KEY

TAKEAWAYS

- Wells Fargo inventory hits a brand new all-time excessive

- The Monetary sector has been gaining energy with a number of massive financial institution shares displaying constructive motion

- Momentum in WFC could also be sturdy now however a slowdown may imply a giant pullback for the reason that inventory is buying and selling above its common worth motion

Wells Fargo (WFC)’s inventory worth has been trending greater since November 2023, after it broke out above a downward-sloping trendline. The corporate has had its share of woes, which is clear in its inventory worth’s uneven motion. General, although, the inventory, together with different massive banks, has been trending greater and has hit a brand new all-time excessive.

So is the inventory value shopping for? Let’s analyze the Monetary sector and dive into WFC’s inventory charts.

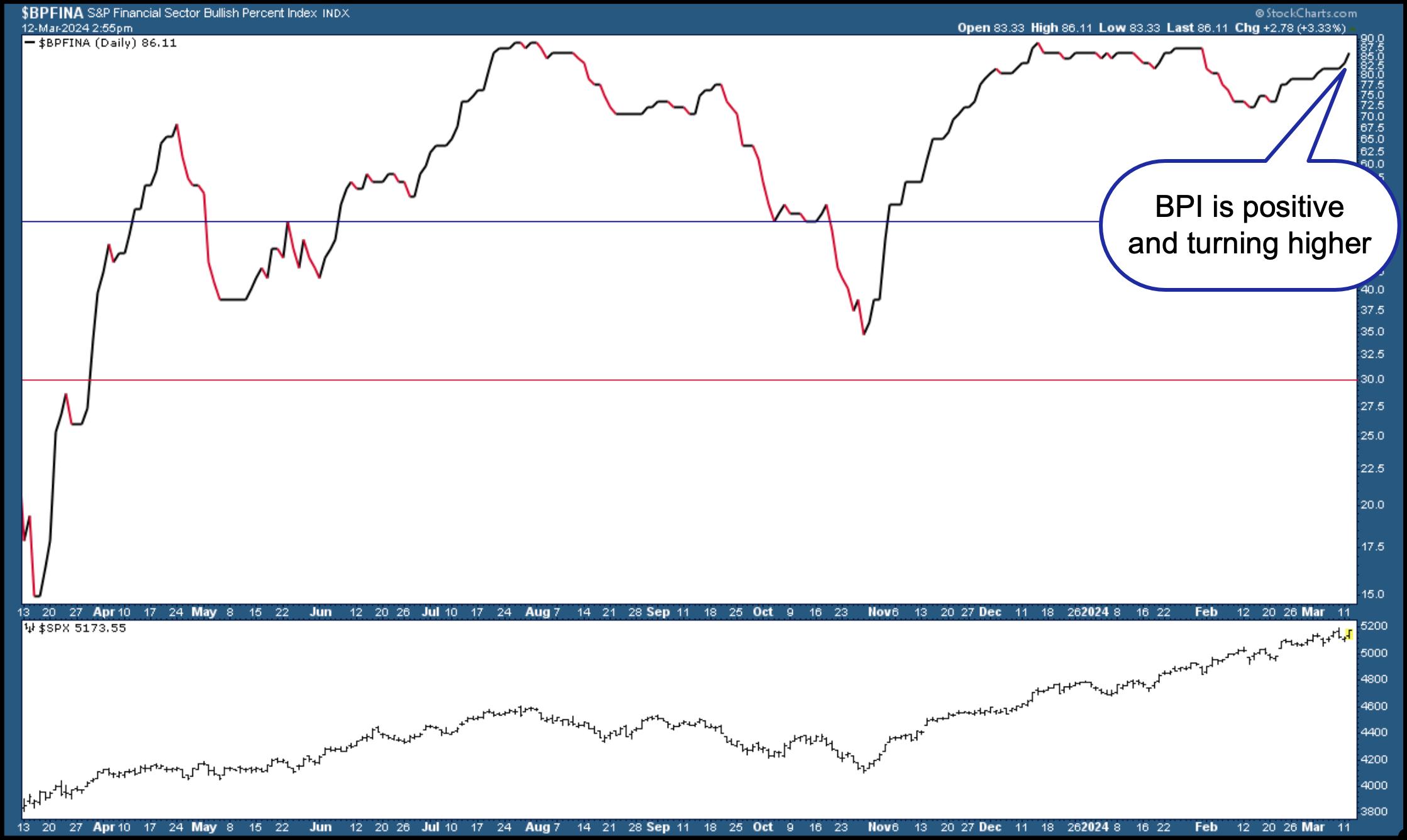

Bullish P.c Index

The chart beneath of the S&P Monetary Sector Bullish P.c Index ($BPFINA) exhibits it is at 86.11, indicating the Monetary sector is bullish. The indicator is popping greater, which means that financials should proceed to development greater.

CHART 1. S&P FINANCIAL SECTOR BULLISH PERCENT INDEX (BPI). The Monetary sector is bullish and will stay that means for an prolonged time frame.Chart supply: StockCharts.com. For academic functions.

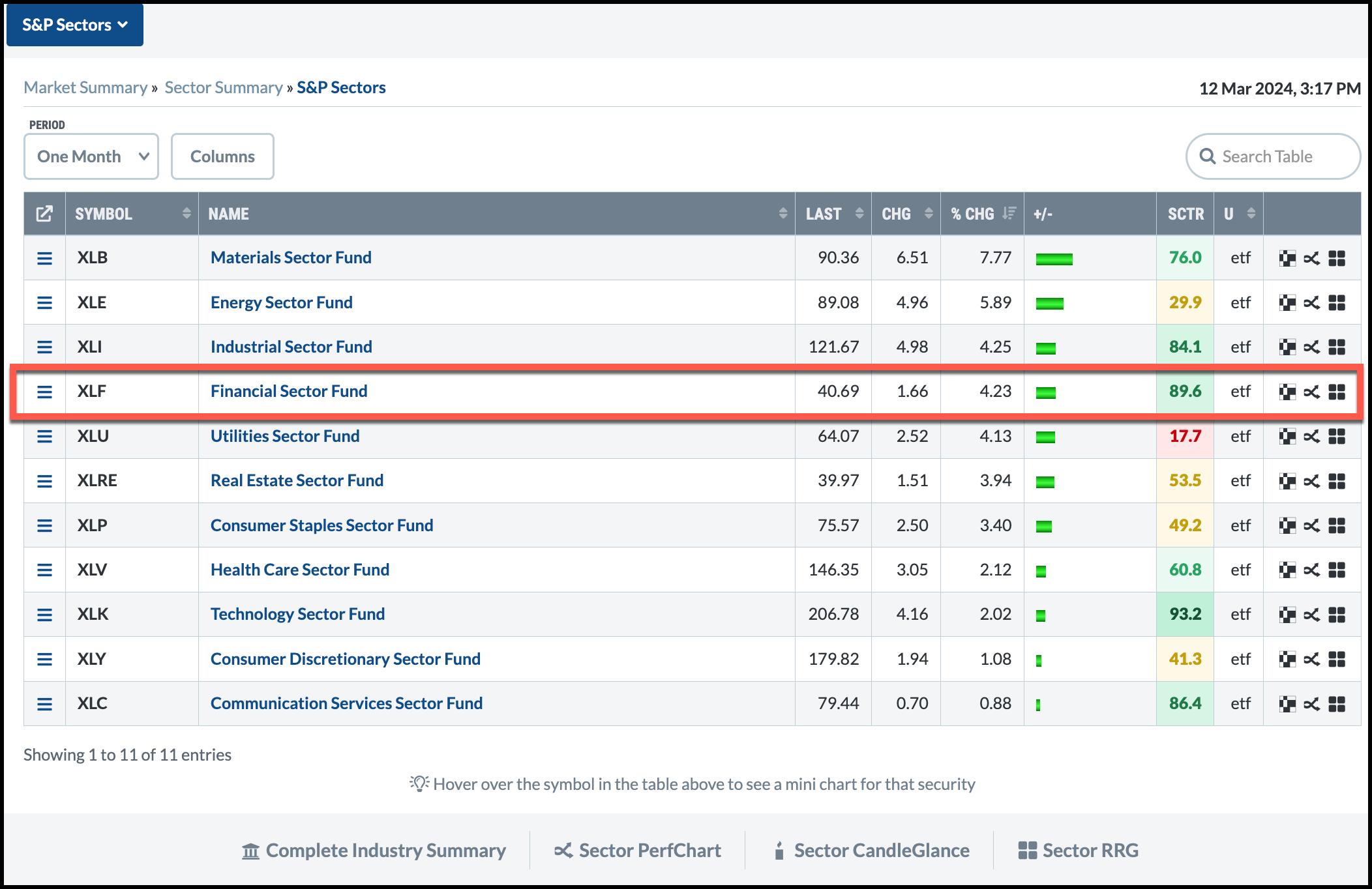

Sector Abstract

For those who have a look at the one-month sector efficiency utilizing the StockCharts Sector Abstract, the Monetary Choose Sector SPDR (XLF), a proxy for the sector, is not the best performer, nevertheless it has the second highest StockCharts Technical Rating (SCTR) rating of 89.

CHART 2. ONE-MONTH SECTOR SUMMARY. The Monetary sector will not be the highest sector performer, nevertheless it has the second-highest SCTR rating, which makes it a strong-performing sector.Chart supply: StockCharts.com. For academic functions.

Each information factors recommend that the Monetary sector is robust and that it’s value testing WFC inventory.

Image Abstract

The Image Abstract device in StockCharts offers you a hen’s-eye view of a inventory or exchange-traded fund. Enter WFC within the image field and assessment WFC’s inventory chart, elementary information, technical information, earnings historical past, SCTR rank, and the predefined scans with WFC. As of this writing, WFC was filtered in 4 scans—New 52-week Highs, Moved Above Higher Value Channel, P&F Ascending Triple High Breakout, and P&F Double High Breakout. The inventory seems to be technically sturdy and gaining energy.

Month-to-month Chart of WFC Inventory

a 20-year month-to-month chart, you’ll be able to see that WFC had its share of uneven motion.

CHART 3. MONTHLY CHART OF WELLS FARGO STOCK. The inventory is trending greater, however will it pull again?Chart supply: StockCharts.com. For academic functions.

Overlaying the 120-month easy shifting common (SMA) on the month-to-month chart (representing 10 years), you see that regardless of the uneven worth motion, WFC has been gently trending greater, with the worth reverting to common worth motion. For the reason that inventory is buying and selling a lot greater than common, is it more likely to pull again?

Every day Chart of WFC Inventory

The every day chart of WFC beneath has a 50-day SMA overlaid on worth. The sample of worth motion is comparable, in that worth tends to revert to the SMA after it deviates from it. So is WFC too toppy, or is it well worth the funding after a pullback?

CHART 4. DAILY CHART OF WELLS FARGO STOCK. The inventory could also be trying toppy, however, if the momentum remains to be sturdy, the inventory may proceed to rise.Chart supply: StockCharts.com. For academic functions.

When a inventory hits an all-time excessive, there is a cause it is shifting greater. The inventory will proceed rising so long as the momentum helps the worth transfer. This is the reason it helps so as to add a momentum indicator. There are a number of to select from—Transferring Common Convergence/Divergence (MACD), Relative Energy Index (RSI), Common Directional Index, and Price of Change (ROC), to call a number of.

On this instance, the ROC is added to the decrease panel beneath the worth chart. Discover the indicator fluctuates above and beneath the zero line. When the ROC is above the zero line, it signifies constructive momentum. The ROC has pulled again, and will reverse and transfer greater. If ROC strikes beneath the zero line, that is a sign that momentum is slowing. Word how, in earlier pullbacks to the 50-day SMA, the ROC went beneath the zero line, reversed, and moved again greater.

The Backside Line

Although WFC inventory is hitting all-time highs, the momentum hasn’t proven indicators of slowing down. For those who’re nervous about shopping for a inventory that appears toppy, the charts present that WFC may pull again. So long as it stays above its 50-day shifting common on the every day chart, you would enter an extended place so long as the Monetary sector stays wholesome and the upward momentum is robust within the inventory. If you wish to wait until WFC pulls again, it could require some persistence—a vital trait for profitable merchants and traders.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra