Schroders Capital chief funding officer Nils Rode has outlined the agency’s funding priorities, heading into the second quarter of 2024.

Rode mentioned debt and credit score alternate options stay engaging, as rates of interest keep excessive and banks, significantly within the US and Europe, proceed to retreat.

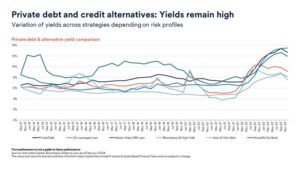

“As danger premiums within the liquid debt market have collapsed, non-public debt and credit score seem very engaging,” he mentioned. “We favour investments providing excessive revenue and benefiting from capital provision inefficiencies.”

These embrace defensive revenue from infrastructure debt with low-volatility money flows, opportunistic revenue from sectors with misery that causes emotional bias, uncorrelated revenue from sectors akin to insurance-linked securities, and revenue capitalising on modifications in financial institution regulation, akin to asset-based finance or microfinance.

Learn extra: Schroders boosts non-public debt crew with double rent

“With many syndicated markets rallying in quarter 4, yield unfold premiums have considerably diminished, even in beforehand cheaper liquid markets like collateralised mortgage obligations and asset-backed securities,” Rode mentioned.

He added that insurance-linked securities are beneficial for portfolio diversification as a result of their lack of correlation with macroeconomic situations and supply engaging returns as a result of greater yields pushed by reinsurance limitations.

He additionally pointed to asset-based finance as a key space as a result of its range and the advantages of Basel III impacts within the US. Alternatives embrace tools, client, and housing, and might be accessed immediately, by way of financing, or by way of danger switch mechanisms akin to financial institution capital reduction.

“As buyers face extensions of their conventional non-public debt ebook’s maturity, methods producing money stream, significantly with near-term revenue or capital return – as is the norm in asset-based finance – are in higher demand,” he mentioned.

Learn extra: Non-public markets turn out to be ‘a mainstay’ of insurance coverage portfolios

Speaking extra typically in regards to the outlook for the second quarter of 2024, Rode mentioned non-public markets had “largely reverted to pre-pandemic ranges when it comes to fundraising, funding exercise, and valuations, making a beneficial surroundings for brand new investments”.

Nevertheless, he mentioned the place 2023 has seen fundraising focused on giant funds, Schroders is in search of small and mid-sized non-public market methods.

Wanting additional forward he mentioned rates of interest have been more likely to stay greater for longer, however easing inflation and potential rate of interest cuts would supply a tailwind for personal market investments within the quick to mid-term.

“That is very true for actual property, the place vital valuation corrections have occurred, and our proprietary valuation frameworks recommend that 2024 and 2025 could also be engaging years for brand new investments,” he added.

Regardless of a broadly optimistic outlook for personal markets, Rode flagged ongoing geopolitical dangers, home political tensions, and dangers from ongoing conflicts, making it vital to keep up selectivity and sturdy diversification inside non-public market allocations.

Learn extra: Schroders Capital hires world head of enterprise improvement and product