In step with the broader pattern within the total crypto market, the Solana (SOL) worth has fallen by 7.5% within the final 24 hours. Nonetheless, based on famend analyst Rekt Capital, there isn’t any motive to modify to the bearish facet.

In a current technical evaluation, the crypto analyst highlighted that Solana is at present displaying potential for an 80% worth rally primarily based on its current consolidation sample. Based on Rekt Capital, Solana is buying and selling inside what seems to be a bull flag formation, as depicted on the weekly SOL/USD chart from Binance.

A Bull Flag sample happens after a robust, virtually vertical worth rise and is characterised by a downward-sloping consolidation that resembles a flag on a pole. The “pole” is fashioned by the preliminary worth surge, whereas the “flag” represents a interval of consolidation with converging trendlines.

Merchants usually look ahead to a decisive breakout above the flag, which may sign the continuation of the prior uptrend. In Solana’s case, the analyst factors out that Solana lately confronted a rejection on the prime of the bull flag sample at $208, indicating a short-term setback in its upward trajectory.

“And if Solana retains this up, it could type a Bull Flag right here earlier than breaking out to problem that Vary Excessive $208 resistance once more,” Rekt Capital famous.

Nonetheless, the underside of this bull flag, which stands at roughly $184, is recognized as a vital assist degree that must be maintained to maintain the bullish momentum alive. Ought to Solana handle to carry above this degree, the setup could favor the continuation of the uptrend.

Notably, Rekt Capital provides that whereas occasional dips or “wicks” into the $173 vary are acceptable, the worth should typically stay above the $184 assist on the weekly time-frame to validate the bullish outlook. The $173 worth degree is marked by a blue horizontal line on the chart, serving as an extra assist zone.

By way of worth targets, the chart reveals an 80.57% potential rally from the underside of the bull flag (“pole flag”), which might translate right into a goal worth of roughly $330 if the bull flag sample is confirmed within the coming days or perhaps weeks.

Solana Bears Achieve The Higher Hand On The Decrease Time Frames

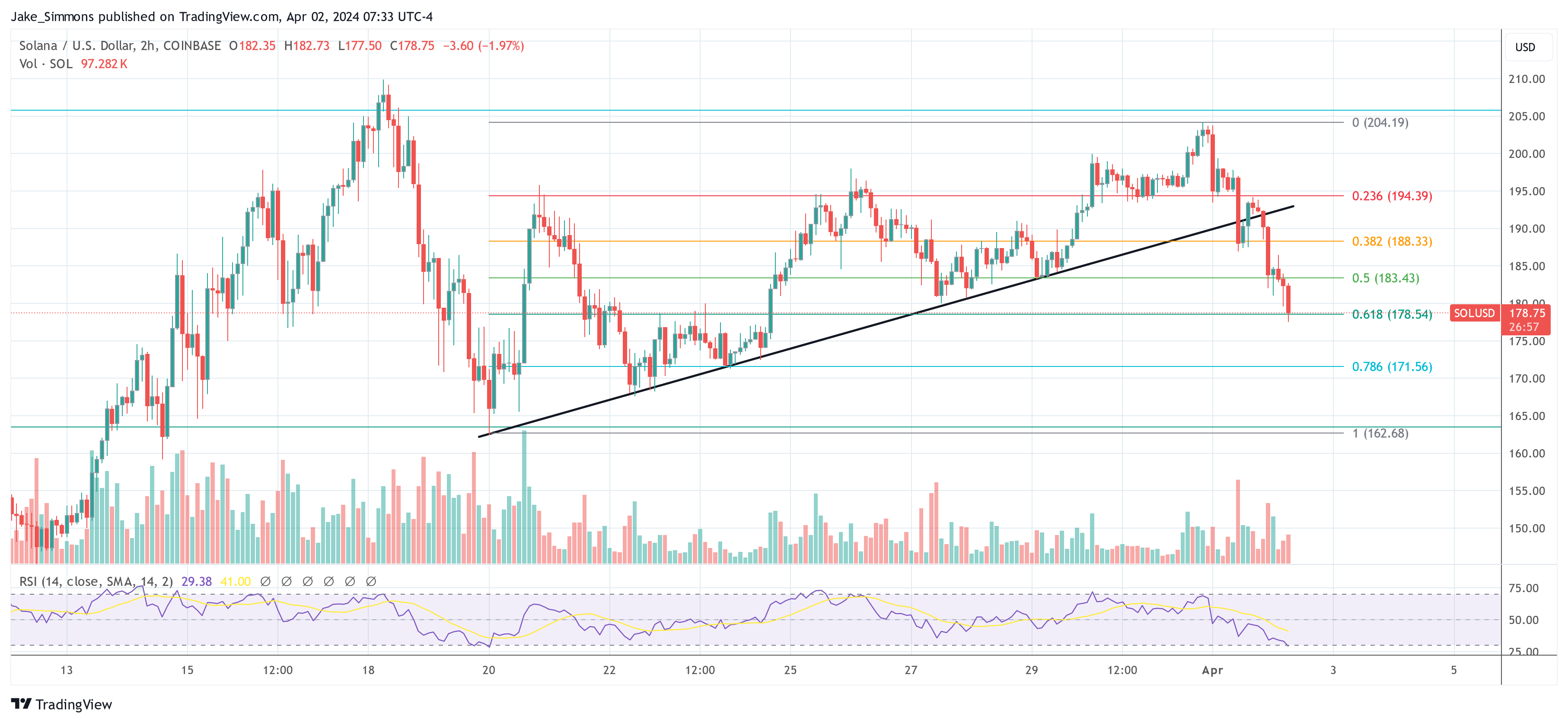

On the decrease time frames, just like the 2-hour chart, the Solana worth misplaced some momentum, indicating potential short-term consolidation or downward motion. SOL skilled a pointy -13% decline, breaking via a big upward trendline (black) that had beforehand offered assist all through an ascending trajectory.

The worth has sliced via the Fibonacci retracement ranges plotted from the swing low at $162.68 to the swing excessive at $204.19, at present hovering across the 0.618 Fib degree at $178.54. Usually, this degree serves as a robust assist zone, however a sustained break beneath might speed up losses towards the following ranges at 0.786 ($171.56) and probably the complete retracement at $162.68.

Quantity indicators present a marked enhance in promoting stress through the worth dip, which substantiates the present bearish momentum. Moreover, the Relative Energy Index (RSI) has plummeted to 29, teetering on the sting of the oversold territory. This implies that sellers are in management, but additionally raises the opportunity of a aid bounce if the RSI dips additional into oversold situations and triggers a reactive shopping for response.

Featured picture from Euronews, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site completely at your individual danger.