The cryptocurrency market has witnessed a big surge after a protracted bear market and the intensified crypto winter attributable to the collapse of crypto exchanges and companies throughout 2022 and a part of 2023.

Notably, Bitcoin and different main cryptocurrencies have skilled substantial value surges, accompanied by renewed curiosity from institutional traders getting into the market by means of lately authorized spot Bitcoin exchange-traded funds (ETFs).

Including to the business’s constructive outlook, asset supervisor and Bitcoin ETF issuer, Grayscale, believes that the present state of the market signifies that the business is within the “center” levels of a crypto bull run.

Grayscale lately launched a complete report detailing their key findings and insights into what lies forward. A more in-depth evaluation of the report by market professional Miles Deutscher sheds mild on the components contributing to this evaluation.

On-Chain Metrics And Institutional Demand

Grayscale’s report begins by highlighting a number of key alerts indicating that the market is at present in the course of a bull run. These embrace Bitcoin’s value surpassing its all-time excessive earlier than the Halving occasion, the overall crypto market cap reaching its earlier peak, and the rising consideration from conventional finance (TradFi) in the direction of meme cash.

To know how lengthy this rally may maintain, Grayscale emphasizes two particular value drivers: spot Bitcoin ETF inflows and robust on-chain fundamentals.

Grayscale notes that just about $12 billion has flowed into Bitcoin ETFs in simply three months, indicating vital “pent-up” retail demand. Furthermore, ETF inflows have constantly exceeded BTC issuance, creating upward value stress as a result of demand-supply imbalance.

Grayscale’s analysis focuses on three crucial on-chain metrics: stablecoin inflows, decentralized finance (DeFi) whole worth locked (TVL), and BTC outflows from exchanges.

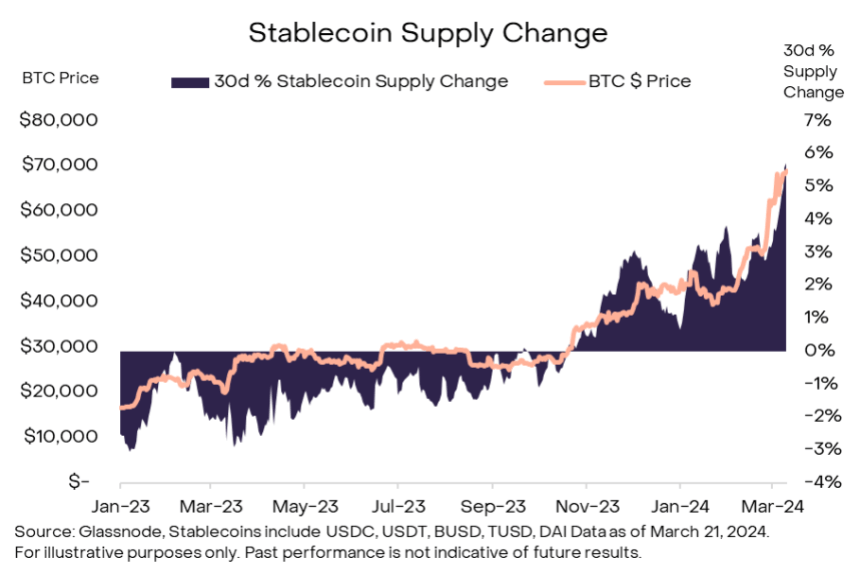

In line with Deutscher, the rise in stablecoin provide on centralized exchanges (CEXs) and decentralized exchanges (DEXs) by roughly 6% between February and March suggests enhanced liquidity, making extra capital available for buying and selling.

Moreover, for the analyst, the doubling of the overall worth locked into DeFi since 2023 represents rising person engagement, elevated liquidity, and improved person expertise inside the DeFi ecosystem.

The outflows from exchanges, which at present account for about 12% of BTC’s circulating provide (the bottom in 5 years), point out rising investor confidence in BTC’s worth and a desire for holding reasonably than promoting.

Based mostly on these catalysts, Grayscale asserts that the market is within the “mid-phase” of the bull run, likening it to the “fifth inning” in baseball.

Promising Outlook For Crypto Business

A number of key metrics assist Grayscale’s evaluation, together with the Internet Unrealized Revenue/Loss (NUPL) ratio, which signifies that traders who purchased BTC at decrease costs proceed to carry regardless of rising costs.

In line with Deutscher, the Market Worth Realized Worth (MVRV) Z-Rating, at present at 3, implies that there’s nonetheless room for progress on this cycle. Moreover, the ColinTalksCrypto Bitcoin Bull Run Index (CBBI), which integrates a number of ratios, at present stands at 79/100, suggesting that the market is approaching historic cycle peaks with some upward momentum remaining.

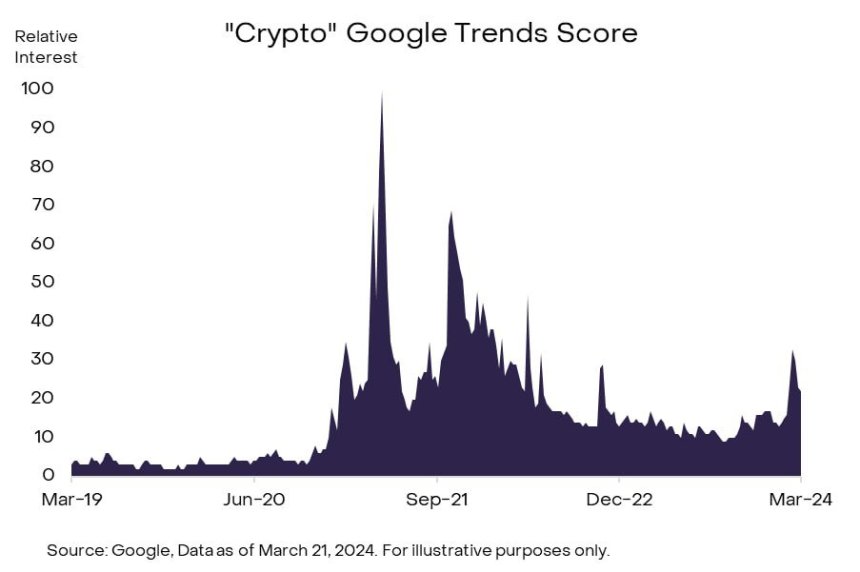

Moreover, retail curiosity has but to totally return this cycle, as evidenced by decrease cryptocurrency YouTube subscription charges and decreased Google Tendencies curiosity for “crypto” in comparison with the earlier cycle.

Finally, Grayscale retains a “cautiously optimistic” stance relating to the way forward for this bull cycle, given the promising alerts and evaluation outlined of their report.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual danger.