The Bitcoin mid-September rally has slowed down main as much as the tip of the month. Though it ended September at a inexperienced month-to-month candle shut, the cryptocurrency has fallen beneath the psychological $65,000 worth mark once more, with the concern and greed index getting back from greed to impartial sentiment. This appears to have triggered some second-guessing amongst Bitcoin buyers. Nonetheless, CryptoQuant CEO Ki Younger Ju will not be entertaining any such thought.

In keeping with Ki Younger Ju, Bitcoin continues to be in the midst of a bull cycle. That is constructive information for Bitcoin buyers, because the crypto business is now transitioning right into a traditionally bullish fourth quarter of the 12 months.

Bitcoin Bull Market Not Over

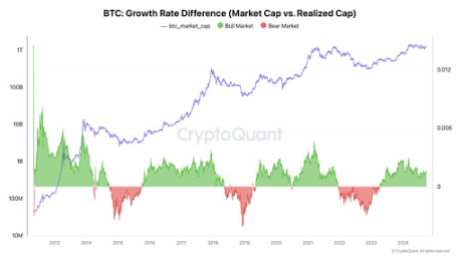

CryptoQuant CEO Ki Younger Ju is a part of fervent Bitcoin investors who stay unfazed by the current worth fluctuations. Nonetheless, his stance isn’t simply primarily based on speculations however is backed by technical worth knowledge and evaluation. Ki Younger Ju attracts his bullish outlook on the Bitcoin development price distinction, which presents an fascinating outlook on the cryptocurrency. Basically, the Bitcoin development price distinction compares the market cap of Bitcoin to its realized cap in an effort to gauge its bullish or bearish energy.

Associated Studying

The market cap of a cryptocurrency is the whole worth of all cash in circulation, calculated by multiplying the present worth by the whole provide. In distinction, the realized cap takes under consideration the precise worth paid for every BTC in circulation primarily based on the worth at which every coin final moved. A better market cap development price suggests the spot worth of the typical coin has elevated in comparison with the final it was moved.

In keeping with a Bitcoin technical chart he shared on social media platform X, Ki Younger Ju famous that Bitcoin’s market cap continues to be rising sooner than its realized cap, which continues to level to a bull cycle. Notably, the analyst has talked about in an earlier evaluation of the expansion price distinction that this development, which began in late 2023, sometimes lasts for a median of two years.

What Does This Imply For BTC?

Going by previous bull cycle developments, which Ki Younger Ju famous sometimes lasts for about two years, Bitcoin is predicted to proceed in a bull cycle for at the least greater than a 12 months going ahead. Moreover, present fundamentals level to regular development for Bitcoin as inflows proceed to pour in from institutional buyers.

Associated Studying

Talking of institutional buyers, Spot Bitcoin ETFs, which ended final week with the most important influx ($494.27 million) since July 22, have begun the brand new week on a constructive be aware. Notably, they registered $61.3 million in internet inflows yesterday, which is a signal of fine issues to return. Institutional involvement, particularly by means of autos like Spot Bitcoin ETFs, is an important issue in BTC’s sustained worth development.

On the time of writing, Bitcoin is buying and selling at $64,080.

Featured picture created with Dall.E, chart from Tradingview.com