In a latest technical evaluation replace, the crypto analyst often known as Darkish Defender supplied insights into the value actions of XRP in opposition to the US greenback. The analyst employs the Elliott Wave Concept to dissect the value actions of XRP. This strategy, rooted within the psychological patterns of market contributors, illustrates worth traits by a definite 5-3 wave cycle.

This consists of 5 waves following the first pattern route and three corrective waves. In accordance with Darkish Defender, XRP is exhibiting an uptrend since January of 2023, present process an “ABC” correction section from November 2023 to February 2024. This section set the stage for a brand new bullish wave sequence.

Hello all. I hope you had a fantastic weekend.

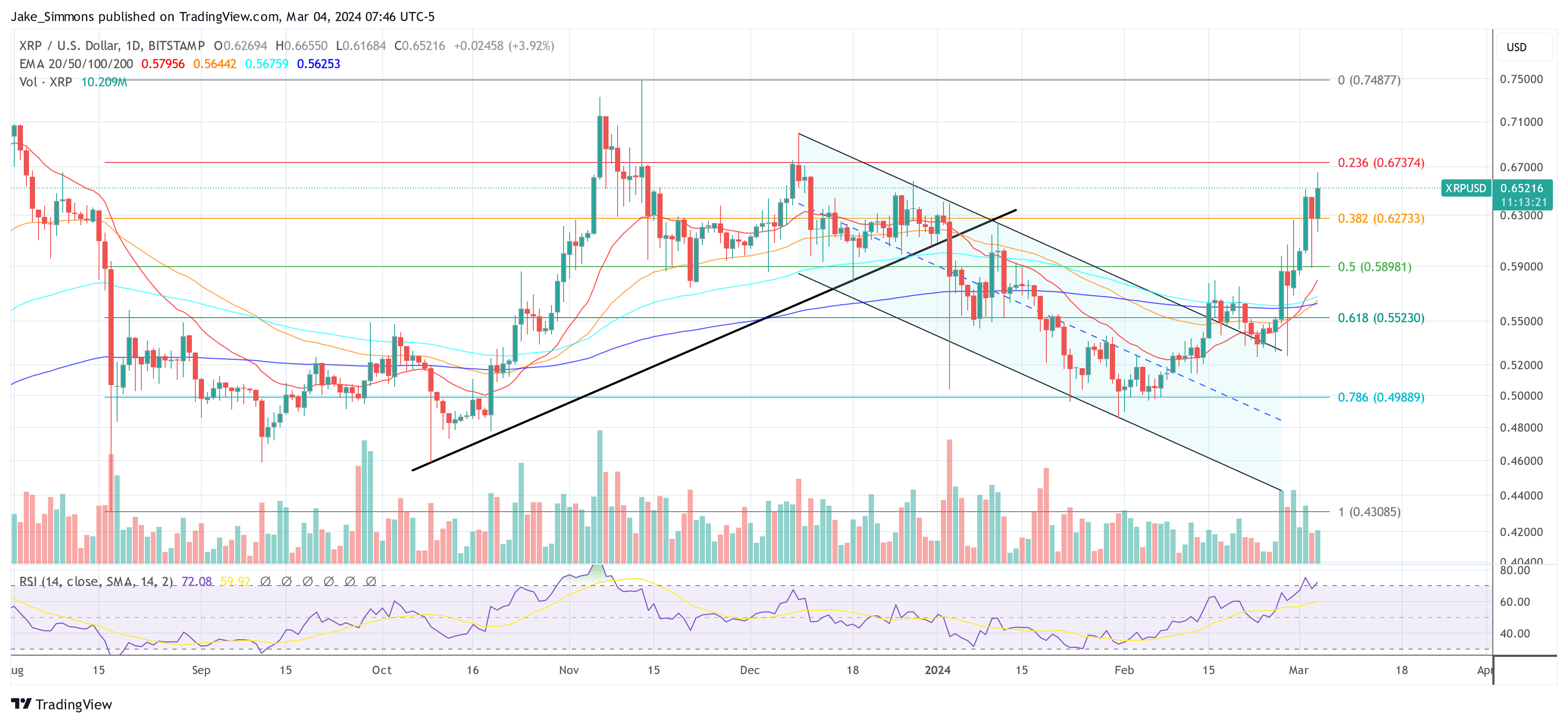

Let’s first test our earlier sample & replace it.#XRP strolling strictly round our Fibonacci stage at $0.6462. The traces are clear & correct.

Checking MACD, Ichimoku & RSI indicators, XRP is anticipated to proceed the uptrend as we… pic.twitter.com/fetf2IH7nl

— Darkish Defender (@DefendDark) March 4, 2024

XRP Worth Eyes $1 By Finish Of March

The present market dynamics of XRP are encapsulated in a wave sample marked from (1) to (4), as per Elliott Wave ideas. The preliminary wave peaked on February 16, 2024, reaching near $0.58, showcasing a powerful market sentiment as the next second wave’s retracement was modest, halting at $0.525 somewhat than totally reverting to the place to begin of wave (1).

XRP is presently navigating by Wave (3), which is usually the longest and strongest, indicating a possible surge in the direction of the $0.81 mark. The forthcoming Wave (4) is anticipated to be corrective, with a projection of a dip to round $0.75, main right into a remaining thrust in Wave (5) focusing on the $0.9191 to $1 vary by late March.

Notably, Darkish Defender’s evaluation additionally incorporates Fibonacci retracement ranges, additional refining the predictive accuracy by figuring out potential market help and resistance factors. The value of XRP has just lately surpassed a important resistance stage, which was beforehand recognized as a downtrend line (pink) stemming from level (B) on the chart.

This breakout signifies a powerful bullish sign, because the resistance become a help stage. Darkish Defender highlighted that the resistance has been “Eradicated,” suggesting that prior worth ceilings are now not limiting upward motion.

Nevertheless, a notable problem lies forward with the 161.8% Fibonacci stage at $0.6462, which has already repelled the value on a number of events. Overcoming this barrier is essential for sustaining Wave (3)’s momentum. The evaluation forecasts an bold breach above the 261.8% Fib stage at $0.7707 throughout Wave (3), albeit with an anticipated correction under this threshold in Wave (4), utilizing the November 2023 excessive as a pivotal help marker.

For merchants, these insights underscore the significance of monitoring Fibonacci ranges and wave patterns to gauge future actions. Nonetheless, the subjective nature of wave evaluation necessitates corroborative proof from different technical indicators for a holistic market outlook.

To this finish, Darkish Defender has referenced extra technical instruments, together with the Transferring Common Convergence Divergence (MACD), the Ichimoku Cloud, and the Relative Energy Index (RSI). Though the evaluation doesn’t visually element these indicators, the commentary suggests that each one three help a continued bullish pattern for XRP, reinforcing the prediction of an ongoing uptrend. He acknowledged, “Checking MACD, Ichimoku & RSI indicators, XRP is anticipated to proceed the uptrend as we predicted.

At press time, XRP traded at $0.65216.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.