The crypto market has proven an unbelievable efficiency over the previous week. Bitcoin has sustained momentum and risen above the $60,000 stage, reaching $64,000.

The degrees reached on the finish of February have advised to many traders that March may very well be an much more spectacular month for the present bullish rally.

Nevertheless, no prediction is about in stone, as many elements might swing traders’ sentiments and transfer the developments in the other way. For the time being, the crypto market appears to have taken a small pause to catch its breath.

Crypto Market Momentarily Slows Down

The worldwide crypto market reached a big milestone for this bullish run a couple of days in the past. As reported, the entire crypto market cap hit $2T on February 27, an accomplishment not seen since April 2022.

As March begins, the market cap for the crypto market sits at $2.3 trillion, representing a 17.97% surge within the 7-day timeframe. This progress has surpassed the extent established in early 2022 and doubtlessly clears the trail to the $2.4 trillion mark seen in December 2021.

Nonetheless, the market rise seemingly slowed down momentarily. The present market cap of $2.31 trillion represents a modest 1.32% lower during the last day, in line with CoinMarketCap information.

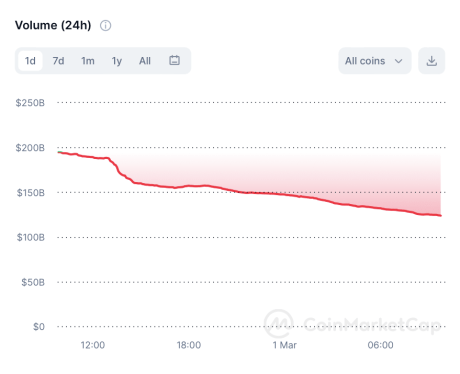

Equally, the entire crypto market buying and selling quantity was round $127.9 billion at writing time, registering a big 35.77% drop from yesterday.

Buying and selling quantity chart within the final 24 hours. Supply: CoinMarketCap

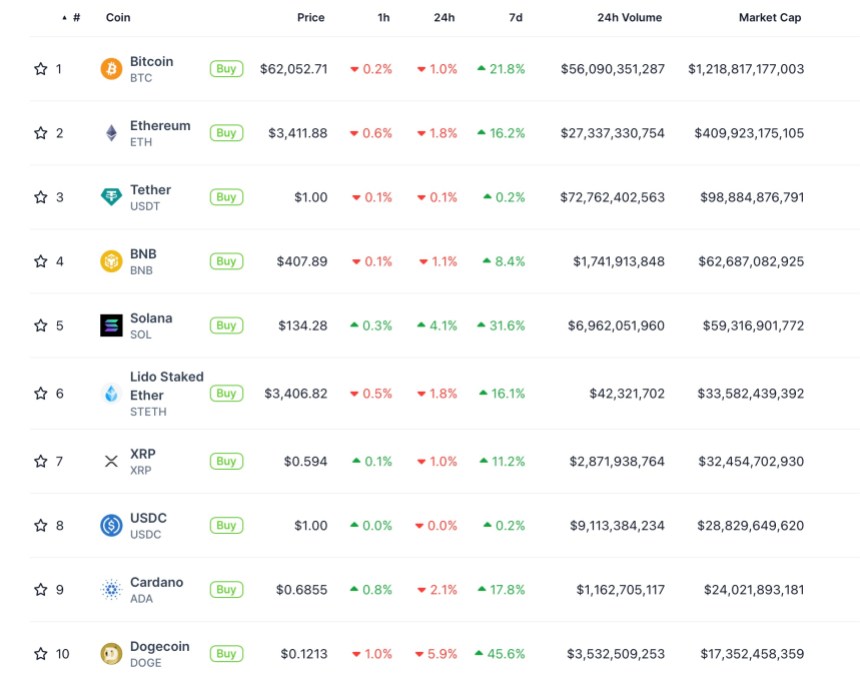

The information exhibits that Bitcoin and Ether have confronted over 40% market exercise lower in comparison with the buying and selling quantity registered 24 hours in the past. Equally, a few of the largest memecoins confirmed a slowdown in efficiency.

Because the checklist under exhibits, Dogecoin (DOGE) registered a 5.9% worth drop on the final day. Likewise, Shiba Inu’s (SHIB) worth decreased by 5.8% in the identical timeframe.

Worth efficiency of the highest ten cryptocurrencies within the final 24 hours. Supply: CoinGecko

Quite the opposite, Solana (SOL) carried out higher on the final day than the highest ten cryptocurrencies, registering a 4.1% worth surge. SOL’s $134 worth locations it alongside DOGE because the best-performing cryptocurrencies among the many prime ten within the final seven.

Among the many largest gainers on the final day, PEPE reversed yesterday’s 12% worth drop after registering a ten.9% progress through the previous 24 hours. Equally, the dog-themed memecoins dogwifhat (WIF) and (BONK) registered a worth enhance of 20,66% and 6.65%, respectively.

Bitcoin And Ether Stay Sturdy Amid The Market Volatility

Some analysts count on a big halving-related drop in Bitcoin’s worth. In the meantime, the King of crypto has proven sturdy resistance above an enormous help wall, as crypto analyst Ali Martinez suggests.

Over 1 million addresses are shopping for over 671,000 BTC inside the $60,000 and $62,000 worth vary. Which, in line with the analyst, highlights a powerful investor confidence. This confidence may very well be an important help stage and a cushion in opposition to a future worth drop.

#Bitcoin holds above an enormous help wall, with 1 million addresses shopping for over 671,000 $BTC inside the worth vary of $60,334 to $62,155.

This accumulation zone highlights sturdy investor confidence and will function an important stage of help for #BTC, doubtlessly… pic.twitter.com/lmghohWR1U

— Ali (@ali_charts) March 1, 2024

At writing time, the flagship cryptocurrency trades at round $62,052.71, which solely accounts for a 1% lower from the day earlier than. BTC has elevated over 21.8% within the final week, and it’s solely 10.34% decrease than its all-time excessive (ATH) of $69,000 registered in November 2021.

Likewise, it’s value noting that Ether (ETH) has been exhibiting a strong efficiency prior to now few days amid the risky crypto market. Sustaining its worth vary prior to now 24 hours, the ‘king of altcoins’ registered solely a 1.8% worth lower from yesterday. ETH presently trades at $3,411.88, representing a notable 16.2% rise prior to now week.

Bitcoin efficiency within the 1-day chart. Supply: BTCUSDT on TradingView.com

Featured picture from Unsplash.com, Chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal threat.