India’s smartwatch market has reworked, seemingly in a single day. For years, it has been dominated by its homegrown gamers, whereas world giants like Apple and Samsung have struggled for presence, amid the lots of of tens of millions of annual shipments. Immediately, nevertheless, the class has been flooded with unknown manufacturers, which don’t have any prior and important existence. These have began gaining buyer focus and are anticipated to ultimately push the market towards a consolidation stage.

Home manufacturers like Hearth-Boltt, Noise and boAt have dominated the class, making up greater than 60% of the full market. Apple and Samsung, then again, fell from 4.5% to a bit over 2% share mixed, with 1.1 million items shipped in 2023, in response to market intelligence agency IDC.

In the meantime, new entrants have seen a surge of their market share from three to 3-5% in 2020 to 15-20% final 12 months. Vikas Sharma, senior market analyst for wearable units, IDC, advised TechCrunch that the class now accounts for 134.2 million items yearly.

These manufacturers generally carry an unrecognized title or are knockoffs of established merchandise. Many are direct copies of huge world manufacturers like Apple and Samsung, priced at lower than $12 (1,000 Indian rupees). The Apple Watch worth in India begins at $360 (29,900 Indian rupees) for the Apple Watch SE, whereas the Samsung Galaxy Watch 4 retails at $290 (23,999 Indian rupees). The Indian smartwatches from manufacturers equivalent to Hearth-Boltt, boAt and Noise begin from $12.

Apple Watch Extremely lookalike obtainable on-line in India at about $9. Picture Credit: Flipkart

In contrast to the costlier fashions, off-brand merchandise usually don’t have any warranties. In some circumstances, the retailer provides clients a substitute assure, however that’s, too, not offered by the producer and given merely on a chunk of paper and even verbally. Health monitoring metrics are sometimes inaccurate as a consequence of inferior choice of sensors to save lots of prices, whereas the {hardware}/software program combo leaves a lot to be desired. However, the accuracy — even on the smartwatches provided by established Indian gamers — generally doesn’t match that of the Apple Watch or Samsung Galaxy Watch, as these distributors compromise on sensor high quality to take care of affordability.

“The accuracy of the sensors isn’t ok [across most affordable smartwatches] to supply the identical degree of person expertise, which customers get in a premium mannequin,” Counterpoint’s senior analysis analyst Anshika Jain advised TechCrunch.

Sharma identified the aesthetics, which make these unknown branded fashions resemble the Apple Watch and Apple Watch Extremely or some high-end rounded smartwatches, in addition to affordability, assist them acquire buyer consideration.

Hong Kong-based market analyst agency Counterpoint Analysis has noticed the variety of unknown manufacturers within the Indian smartwatch market has grown from 78 in 2021 to 128 in 2023.

“There was virtually 80-90% progress within the variety of unknown manufacturers,” stated Jain. “This clearly signifies how the market has turn into extra crowded now.”

She famous the sample the analyst agency has noticed for the final couple of years: Most unknown manufacturers emerge throughout the third quarter — across the time of the festive season within the nation — and stay lively for one or two quarters earlier than disappearing fully. Moreover, these are seemingly white-label merchandise imported from China at dirt-cheap costs or assembled by an Indian electronics manufacturing companies accomplice, she stated.

Declining costs

The expansion of unknown manufacturers within the Indian smartwatch market has not but considerably impacted all of the native corporations dominating the market. Nevertheless, the prevailing gamers are cautious. Some established native manufacturers have began feeling the warmth. Moreover, the rising market share of unknown manufacturers has decreased the common promoting worth (ASP).

Sameer Mehta, co-founder and CEO of Warburg Pincus-backed boAt, advised TechCrunch the decline in ASPs is as excessive as 90%.

“Total volumes have began happening,” he stated. “ASPs have declined by, say, 90%, which basically doesn’t fare nicely for any trade. Inform me one trade the place the value erosion reaches 90% in only one 12 months.”

Market analysts have additionally noticed a large dip within the ASP, although not as substantial a drop as Mehta talked about.

Jain of Counterpoint, in the meantime, stated the ASP dropped by round 39% to $36 in 2023 from $59 in 2022. “There’s lots of froth on the backside, which is simply bringing in units and placing it out available in the market. As soon as that goes away, there might be some sanctity. Everyone will cease investing within the enterprise if no one is creating wealth within the enterprise.”

boAt, India’s third-leading smartwatch model, noticed a 17% decline in year-on-year progress within the fourth quarter, per IDC. The smartwatch enterprise contributes about 20% of the startup’s revenues.

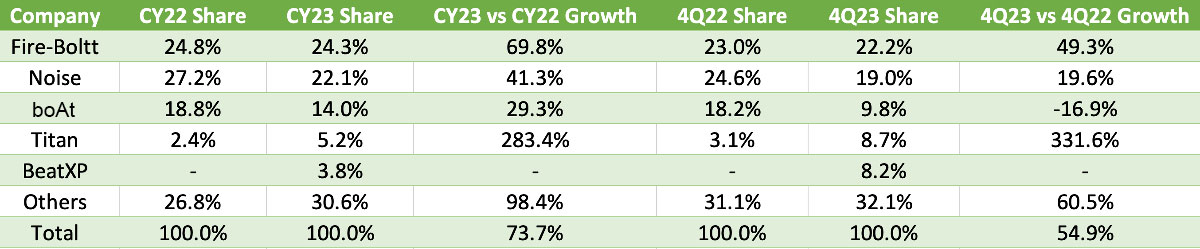

Picture Credit: TechCrunch / IDC

Mehta stated regardless of seeing some influence from the unrecognized manufacturers, boAt would proceed to generate 15-20% of revenues from smartwatches within the subsequent couple of years.

In contrast to boAt, Hearth-Boltt and Noise (the highest two manufacturers), noticed year-on-year progress in the identical quarter.

Gaurav Khatri, co-founder of Bose-backed Noise, advised TechCrunch the startup didn’t see any notable influence from the “fixed inflow of recent entrants and types.”

Strikes to retain the market

Market specialists consider the continuing shift with unknown manufacturers increasing their presence will have an effect on all key gamers — except the dominants change their technique and add extra worth to their future smartwatches.

Presently, market incumbents primarily goal first-time consumers — much like unknown manufacturers. As a substitute, analysts consider that established manufacturers ought to goal present clients.

“Individuals are not choosing these [established Indian branded] smartwatches for his or her subsequent buy with the identical degree of enthusiasm for the primary buy… the principle motive is clearly the client expertise and person interface of those units, which isn’t that easy,” stated Counterpoint’s Jain.

Most established Indian gamers don’t deal with bringing distinctive priceless options to smartwatches, not like their big-tech counterparts together with Apple and Samsung. Smartwatch makers within the nation additionally generally use the identical Chinese language authentic design producers [ODMs], limiting product differentiation. Many of those fashions even bear an uncanny resemblance to Apple and Samsung. Nevertheless, Indian manufacturers declare to develop printed circuit boards regionally, and design software program experiences in-house, distinguishing themselves from world gamers. Native assembling basically helps producers keep away from import duties which are 20%.

Final 12 months, smartwatch manufacturers boAt and Noise entered the sensible ring market in India to diversify their product catalog. Nevertheless, the sensible ring market in India, which noticed greater than 100,000 shipments in 2023, is led by Ultrahuman, with a share of 43.1% in This autumn, per IDC.

Mehta of boAt advised TechCrunch the startup is seeking to deal with creating totally different classes within the smartwatch market, equivalent to new fashions aimed toward children and the aged, sports activities and wellness, to retain its presence. Equally, it’s seeking to design its new smartwatches for second- or third-time consumers, who’re extra conscious of their well being and wellness and search for better-quality units. Nonetheless, these adjustments will enhance the pricing of boAt smartwatches.

That stated, market analysts like IDC’s Sharma predicts the Indian smartwatch market will see solely single-digit progress this 12 months as a consequence of stiff competitors from unknown manufacturers and dropping ASPs. The market used to see over 150% year-on-year progress within the earlier years.

Sharma additionally believes that the smartwatch market could consolidate within the coming couple of years, and fewer gamers can be left.

“There might be a flatline coming within the subsequent two years… all of it picked up after COVID, and now it’s gone to a sky degree… we’ll quickly see a saturation level,” he stated.