The Inputs Instructions

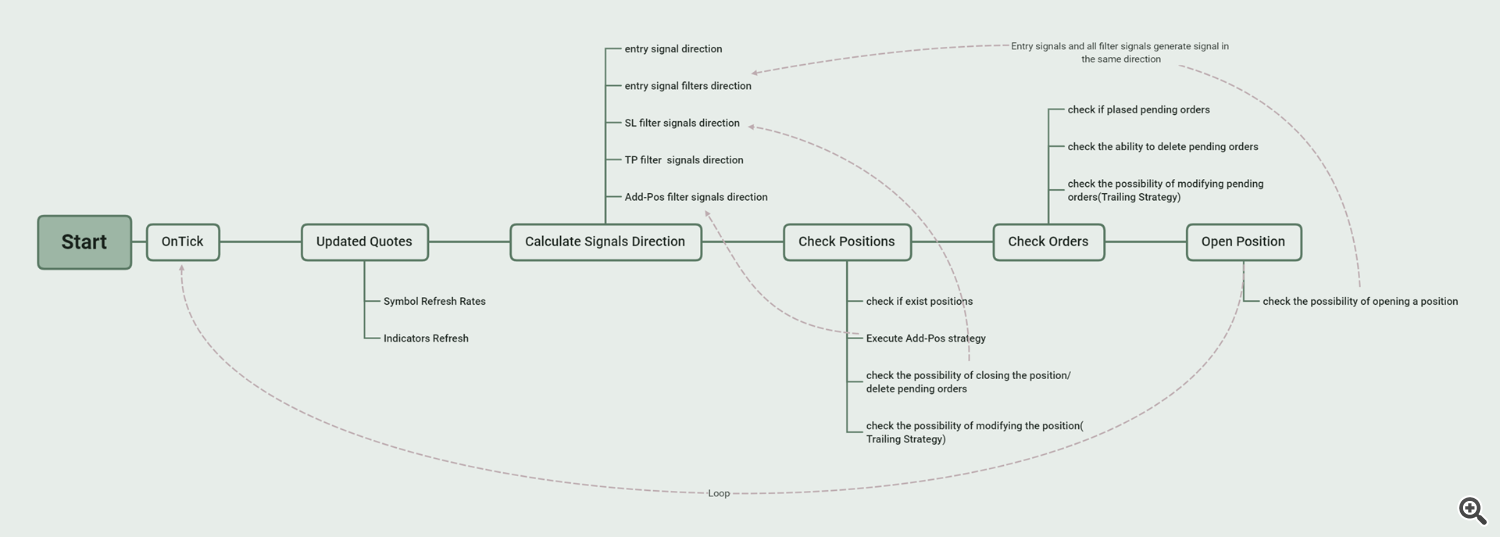

While you first use SMC EA, please bear in mind its fundamental logic.

Select one and just one entry sign may be chosen within the Present Interval Time Body. When the entry sign outputs a protracted course, if no filtering sign is added, the order will probably be positioned instantly. If a number of filtering indicators are added, all of those filtering indicators should generate a protracted course on the similar time earlier than putting an order. So long as one filtering sign doesn’t generate a protracted course, it doesn’t meet the situations for putting an order. This system permits including filtering indicators beneath three TFs (Present Interval TF, TF1 and TF2), and a number of filtering indicators may be added beneath every TF. Particular consideration needs to be paid right here to the choice setting of sign validity interval(Final Sign Expiration) for every filter sign. This feature is to increase the time of a sure sign, as many indicators are solely generated on a sure bar.

For instance:

If my technique is to position an order if FVG seems inside 10 bars after the primary line and sign line of MACD intersect within the Present Interval (assume 15m). In the meantime, in HTF (assuming 1 day), Worth must be above MA and MA is upward. So I ought to set it this fashion:

- First, choose FVG because the entry sign, and set the specified bull/bear sign mode and entry mode within the FVG Sign Parameters space. Right here, we need to enter the market instantly after FVG seems, so we select “FVG Fashioned” for the “Sign Bull/Bear Sample Utilization” and “Commerce at Market Worth” for the “Sign Entry Sample Utilization”.

- The second step is to set the required SL and TP. You possibly can select fastened Pips or ATRs, or select to make use of the SL and TP supplied by the entry sign or filter sign.

- The third step, activate MACD filter on Present Interval, and set “Sign Bull/Bear Sample Utilization” to “Search for an intersection of the primary and sign line”. Set “Final Sign Expiration” to 10.

- Ultimately, set Timeframe1 to “1 Day”, activate MA filter on TF1, and set “Sign Bull/Bear Sample Utilization” to “Shut Worth Above/Beneath the indicator, MA is upwards/downwards”.

===========INPUTS FOR EXPERT===========

-

EA Magic Quantity: a novel identifier that distinguishes between completely different orders or trades positioned by an Skilled Advisor (EA). Make sure that every EA you’re utilizing has a distinct magic quantity.

-

EA Run in Each Tick: This parameter is used to determine on worth motion checks if it will likely be accomplished on tick or on the formation of a 1 minute. At the moment, all indicators don’t require an On Tick stage, so the default setting is fake.

===========INPUTS FOR ENTRY SIGNAL===========

———–Basic Settings———–

-

Choose Entry Sign for commerce in Present Interval: Right here, we choose the entry indicators for buying and selling. This system has 10+ built-in entry indicators for choice, and the entry indicators may be additional expanded in response to person wants sooner or later. After deciding on the entry sign, it is advisable set the parameters of the sign within the corresponding sign parameter setting space.

-

Choose SL Kind: There are 6 sorts to decide on.

- No SL: No cease loss is about for orders.

- SL in Factors: Set a hard and fast variety of factors because the cease loss for the order.

- SL in ATRs: Set a hard and fast a number of ATRs because the cease loss for the order.

- Swing Excessive/Low: Use the latest swing excessive as a cease loss for brief orders and the latest swing low as a cease loss for lengthy orders.

- SL Offered by Entry Sign: Use the cease loss sort set by the entry sign because the cease loss for the order. Every entry sign could present a number of cease loss sorts, which may be set within the entry sign parameter setting space.

- SL Offered by Filter: We could have added a number of filtering indicators to the entry sign, every of which may present a distinct cease loss sort. Right here, we will select the cease loss sort supplied by the filtering sign because the cease loss for the order. Every filtering sign could present a number of cease loss sorts, which may be set within the filtering sign parameter setting space.

-

—ATR Peroid: If SL in ATRs is chosen above, the ATR Interval must be set right here.

-

—Cease Loss stage (in pips/ATR): Set particular numerical values for SL in Pips or SL in ATRs. If the variety of decimal digits of the value is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

Set SL Offsets(in ATR): Add an offset to the usual SL chosen above. Optimistic worth will improve SL, destructive worth will lower SL.

-

Choose TP Kind: There are 7 sorts to decide on.

- No TP: No take revenue is about for orders.

- TP in Factors: Set a hard and fast variety of factors because the take revenue for the order.

- TP in ATRs: Set a hard and fast a number of ATRs because the take revenue for the order.

- “X” SL: Use a hard and fast a number of of SL because the take revenue for the order.

- Swing Excessive/Low: Use the latest swing excessive as a take revenue for lengthy orders and the latest swing low as a take revenue for brief orders.

- TP Offered by Entry Sign: Use the take revenue sort set by the entry sign because the take revenue for the order. Every entry sign could present a number of take revenue sorts, which may be set within the entry sign parameter setting space.

- TP Offered by Filter: We could have added a number of filtering indicators to the entry sign, every of which may present a distinct take revenue sort. Right here, we will select the take revenue sort supplied by the filtering sign because the take revenue for the order. Every filtering sign could present a number of take revenue sorts, which may be set within the filtering sign parameter setting space.

-

—Take Revenue stage (in pips/ATR): Set particular numerical values for TP in Pips or TP in ATRs. If the variety of decimal digits of the value is 3 or 5, 1Pips = 10Points, else 1Pips = 1Point.

-

—TP “X” Worth: Set the “X” values for “X” SL chosen above.

-

Set TP Offsets(in ATR): Add an offset to the usual TP chosen above. Optimistic worth will improve TP, destructive worth will lower TP.

-

–

-

MS Size (Depth) for Swing Excessive/Low: That is used for the smc indicator that’s applied to research market construction, and it has an impression on the place to set the SL/TP if the choice Swing Excessive/Low is used.

-

Expiration of pending orders (in bars): This parameter will mean you can set an expiration time for your orders, 0 means no expiration time is about, 2 signifies that the expiration time of the order is 2 bars. For instance, when buying and selling on the 1 hour, 2 implies that the expiration time of the order is 2 hours.

-

Most variety of orders: The utmost variety of orders allowed by EA, which is able to embrace the present positions.

-

Minimal Distance between two pos(in pips)(0 means No restrictions): Restrict the space between the closest two positions in the identical course.

-

Breakeven when earlier positions are in loss: When the float lack of the earlier place exceeds the desired worth, the present order to be entered and the earlier order execute a breakeven technique.

-

—Loss Threshold (in factors): If the above choice is true, set the floating loss worth right here.

-

Shut Positions When reverse sign: When the entry sign reveals a sign in the other way, Shut Place.

-

–

-

Commerce Solely in Outlined Kill zone: Buying and selling Window, If set to false, the trades will run your entire day. If set to true, it is advisable set the beginning and ending hours of your kill zone.

-

—Killzone Start Hour(0-23): Beginning hour of the kill zone

-

—Killzone Start Minute(0-59): Beginning minute of the kill zone

-

—Killzone Finish Hour(0-23): Ending hour of the kill zone

-

—Killzone Finish Minute(0-59): Ending minute of the kill zone

-

–

-

Shut Positions at Sure Time: If true, the EA will shut all promote or purchase trades on the outlined shut place time.

-

—Hour to Shut Positions(0-23): Closing Hour of all open positions

-

—Minute to Shut Positions(0-59): Closing Minute of all open positions

-

Cancel Orders at Sure Time: If true, the EA will delete all pending orders on the outlined delete orders time.

-

—Hour to Cancel Orders(0-23): Deleting Hour of all open orders

-

—Minute to Cancel Orders(0-59): Deleting Minute of all open orders

-

–

-

Use Day by day Revenue Restrict: This can mean you can activate the every day revenue limitation.

-

—Max Day by day Revenue %:

-

Use Day by day Drawdown Restrict: This can mean you can activate the every day drawdown limitation.

-

—Max Day by day DD %:

———–Composite-Candle Sign Parameter settings———–

-

Flip On/Off Candles Sign as filter On Present Interval: If this sign will not be chosen as an entry sign, it may be used as a filter sign. If chosen, then this selection can’t be true, even when set to true, it won’t work.

-

Sign Bull/Bear Sample Utilization: Every sign gives a number of sample modes for customers to select from. Composite-Candle Sign gives two sample modes to select from.

- Composite-Candle is bull/bear: This system detects the candles of the most recent 3 to ‘ Max Vary for Sample Search ‘. If their worth fluctuation is bigger than the set ‘ Minimal Fluctuation Vary of Worth (in ATR) ‘, these candles are mixed into one Candle. If the higher shadow of this mixed Candle is lower than the ‘Shadow Small’ and decrease shadow of this mixed Candle is higher than ‘ Shadow Large‘, it can generate a protracted sign. If the decrease shadow of this mixed Candle is lower than the ‘Shadow Small’ and higher shadow of this mixed Candle is higher than ‘ Shadow Large‘, it can generate a brief sign.

- Composite-Candle is bull/bear and Worth close to the Swing Excessive/Low: When a mixed Candle that meets the situations seems and it seems close to Swing Excessive/Low, it generates a bull/bear sign.

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

-

—Max Vary for Sample Search(in bars): Set the utmost search variety of candles.

-

—Minimal Fluctuation Vary of Worth(in ATR): Set the minimal worth fluctuation vary for Composite-Candle.

-

—ATR Interval for Candles: Set the ATR Interval to find out the magnitude of worth fluctuations.

-

—Shadow Large for Candles Sample: Multiply this worth by the distinction between the excessive and low of the mixed candle.

-

—Shadow Small for Candles Sample: Multiply this worth by the distinction between the excessive and low of the mixed candle.

-

—Candles Mode Utilization: 3 modes to select from. By default, choose Basic mode.

- Basic: shadow_h=high-((open>shut)?open:shut); shadow_l=((open<shut)?open:shut)-low;

- Fashionable 1: shadow_h=high-close; shadow_l=((open<shut)?open:shut)-low;

- Fashionable 2: shadow_h=high-close; shadow_l=open-low;

- Sign Inverting: When we have to commerce in the other way of the entry sign, we will set this selection to True. For instance, when our entry sign selects MarketStructurue, we promote when a Bull BOS happens, and purchase when a Bear BOS happens. When used as a filter sign, this parameter causes it to output a reverse sign.

-

Final Sign Expiration(Candles nums):This feature solely takes impact when this sign is used as a filter sign. Some indicators are solely generated on a sure candle, and when utilizing them as filters, we wish them to generate indicators on a number of consecutive candles, so we have to set Sign Expiration for them. For instance, we use FVG because the entry sign, Timeframe1 selects Present, Activate MACD sign because the filter, and choose “Search for an intersection of the primary and sign traces” because the sign mode. The MACD sign is barely generated when the primary and sign traces intersect. If there isn’t a FVG fashioned sign at the moment, the buying and selling situations won’t be met. Due to this fact, we have to set the Sign Expiration for the MACD sign. Assuming it’s set to 7, within the 7 candles after the primary and sign traces intersect, if there’s an FVG fashioned sign, it may be generated a Buying and selling sign.

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set:

- Excessive/Low of the Composite-Candle: Use the excessive and low factors of the mixture candle as a cease loss.

———–MA Sign Parameter settings———–

- Shut Worth Above/Beneath the indicator

- CloseP above MA, OpenP under MA, MA is upwards

- CloseP and OpenP above MA, LowP under MA, MA is upwards

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

———–MACD Sign Parameter settings———–

- MACD line is upwards

- MACD line has a reverse

- Search for an intersection of the primary and sign line

- Search for an intersection of the primary line and the zero stage

- Search for the “divergence” sign

- Search for the “double divergence” sign

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

———–RSI Sign Parameter settings———–

- Oscillator is directed upwards/downwards

- Seek for a reverse of the oscillator upwards/downwards behind the extent of overselling(RSI<30)/overbuying(RSI>70)

- Seek for the “failed swing” sign

- Seek for the “divergence” sign

- Seek for the “double divergence” sign

- Seek for the “head/shoulders” sign

- Commerce at Market Worth : When there’s a bullish or bearish sign, instantly enter on the market worth.

-

—RSI Interval for quick: The “interval of calculation” parameter of the oscillator.

-

—RSI Utilized: The “costs collection” parameter of the oscillator.

-

Sign Inverting:

-

Final Sign Expiration(Candles nums): The precept is similar as above.

-

–

———–WPR Sign Parameter settings———–

- the oscillator is directed upwards

- seek for a reverse of the oscillator upwards behind the extent of overselling

- seek for the “divergence” sign

- Commerce at Market Worth : When there’s a bullish or bearish sign, instantly enter on the market worth.

———–BreakerBlocks Sign Parameter settings———–

- BB fashioned and LowP above BB backside or HighP under BB high

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

- Commerce at Block Worth: Commerce at Breaker Block Worth.

- Imply threshold Worth: Commerce on the imply threshold worth of the Block.

-

—BB iStructure Algo: Inner MS algorithm choose.

-

—BB iStructure Break Kind: Break Kind for Inner MS.

-

—BB iStructure Size: Depth for indicator to research inner market construction.

-

—BB sStructure Algo: Swing MS algorithm choose.

-

—BB sStructure Break Kind: Break Kind for swing MS.

-

—BB sStructure Size: Depth for indicator to research swing market construction.

-

Sign Inverting:

-

Choose SL Kind Offered by this Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- Breaker Block Excessive/Low: Use the excessive and low factors of the breaker block as a cease loss.

- N-Form Excessive/Low: Use the excessive and low factors of the N-Form as a cease loss.

———–BSL/SSL Sign Parameter settings———–

- BSL/SSL fashioned,LowP above BSL or HighP under SSL

- BSL/SSL fashioned

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

- Imply threshold Worth:

-

—BSL/SSL iStructure Algo: Inner MS algorithm choose.

-

—BSL/SSL iStructure Break Kind: Break Kind for Inner MS.

-

—BSL/SSL iStructure Size: Depth for indicator to research inner market construction.

-

—BSL/SSL sStructure Algo: Swing MS algorithm choose.

-

—BSL/SSL sStructure Break Kind: Break Kind for swing MS.

-

—BSL/SSL sStructure Size: Depth for indicator to research swing market construction.

-

Sign Inverting:

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- BSL/SSL Area Excessive/Low

———–FiboRe Sign Parameter settings———–

- FiboRe exceeding set worth: Fibo-Re stage exceeding ‘FiboRe MinRe‘ and fewer than ‘FiboRe MaxRe‘.

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

- The Worth of Max FiboRe Pre-set: Most stage worth of Fibo-Retracement.

- The Worth of Min FiboRe Pre-set: Minimal stage worth of Fibo-Retracement.

-

—FiboRe iStructure Algo: Inner MS algorithm choose.

-

—FiboRe iStructure Break Kind: Break Kind for Inner MS.

-

—FiboRe iStructure Size: Depth for indicator to research inner market construction.

-

—FiboRe sStructure Algo: Swing MS algorithm choose.

-

—FiboRe sStructure Break Kind: Break Kind for swing MS.

-

—FiboRe sStructure Size: Depth for indicator to research swing market construction.

-

—FiboRe FBR Kind: Select Inner MS or Swing MS for Fibo-Re.

-

—FiboRe MinRe for Sign: Minimal stage for Fibo-Re.

-

—FiboRe MaxRe for Sign: Most stage for Fibo-Re.

-

Sign Inverting:

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- Market Construction Excessive/Low

- Consumer Set Fibo-Re Stage for SL: Set the desired Fibo-Re stage worth within the following settings.

———–FVG Sign Parameter settings———–

- FVG fashioned

- FVG fashioned and three bull/bear candles in a row sample

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

- Imply threshold Worth of the FVG:

- FVG High/Btm Worth: High/Btm Worth of the FVG Block.

-

—FVG Interval: The timeframe parameter of the FVG.

-

—FVG Stuffed Kind: Choose FVG crammed sort.

-

—FVG MiniSize Filter: FVG Threshold (minval=0.1, step=0.1).

-

Sign Inverting:

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- FVG Block Excessive/Low:

- FVG 3 Candles Excessive/Low: The excessive and low factors of the three candles that type FVG.

———–Killzone Sign Parameter settings———–

- Worth break KZ: Inside the set KILLZONE time, the value will type an oblong space. When the value breaks by the excessive and low factors of this rectangular space, a sign is generated. For instance, we will set the time of KZ for AsiaRange and enter lengthy or brief positions when the value breaks by the excessive and low factors of AsiaRange.

- Prohibited commerce outdoors the KZ time: This mode is principally used to set the time interval for buying and selling, with out buying and selling outdoors the interval.

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

- Imply threshold Worth: Use the center worth of Killzone because the open worth.

-

—Killzone Start Hour: Beginning hour of the kill zone

-

—Killzone Start Minute: Beginning minute of the kill zone

-

—Killzone Finish Hour: Ending hour of the kill zone

-

—Killzone Finish Minute: Ending minute of the kill zone

-

—Killzone Label Textual content: This parameter specifies the KZ label textual content that will let straightforward to view on the chart.

-

—Killzone Present Final: This parameter is about to show the utmost variety of KZ rectangles on the chart.

-

—Killzone Present Predict: This parameter is about to show the anticipated Stage on the chart.

-

Sign Inverting:

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- KZ ZONE Excessive/Low: Use the excessive and low factors of the KZ area as cease loss for orders.

———–Market Construction Sign Parameter settings———–

-

Flip On/Off MarketStructure Sign as filter On Present Interval: The precept is similar as above.

-

Sign Bull/Bear Sample Utilization:

- MS fashioned: CHOCH(MSS) and BOS fashioned sign.

- CHOCH fashioned: CHOCH(MSS) fashioned sign.

- BOS fashioned: BOS fashioned sign.

- Commerce at Market Worth: When there’s a bullish or bearish sign, instantly enter on the market worth.

- Imply threshold Worth: Center worth of MS construction

- MS High/Backside Worth: The excessive and low factors of MS construction

-

—MS Construction Algo: MS algorithm choose.

-

—MS Construction Break Kind: Break Kind for MS.

-

—MS Construction Size(Depth): Depth for indicator to research market construction.

-

Sign Inverting:

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- Market Construction Excessive/Low

———–NWOG/NDOG Sign Parameter settings———–

- NWOG fashioned and CloseP above/under NWOG

- Worth callback to NWOG area

- NDOG fashioned and CloseP above/under NDOG

- Worth callback to NDOG area

- Commerce at Market Worth

- Meanthreshold Worth

- Not Set

- NWOG/NDOG Block Excessive/Low

———–OrderBlock Sign Parameter settings———–

- OB/iOB fashioned: Swing OrderBlocks and Inner OrderBlocks fashioned indicators.

- OB/iOB touched: Swing OrderBlocks and Inner OrderBlocks touched indicators.

- OB/iOB break: Swing OrderBlocks and Inner OrderBlocks break indicators.

- OB fashioned

- iOB fashioned

- OB touched

- iOB fashioned

- OB break

- iOB break

- Commerce at Market Worth

- Meanthreshold Worth: Meanthreshold Worth of the Order Block

- OB High/Btm Worth: High or Backside Worth of the Order Block

-

—OB iStructure Algo: Inner MS algorithm choose.

-

—OB iStructure Break Kind: Break Kind for inner MS.

-

—OB iStructure Size: Depth for indicator to research inner market construction.

-

—OB sStructure Algo: Swing MS algorithm choose.

-

—OB sStructure Break Kind: Break Kind for swing MS.

-

—OB sStructure Size: Depth for indicator to research swing market construction.

-

Sign Inverting:

-

Choose SL Kind Offered by the Sign: If the SL TYPE is about to “SL Offered by Entry Sign” within the normal settings part, then the SL Kind set right here will probably be used for the order.

- Not Set

- OB Block Excessive/Low