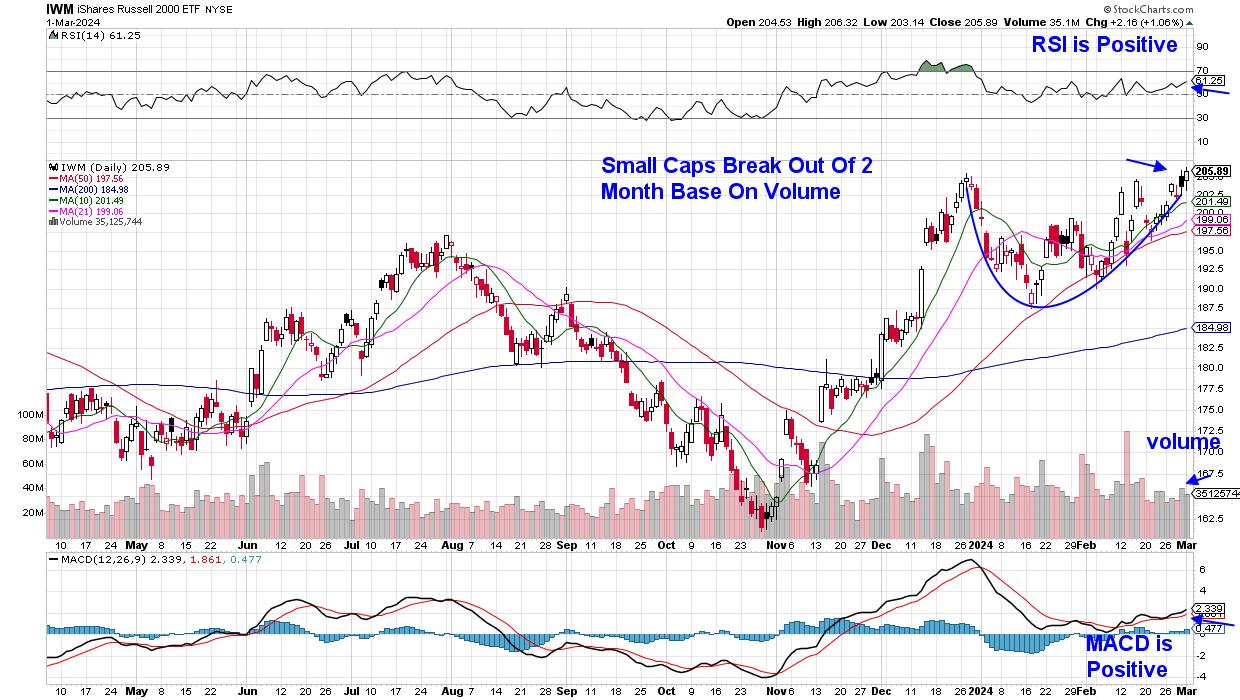

The S&P 500 and the NASDAQ each reached an all-time excessive right now boosted by a Tech-fueled rally amid AI-related names. Small-cap shares additionally had a bullish day after posting a two-month base breakout to near-term highs. This index has had a troublesome interval not too long ago, as almost 15% of its shares are within the Regional Financial institution group, which is down 9.5% year-to-date. Comparatively excessive rates of interest have additionally damage, amid greater borrowing prices which lowered the expansion outlooks for a lot of of those smaller firms.

Each day Chart of Russell 2000 Small Cap Index (IWM)

Each day Chart of Russell 2000 Small Cap Index (IWM)

Renewed curiosity in Biotech shares is one cause for the current rally within the Russell 2000 Index. This group accounts for 25% of this index, and optimistic medical trials, coupled with the anticipation of extra mergers of Biotechs with Giant Cap Pharmas, has fueled the curiosity.

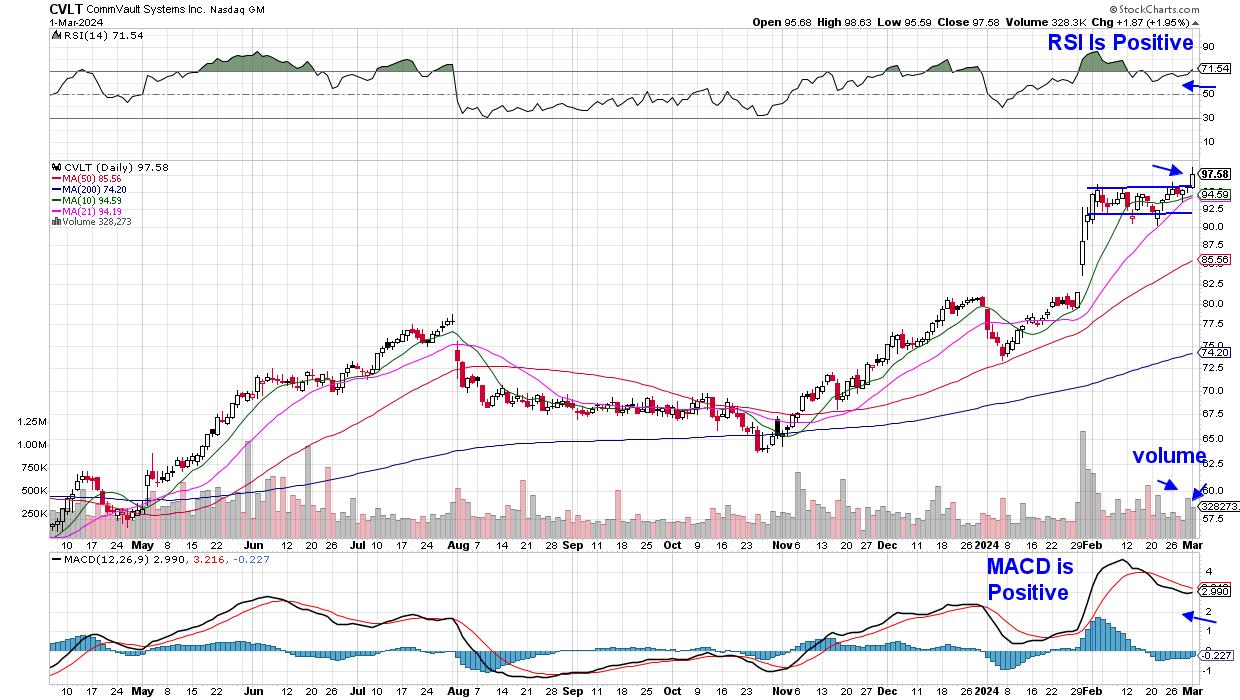

Positive aspects in AI-related shares have additionally contributed, led by Tremendous Micro Laptop (SMCI), which has exploded during the last 2 months. Beneath is the chart of one other noteworthy small-cap tech firm – CommVault Programs (CVLT).

Each day Chart of CommVault Programs (CVLT)

Each day Chart of CommVault Programs (CVLT)

The supplier of knowledge safety methods, which helps firms get better from cyber assaults, posted one in every of their finest quarterly outcomes ever in late January after seeing subscription income achieve 29% over final yr. CVLT gapped up in worth in response, and its four-week interval of consolidation has allowed the inventory to arrange for an additional leg up.

Small-cap shares are inherently extra risky, nevertheless, so I might recommend retaining a detailed eye on the RSI for any hints of greater than only a small pullback. With my work, I have a tendency to stay to larger-cap names that may appeal to institutional cash, which can assist result in outsized positive factors. In reality, my MEM Edge Report recognized 4 of the highest 5 year-to-date winners within the S&P 500. Along with including them to my Steered Holdings Record in November, subscribers have been alerted to specific purchase factors on any pullbacks.

These 4 outperformers have positive factors starting from 34% to 66% over the previous 2 months, and they’re part of the twenty different cultivated shares from my report which are poised to proceed to outperform these upward-trending markets.

My twice-weekly MEM Edge Report additionally offers in-depth info relating to sector rotation and broader market traits. Be certain and use this hyperlink right here to entry a four-week trial at a nominal charge. You may even have instant entry to prior experiences that specify why these profitable shares are buying and selling greater and find out how to uncover exact purchase factors.

Warmly,

Mary Ellen McGonagle

MEM Funding Analysis

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra