The 200-day SMA is probably essentially the most extensively used long-term shifting common. As its identify implies, it’s a easy indicator that chartists can use for trend-following and momentum methods. For trend-following, we simply must know the place costs stand relative to the 200-day SMA. For momentum, we have to measure the space between value and the 200-day SMA. Let us take a look at examples from two Nasdaq 100 shares.

The 200-day SMA is probably essentially the most extensively used long-term shifting common. As its identify implies, it’s a easy indicator that chartists can use for trend-following and momentum methods. For trend-following, we simply must know the place costs stand relative to the 200-day SMA. For momentum, we have to measure the space between value and the 200-day SMA. Let us take a look at examples from two Nasdaq 100 shares.

The primary chart reveals Apple (AAPL) with the 200-day SMA in pink and the 5-day SMA in inexperienced. I additionally wish to easy closing costs with a 5-day SMA to scale back whipsaws (unhealthy indicators). The blue circle on the chart reveals a whipsaw in late October. “Cut back” is the important thing phrase right here as a result of we can’t totally get rid of whipsaws. The pink circle reveals the 5-day SMA breaking decisively beneath the 200-day SMA in late February. AAPL is in a downtrend and never being thought-about for our dual-momentum methods.

The indicator window reveals the proportion distance between the 5-day SMA and 200-day SMA. This indicator can additional filter indicators and cut back whipsaws by including a bullish threshold at +1% and a bearish threshold at -1%. An uptrend indicators when the 5-day is greater than 1% above the 200-day and a downtrend indicators when the 5-day is greater than 1% beneath the 200-day. This little filter would have prevented the whipsaws in late October and mid March (pink circles).

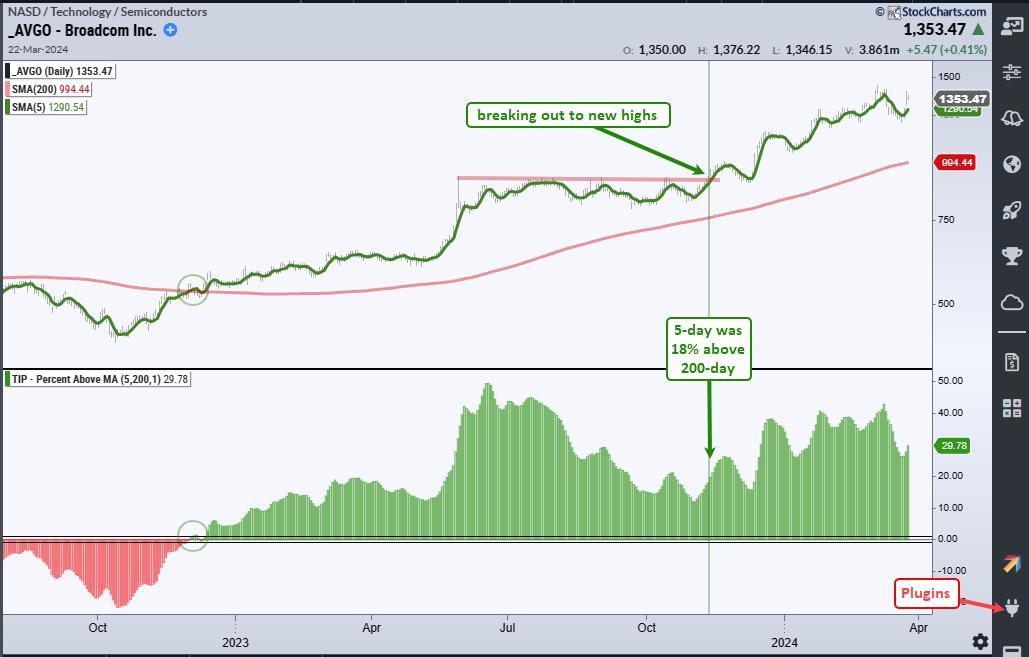

Chartists may use % above MA (5,200) to quantify the power of the pattern. AAPL was nonetheless in an uptrend in early November, however the 5-day was solely 5% above the 200-day SMA on November ninth (inexperienced line). Hold this quantity in thoughts as we transfer to the second chart, Broadcom (AVGO). The chart beneath reveals AVGO triggering bullish in December 2022 because the 5-day SMA was greater than 1% above the 200-day SMA (inexperienced circles). Be aware that this indicator is a part of the TIP Indicator Edge Plugin for StockCharts ACP.

The inexperienced line marks November ninth and the 5-day SMA was 18% above its 200-day SMA on this date. This implies it was a lot stronger than AAPL, which was solely 5% above its 200-day. AVGO clearly gained the momentum contest in early November. The inventory was additionally breaking out to new highs in early November (pink line). AVGO stays one of many leaders within the Nasdaq 100 as a result of its 5-day SMA is nearly 30% above its 200-day SMA. Chartists buying and selling momentum methods would nonetheless be targeted on AVGO as a result of it’s in an uptrend and main. That is the essence of dual-momentum.

TrendInvestorPro presents momentum-rotation methods that commerce shares within the Nasdaq 100 and S&P 500. These methods are totally systematic and commerce on a weekly foundation. Rankings and indicators are posted each Saturday morning for subscribers. Click on right here to see efficiency metrics and study extra.

//////////////////////////////////////////////////

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering indicators inside the pattern, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.