In a big milestone for the cryptocurrency market, Bitcoin (BTC), the most important digital asset, shattered its earlier data, surging previous the $69,000 mark to ascertain a new all-time excessive (ATH) of $69,300 on Tuesday.

The achievement marked a historic second for BTC, which hadn’t reached such ranges in over two years. Nonetheless, the crypto’s upward trajectory exhibits no indicators of slowing down, with consultants predicting additional value features.

Bitcoin Value And ETFs In Excellent Concord

Based on information from Deribit, an choices and futures crypto alternate and analytics agency GenesisVol, BTC is anticipated to expertise a possible enhance of as much as 20.8% inside the subsequent 30 days.

These projections counsel that, below superb circumstances, Bitcoin’s value may break via the $80,000 barrier. Even conservative merchants are optimistic, anticipating BTC to simply surpass $70,000 and attain round $75,000.

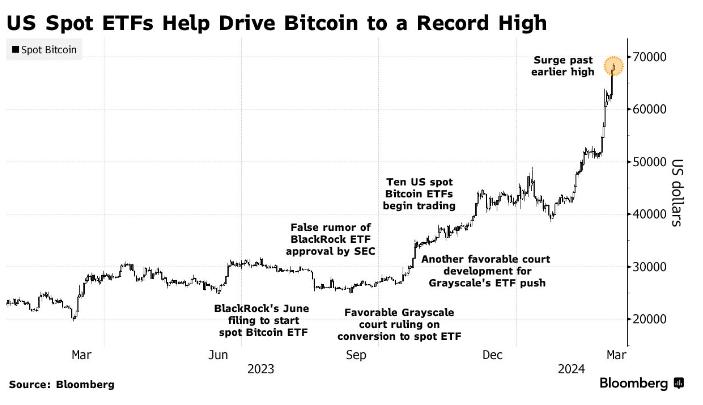

As well as, the current approval of spot Bitcoin exchange-traded funds (ETFs) has performed a pivotal position in Bitcoin’s success, suggesting that the upward development in BTC costs, coupled with bullish sentiment amongst choices merchants and institutional and retail traders, is much from over.

Bloomberg ETF knowledgeable Eric Balchunas emphasised the importance of this improvement, stating that it represents a vital second for each Bitcoin and ETFs. Balchunas believes the surge from $25,000 to $69,000 was largely pushed by hopes of ETF approval and subsequent flows.

The knowledgeable claimed that the synergy between ETFs and Bitcoin has confirmed mutually useful, as ETFs have enhanced liquidity, affordability, comfort, and standardization for traders.

Notably, the ten-spot Bitcoin ETFs have amassed over $50 billion in property, with a staggering $8 billion generated from flows and the remaining attributed to the rising worth of Bitcoin.

Nonetheless, as Bitcoin reached its new peak, elevated market volatility led to a liquidation surge. Journalist Colin Wu reported a pointy 5% drop in Bitcoin’s value inside an hour, with Binance recording under $65,000. Throughout this hour, liquidations amounted to a staggering $142 million.

BTC Promote Sign

Though bullish traders are presently on cloud 9, famend crypto analyst Ali Martinez has sounded the alarm because the TD Sequential indicator just lately flashed a promote sign on the day by day chart of Bitcoin.

The TD Sequential indicator, developed by market knowledgeable Tom DeMark, makes use of value patterns and sequences to determine potential development reversals in numerous monetary markets, together with cryptocurrencies.

Martinez emphasised the indicator’s notable observe document in predicting Bitcoin’s value actions because the starting of the 12 months. The TD Sequential indicator issued a purchase sign in early January, simply earlier than Bitcoin’s value surged 34%.

Conversely, a promote sign was given in mid-February, adopted by a 4.44% drop within the worth of BTC. So, contemplating the earlier promote indicators, a possible drop in direction of the $62,000 value degree might be within the making for the most important cryptocurrency available on the market, nonetheless holding the $60,000 assist, which will likely be key for BTC’s prospects.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.