest firm to make information within the area.

Whereas Jason Mikula broke the story on LinkedIn it was confirmed by CEO Chris Dean on the firm weblog yesterday. Treasury Prime has laid off about half the corporate and is pivoting to a extra direct strategy with banks.

Whereas Treasury Prime had established itself as a significant participant within the BaaS area by promoting to fintechs, going ahead it is going to be centered on promoting software program to banks.

The corporate introduced a brand new Financial institution-Direct product that may assist banks work instantly with fintechs and types. So moderately than be a kind of matchmaking service between banks and fintechs they may work with banks to ascertain direct relationships with fintechs and different non-banks.

Dean additionally acknowledged the elevated regulatory scrutiny that has introduced quite a lot of uncertainty to the BaaS area. And regulators need banks to have direct oversight of their fintech companions and never use an middleman.

I’ve an interview scheduled with Chris Dean at Fintech Meetup on Tuesday to report a podcast episode, it immediately obtained a complete lot extra fascinating. Search for that in late March.

Featured

> Treasury Prime Cuts Employees Amid Shift to ‘Financial institution-Direct’ Providing

Embedded banking agency Treasury Prime is chopping employees amid a brand new shift in technique as CEO Chris Dean made clear in a weblog submit yesterday.

From Fintech Nexus

> Orum launches direct entry to the Fed with Ship API

By Peter Renton

With Orum’s new Ship API small banks and fintechs will now have direct entry to the Fed’s funds rails.

> Mercado Libre hits 50 million fintech customers in Latin America

By David Feliba

Mercado Pago, the fintech arm of Latin America e-commerce large Mercado Libre, reported a big milestone in its fintech enterprise.

Podcast

Ana Mahony, Founder & CEO of Addition Wealth on the digital plus human strategy to monetary well being

Digital instruments are important for delivering monetary well being merchandise that may make a distinction. However many lack the human…

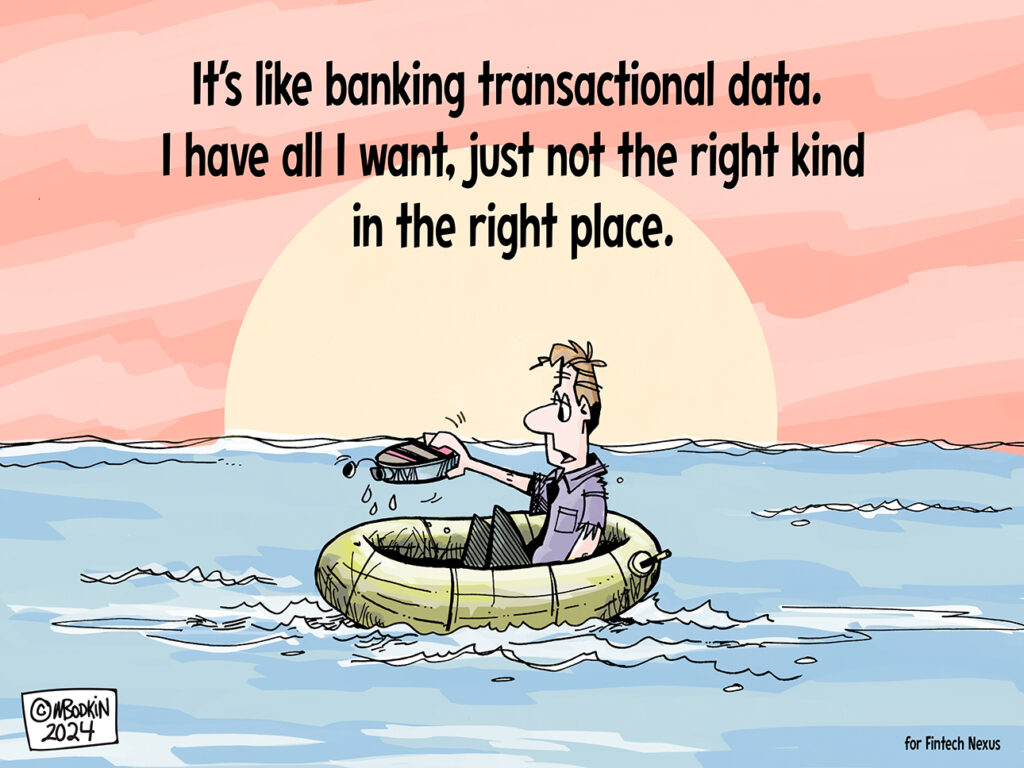

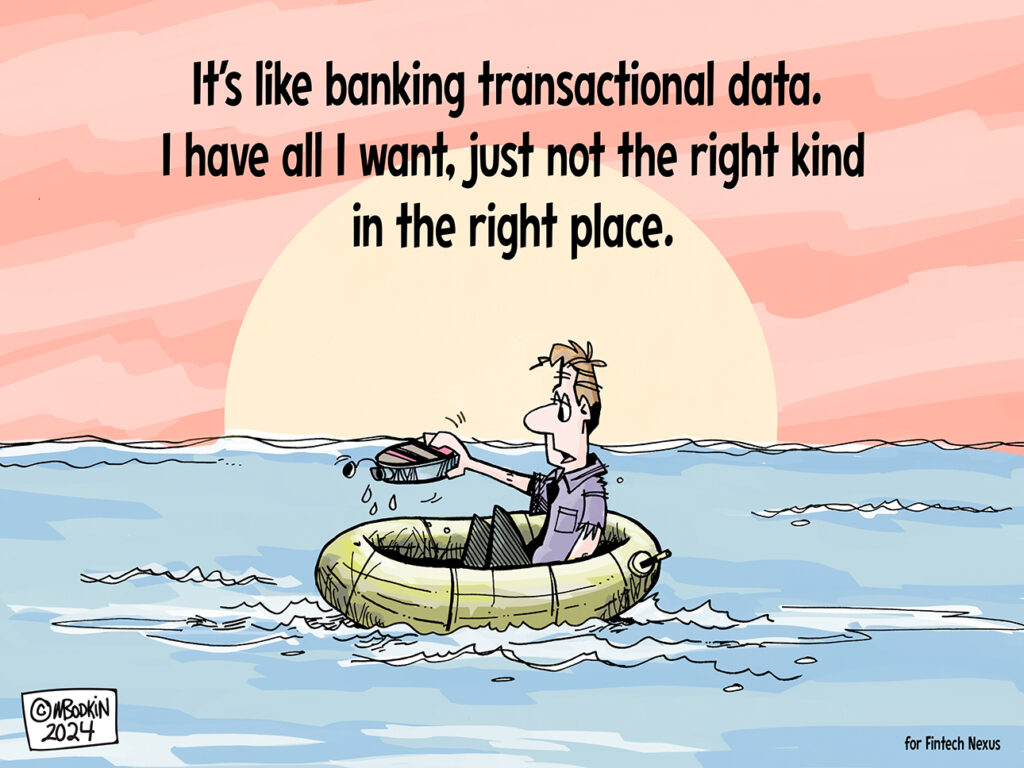

Editorial Cartoon

Additionally Making Information

- USA: How credit score unions can enhance shopper mortgage reimbursement efficiency

Roughly 2.53% of shopper loans held by industrial banks within the US had been reported as delinquent within the third quarter of 2023. Whereas this delinquency charge had beforehand declined from its peak of two.47% within the first quarter of 2020, it has since resumed an upward development starting in 2021.

To sponsor our newsletters and attain 275,000 fintech fanatics along with your message, contact us right here.