Ethereum (ETH) stands as a bellwether for the business’s ebbs and flows. As of press time, Ethereum was buying and selling at $3,174, its value making an attempt to succeed in the essential $3,000 mark. Nonetheless, beneath the floor of those seemingly secure waters lies a fancy interaction of market forces and investor sentiment.

Supply: CoinMarketCap

Ether’s Difficult Trajectory

Since final week, the decrease timeframes have seen repeated breaches of the $3,000 psychological threshold, and the keenness surrounding the altcoin king has considerably waned.

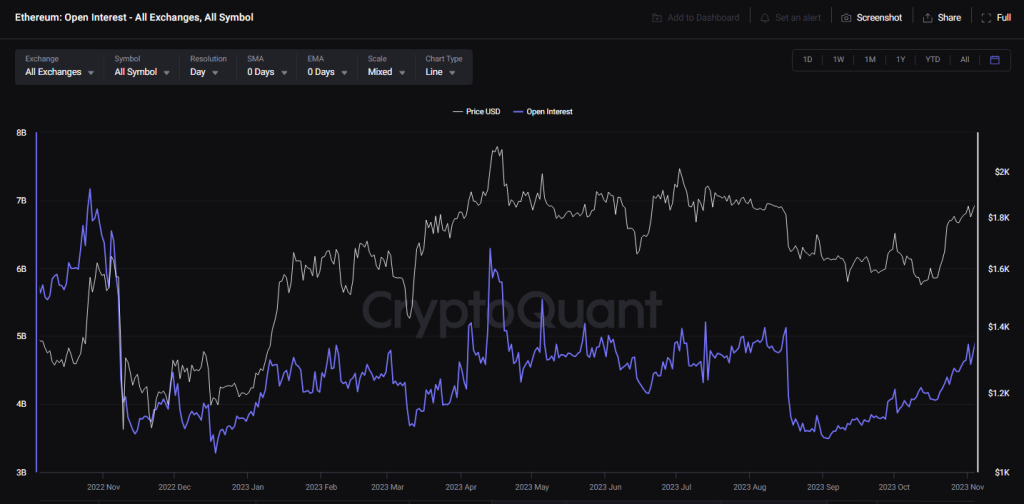

This downward stress is additional underscored by the notable drop in Open Curiosity (OI) behind ETH futures contracts, which plummeted from $10 billion to $7 billion in April alone.

Such a decline suggests a recalibration within the futures market, probably signaling a cooling-off interval for speculative buying and selling exercise.

Supply: CryptoQuant

Navigating Uneven Waters

Nonetheless, amidst the uncertainty, there exists a glimmer of hope for ETH bulls. Historic precedents, such because the mid-February 2021 correction, provide perception into the resilience of Ethereum’s value.

Following an analogous dip from an all-time excessive of $1,900 to $1,400, Ethereum skilled a V-shaped reversal, demonstrating the market’s propensity for swift recoveries. This historic context serves as a guiding gentle for traders navigating the uneven waters of cryptocurrency volatility.

Whole crypto market cap at present at $2.3 trillion. Chart: TradingView

On the social sentiment entrance, Ethereum’s trajectory has been a story of two halves. Whereas sentiment was strongly constructive in February and briefly in mid-March, a detrimental sentiment has dominated as costs entered a correction part. Components reminiscent of excessive fuel charges on the Ethereum community have seemingly contributed to this shift, highlighting the influence of sensible issues on market sentiment.

Ethereum: Basic Metrics

Inspecting Ethereum’s basic metrics gives additional insights into its present state. Community development has slowed in current months, signaling a possible decline in demand. Nonetheless, a more in-depth look reveals a silver lining: the 90-day imply coin age has trended steadily larger since late March, indicating a network-wide accumulation of ETH.

Ether value motion within the final 24 hours. Supply: CoinMarketCap

As Ethereum continues to navigate these turbulent waters, all eyes are on key resistance ranges. Breaking above the $3,300 barrier might instill confidence amongst merchants and traders, probably heralding a brand new wave of bullish momentum. Nonetheless, uncertainties loom giant, notably in gentle of the broader market dynamics and the promoting stress on Bitcoin, Ethereum’s perennial counterpart.

Whereas challenges abound and uncertainties persist, Ethereum’s historic efficiency and basic strengths provide hope for a brighter future. As traders brace for potential headwinds and alternatives alike, Ethereum stands poised to climate the storm and emerge stronger on the opposite aspect.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.