Bored with spending hours on tedious admin and accounting duties? You’re not alone. Many companies battle to maintain up with the limitless paperwork, information entry, and handbook processes that decelerate operations. The excellent news is that there’s a strategy to break away from these time-consuming duties. With the suitable instruments, you’ll be able to automate and streamline every little thing from bookkeeping to payroll, making your enterprise run smoother and extra effectively.

On this article, we’ve compiled a listing of 10 admin and accounting instruments that can remodel the best way you run your enterprise. Whether or not you’re a startup seeking to get organised or a longtime firm aiming to optimise your processes, these instruments are designed to spice up your effectivity and maintain you centered on development. Let’s take a better take a look at how these platforms can energy up your operations.

1. Docyt: AI-powered doc administration and bookkeeping

Docyt is an AI-driven platform that automates bookkeeping and doc administration by integrating along with your accounting software program. It permits companies to scan, organise, and handle receipts, invoices, and different monetary paperwork, decreasing the necessity for handbook information entry. By automating duties akin to expense administration, income reconciliation, and month-end closing, Docyt offers real-time monetary insights. The platform’s customisable reporting and multi-entity accounting capabilities allow companies to streamline operations and deal with development.

Pricing:

- Impression: $299/month – Contains AI-driven bookkeeping, expense and income administration, and real-time reporting for small companies.

- Superior: $499/month – Provides help for as much as 3 income techniques and 100 payments per 30 days, with department-level P&L reporting.

- Superior Plus: $799/month – Gives superior options akin to income deposit monitoring, help for 150 payments/month, and line merchandise information extraction.

- Enterprise: $999+/month – Customized pricing for companies needing extra licenses, a number of income techniques, or superior reporting choices.

2. Factorial: All-in-one HR administration resolution

Factorial is an HR platform designed to streamline human assets duties, from payroll and advantages administration to worker time monitoring and efficiency critiques. Tailor-made for small and medium-sized companies, Factorial affords instruments for managing worker information, monitoring break day, and automating payroll processes. With built-in compliance options and an intuitive interface, it helps HR groups deal with strategic duties moderately than handbook administrative work.

Pricing:

- Free Plan: Obtainable for small groups with primary HR administration wants.

- Enterprise Plan: €4 per worker per 30 days, consists of superior options like time monitoring and doc administration.

- Enterprise Plan: Customized pricing for bigger companies that want extra help and tailor-made options.

3. Gusto: All-in-one payroll and advantages platform

Gusto is an all-in-one HR platform that helps companies handle and simplify payroll, advantages, and HR wants effectively. It affords full-service payroll, together with automated tax submitting and compliance instruments, in addition to worker advantages like medical health insurance and retirement plans. Gusto additionally offers instruments for hiring, onboarding, time monitoring, and expertise administration to reinforce productiveness and worker engagement. With over 300,000 companies utilizing the platform, Gusto streamlines HR processes for corporations of all sizes.

Pricing:

- Easy: $40/month base + $6 per worker – Contains single-state payroll, automated tax filings, worker profiles, and primary accounting integrations.

- Plus: $60/month base + $9 per worker – Gives multi-state payroll, next-day direct deposit, superior accounting options like time monitoring and challenge monitoring, and expense administration.

- Premium: $135/month base + $16.50 per worker – Provides precedence help, devoted success managers, and superior compliance options, excellent for companies needing deeper accounting insights and sophisticated payroll wants.

- Contractor Solely: $35/month base + $6 per contractor – Preferrred for contractor-only companies, offering contractor funds and 1099 filings.

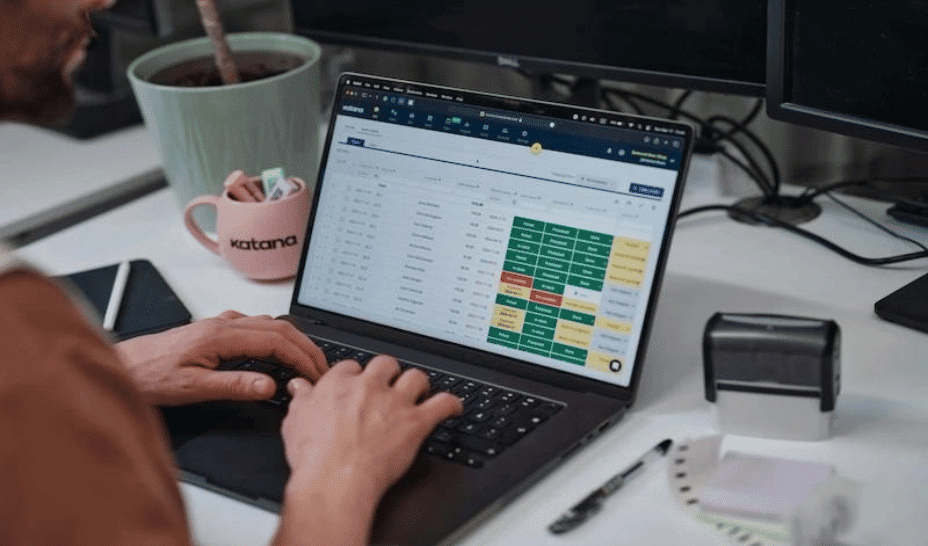

4. Katana Cloud Stock: Manufacturing and stock administration with built-in accounting

Katana is an all-in-one manufacturing and stock administration platform designed to assist companies handle their manufacturing, stock, and order fulfilment processes. The platform caters to small companies and enormous producers, providing real-time insights into inventory ranges, manufacturing schedules, and order administration. With its integrations to fashionable accounting techniques like Xero and QuickBooks, Katana ensures that stock information is all the time aligned with monetary data for environment friendly operations.

Pricing:

- Starter: $179/month billed yearly or $199/month billed month-to-month – Preferrred for small companies needing a scalable resolution with important stock administration options. Contains 1 stock location, limitless customers, integrations, and SKUs.

- Normal: $359/month billed yearly or $399/month billed month-to-month – For rising companies with superior stock wants, together with 3 stock areas, barcode scanning, multicurrency help, customized person permissions, and superior insights.

- Skilled: $799/month billed yearly or $899/month billed month-to-month – Designed for established corporations requiring complicated workflows, full traceability, planning and forecasting, API entry, and warehouse administration with help for as much as 10 stock areas.

5. Melio: Simplified funds for small companies

Melio is a cost resolution that streamlines invoice funds for small companies. The platform permits corporations to pay distributors and contractors by way of financial institution switch (ACH), checks, or bank card, even when the seller doesn’t settle for card funds. Melio integrates with accounting software program like QuickBooks, making certain seamless invoice administration and cost reconciliation. Its user-friendly interface permits companies to handle their funds from one dashboard, decreasing the trouble of handbook funds.

Pricing:

- Go: Free – 5 free ACH transfers/month, 10 QuickBooks/Xero syncs, restricted to at least one person.

- Core: $25/month – 20 free ACH transfers, limitless 2-way QuickBooks/Xero sync, batch funds, and person administration.

- Enhance: $55/month – 50 free ACH transfers, 2-day ACH supply, superior workflows, and premium help.

6. Navan: Handle journey bills and company spending

Navan, previously generally known as TripActions, is an all-in-one platform that streamlines enterprise journey and expense administration. Providing full visibility and management over worker spending, Navan helps corporations handle their funds in real-time. It automates expense monitoring, enhances price range management, and simplifies journey administration—all from one intuitive platform.

Pricing:

Customized pricing based mostly on enterprise wants.

7. Shoeboxed: Expense monitoring and receipt organisation

Shoeboxed simplifies expense administration by permitting customers to digitise and organise paper receipts by means of its automated information extraction and human verification expertise. Whether or not you’re a small enterprise proprietor, freelancer, or accountant, Shoeboxed helps you effectively monitor bills, put together for tax season, and keep organised.

Pricing:

- Startup: $18/month (600 digital and 300 bodily scans/12 months)

- Skilled: $36/month (1,800 digital and bodily scans/12 months)

- Enterprise: $54/month (3,600 digital and bodily scans/12 months)

8. Synder: Automated accounting for e-commerce companies

Synder is an accounting automation instrument designed for small and mid-sized companies, notably these within the e-commerce and SaaS sectors. It helps corporations sync transactions from a number of gross sales channels into accounting platforms like QuickBooks, Xero, and Sage Intacct. This streamlines bookkeeping duties akin to income recognition and transaction reconciliation, making certain accuracy and saving time. Synder helps over 30 integrations, permitting companies to handle their monetary information throughout platforms like Shopify, Stripe, and WooCommerce.

Pricing:

- Medium: $52/month (as much as 500 transactions/month)

- Scale: From $92/month (1K – 5K transactions/month)

- Massive: From $220/month (10K – 50K transactions/month)

- Enterprise: Customized pricing for companies with 50K+ transactions/month

9. Treasury Software program: Streamlined treasury administration and ACH funds

Treasury offers sturdy instruments for companies to automate the creation and transmission of ACH information, reconcile financial institution accounts, and streamline cost processes. Designed for corporations of all sizes, it simplifies duties akin to producing ACH information for vendor funds, worker direct deposits, and buyer collections it additionally consists of fraud prevention instruments akin to constructive pay, which helps be sure that solely authorised checks are processed by the financial institution. With built-in options for managing recurring funds, reversing transactions, and dealing with worldwide transfers

Pricing:

- Normal: $39.95/month (single person) or $79.95/month (multi-user) – Contains primary ACH file creation, NACHA compliance, and integration with QuickBooks and Excel.

- Company: $59.95/month (single person) or $99.95/month (multi-user) – Provides options akin to e-mail notifications for transactions, help for extra ACH codecs, and ACH file parsing utilities.

- Superior: $109.95/month (single person) or $149.95/month (multi-user) – Offers all Company options plus help for worldwide ACH transactions, a number of origination accounts, tax cost codecs, and EDI engine for company commerce exchanges.

10. Xero: Cloud-based accounting for companies of all sizes

Xero is an intuitive accounting platform designed to assist small companies, accountants, and bookkeepers handle their funds effectively. It affords important instruments for invoicing, expense monitoring, invoice funds, and money circulation administration, with the flexibleness to combine with varied apps as your enterprise grows. Xero’s user-friendly interface simplifies on a regular basis accounting duties, making it an incredible resolution for companies of all sizes.

Pricing:

All plans embrace 24/7 on-line help, safe information storage, and the choice so as to add extra options like expense monitoring, challenge administration, and superior analytics at an additional value.

- Starter: $29/month – Preferrred for small companies with primary accounting wants, together with sending quotes and 20 invoices, coming into 5 payments, and financial institution transaction reconciliation.

- Normal: $46/month – Suited to rising companies, providing all Starter options with elevated transaction limits.

- Premium: $62/month – Designed for companies with superior wants, together with help for a number of currencies and extra complicated workflows.

By the best way: When you’re a company or investor on the lookout for thrilling startups in a selected marketplace for a possible funding or acquisition, take a look at our Startup Sourcing Service!