We’ve got seen nearly all the things we have wanted to see to substantiate this highly effective secular bull market advance because the starting of 2023. There was actually just one factor lacking and it isn’t lacking any longer. I will get to that in a minute.

However let us take a look at essentially the most aggressive sector within the inventory market and let’s consider the expansion vs. worth commerce that has characterised and pushed an amazing transfer greater in U.S. equities.

Expertise (XLK):

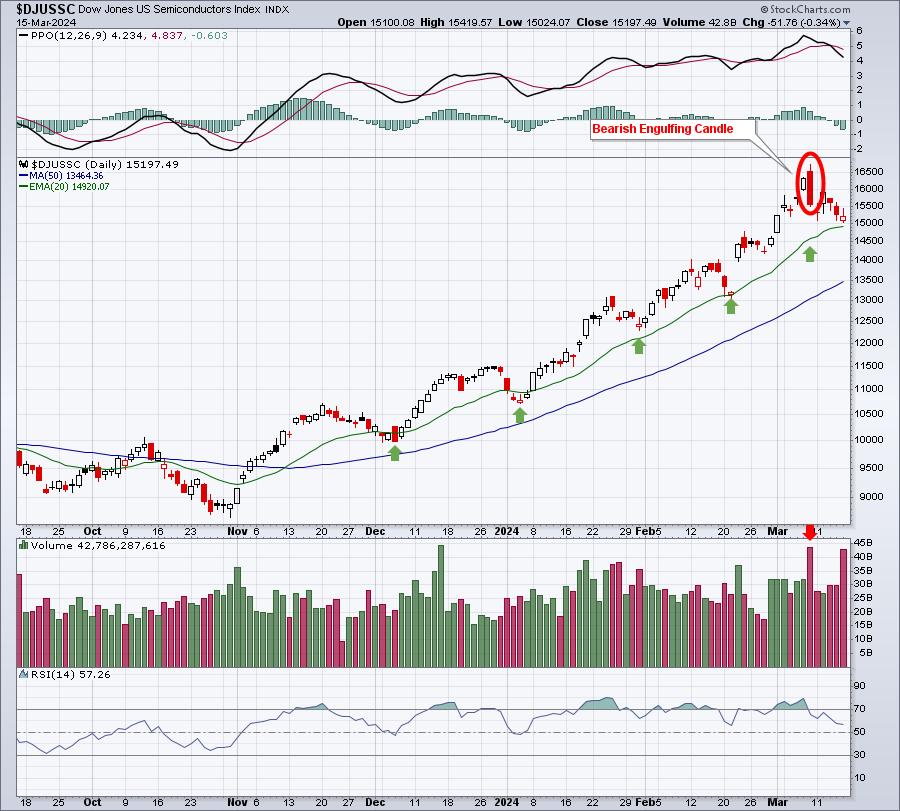

Semiconductors ($DJUSSC) have been the lifeblood of know-how’s management and know-how represents practically 30% of the S&P 500 now – thanks largely to the large advance in know-how shares. After a exceptional 200% advance in semiconductors over 15 months, we have seen the DJUSSC cool off a bit, which started with the bearish engulfing candle I identified one week in the past:

From the excessive on Friday, March eighth to the low on Friday, March fifteenth, the DJUSSC misplaced roughly 10%. That had an apparent affect on know-how shares typically, which lagged most sectors final week.

The very ugly bearish engulfing candle, along with the HUGE quantity, is to not be ignored. It “might” signify a serious high on this group for awhile, which is not a nasty factor. We should not count on the DJUSSC to triple each 15 months, that is not sustainable. But when it pauses within the near-term, it is more likely to have a big impact as lots of its element shares are represented in each the S&P 500 ($SPX) and the NASDAQ 100 ($NDX). The group is way more closely represented within the $NDX. Semiconductors represents practically 22.86% and 9.76% of the $NDX and $SPX, respectively. Whereas there’s loads of development shares within the S&P 500, the NASDAQ 100 is way more closely impacted by development shares. That is why I prefer to comply with the $NDX:$SPX ratio. It is a “development vs. worth” ratio that gives us one take a look at the chance setting that we’re in. When the ratio goes up, we are able to usually conclude that the market setting is “threat on”, which normally results in greater inventory costs. A falling ratio, nevertheless, can sign “threat off”, which might imply extra warning. Here is the place we presently stand:

Throughout the summer time of 2023, the $NDX:$SPX ratio declined and this “threat off” sign resulted in a ten% correction because the benchmark S&P 500 adopted go well with to the draw back. However take a look at the final 3 “threat off” readings within the $NDX:$SPX ratio. The S&P 500, for essentially the most half, has saved gaining floor, particularly over the previous two months. What’s modified?

Nicely, thanks for asking, as a result of this was the lacking ingredient within the secular bull market in 2024. Let me present you what is modified. It is known as BULLISH ROTATION:

XLI:$SPX

XLF:$SPX

XLE:$SPX

XLB:$SPX

Over the summer time months, after we turned “threat off”, the proceeds from promoting these aggressive sectors merely left the market, it did not rotate to and create bullishness in different sectors out there. You’ll be able to see that by merely following all of these purple directional traces for every of the 4 sectors proven above. This time is completely different and the above relative sector charts assist us visualize the distinction.

I imagine know-how will likely be wonderful in time, however a interval of underperformance would not be a nasty factor in any respect. The truth is, the rotation is creating super alternatives in different areas of the market. You could acknowledge this shift now, as a result of it is rising the probability that our present bull market run could solely simply be starting.

In Monday morning’s FREE EB Digest publication article, I will be that includes an organization (exterior the know-how sector) that lately broke out and appears poised for considerably greater worth down the street as cash has been pouring into its sector. You’ll be able to CLICK HERE to join this FREE publication along with your title and e mail deal with. There isn’t any bank card required and it’s possible you’ll unsubscribe at any time.

Make the most of this rotation!

Completely satisfied buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Day by day Market Report (DMR), offering steering to EB.com members day by day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a novel ability set to method the U.S. inventory market.