Charles Edwards, founding father of the Bitcoin and digital asset hedge fund Capriole Investments, printed an in depth examination of Bitcoin’s present market part suggesting a bullish trajectory, doubtlessly reaching the $100,000 mark. The evaluation hinges on the identification of a Wyckoff ‘Signal of Energy’ (SOS), an idea derived from the century-old Wyckoff Technique that research provide and demand dynamics to forecast worth actions.

Understanding The Wyckoff ‘SOS’: Bitcoin To $100,000?

The Wyckoff Technique, developed by Richard D. Wyckoff, is a framework for understanding market constructions and predicting future worth actions by the evaluation of worth motion, quantity, and time. The ‘Signal of Energy’ (SOS) inside this system signifies some extent the place the market reveals proof of demand overpowering provide, indicating a powerful bullish outlook.

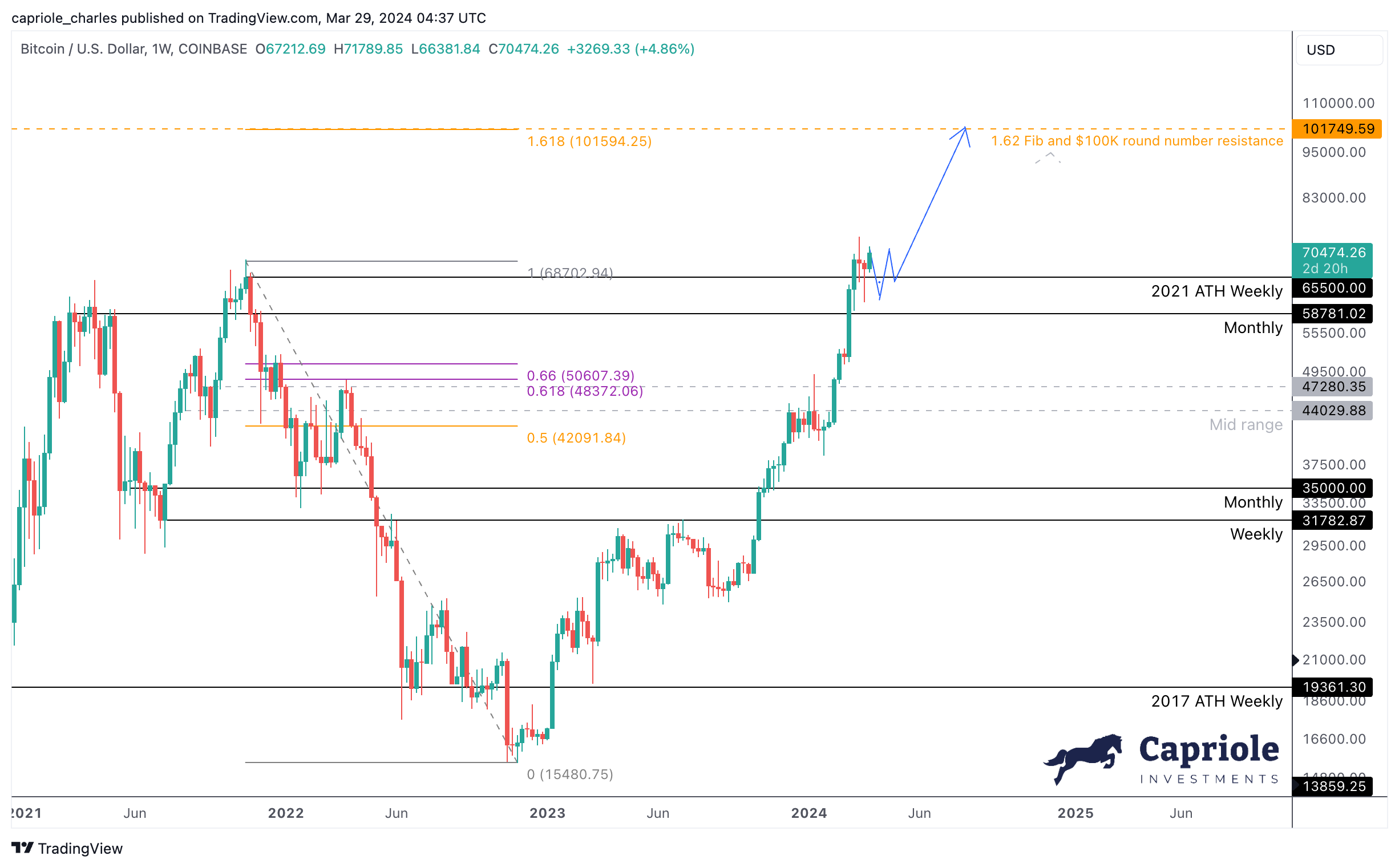

Edwards’s statement of an SOS sample in Bitcoin’s current worth actions means that the market is at a pivotal level, the place sustained upward momentum is very possible. In Capriole’s newest e-newsletter, Edwards supplied a exact depiction of Bitcoin’s market habits, highlighting a interval of volatility and consolidation within the $60,000 to $70,000 vary.

This part was anticipated by the hedge fund. At the moment, as Bitcoin ventures above its final cycle’s all-time highs, it aligns with the expected zig-zag SOS construction. Edwards elucidates, “It will not be stunning to see a liquidity seize at / into all-time highs […] All consolidation above the Month-to-month stage at $56K is extraordinarily bullish. It will be unusual (however not inconceivable) for worth to proceed in a straight line up.”

The “zig-zag” part additionally completely aligns with the halving cycle as BTC tends to consolidate “each months both aspect of the Halving.” Edwards added that “the realities of a a lot decrease provide progress fee + unlocked pent up tradfi demand will then kick-in and launch 12 months of traditionally the most effective risk-reward interval for Bitcoin.”

From a technical perspective, Bitcoin’s foray into worth discovery territory above $70,000 is devoid of serious resistance ranges. This opens a pathway to psychological and Fibonacci extension ranges, with Edwards pinpointing $100,000 as the following main psychological resistance.

The 1.618 Fibonacci extension from the 2021 excessive to the 2022 low is famous at $101,750, serving as a technical marker for potential resistance. Edwards displays on investor sentiment, stating, “You may as well think about fairly a number of buyers can be comfortable seeing six-digit Bitcoin and taking revenue in that zone,” acknowledging the psychological influence of such milestones.

BTC Fundamentals Help The Bull Case

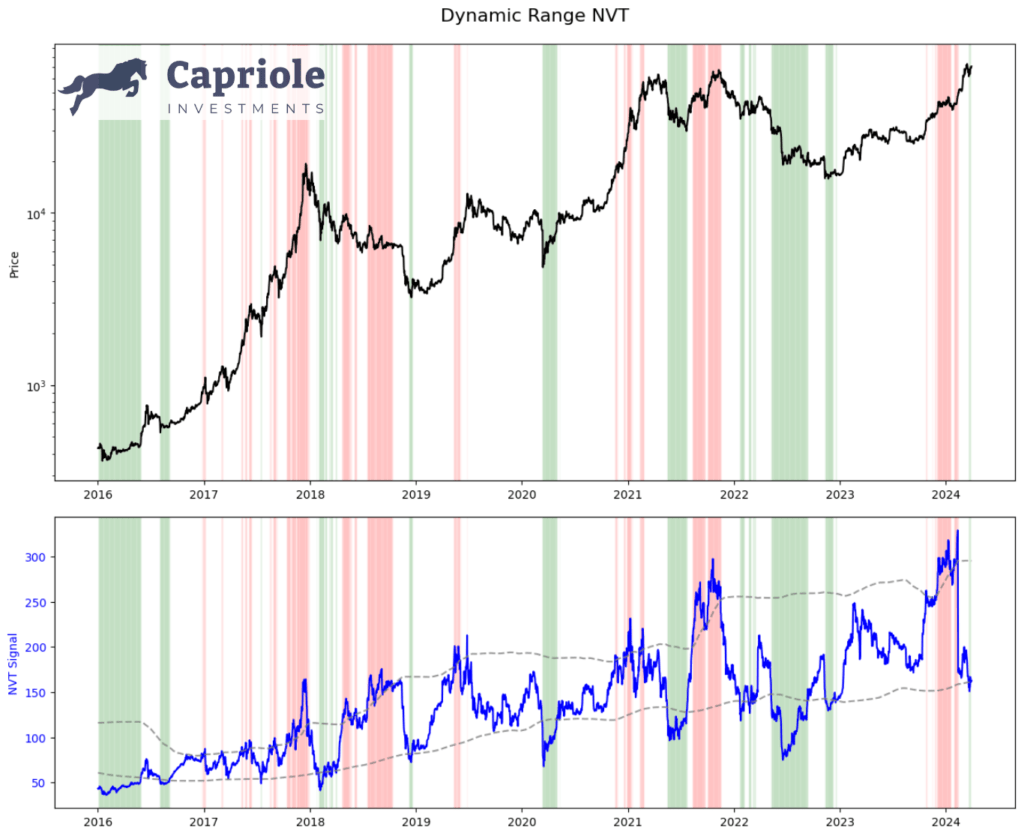

Edwards additionally delves into the significance of fundamentals, underscoring their function in offering a bullish backdrop for Bitcoin. The introduction of the Dynamic Vary NVT (DRNVT), a novel metric to Capriole, signifies that Bitcoin is at present undervalued. Edwards describes DRNVT as “Bitcoin’s ‘PE Ratio’”, which assesses the community’s worth by evaluating on-chain transaction throughput to market capitalization.

The present DRNVT readings counsel a horny funding alternative, given Bitcoin’s undervaluation at all-time worth highs. “What’s fascinating at this level of the cycle is that DRNVT is at present in a worth zone. With worth in any respect time highs, this can be a promising and weird studying for the chance that lies forward in 2024. It’s one thing we didn’t see in 2016 nor 2020,” Edwards remarked.

With each technical indicators and basic evaluation signaling a bullish future for Bitcoin, the anticipation surrounding the upcoming Halving occasion provides additional momentum to the constructive outlook. Regardless of the expectation of volatility and consolidation within the quick time period, Edwards confidently states, “chances are beginning to skew to the upside as soon as once more.”

At press time, BTC traded at $69,981.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual threat.