KEY

TAKEAWAYS

- The potential for just one rate of interest lower and escalation of geopolitical tensions will increase uncertainty ranges for buyers

- The 100-day easy shifting common might be the S&P 500’s subsequent help degree

- Huge selloff in Tech shares sends the Nasdaq Composite under its 100-day shifting common

What a distinction per week makes.

Final week, the inventory market modified its tune from up, up, up,… to up, down, up, down. That made it really feel like buyers have been unsure, but the CBOE Volatility Index ($VIX) wasn’t excessive sufficient to verify the concern. This week, the market’s singing one other tune emphasizing the phrase “down.” This week, the promoting stress was extra dominant, particularly within the Tech sector. Does this imply the bear is popping out of hibernation?

The Macro Surroundings

We heard feedback from two Federal Reserve Presidents, John Williams and Austan Goolsbee, who left open the potential of a fee hike. Fed Chair Jerome Powell prompt rates of interest might stay increased for longer. Subsequent week, we’ll get the March PCE information, and, in mild of the Fed feedback, it might be increased than estimates.

We’ll additionally get the Q1 GDP, which is able to in all probability reveal the continued energy of the US economic system. If the economic system continues to be resilient, we might not see a fee lower this yr. As of now, the inventory market has priced in a minimum of one fee lower in 2024, which is completely different than the 4 that have been anticipated earlier within the yr.

In a “increased for longer” rate of interest setting, two occasions that might have intensified the promoting stress on the finish of the week are:

- Escalating geopolitical tensions within the Center East, which, in the meanwhile, have tapered.

- Choices expiration day, which suggests heavy buying and selling quantity.

No person desires to open new positions on a Friday, particularly after a risky buying and selling week. Something might occur over the weekend, and merchants would quite be affected person and wait to see if the inventory market has additional to fall earlier than leaping in.

The Broader Market

You have heard the adage, “Markets take the steps up and the elevator down.” You’ll be able to see this play out within the charts of the broader indexes.

The S&P 500

The S&P 500 ($SPX) closed under 5,000, a big psychological degree. On the day by day chart, the index broke under its 50-day easy shifting common (SMA) and is now approaching its 100-day SMA. The final six days have been an elevator journey down and, the best way the chart appears, there might be extra promoting subsequent week.

FIGURE 1. DAILY CHART OF THE S&P 500. Because the S&P 500 fell under its 50-day SMA, it is taken the elevator down. The index is now approaching its 100-day SMA, which might be its subsequent help degree. Will it fall under the help?Chart supply: StockCharts.com. For instructional functions.

On the weekly chart, the S&P 500 is above its 50-week SMA, however has three consecutive down weeks, which does not paint a fairly image. Proper now, it appears as if the index has additional to fall.

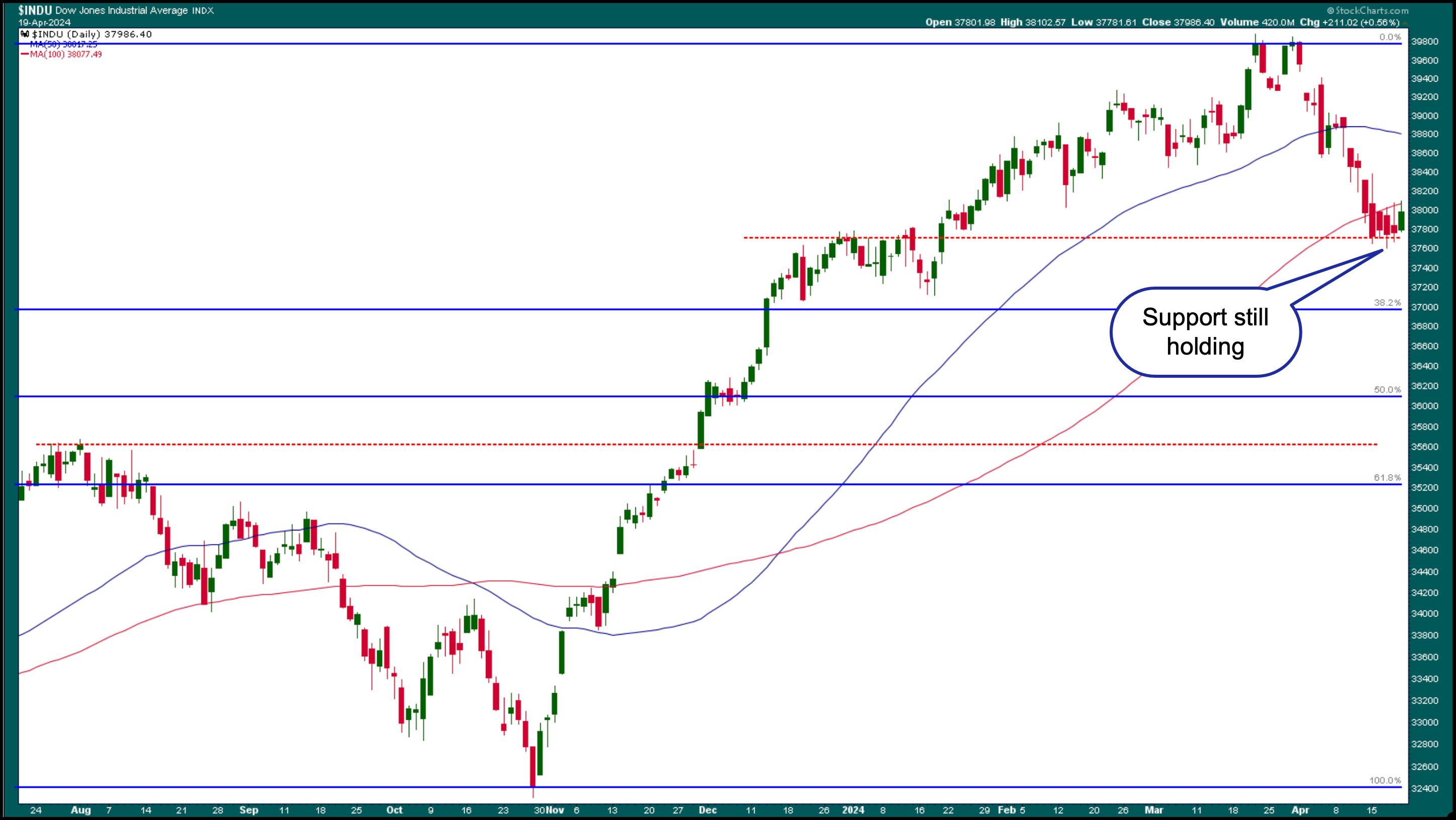

The Dow Jones Industrial Common

After its most up-to-date selloff, the Dow Jones Industrial Common ($INDU) is buying and selling round a help degree (December 2023 excessive). The day by day chart under reveals that regardless that the index closed increased on Friday, it hit resistance from its 100-day SMA.

FIGURE 2. DAILY CHART OF DOW JONES INDUSTRIAL AVERAGE ($INDU). After its elevator journey down, $INDU seems to have hit a help degree and making an attempt to reverse, which is a optimistic signal.Chart supply: StockCharts.com. For instructional functions.

The Nasdaq Composite

The Expertise sector was hit laborious this week. NVIDIA (NVDA) fell over 9% on Friday; Tesla (TSLA) shares continued to fall, hitting a brand new 52-week low; and Superior Micro Gadgets (AMD) fell over 5%.

Tremendous Micro Computer systems (SMCI), which has been within the prime 5 StockCharts Technical Rank (SCTR) for months, fell over 23%. The selloff was attributable to the corporate’s determination to not preannounce its earnings outcomes because it has prior to now.

Appears to be like like buyers have been taking their Tech inventory earnings. On account of the massive Tech selloff, the Nasdaq Composite is buying and selling under its 100-day SMA (see chart under).

FIGURE 3. DAILY CHART OF NASDAQ COMPOSITE. After falling under its 100-day SMA, the Nasdaq Composite might slide to its 200-day SMA. The small wick on the backside is barely encouraging, however subsequent week is one other week.Chart supply: StockCharts.com. For instructional functions.

Every time there is a large selloff, as was the case this week, buyers query whether or not the market has hit a backside and if it is an excellent time to open lengthy positions. There was a bit little bit of that on Friday, however each time the market rallied, it met stress from sellers and the rally fizzled. When technicals nonetheless level decrease, chances are you’ll need to undertake a “wait and see” method earlier than getting into lengthy positions.

No person is aware of what’s going to occur subsequent week, however tech firms will begin reporting earnings, and that might carry the inventory market.

Some Vibrant Spots

After experiencing a plunge much like that of the broader indexes, the Monetary sector is displaying indicators of a reversal. The day by day chart of the Monetary Choose Sector SPDR (XLF) under reveals a attainable reversal, though a collection of upper highs and better lows is required earlier than an uptrend may be established. XLF would want to interrupt above.

FIGURE 4. DAILY CHART OF FINANCIAL SELECT SECTOR SPDR ETF (XLF). Appears to be like like XLF should overcome the resistance from its 50-day shifting common earlier than its development reverses.Chart supply: StockCharts.com. For instructional functions.

Shares of Financial institution of America (BAC), JP Morgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) all traded increased on Friday. WFC’s inventory worth reached a brand new all-time excessive. Valuable metals, akin to gold and silver, are buying and selling increased. As geopolitical tensions come up, buyers flip to those safe-haven investments.

It was fascinating to see the CBOE Volatility Index ($VIX) hit a excessive of 21.36, near the 23 degree it hit in October final yr. But it surely pulled again and closed at 18.71. The upper volatility might have been due to choices expiration.

Should you have a look at the chart of the Nasdaq Composite, you may see that this coincided with the October selloff in Tech shares. Will the broader markets observe the same path, given Tech earnings begin subsequent week? We’ll have to attend and see.

The Backside Line

This week’s inventory market motion wasn’t nice, and whereas it is tempting to search out bargains in shares, it is best to train endurance. As an alternative of chasing positions, it is a wonderful time to investigate charts and observe the market’s actions. This will go a great distance in understanding the irrational nature of the inventory market.

Finish-of-Week Wrap-Up

- S&P 500 closes down 0.88% at 4,967.23, Dow Jones Industrial Common up 0.56% at 37,986; Nasdaq Composite down 2.05% at 15,282.01

- $VIX up 3.94% at 18.71

- Greatest performing sector for the week: Utilities

- Worst performing sector for the week: Expertise

- Prime 5 Massive Cap SCTR shares: MicroStrategy Inc. (MSTR); Coinbase World Inc. (COIN); Tremendous Micro Pc, Inc. (SMCI); Vistra Power Corp. (VST); Vertiv Holdings (VRT)

On the Radar Subsequent Week

- Q1 2024 US GDP

- March Core PCE

- March Sturdy Items Orders

- Earnings season is in full swing with Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Intel Corp. (INTC), and Visa (V) reporting.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.