There was a rise in financial institution accounts belonging to crypto professionals being frozen or restricted throughout the UK, US, and EU over the previous few months. They are saying you typically don’t care about one thing till it occurs to you; effectively, this week, it did. To my real shock, it got here from the one place I least anticipated it.

Revolut has lengthy been thought to be probably the most crypto-friendly financial institution in the UK, providing in-app crypto purchases and, in 2023, lastly including the power to ship and obtain crypto, albeit with sure limitations. Nevertheless, latest occasions have referred to as into query the financial institution’s dedication to offering a seamless expertise for its cryptocurrency-using clients.

Regardless of the UK not being a part of the European Union, below which MiCA EU rules apply, the newly carried out Journey Rule requires comparable disclosures. Because of this customers at the moment are required to disclose and establish the homeowners of any unhosted wallets which are the recipients of withdrawals from Revolut.

Nevertheless, UK crypto companies are allowed to use a risk-based method to find out when they need to collect data on unhosted wallets. They merely have to have the aptitude to establish the place their clients are transacting with unhosted wallets and assess the riskiness of these transactions.

How the UK’s most crypto-friendly financial institution froze my account of 0.23ETH

Two days in the past, I bought a modest 0.23 ETH (£550) via the Revolut app and tried to switch the funds to my private Ethereum pockets, which is linked to a well known ENS area. To my shock, Revolut blocked the transaction and took charges from the account. Furthermore, my complete checking account, together with a joint account with my spouse, was frozen.

After a number of hours of frustration and confusion, the account was ultimately unfrozen, and costs have been refunded after an extra request. Nevertheless, the particular pockets handle stays blocked, stopping me from sending funds to that account. This expertise has left me questioning the true nature of Revolut’s supposed crypto-friendliness. Given the options within the UK, Revolut stays the most suitable choice for these unhappy with conventional banks, however it’s a low bar. I consider that incidents reminiscent of these have much less to do with Revolut being ‘anti-crypto’ and extra to do with a worry of regulatory retribution.

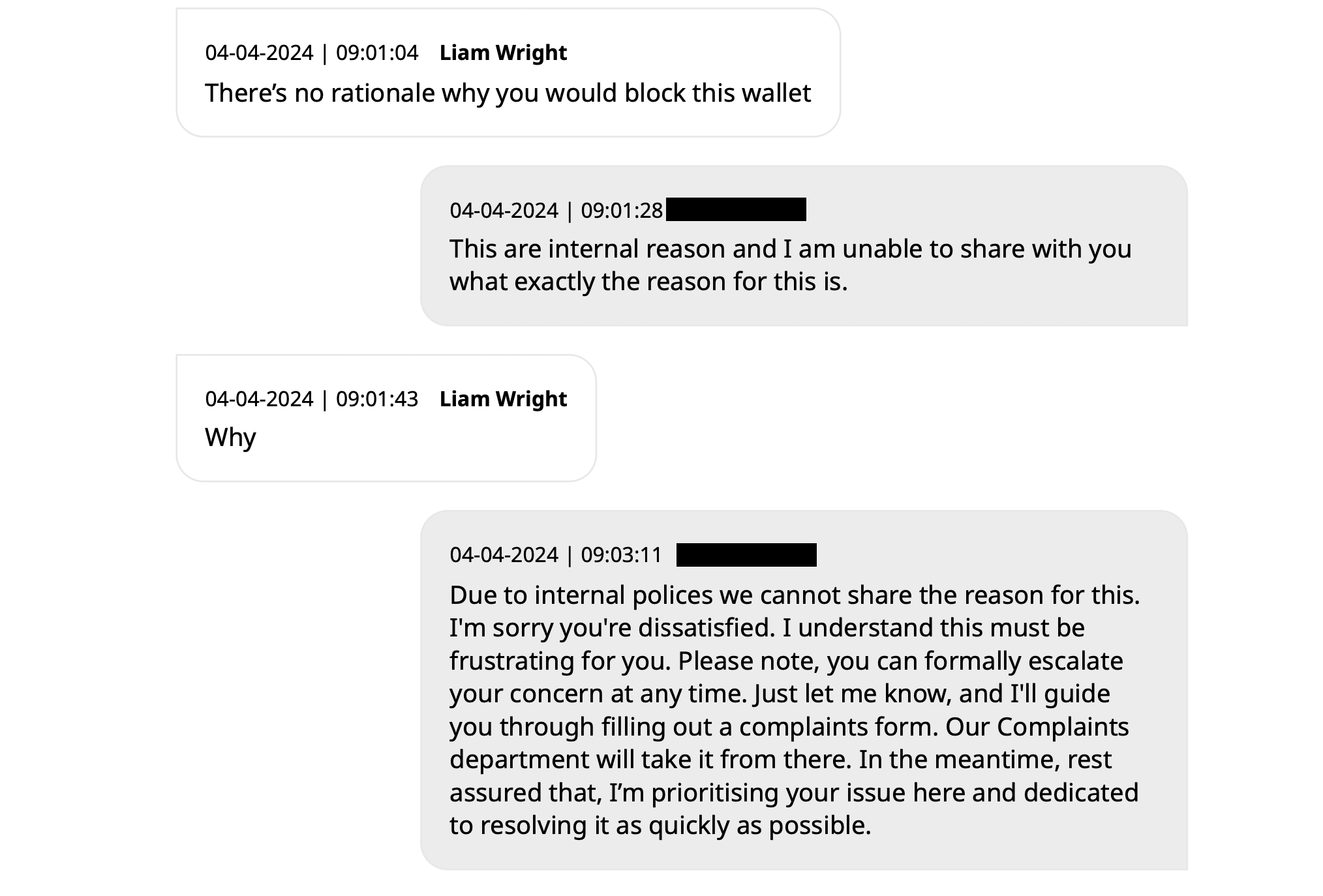

Nonetheless, the chat transcript between Revolut’s help group and me reveals a scarcity of transparency concerning the explanations behind the account freeze and the pockets handle block. The help representatives couldn’t present a transparent clarification, citing inner insurance policies that forestall them from sharing the particular causes for these actions.

This incident raises considerations in regards to the autonomy and management that Revolut customers have over their very own funds, notably on the subject of digital belongings transactions. Blocking a private pockets handle with out a passable clarification undermines belief within the financial institution’s capability to facilitate easy crypto transactions.

Because the UK navigates the post-Brexit monetary panorama, banks like Revolut should strike a steadiness between compliance with rules and offering a user-friendly expertise for his or her clients. The strict utility of legal guidelines and the shortage of transparency in addressing account and pockets points threat alienating crypto customers who depend on these companies. That is very true on condition that the corporate is seeking to open a devoted crypto trade providing.

Debanking crypto customers in america

In america, even crypto customers who’ve been long-time clients of conventional banks face account closures resulting from their involvement with digital belongings. John Paller, co-founder of ETH Denver, not too long ago shared his expertise on Twitter, revealing that Wells Fargo had debanked him after 26 years of patronage and hundreds of thousands paid in charges. Paller’s checking, financial savings, bank card, private line, non-profit, and enterprise accounts have been all shut down with out clarification, regardless of him not utilizing his private accounts for crypto purchases in latest instances.

Caitlin Lengthy, Founder and CEO of Custodia Financial institution, responded to Paller’s tweet, noting a big enhance in inquiries from crypto corporations urgently searching for to switch financial institution accounts closed by their banks. She referred to this pattern as one other wave of “Operation Choke Level 2.0,” suggesting a full-on witch hunt towards crypto-related companies.

Bob Summerwill, Director of the Ethereum Traditional Cooperative, echoed the sentiment, emphasizing the necessity for banks like Custodia. He shared his personal expertise with PayPal, which closed the Ethereum Traditional Cooperative’s account with out offering particular causes, solely stating that the choice was everlasting and couldn’t be overturned.

These incidents spotlight a rising concern inside the crypto group: even those that have established relationships with conventional banks and have a compliance historical past are susceptible to shedding entry to banking companies. The dearth of transparency and the abrupt nature of those account closures increase questions in regards to the underlying motivations behind these actions and the potential impression on the expansion and adoption of cryptocurrencies in america.

Optimistic friction actually simply means a horrible consumer expertise

Anecdotally, I’ve additionally heard from at the very least 5 different people who work in crypto and frequently transfer substantial sums of FIAT forex via conventional banks which have had accounts frozen. I’m not advocating for a Wild West; widespread sense regulation is all I ask.

The UK’s method to regulation additionally contains what it considers ‘optimistic friction.’ The idea refers to a set of regulatory measures designed to introduce sure limitations or checks that decelerate the method of investing in digital belongings. These measures are meant to counteract the social and emotional pressures which may lead people to make hasty or ill-informed funding choices. The Monetary Conduct Authority (FCA) has launched these ‘optimistic frictions’ as a part of its monetary promotions laws, aiming to reinforce client safety within the crypto market.

Particular examples of “optimistic friction” embrace customized threat warnings and a 24-hour cooling-off interval for first-time traders with a agency. These measures are designed to make sure that people are adequately knowledgeable in regards to the dangers related to crypto investments and have adequate time to rethink their funding choices with out the affect of speedy emotional or social pressures.

The fact is a collection of questions designed to scare off new traders, adopted by an unpleasant banner warning throughout the highest of each crypto app that seemingly by no means goes away even after you might have handed all necessities.

I want to know when the federal government can be implementing a check on fractional reserve banking for all conventional finance clients? We have now to know in regards to the nuances of presidency regulation on crypto, reminiscent of who the FCA oversees and whether or not a whitepaper is required. Suppose we have been to ask ten individuals on the road what occurs while you deposit funds into their checking accounts. I ponder what number of would cross the check?

What number of know US and UK banks’ reserve necessities are 0%? Earlier limits of 5 – 10% have been dropped in 2020, and now it’s at a financial institution’s personal discretion how a lot of its clients’ funds are literally held in money. Due to this fact, it’s totally authorized for a financial institution to take a £1,000 deposit and mortgage the entire quantity out to a different get together.

After all, conventional finance is regulated, and cash is ‘assured’ by authorities insurance coverage, so we don’t want to fret. Let’s simply not look again to 2008 after we needed to depend on such instruments, we could? It took lower than 10% of consumers to withdraw funds from Northern Rock for it to break down.

Banks don’t have your whole cash; well-run crypto exchanges and self-custody wallets do, however rules counsel we ought to be petrified of crypto?

I feel it’s the banks which are terrified.

I requested Revolut’s help and X groups if the PR division want to touch upon my scenario forward of this op-ed, however the query was repeatedly ignored.