Stripe has, for a while, been one of many main fintech firms globally with regards to scale.

However the numbers it revealed right now in its annual letter are really staggering. It processed $1 trillion, round 1% of world GDP, by means of its platform in 2023. It crossed that milestone simply 15 years after it was based.

Founders Patrick and John Collison penned the 12-page letter the place they opined on the state of Stripe, tweaks they’ve made to the checkout course of, their automation efforts, VC funding, clear power, robotics and extra.

In addition they commented on the report variety of startups which are utilizing Stripe right now and the truth that startups based in 2022 are producing income at a quicker tempo than these based in 2019.

Regardless of the challenges within the fintech ecosystem Stripe continues to be a vibrant spot. They’re nonetheless rising at a fast tempo whereas being “robustly money move optimistic in 2023”.

It is a bullish signal for all of fintech.

Featured

> Stripe reveals it handed $1 trillion in whole cost quantity in 2023

By Jacqueline Corba

Fintech large Stripe revealed in its annual letter printed Wednesday that it surpassed $1 trillion in whole cost quantity in 2023.

From Fintech Nexus

> Capstack Applied sciences has the treatment for SVB ills

By Tony Zerucha

Capstack Applied sciences’ founder and CEO Michal Cieplinski believes he has the antidote to the Silicon Valley Financial institution meltdown, and Citi Ventures agrees.

Podcast

Adam Famularo, CEO of WorkFusion on utilizing AI digital employees to struggle monetary crime

The CEO of WorkFusion discusses the function of AI digital employees in detecting monetary crime and the way they will increase a human…

Webinar

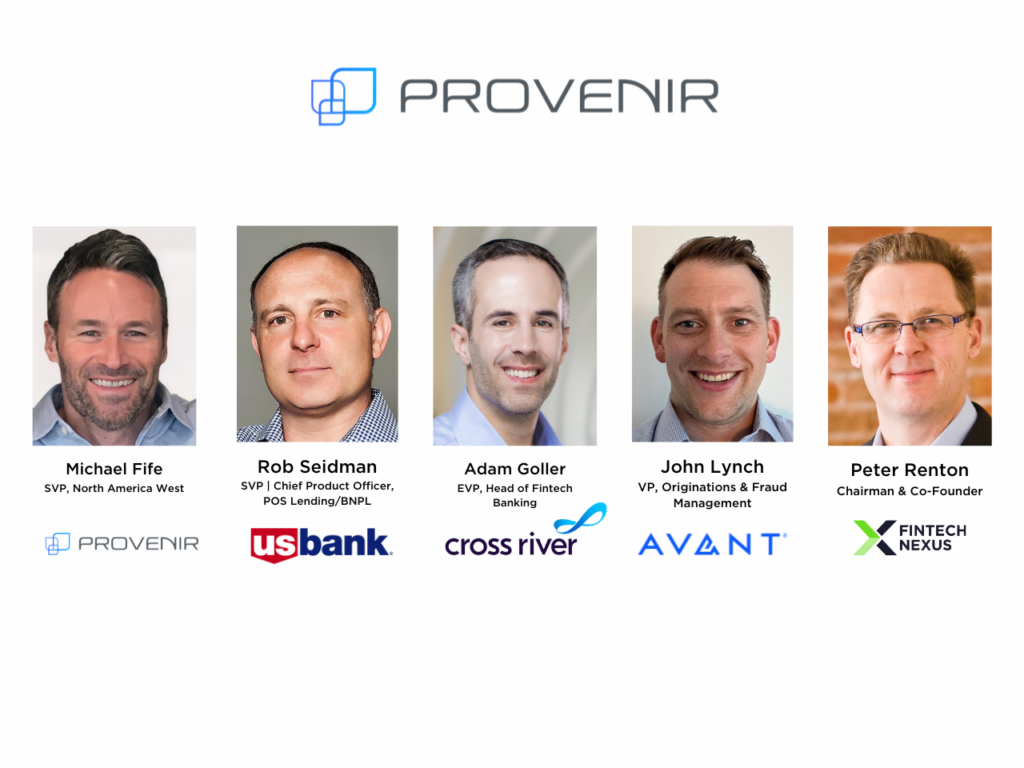

How Shopper Lenders Can Scale back Friction With out Compromising on Danger and Fraud Prevention

Mar 21, 2pm EDT

Buyer expertise is extremely necessary to right now’s discerning customers, whether or not they’re on the lookout for monetary providers…

Additionally Making Information

- USA: LoanDepot Invests in Expertise to Put together for Mortgage Business Rebound

LoanDepot is investing in expertise because it prepares for a rebound in industrywide mortgage origination volumes. Whereas the supplier of house lending options decreased its bills by 36% in 2023, right-sizing itself for right now’s decrease market volumes, it additionally invested in platforms and techniques to spice up productiveness.

To sponsor our newsletters and attain 275,000 fintech fanatics along with your message, contact us right here.