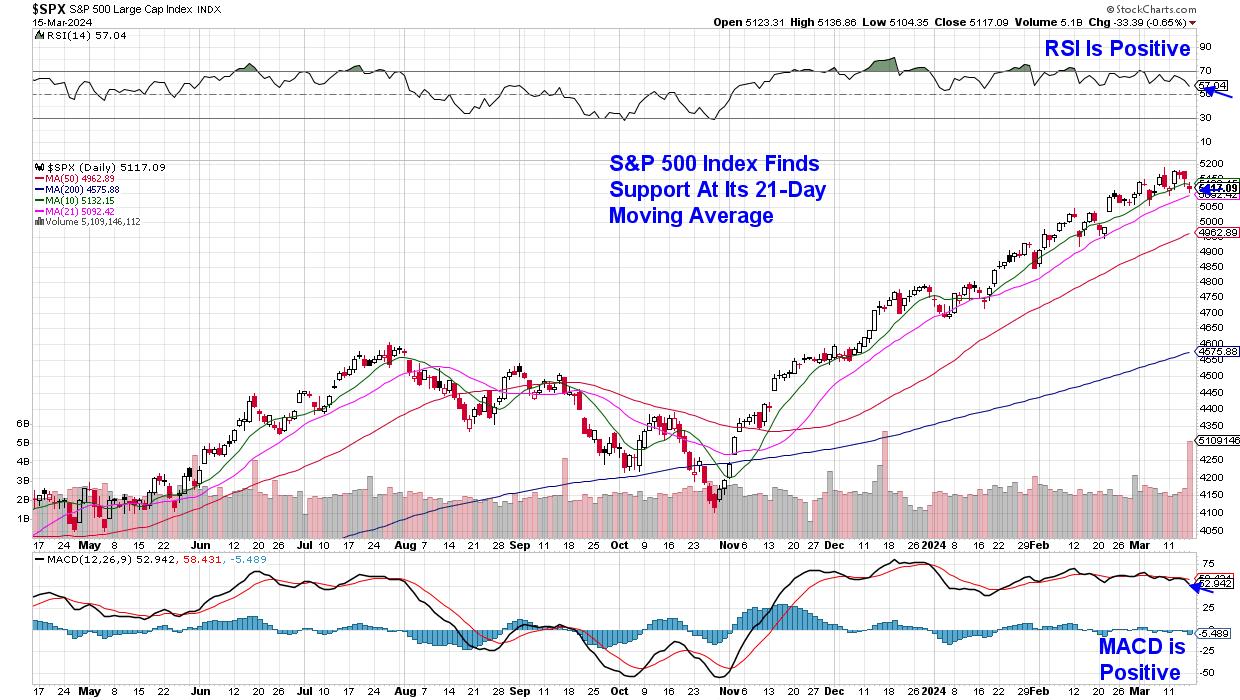

The S&P 500 ended the week with a slight pullback that has this Index closing under its key 10-day easy shifting common, however above its 21-day shifting common. With the RSI and MACD in optimistic territory, the near-term uptrend on this Index stays in place. Whereas final week’s orderly worth motion is in keeping with 4 different nominal pullbacks we have seen to this point this 12 months, there’s been loads of turbulent worth motion beneath the floor, as buyers have responded sharply to a number of high-profile corporations after the discharge of their earnings studies.

Each day Chart of S&P 500 Index

Each day Chart of S&P 500 Index

For a lot of who comply with my work, you may know that I am fairly bullish on gaps up in worth after earnings, as they typically result in additional upside after a interval of consolidation to digest the big achieve. A primary instance could be Shake Shack (SHAK), which gapped up in worth after the discharge of robust earnings in mid-February, which pushed the inventory out of a base and into an uptrend. SHAK was part of my MEM Recommended Holdings Checklist simply previous to the discharge, and it stays on our purchase listing because it’s in an uptrend.

As we speak, we’ll deal with shares that hole down after earnings however then go on to reverse that hole down. These shares will typically have extra work to do earlier than coming into a brand new uptrend; nevertheless, shorter-term buyers can benefit from any reversal if utilizing the correct intraday chart to information your entry.

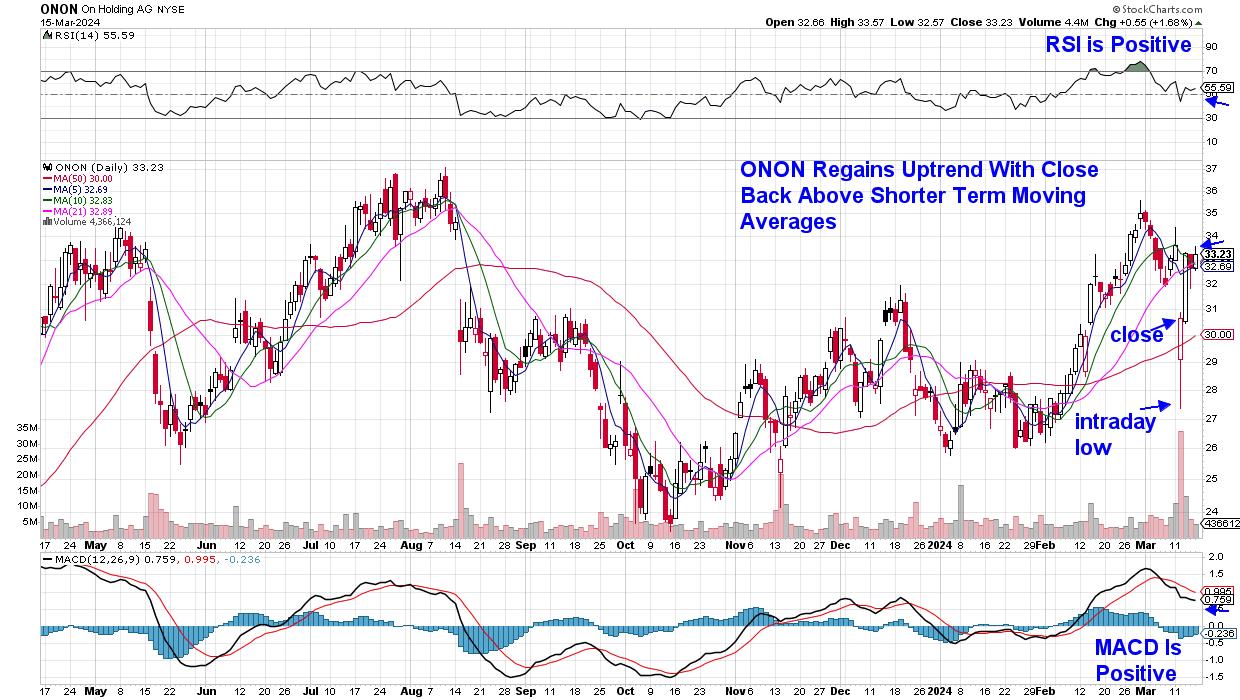

Let’s check out Switzerland-based footwear firm On Holding (ONON). The inventory gapped down 18% on Tuesday after reporting earnings that have been under estimates. As you may see on the every day chart under, buyers got here in on the dip in order that it closed the day down 8%. The inventory has continued to commerce larger, and ONON is now in an uptrend.

Each day Chart of On Holding (ONON)

Each day Chart of On Holding (ONON)

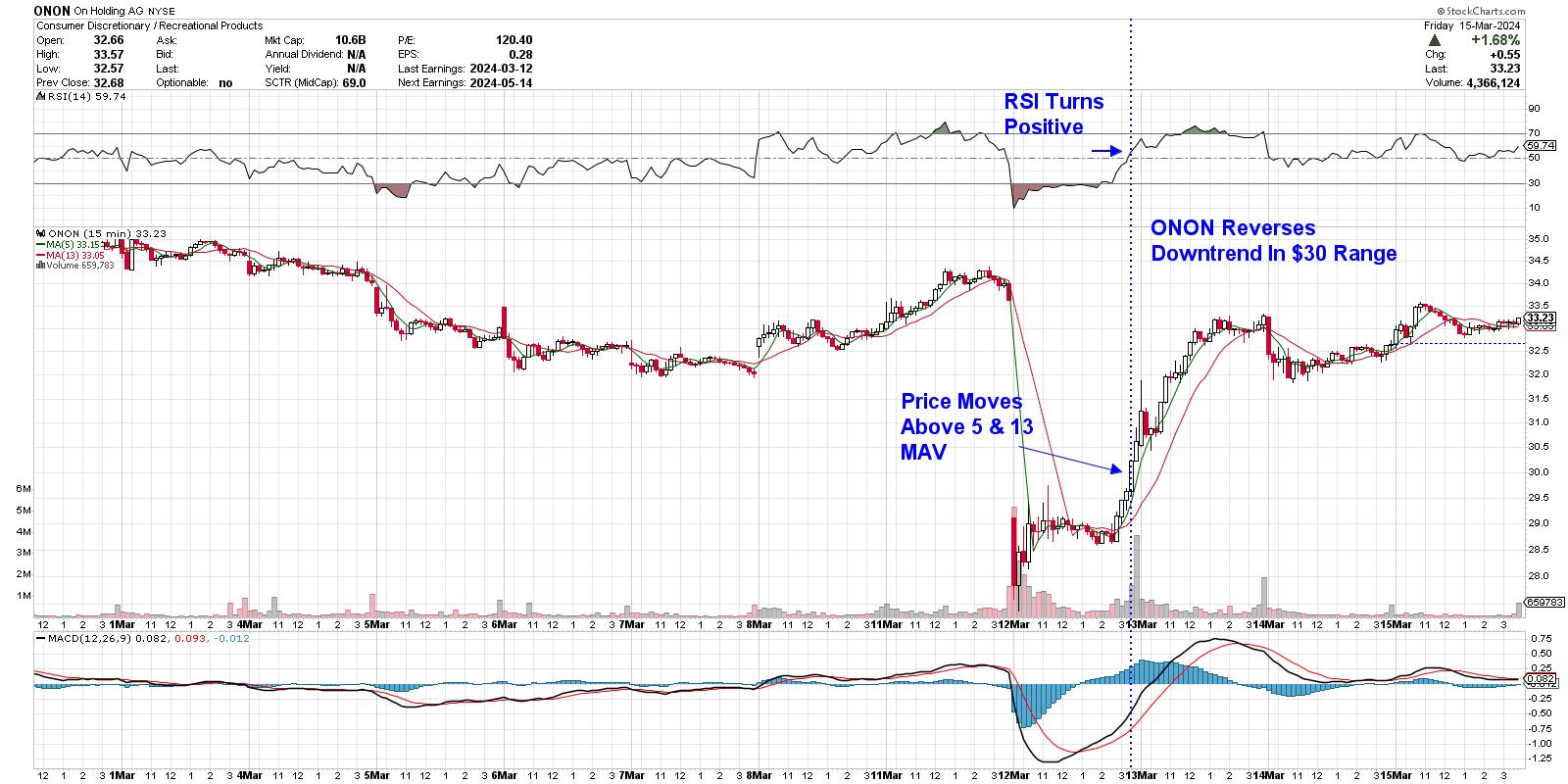

As buyers start to purchase the inventory on the dip, shorter-term buyers will need to preserve an in depth eye on a 15 minute/intraday chart. Utilizing the identical indicators as on a every day chart, the primary optimistic sign could be an in depth above the 5 and 13 easy shifting averages. From right here, you may be looking out for affirmation of an uptrend by the use of the RSI shifting above 50 and into optimistic territory. For ONON, this befell within the $30 vary. To be able to stick with the commerce, each indicators would want to stay in place which, on this case, would have netted 10%.

Intraday/15-Minute Chart of On Holding (ONON)

Intraday/15-Minute Chart of On Holding (ONON)

As famous earlier, the broader markets are in an uptrend and, whereas constructive, the Know-how sector is near turning unfavourable after a number of heavyweight areas got here underneath promoting strain final week. For many who’d like perception into what’s going down inside this management space of the markets, use this hyperlink right here to take a 4 week trial of my twice-weekly MEM Edge report at a nominal charge. You will additionally obtain info regarding rotation going down elsewhere within the markets, in addition to alerts to a reversal of the present market uptrend.

Warmly,

Mary Ellen McGonagle

Mary Ellen McGonagle is an expert investing marketing consultant and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra