Main good contract platform Ethereum (ETH) is displaying indicators of progress regardless of its underperformance and the regulatory uncertainty surrounding it, in accordance with market intelligence agency IntoTheBlock.

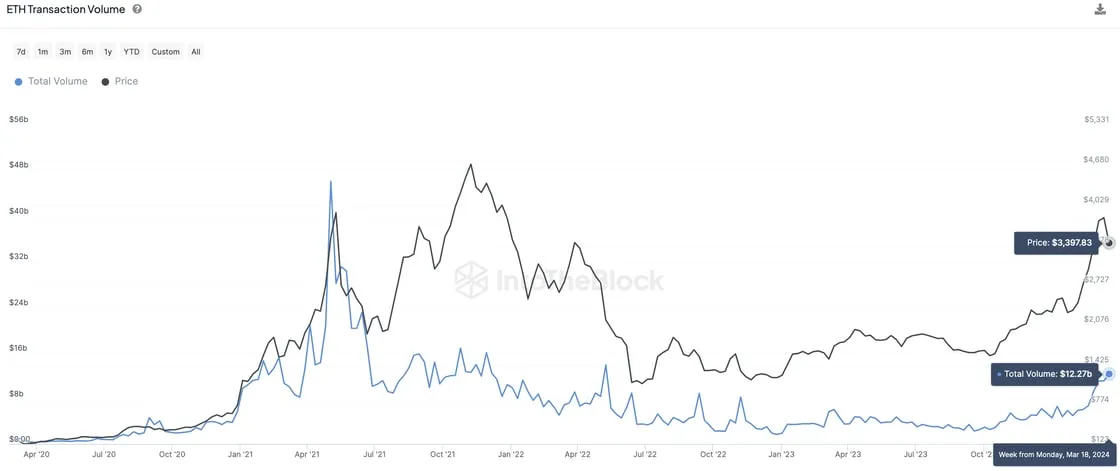

In a brand new article, the pinnacle of analysis on the crypto analytics platform says that Ethereum volumes are reaching ranges they haven’t seen in years, signaling progress.

“Ethereum has been topic to criticism by many over the previous few months. Inside crypto, individuals level to ETH’s worth underperforming and traction on Solana as an indication of Ethereum shedding its mojo. Past crypto, regulators are actually reportedly cracking down on the Ethereum Basis and going after ETH as a safety.”

In response to IntoTheBlock, this week, the quantity of ETH transferred on its mainnet reached its highest level since Might 2022 whereas the quantity of ETH on layer-2 scaling options lately surpassed 10 million for the primary time ever.

IntoTheBlock says that exercise on layer-2s Arbitrum (ARB), Optimism (OP), and Base (BASE) goes at over twice the speed than it’s on Ethereum’s mainnet. Moreover, the market intelligence agency says that since ETH’s charges dropped 90% after the Dencun replace on March thirteenth, exercise on layer-2 blockchains ought to ramp up much more.

Nonetheless, IntoTheBlock does acknowledge that Ethereum has lagged behind crypto king Bitcoin (BTC) and the S&P 500 this cycle.

“Worth-wise, there’s an argument to be made towards ETH comparatively lagging behind up to now this cycle. Nonetheless, when it comes to on-chain knowledge, Ethereum continues to develop.”

Earlier this month, Gary Gensler, the Chairman of the U.S. Securities and Alternate Fee (SEC), declined to touch upon whether or not Ethereum counts as safety or a commodity, including to the regulatory uncertainty surrounding the second-largest digital asset by market cap because the regulatory company remains to be within the technique of deciding whether or not or to not approve a number of bids to create ETH-based exchange-traded funds (ETFs).

Ethereum is buying and selling for $3,333 at time of writing, a 3.75% lower over the last 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney