A quant has defined that the previous sample within the Bitcoin taker buy-sell ratio metric could recommend the most effective window to begin promoting the asset.

Bitcoin Taker Purchase Promote Ratio Could Reveal Promoting Alternatives

In a CryptoQuant Quicktake publish, an analyst mentioned the development within the Bitcoin “taker purchase promote ratio.” This indicator retains observe of the ratio between the Bitcoin taker purchase and taker promote volumes.

When the worth of this metric is bigger than 1, the buyers are prepared to buy cash at a better value proper now. Such a development implies a bullish sentiment is the dominant power out there.

Alternatively, the indicator being below the mark suggests the promoting strain could also be increased than the present shopping for strain within the sector. As such, the bulk could share a bearish mentality.

Now, here’s a chart that reveals the development within the 30-day shifting common (MA) Bitcoin taker buy-sell ratio over the previous couple of years:

The 30-day MA worth of the metric seems to have been taking place in current days | Supply: CryptoQuant

Because the above graph reveals, the 30-day MA Bitcoin taker buy-sell ratio has just lately fallen under the 1 degree. The quant has highlighted within the chart the area of the metric the place the bull run peaks in 2021 shaped.

The indicator would seem to dip under 0.97 throughout each the heights registered in that bull run. In accordance with the analyst, such indicator values recommend the euphoria part of the market the place the good cash begins to promote. Nonetheless, the costs proceed to carry on because the retail buyers proceed to FOMO into the asset.

To this point, the indicator has approached the 0.98 degree in its newest decline, implying that it’s not but on the ranges the place the potential of a high would possibly change into vital if the sample of the earlier bull run is something to go by.

The Bitcoin taker purchase promote ratio may additionally be used as a shopping for sign, with the 1.02 degree being an vital degree. The quant notes, nevertheless, that the metric is best at displaying an overbought market than it’s for pinpointing oversold circumstances.

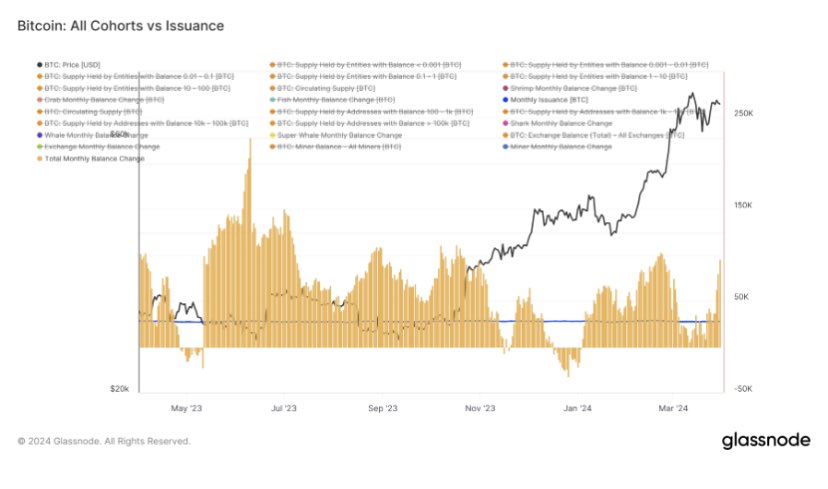

In different information, as an analyst identified in a publish on X, all of the Bitcoin investor teams have amassed a web quantity of 95,000 BTC ($6.5 billion on the present alternate fee) over the previous month.

The development within the month-to-month stability change for all BTC cohorts | Supply: @jvs_btc on X

This fast accumulation means that the Bitcoin investor teams have been shopping for up considerably greater than the miners have produced. The chart reveals that an accumulation streak of comparable ranges adopted the current rally within the asset, so this newest one can be bullish for the asset.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $68,600, up greater than 3% over the previous week.

Seems like the value of the coin has registered a pointy drop prior to now 24 hours | Supply: BTCUSD on TradingView

Featured picture from iStock.com, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal danger.