The top of analysis on the on-chain analytics agency CryptoQuant has defined why promoting stress from Bitcoin merchants could also be declining.

Bitcoin Brief-Time period Holder Realized Value Has Risen To $60,000

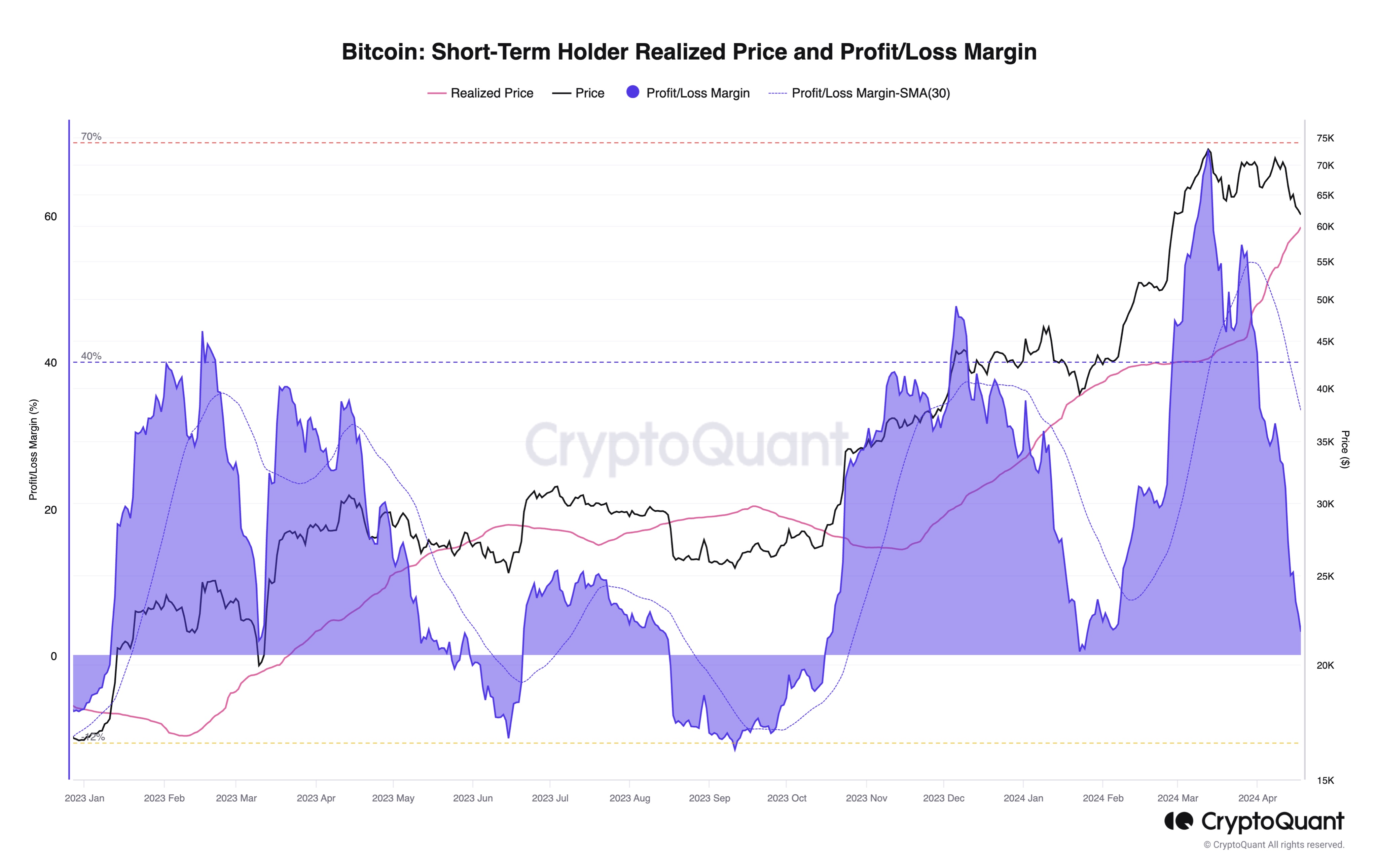

In a brand new put up on X, CryptoQuant head of analysis Julio Moreno has mentioned why the short-term holder promoting stress could also be declining for BTC. The “short-term holders” (STHs) check with the Bitcoin traders who’ve been holding onto their cash since lower than 155 days in the past.

The STHs embody the “merchants” of the market who make many strikes inside quick durations and don’t are likely to HODL their cash. This group will be fairly reactive to market actions, simply panic promoting every time a crash or rally takes place.

Typically, traders in income usually tend to promote their cash, so one strategy to gauge whether or not the STHs could be seemingly to participate in a selloff is thru their revenue/loss margin.

Right here, Moreno has cited the revenue/loss margin of this cohort based mostly on its realized value.

The realized value of the group seems to have been going up in current weeks | Supply: @jjcmoreno on X

The STH realized value (highlighted in pink) right here refers back to the common value foundation or acquisition value of the traders a part of this cohort calculated utilizing blockchain transaction historical past.

When the spot worth of the cryptocurrency is above this degree, it signifies that these holders as an entire are sitting on some internet income proper now. Alternatively, the value being beneath the metric implies the dominance of losses.

From the above chart, it’s seen that Bitcoin has been above the STH realized value for the previous few months, which means that these merchants have been having fun with income.

That is typical throughout bull markets as the value retains pushing up, letting these traders make income. Whereas STHs have a tendency to remain within the inexperienced in these durations, tops do develop into possible to happen if these income get excessive.

As is clear within the graph, the revenue/loss margin spiked to important ranges simply as BTC set its newest all-time excessive, which continues to be the highest to date.

Not too long ago, as Bitcoin has consolidated between the $60,000 to $70,000 vary, the STH realized value has quickly risen, now attaining a worth of round $60,000. This happens as a result of as STHs have traded on this vary, their acquisition costs have been repriced at these greater ranges, thus pushing up the common.

BTC has been fairly near this degree lately in order that the STHs wouldn’t be holding that a lot revenue now. “Bitcoin promoting stress from merchants could also be declining as unrealized revenue margins are principally zero now,” notes the CryptoQuant head.

BTC Value

Bitcoin has continued to point out motion contained inside its current vary as its value remains to be buying and selling round $65,200.

Seems like the value of the asset has rebounded prior to now day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal threat.