Precision Buying and selling: Introducing Our MT5 Indicators for Optimum Market Insights

Precision Buying and selling: Introducing Our MT5 Indicators for Optimum Market Insights

We have now set a premium value for our MT5 indicators, reflecting over two years of improvement, rigorous backtesting, and diligent bug fixing to make sure optimum performance. Our confidence within the precision and accuracy of our indicators is such that we recurrently showcase them in real-time market circumstances via each day content material on our social media channels.

Our perception in buying and selling simplicity, adhering to the precept of shopping for low and promoting excessive (or vice versa), is echoed in our indicators’ clear show of potential entry and exit factors. We constantly present each day content material demonstrating our indicators in motion. Moreover, we provide merchants the chance to hire our indicators for $66 per 30 days. This enables merchants to check the indicator for one month with their chosen buying and selling pair earlier than committing to a yearly subscription.

We’re dedicated to monitoring person suggestions intently and making mandatory enhancements to our indicators ought to any bugs come up, guaranteeing that merchants have entry to the best instruments for his or her buying and selling endeavours.

Liquidity Finder – CLICK HERE TO BUY

Compatibility:

Liquidity Finder works with all monetary devices forex pairs, indicies, commodities and cryptocurrencies

The Liquidity Finder pin factors liquidity zones in any monetary instrument, together with forex pairs, cryptocurrencies, commodities and indices. The Liquidity finder reveals earlier and present liquidity zones, down to the current minute, offering important details about your chosen buying and selling pair, when conducting chart evaluation or initiating trades.

The Liquidity Finder permits you to observe the place value consolidates, retraces, resists, or settles inside assist areas. It pinpoints areas the place market contributors are more likely to react to cost actions, offering real-time insights into market dynamics. Moreover, the Liquidity Finder provides a visible illustration as the value approaches potential liquidity zones, enabling customers to make fast and knowledgeable choices.

Certainly one of its standout options is its potential to establish bullish and bearish momentum. The colour-coded value ranges change dynamically in real-time, visually indicating bullish or bearish momentum, in addition to when a value stage is impartial.

The Liquidity Finder shops the whole day’s exercise as a CSV file inside an inside folder on MT5, making historic knowledge simply accessible for future evaluation. Please check with our connected YouTube video for priceless insights into the performance and detailed breakdown of how the Liquidity Finder presents important info, aiding merchants view charts with readability.

What’s liquidity?

Liquidity refers to when traders are actively shopping for or promoting at a specific value stage, inflicting the value to stay comparatively steady over a sure interval. Excessive liquidity signifies a considerable presence of each consumers and sellers actively collaborating in forex buying and selling, leading to slim bid-ask spreads and steady market costs. Quite the opposite, low liquidity could result in broader spreads and heightened value volatility as a consequence of a lowered variety of market contributors.

Key Options

- Assessment value motion for the present week, final week and final month.

- Monitor value motion for the whole month down to the current second.

- Areas of liquidity are represented by a better numerical worth.

- Shows distribution of costs throughout totally different ranges to establish areas of concentrated buying and selling exercise.

- View dynamic value motion from M5 timeframe to H4.

- All tally’s replace on the shut of the candle inside their respective time frames.

- Dynamic highlighting system signifies the present value place relative to corresponding value ranges.

- Dynamic highlighting system additionally signifies when the value is approaching a liquidity zone.

- Rapidly visualize bullish or bearish momentum at totally different value ranges from market open, via color illustration of numerical values.

- Possibility to decide on which tally knowledge to show or conceal, whereas buying and selling or conducting chart evaluation.

- Choice to reposition the Liquidity Finder to both the left or proper facet of the chart.

- Save each day buying and selling exercise in a CSV file for future reference or chart evaluation.

- Affords an intuitive interface for straightforward interpretation and evaluation of incoming knowledge.

- Visible illustration of value motion akin to spikes, divergences or tendencies.

- Can be utilized at the side of different technical indicators for complete market evaluation.

- Permits customers to research historic value motion to establish previous areas of liquidity and tendencies for chart evaluation.

- Permits customers to personalize settings akin to font color, session choice, and time intervals.

Numeric Worth Color Indication

- Blue Numerical Values – Bullish Momentum: Signifies a surplus of consumers and lack of sellers, pushing the value up from the corresponding value stage

- Purple Numerical Values – Bearish Momentum: Signifies a surplus of sellers and lack of consumers, pushing the value down from the corresponding value stage

- Black Numerics – Impartial Momentum: Signifies an equal quantity of consumers and sellers at the corresponding value stage

Be aware: Any buying and selling determination made needs to be primarily based on unbiased evaluation and an intensive understanding of fundamentals, quite than solely counting on tally counts or the color of numerical values.

Tally Time-Frames

- Tally M5: A better numeric worth signifies better liquidity at a particular value stage, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver via this stage simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value stage. This info sometimes updates on the shut of every 5-minute candle.

- Tally M15: A better numeric worth signifies better liquidity at a particular value stage, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver via this stage simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value stage. This info sometimes updates on the shut of every 15-minute candle.

- Tally M30: A better numeric worth signifies better liquidity at a particular value stage, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver via this stage simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value stage. This info sometimes updates on the shut of every 30-minute candle.

- Tally H1: A better numeric worth signifies better liquidity at a particular value stage, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver via this stage simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value stage. This info sometimes updates on the shut of every 1-hour candle.

- Tally H4: A better numeric worth signifies better liquidity at a particular value stage, whereas a decrease numeric worth suggests restricted or no liquidity, permitting the value to maneuver via this stage simply with out encountering vital resistance from consumers or sellers. The color of the numerical worth signifies the variety of consumers or sellers current at that value stage. This info sometimes updates on the shut of every 4-hour candle.

Extras

- Save CSV: Save total day’s exercise as a CSV file inside an inside folder on MT5

*The connected GIF file showcases a 2.5-hour video of the Liquidity Finder in motion, condensed into a couple of seconds.

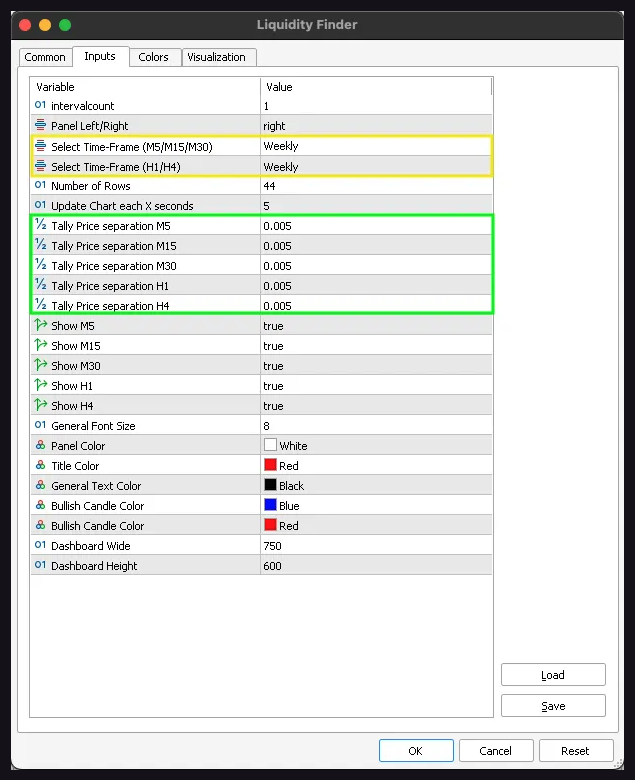

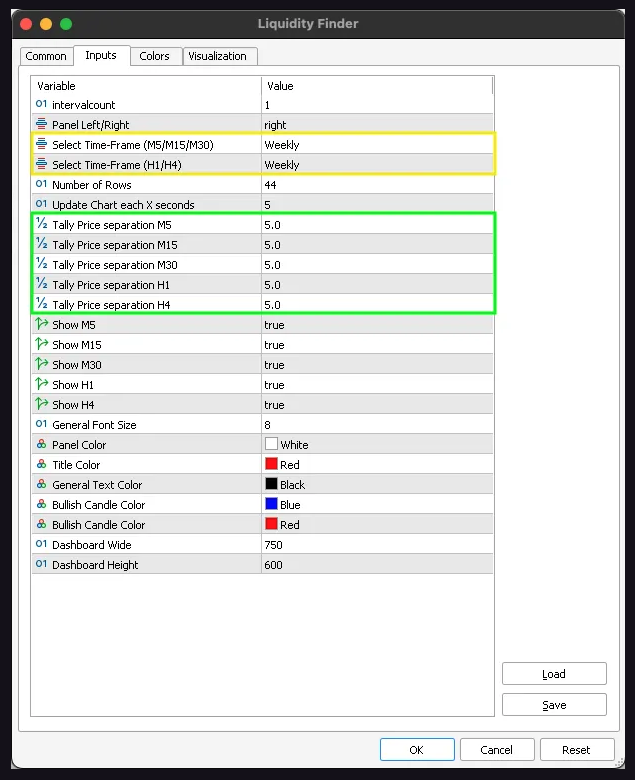

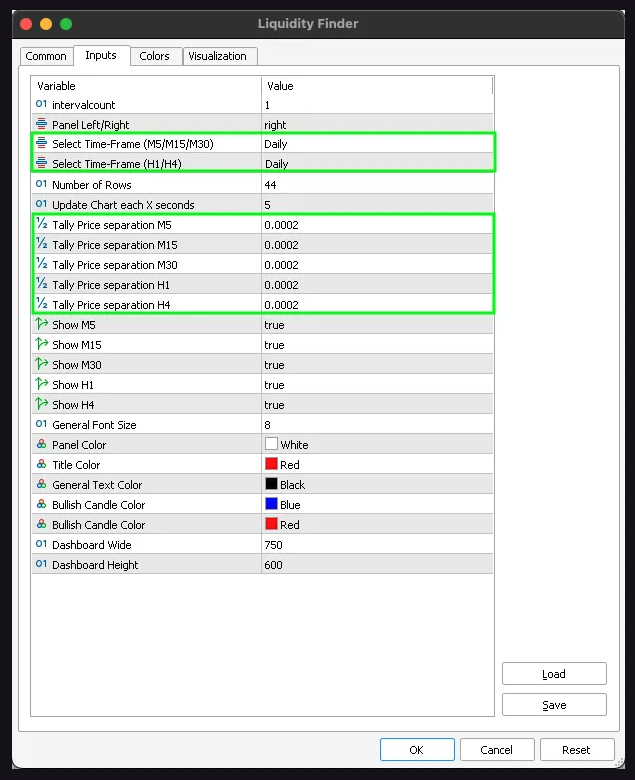

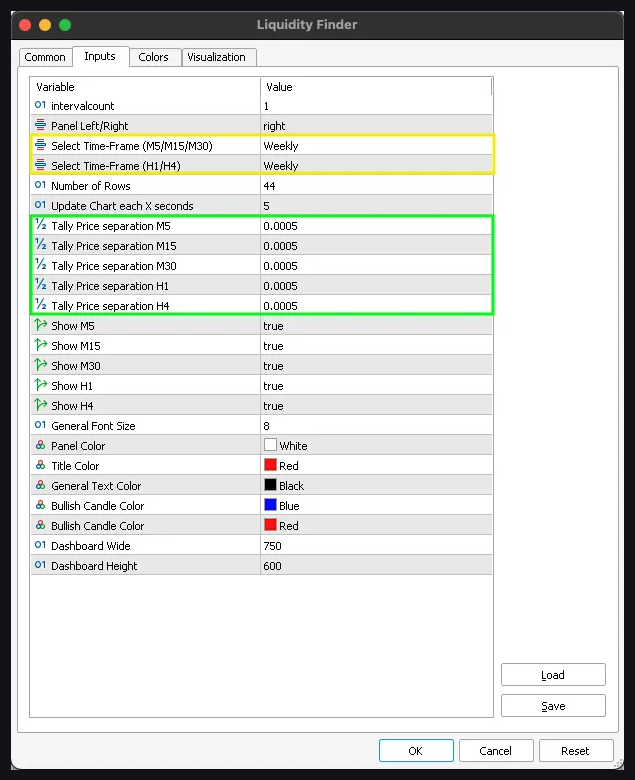

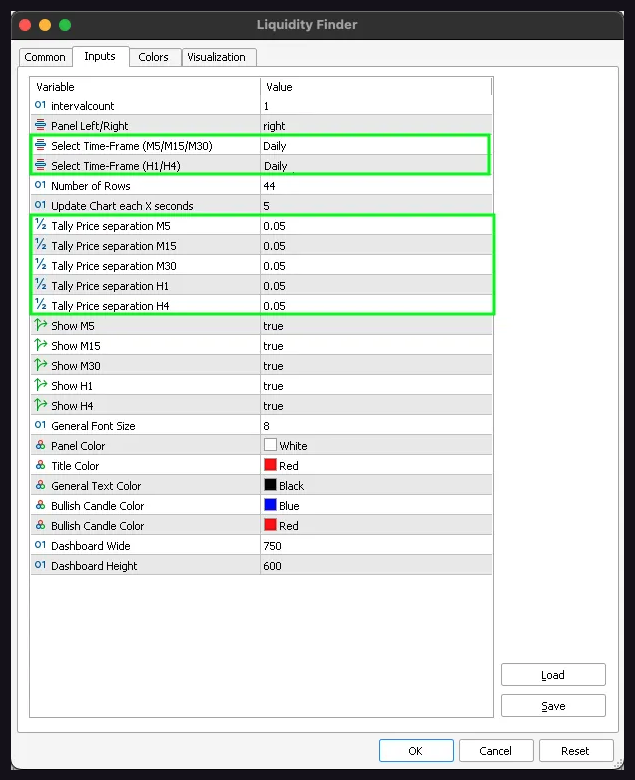

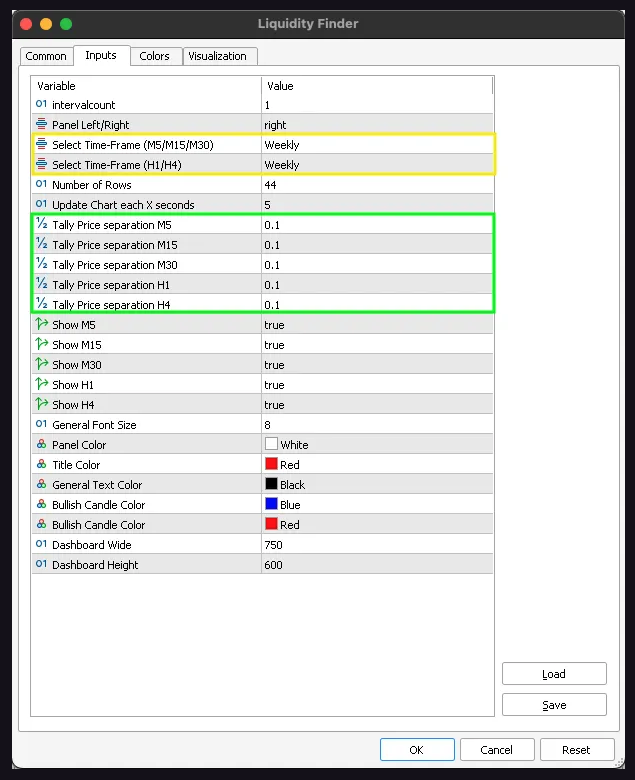

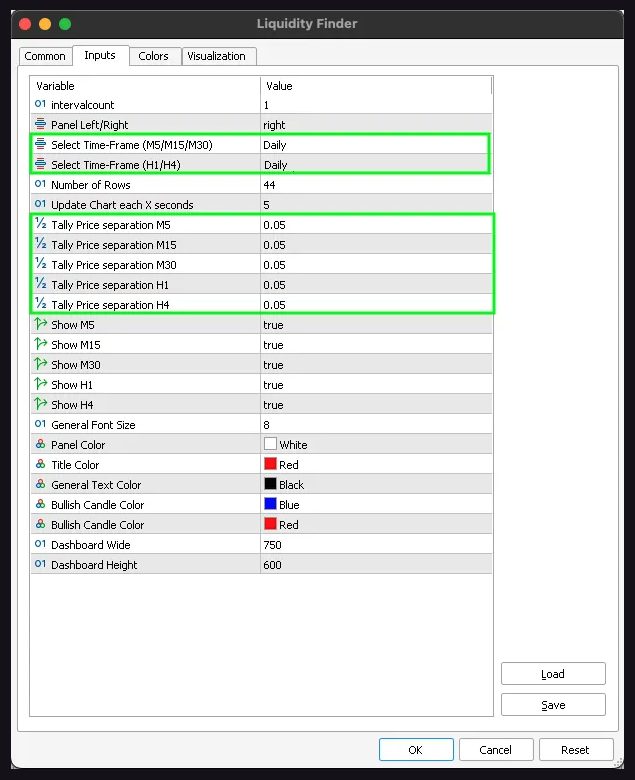

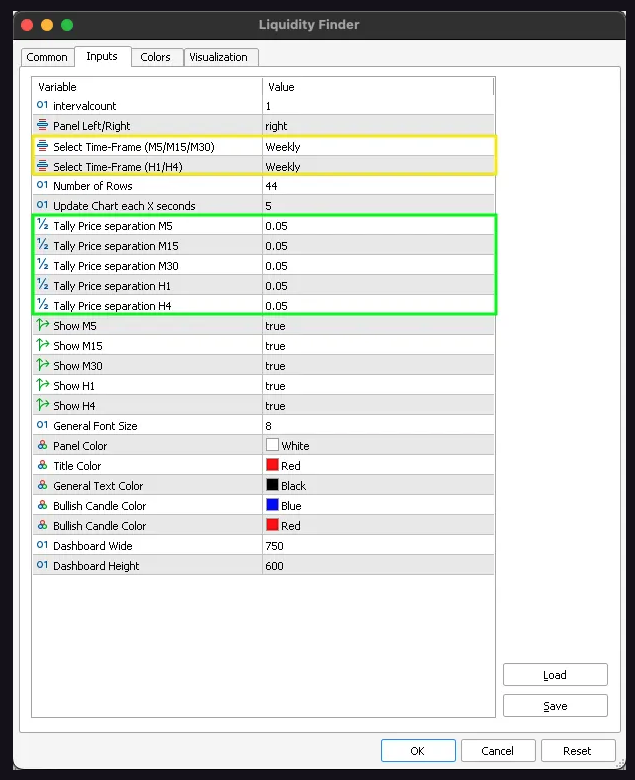

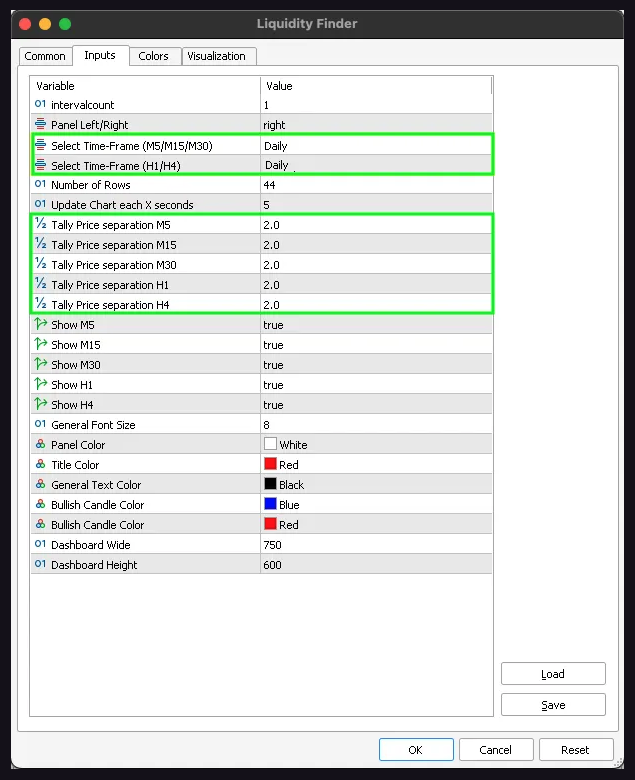

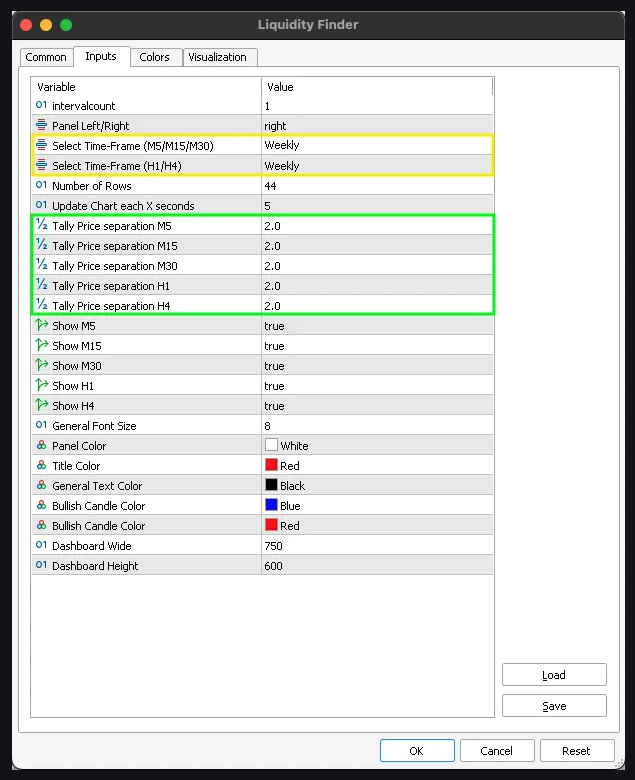

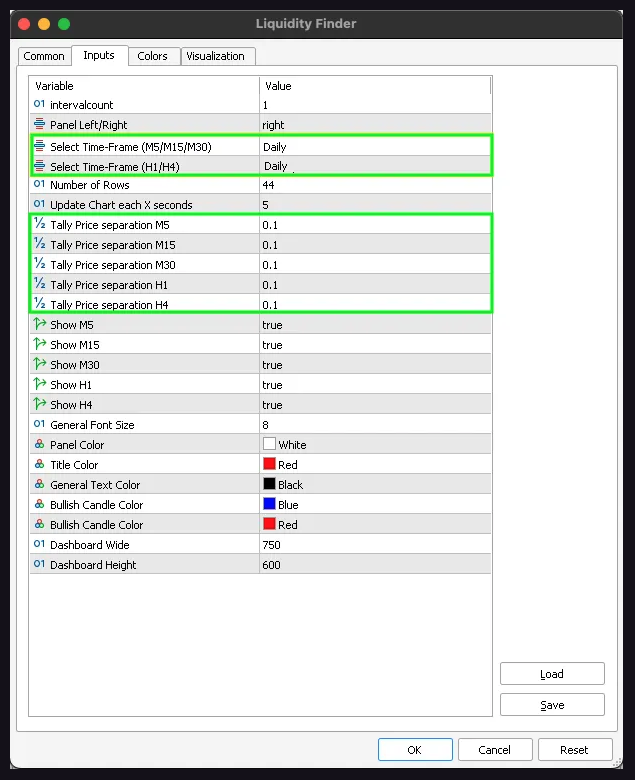

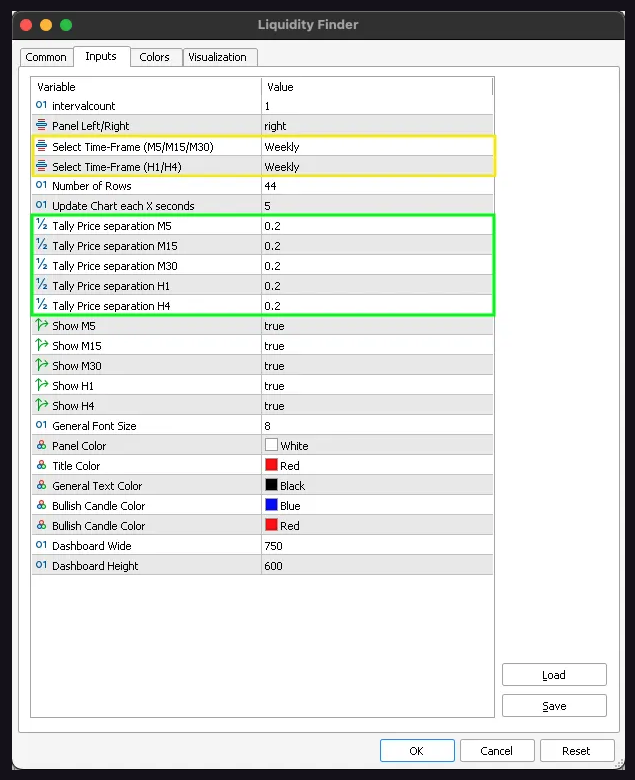

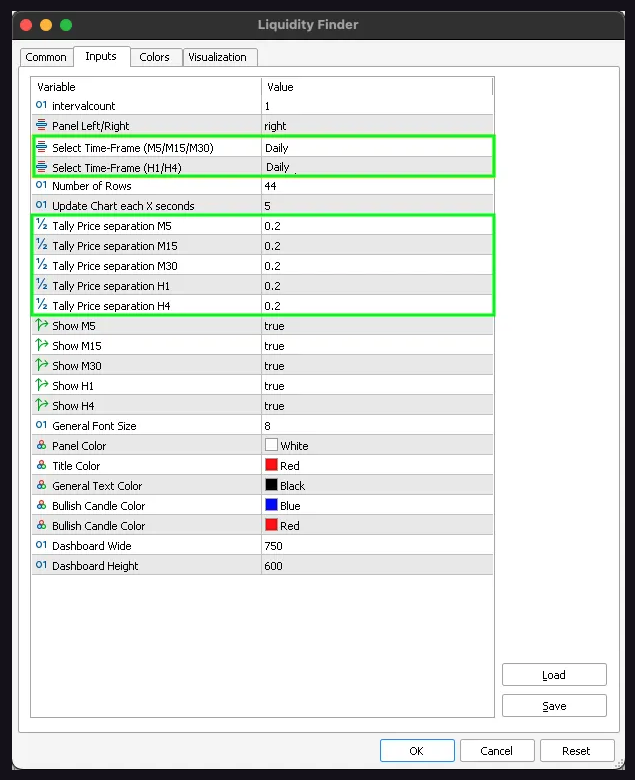

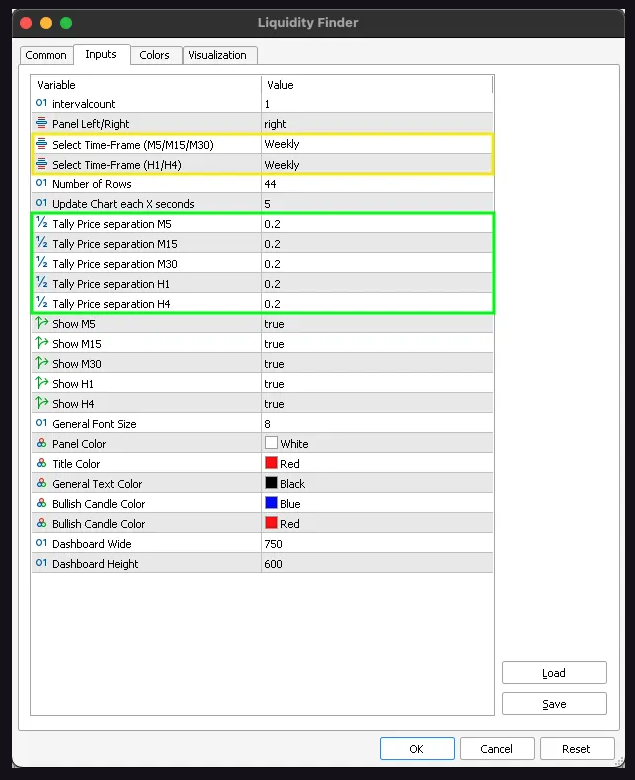

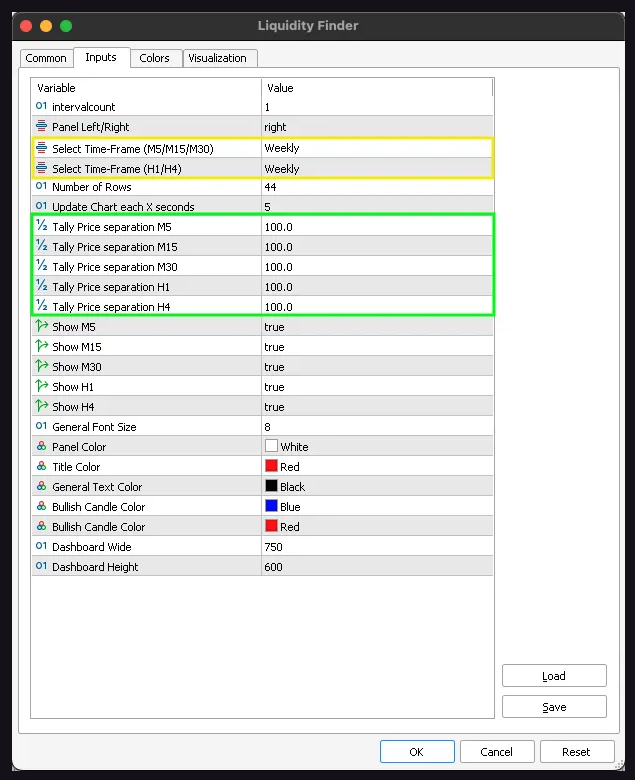

Liquidity Finder Settings

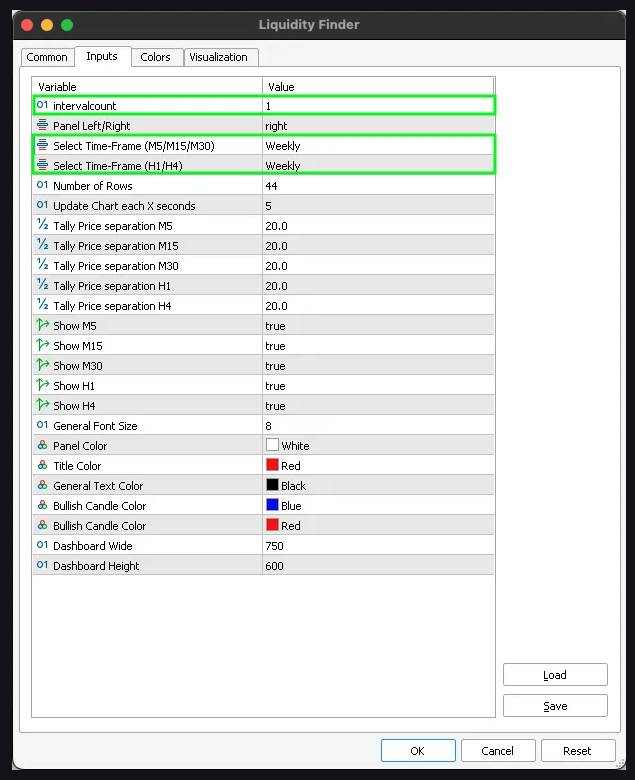

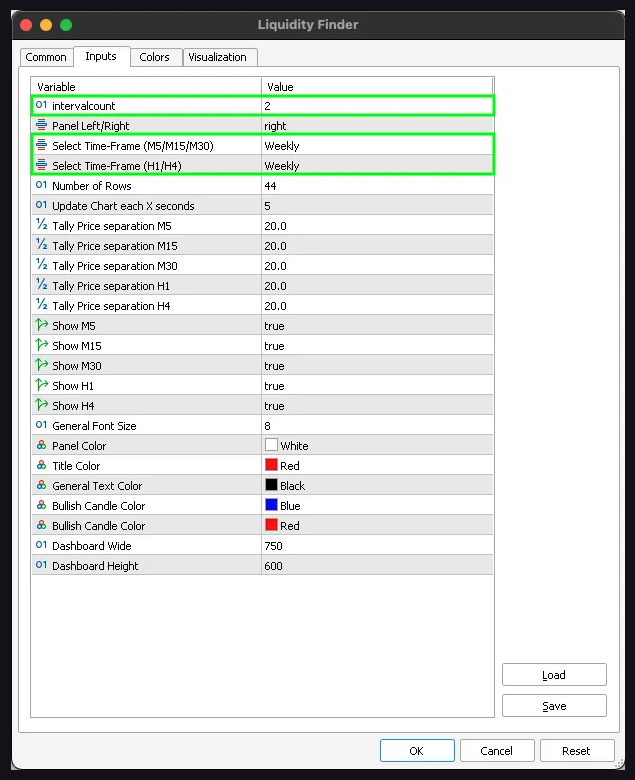

Interval rely: Specify the variety of intervals you want to view, which is dependent upon the chosen Time-Body, Instance: 1 day, 2 days, 3 days, 1 week, 2 week, and so on.

Panel left/proper: You’ll be able to select to place the indicator both to the left or proper facet of the chart.

Replace chart every X seconds: The default setting for chart updates is configured to refresh each 5 seconds. This interval dictates how incessantly the dashboard reveals new knowledge. You’ll be able to select to lower the replace interval to 1 second for real-time updates.

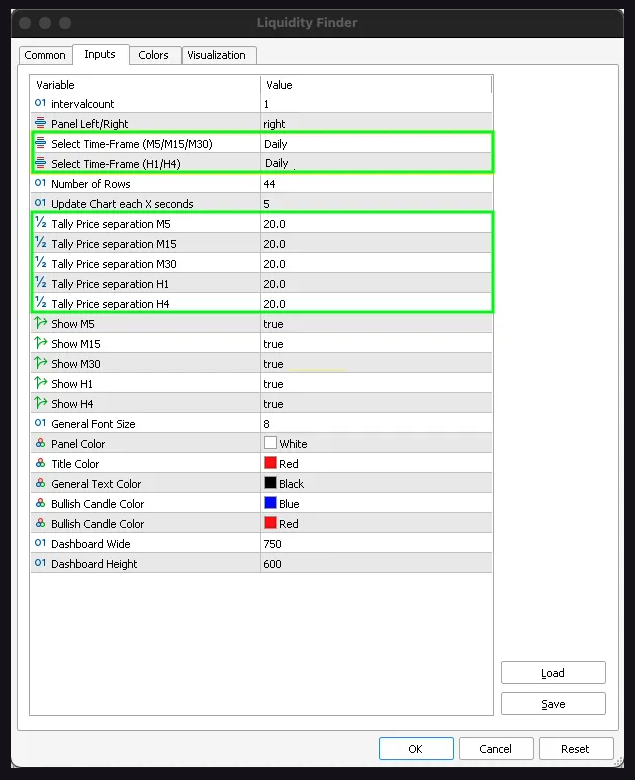

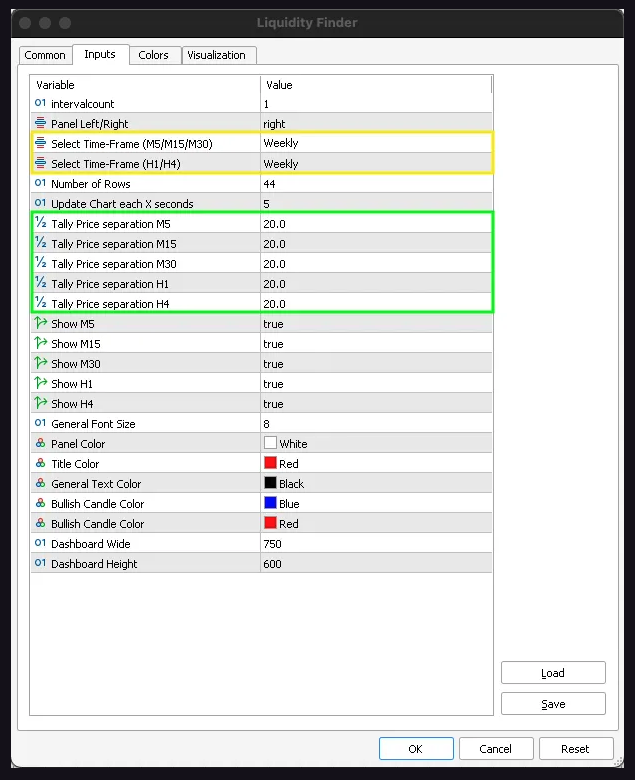

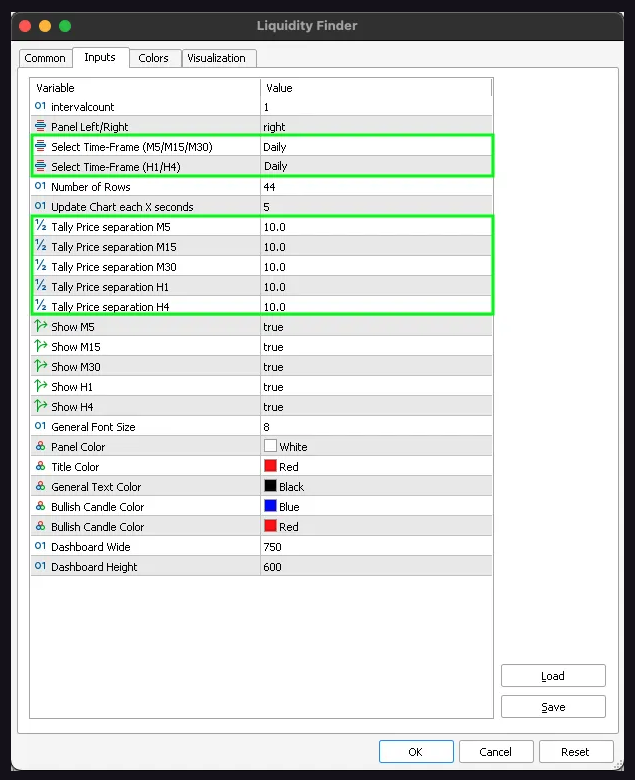

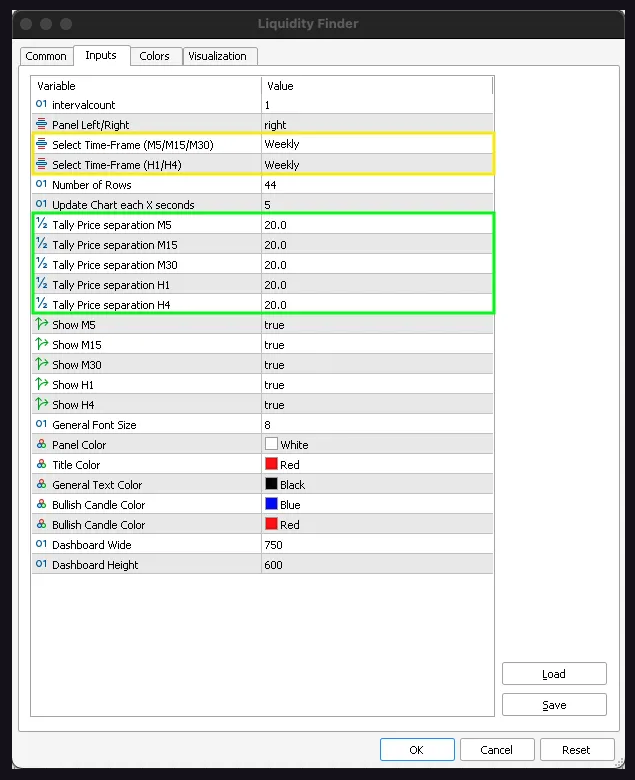

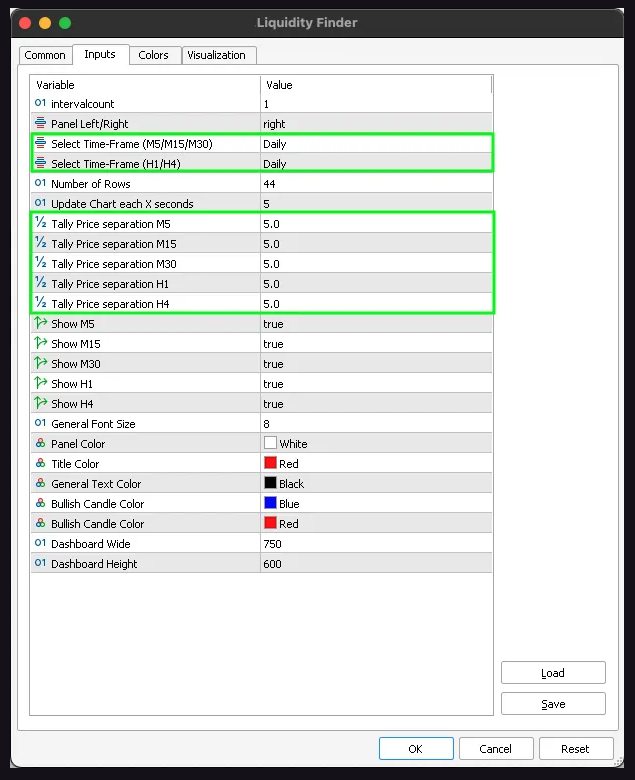

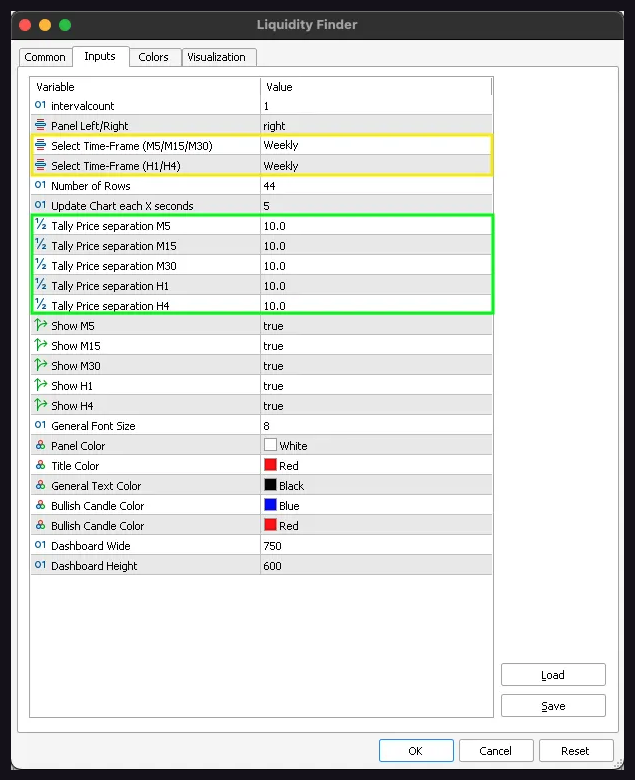

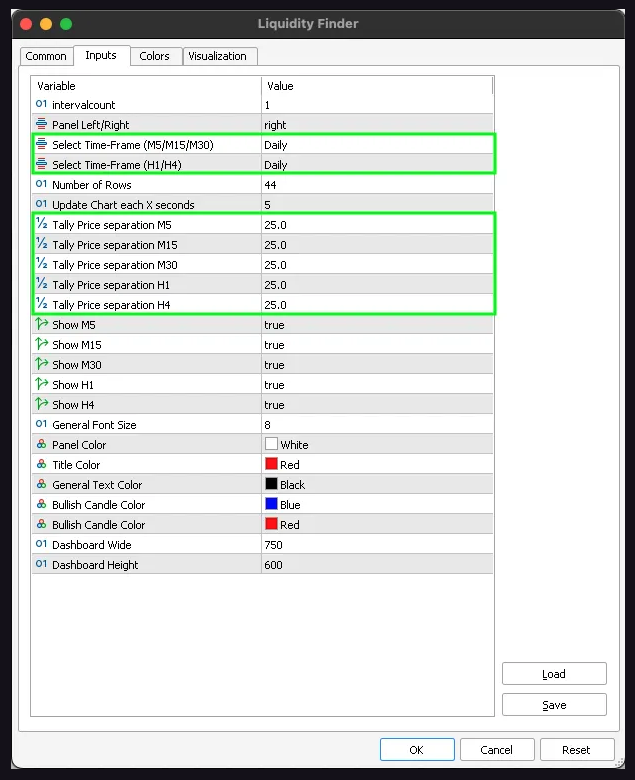

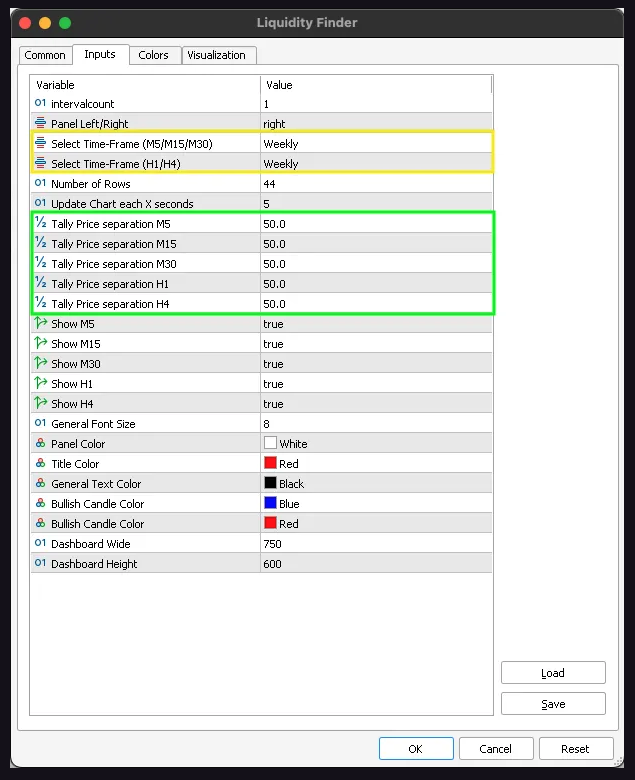

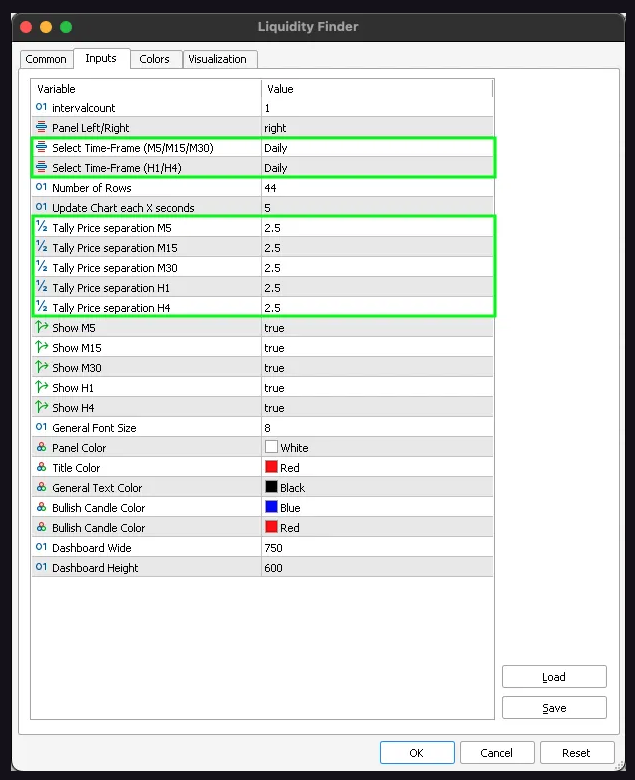

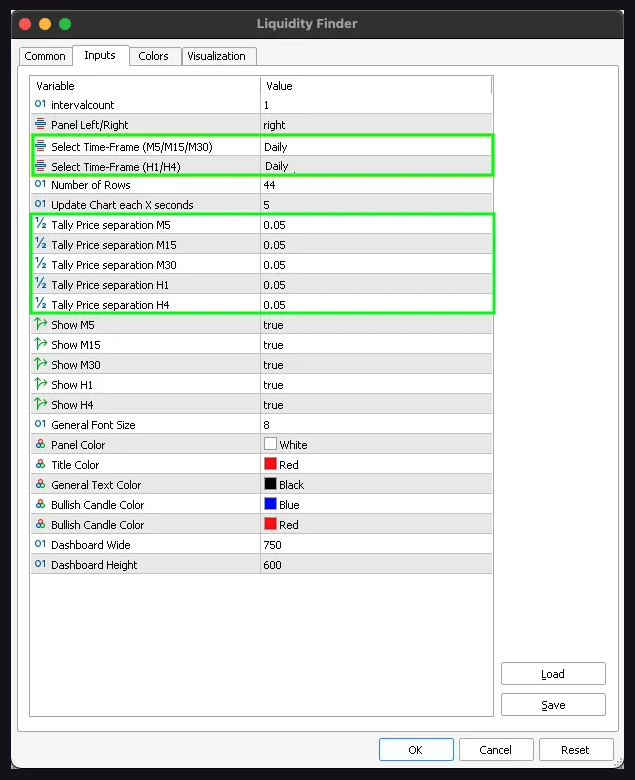

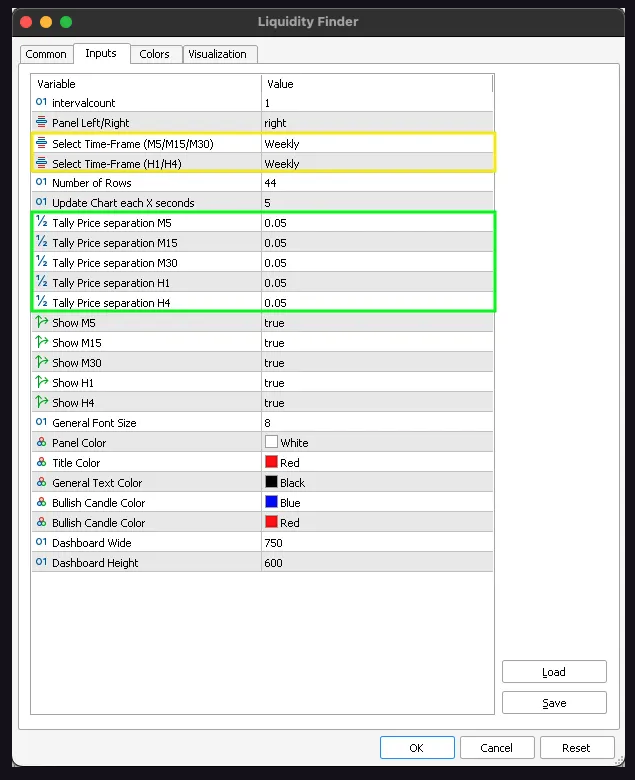

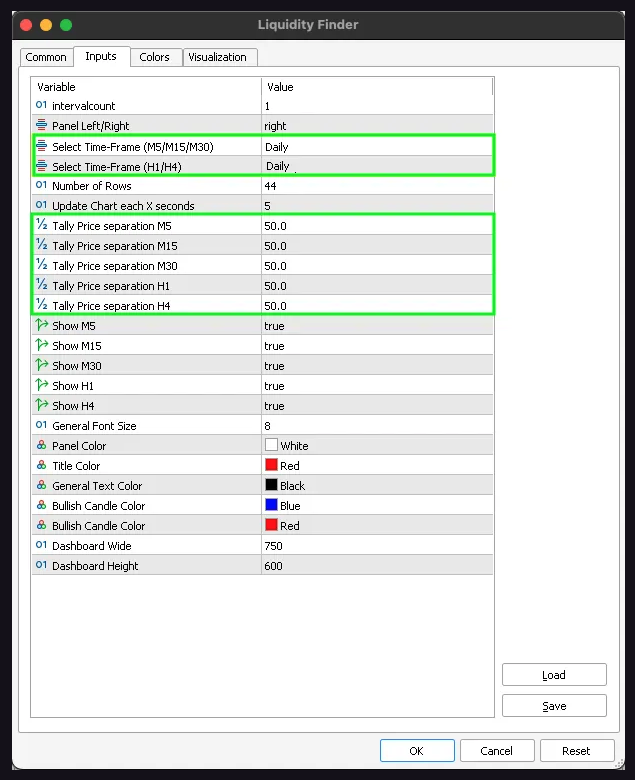

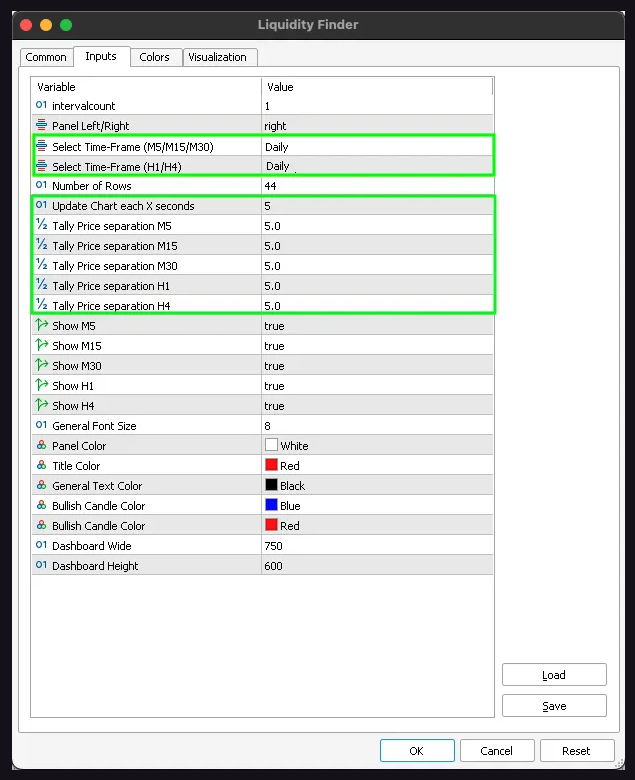

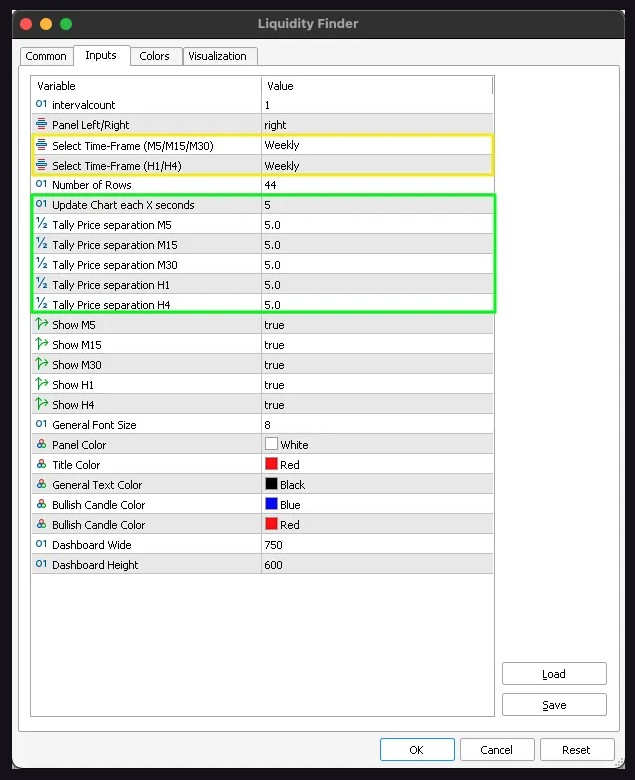

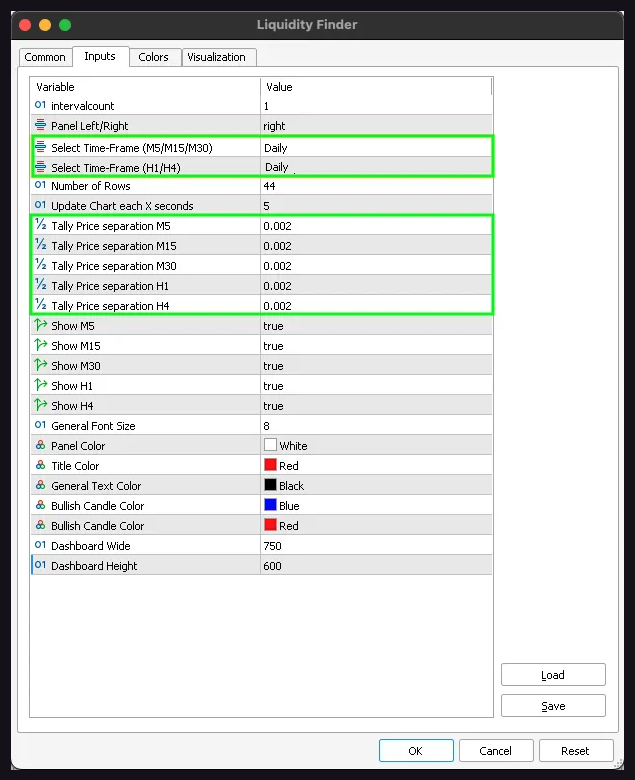

Tally value separation – M5, M15, M30, H1 & H4: These parameter represents the space between costs, indicating the value ranges with the best liquidity. We have now performed again testing on nearly all of buying and selling pairs, and beneath are the advisable settings for optimum outcomes throughout most pairs.

Present – M5, M15, M30, H1 & H4: You may have the choice to decide on which period body you wish to show whereas buying and selling or conducting chart evaluation. Setting it to “true” will present the chosen timeframe, whereas setting it to “false” will disguise the chosen timeframe.

Dashboard extensive: You may have the choice to change the width of the liquidity finder, if you happen to discover the default setting obstructs visible illustration of the market knowledge. Rising the width from 750 to 800 typically resolves the problem.

Dashboard top: You may have the choice to change the peak of the liquidity finder, if you happen to discover the default setting obstructs visible illustration of the market knowledge. Rising the peak from 600 to 800 typically resolves the problem.

Different settings: You’ll be able to hold the remaining settings as default, they won’t have an effect on the indicator’s efficiency or visible illustration of the market knowledge.

Chart Evaluation: Conduct weekly chart evaluation by adjusting the time frames of M5, M15, M30, H1, and H4 to show weekly knowledge, with the interval rely set to 1. This can assist establish areas of assist, resistance, and liquidity for the current week.

Chart Evaluation: It’s also possible to alter the time frames of M5, M15, M30, H1, and H4 to show weekly knowledge, with the interval rely set to 2. This can assist establish areas of assist, resistance, and liquidity for the current & earlier week.

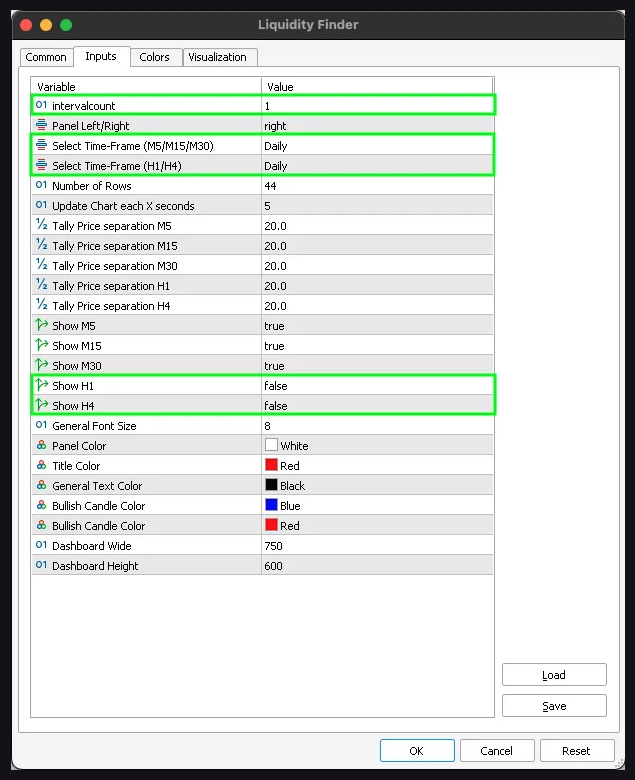

Day Buying and selling Settings: Regulate the time frames of M5, M15, and M30 to show Each day knowledge, with the interval rely set to 1. Disable the show of H1 and H4 time frames. This configuration will present the assist, resistance, and liquidity ranges for the current day.

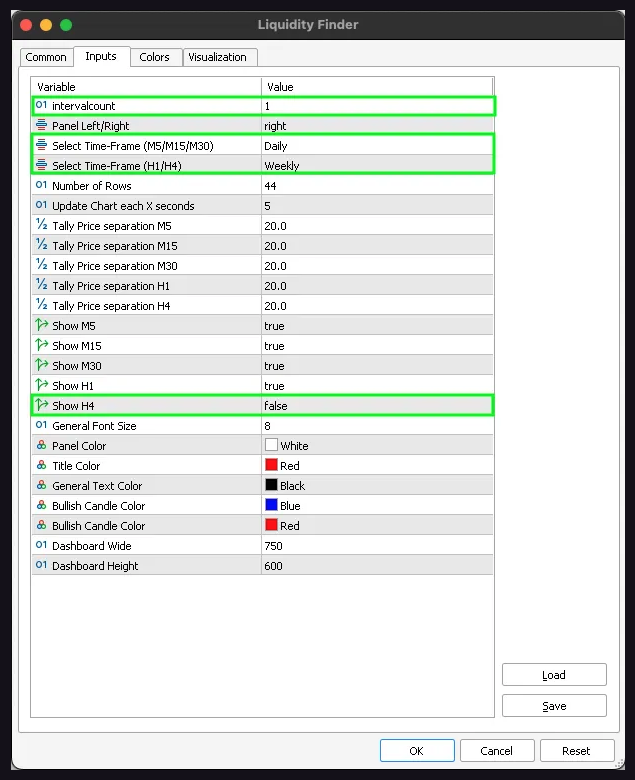

Day Buying and selling Settings: Regulate the time frames of M5, M15, and M30 to show Each day knowledge, H1 and H4 to show weekly knowledge with the interval rely set to 1. Disable the show of H4 timeframe. This configuration will present the assist, resistance, and liquidity ranges for each the current day and the current week on the H1 timeframe.

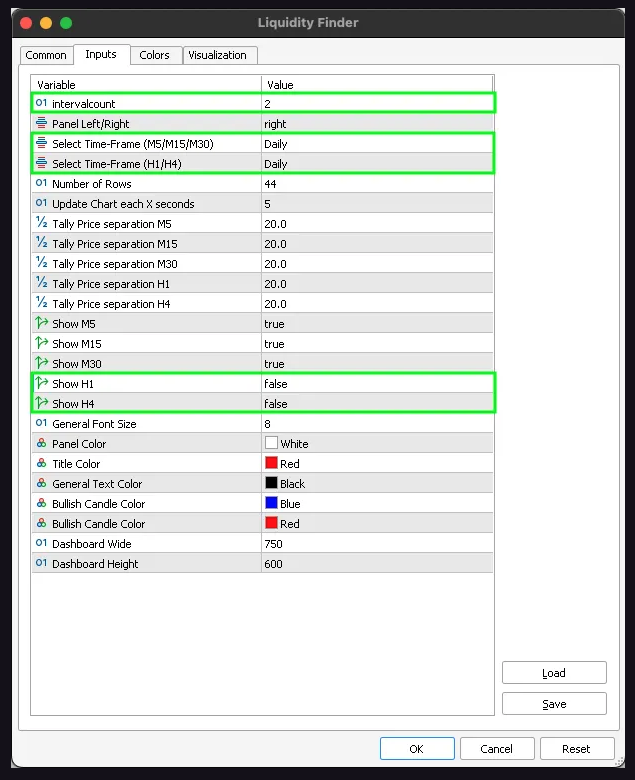

Day Buying and selling Settings: Regulate the time frames of M5, M15, and M30 to show Each day knowledge, with the interval rely set to 2. Disable the show of H1 and H4 time frames. This configuration will present the assist, resistance, and liquidity ranges for the current and former day.

Tally Value Separation: 20.0 (Each day & Weekly)

Tally Value Separation: 10.0 (Each day)

Tally Value Separation: 20.0 (Weekly)

Tally Value Separation: 5.0 (Each day)

Tally Value Separation: 10.0 (Weekly)

Tally Value Separation: 25.0 (Each day)

Tally Value Separation: 50.0 (Weekly)

Tally Value Separation: 2.5 (Each day)

Tally Value Separation: 5.0 (Weekly)

Tally Value Separation: 0.0002 (Each day)

-

EUR/USD

-

GBP/USD

-

CHF/USD

-

AUD/USD

-

USD/CAD

-

NZD/USD

Tally Value Separation: 0.0005 (Weekly)

-

EUR/USD

-

GBP/USD

-

CHF/USD

-

AUD/USD

-

USD/CAD

-

NZD/USD

Tally Value Separation: 0.05 (Each day)

Tally Value Separation: 0.1 (Weekly)

Tally Value Separation: 0.05 (Each day & Weekly)

Tally Value Separation: 2.0 (Each day & Weekly)

Tally Value Separation: 0.1 (Each day)

Tally Value Separation: 0.2 (Weekly)

Tally Value Separation: 0.2 (Each day & Weekly)

Tally Value Separation: 0.05 (Each day & Weekly)

Tally Value Separation: 50.0 (Each day)

Tally Value Separation: 100.0 (Weekly)

Tally Value Separation: 5.0 (Each day & Weekly)

Tally Value Separation: 0.002 (Each day)

Tally Value Separation: 0.005 (Weekly)