KEY

TAKEAWAYS

- The Vitality Sector Stays On a Very Sturdy Rotational Path

- Accomplished Prime Formation In Healthcare Opens Up Important Draw back Threat

- Smaller Expertise Shares Are Taking Over From Mega-Cap Names

A Sector Rotation Abstract

A fast evaluation of present sector rotation on the weekly Relative Rotation Graph:

XLB: Nonetheless on a powerful trajectory contained in the bettering quadrant and heading for main. The upward break of overhead resistance on the value chart appears to be stalling for the time being, which may trigger its relative power in comparison with the S&P 500 to decelerate. General, the development, each by way of worth and relative, remains to be up.

XLC: Continues to lose relative power and momentum contained in the weakening quadrant and rotates towards lagging at a unfavorable RRG-Heading. On the value chart, XLC is battling resistance, which causes its relative efficiency to decelerate.

XLE: Is on the strongest rotation on this universe. Effectively contained in the bettering quadrant on the highest RS-Momentum studying and powered by the longest tail within the universe. The upward break within the worth chart is holding up effectively, and the sector may even deal with a small setback in direction of the previous resistance space (slightly below ~95) with out harming its uptrend.

XLF: Was on its means again to the main quadrant after curling again up inside weakening, however this week’s dip is inflicting the tail to deviate from that path. This implies we should watch this sector intently going into the shut of this week and the start of subsequent week to see if it is a short-term hiccup or an actual change of course. The nasty dip on the value chart pushes XLF again beneath its former resistance ranges, which is normally not a powerful signal. Warning!!

XLI: That is the one sector contained in the main quadrant for the time being, touring at a powerful RRG-Heading, taking the sector increased on each axes. The rally within the worth chart is totally intact however appears to stall at present ranges for 3 to 4 weeks. Loads of room on the chart for a corrective transfer on this sector with out damaging the uptrend.

XLK: The sluggish efficiency, primarily sideways, of the sector because the finish of January has triggered relative power to flatten and for the sector to roll over and rotate into the weakening quadrant on the RRG. The leap right this moment (Thursday, 4/11) triggered an uptick in relative power, however rather more is required to deliver this sector again to the forefront.

XLP: Didn’t make all of it the best way as much as horizontal resistance round 77.50 however set a decrease excessive after a nasty reversal final week. The uncooked RS-Line continues steadily decrease, inflicting the tail on the RRG to stay quick and on the left-hand facet of the graph, indicating a gentle relative downtrend.

XLRE: After a rally on the finish of final 12 months, XLRE ended up in a sideways sample that would change into a double high after that rally. Such a high will likely be confirmed on a break beneath 37, which is the bottom low that was set within the week beginning 2/12. When that occurs, a decline all the best way again to the late 2023 low turns into doable. The relative development reversed again down after a really temporary stint via the main quadrant on the finish of January.

XLU: Simply moved into the bettering quadrant from lagging however stays at a really low RS-Ratio stage. The uncooked RS-Line continues to point out a gentle downtrend, making it arduous for the tail to make all of it the best way to the main quadrant. Value managed to interrupt above a falling resistance line however shortly thereafter stalled within the space of Sept-23, Dec-23, and Jan-24 highs. Strain stays in each worth and relative phrases.

XLV: After a brief rotation via the bettering quadrant that lasted roughly two months, XLV has now returned to the lagging quadrant and is pushing deeper into it on a unfavorable RRG-Heading. On the value chart, XLV accomplished a (double) high formation and broke again beneath its former overhead resistance stage, opening vital draw back danger.

XLY: Is hesitating in a sideways sample since mid-February, however nonetheless in a really shallow, uptrend. Relative power continued to say no however is now nearing its late 2022 relative low, and the RRG-Traces are exhibiting early indicators of enchancment.

Cap-weighted vs Equal-weighted

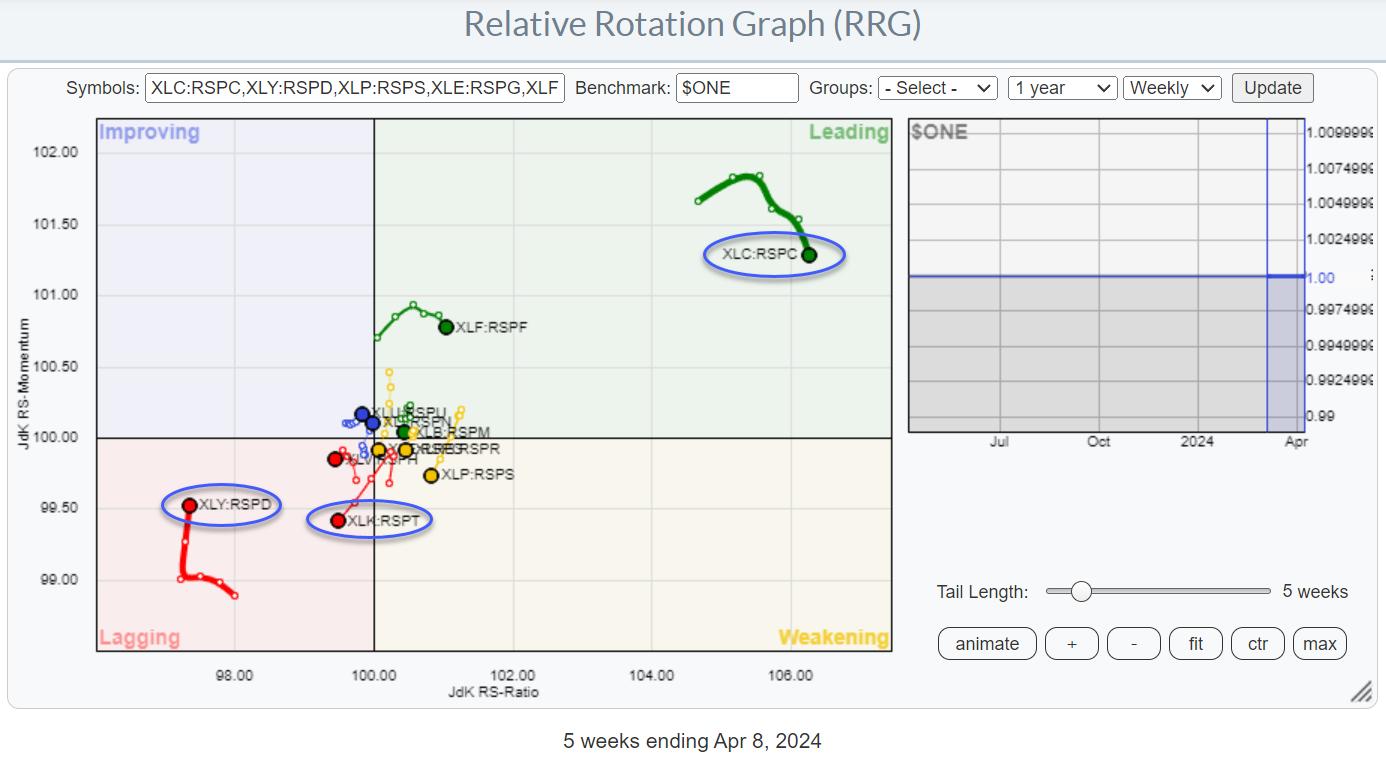

The RRG above reveals the relative rotation of the relationships between the cap-weighted sector ETFs and their equal-weighted counterparts.

The extra attention-grabbing info is coming from the tails which are far-off from the benchmark. On this case, these are the Communication providers sector, which is rolling over contained in the main quadrant, and Client Discretionary, which has simply turned up contained in the lagging quadrant.

This means that the massive(er) cap communication providers shares are actually beginning to underperform the lower-tier market capitalizations. The alternative is true for Client Discretionary, the place the alternative is occurring, and bigger market cap shares are taking on from decrease tier market caps.

An analogous remark may be made for the Expertise sector which is heading straight into the lagging quadrant, which means that large-cap tech is giving option to smaller names.

This info will likely be useful when taking a look at RRGs for particular person shares contained in the sectors.

#StayAlert: –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to every message, however I’ll definitely learn them and, the place fairly doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra