Knowledge exhibits the Bitcoin sentiment has now reached excessive greed ranges greater than even these on the value all-time excessive (ATH) in November 2021.

Bitcoin Worry & Greed Index Is Deep Inside Excessive Greed Territory Now

The “Worry & Greed Index” is an indicator created by Different that retains observe of the overall sentiment current among the many traders within the Bitcoin and wider cryptocurrency market proper now.

The metric represents this common sentiment within the type of a rating mendacity within the zero to hundred vary. To calculate this rating, the index takes under consideration the next 5 components: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments.

When the indicator exhibits a price lower than 47, it signifies that the sentiment across the sector is that of concern. Alternatively, the index being above the 53 mark implies the presence of greed among the many traders. Naturally, the area between these two territories belongs to the impartial mentality.

Moreover these three major sentiments, there are two “excessive” sentiments referred to as excessive concern and excessive greed. The previous of those happens at and under 25, whereas the latter is 75 and above.

Now, here’s what the Bitcoin Worry & Greed Index presently seems like:

The indicator seems to have a really excessive worth in the meanwhile | Supply: Different

As is seen above, the Bitcoin Worry & Greed Index’s present worth is 90, which signifies that the traders are holding a robust sentiment of utmost greed. This newest worth is kind of the leap from the sentiment from yesterday, when the index was round 82.

The rationale behind this sharp improve within the indicator is clearly due to the truth that the cryptocurrency’s value has been pushing in direction of a brand new all-time excessive throughout its newest rally.

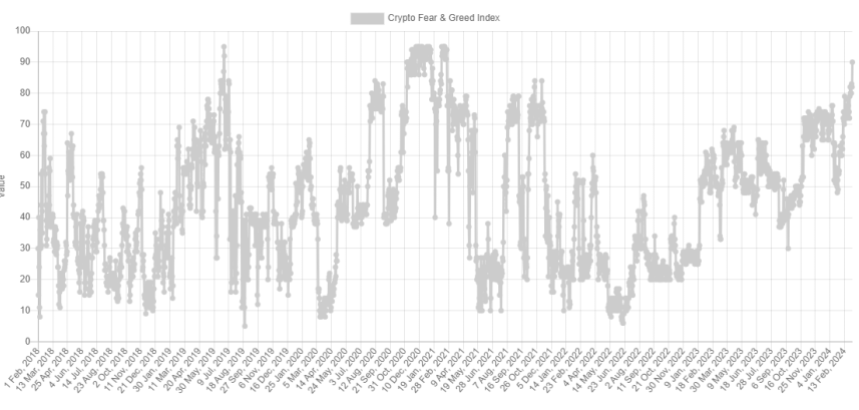

The present stage of the Worry & Greed Index isn’t solely excessive in comparison with the current development, but additionally when contemplating the historic information. The under chart exhibits how the metric’s worth has fluctuated since its inception again in 2018:

The information for the metric over its whole historical past | Supply: Different

As displayed within the graph, the Bitcoin Worry & Greed Index has now surpassed the extent that it assumed through the November 2021 value all-time excessive, because it stands at values just under these noticed between late 2020 and early 2021.

Moreover this era, there has solely been one different occasion within the historical past of the metric the place it has achieved ranges greater than now: the rally peak throughout mid-2019.

Traditionally, Bitcoin has tended to maneuver in opposition to the expectations of the bulk, and as this expectation has leaned extra in direction of one aspect, the chance of such a opposite transfer going down has solely gone up.

The highest within the 2019 rally and November 2021 are simply two such examples of this sample in motion. As such, it’s attainable that the present excessive ranges of the indicator imply that the worth is vulnerable to forming a high proper now.

It needs to be famous, nevertheless, {that a} high doesn’t essentially have to right away observe, as through the first half 2021 bull run, the metric was in a position to preserve at even greater ranges for some time, with out the rally being compromised.

BTC Worth

Bitcoin was on the point of setting a brand new all-time excessive simply earlier, however its value has since cooled off in direction of the $66,700 stage.

Appears like the worth of the coin has been marching up through the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, Different.me, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual danger.