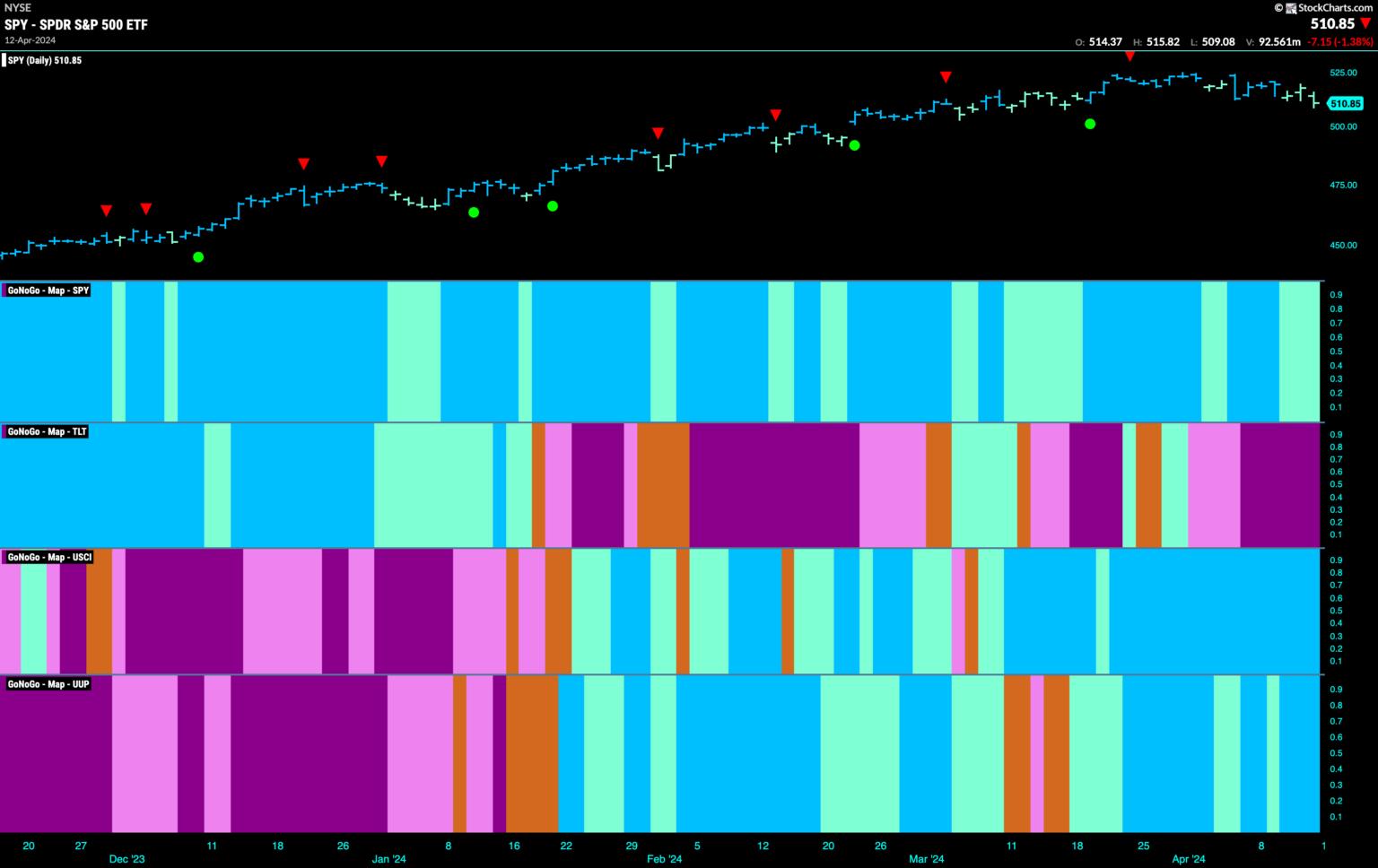

Good morning and welcome to this week’s Flight Path. The fairness “Go” pattern continued this week however we noticed some weak spot as GoNoGo Pattern paints a string of weaker aqua bars to shut out the week. We’ve not seen a brand new excessive in a number of weeks and so we are going to watch this week to see if the “Go” pattern can maintain. Treasury bond costs maintained the “NoGo” power that we noticed final week as we noticed a string of uninterrupted darkish purple bars. The commodity index continued to reveals power this week as blue “Go” bars reigned supreme. The greenback additionally had a really sturdy week because it regained shiny blue bars and hit new highs.

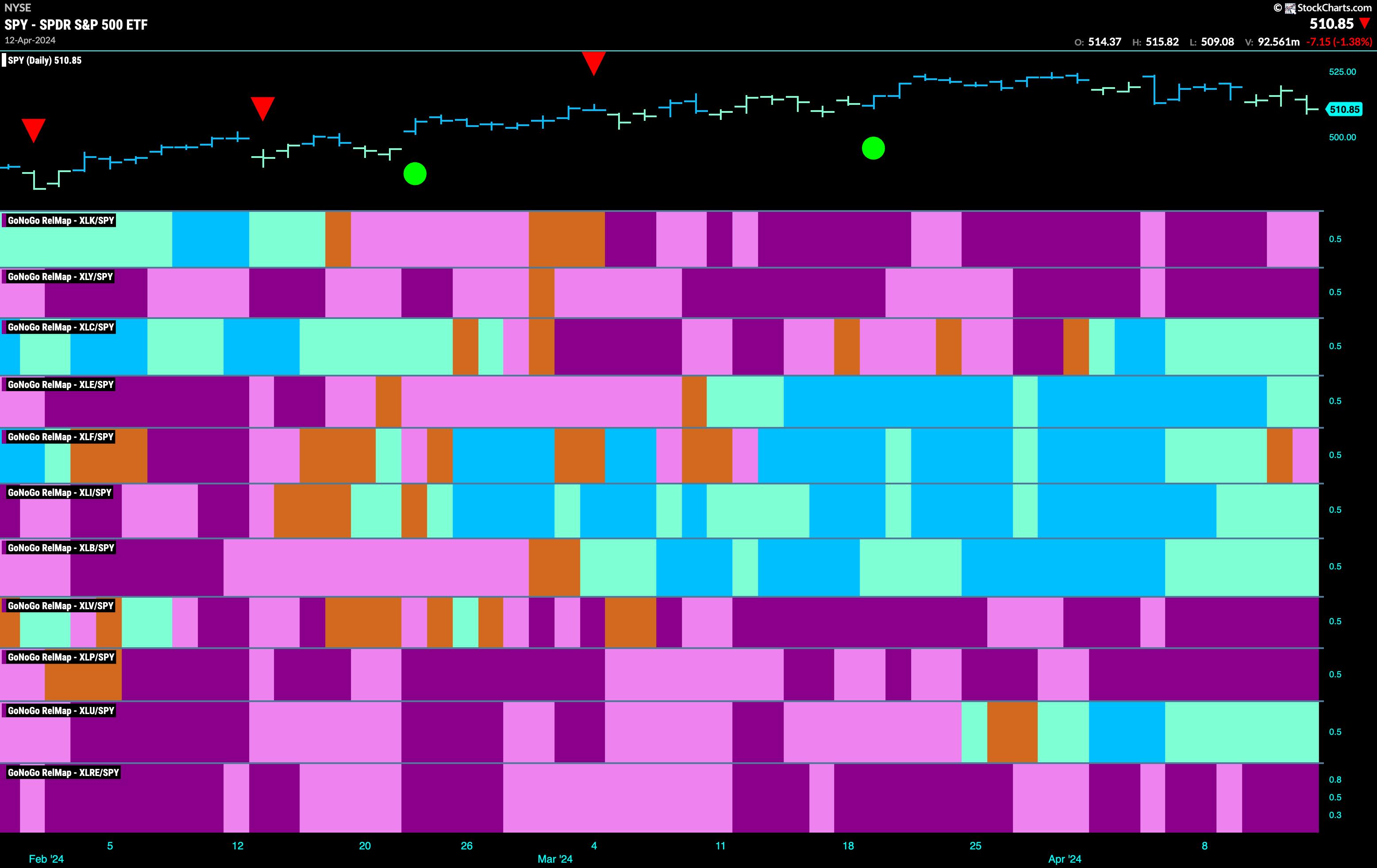

Equities Hanging on by a Thread to “Go” Pattern

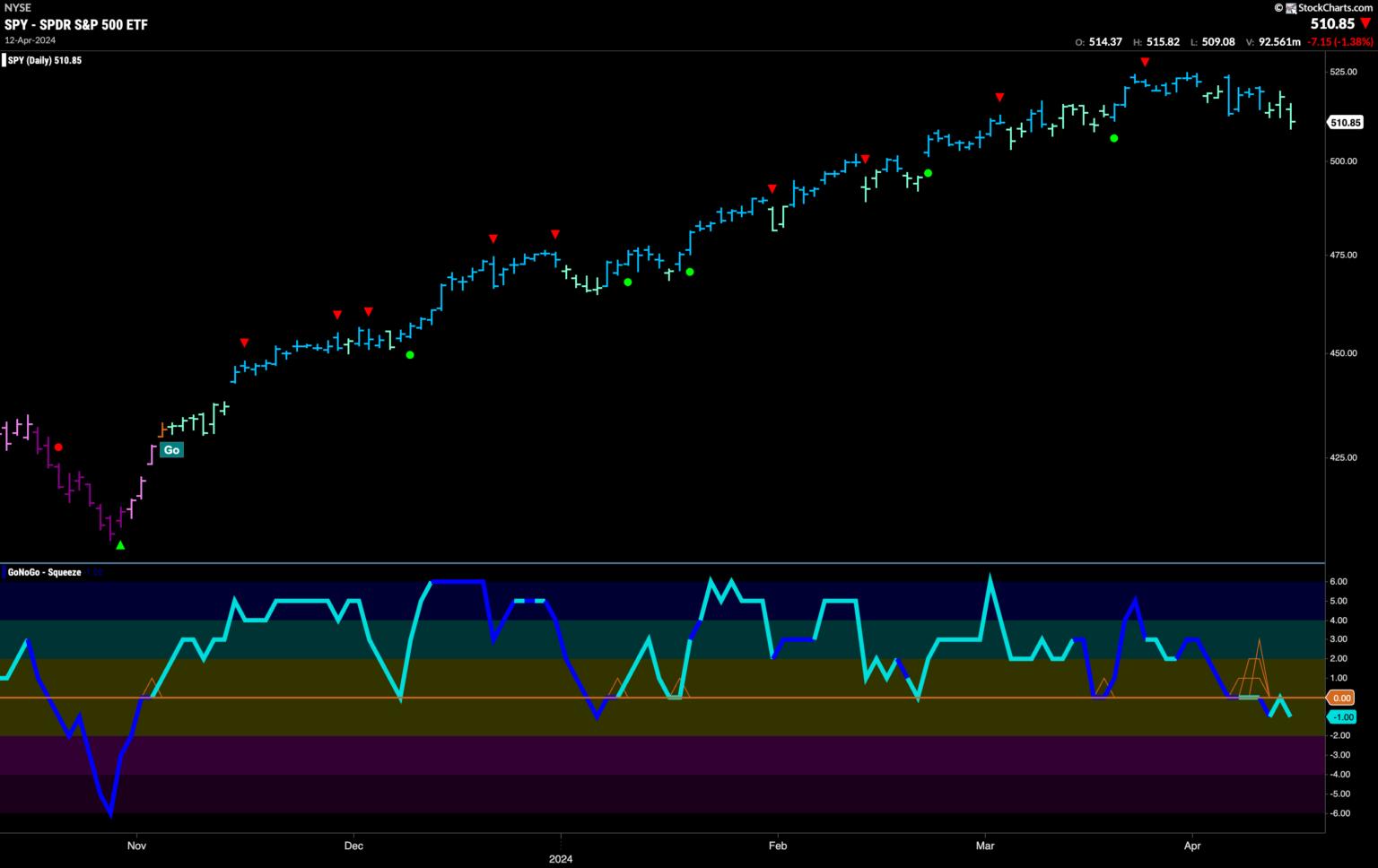

For the reason that final Go Countertrend Correction Icon (crimson arrow) have seen worth wrestle to go larger. Certainly, we have now fallen from these highs and began to color a extra weaker aqua bars of late. That is the strongest risk to the “Go” pattern we have now seen in a number of months. GoNoGo Oscillator fell to the zero line and it has struggled to regain constructive territory. In reality, we have now seen it dip into unfavourable territory and even a fast retest of that stage. The oscillator was turned away by zero again into unfavourable territory which implies that momentum is out of step with the “Go” pattern. We are going to need to see the oscillator regain constructive territory if the “Go” pattern is to outlive.

We see a primary crack within the armor of the weekly “Go” pattern. One other decrease shut was painted a weaker aqua shade by GoNoGo Pattern. As GoNoGo Oscillator falls from overbought territory we see a Go Countertrend Correction Icon (crimson arrow) telling us that worth could wrestle to go larger within the brief time period. If we flip our eye to the decrease panel we will see that GoNoGo Oscillator is falling sharply. We are going to watch carefully because the oscillator approaches the zero line. We might want to see the oscillator discover assist at that stage as we all know that in a wholesome “Go” pattern the oscillator ought to keep at or above zero.

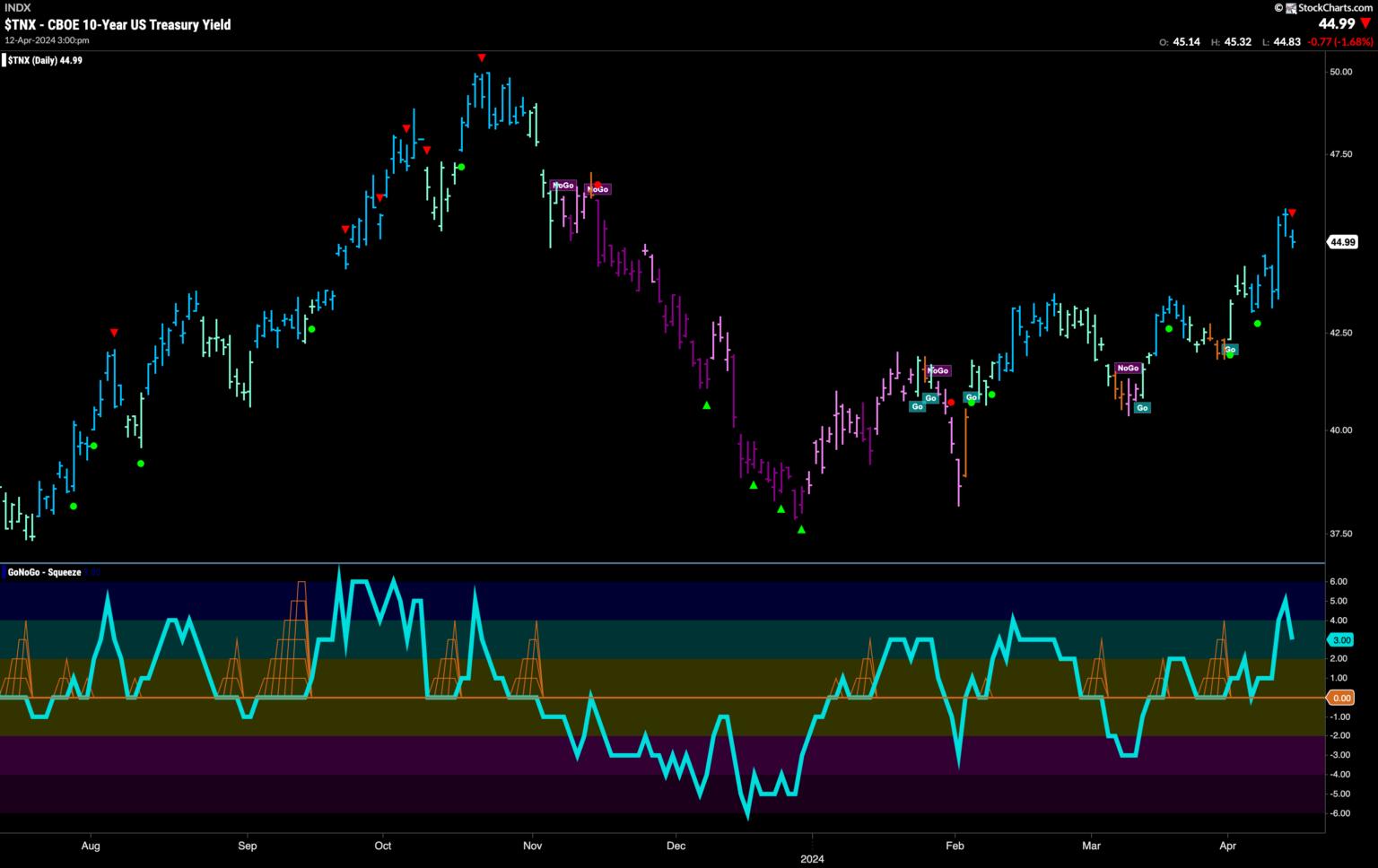

Charges Set One other Larger Excessive

Every week of uninterrupted sturdy blue “Go” bars sees worth set one other larger excessive this week on the each day chart of U.S. treasury charges. We do see a Go Countertrend Correction Icon (crimson arrow) which signifies worth could wrestle within the brief time period to go larger. Maybe a pause then, as GoNoGo Oscillator turns round and heads for the zero line. As worth momentum cools, and worth falls from its latest excessive, we are going to watch to see if the oscillator finds assist because it drops to the zero line.

Greenback Soars this Week as Worth Jumps to New Highs

What a bounce for the greenback within the second half of the week. It was no shock that worth pulled again after the Go Countertrend Correction Icon (crimson arrow) and in order we recognized a bit of pattern weak spot as a result of aqua “Go” bars. It was then vital to look at the oscillator panel because it examined the zero line on heavy quantity (darker blue oscillator line). Rapidly discovering assist, it rallied again into constructive territory and that gave worth the push it wanted to hole larger twice in 3 days and cement new highs.

The long run chart reveals that we have now clearly damaged above a powerful resistance stage that has been on the chart since October of 2023. With open skies forward, and momentum surging within the route of the “Go” pattern we are going to search for worth to consolidate at these ranges and doubtlessly transfer larger. GoNoGo Pattern is portray sturdy blue “Go” bars for a 4th consecutive week.

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing using information visualization instruments that simplify market evaluation to take away emotional bias from funding choices.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise buyers’ mastery and ability in mitigating market danger and maximizing return in capital markets. He’s a seasoned enterprise govt centered on academic know-how for the monetary providers trade. Since 2011, Tyler has offered the instruments of technical evaluation world wide to funding corporations, regulators, exchanges, and broker-dealers.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product improvement of analytics instruments for funding professionals.

Alex has created and applied coaching applications for giant firms and personal purchasers. His educating covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Study Extra