KEY

TAKEAWAYS

- Worth shares are taking on the lead from progress

- When Worth beats progress, the S&P 500 normally doesn’t do too properly

- The power of worth is surfacing throughout all dimension segments of the market

- Vital assist areas for SPY at 480 and 460

Worth taking the lead from progress

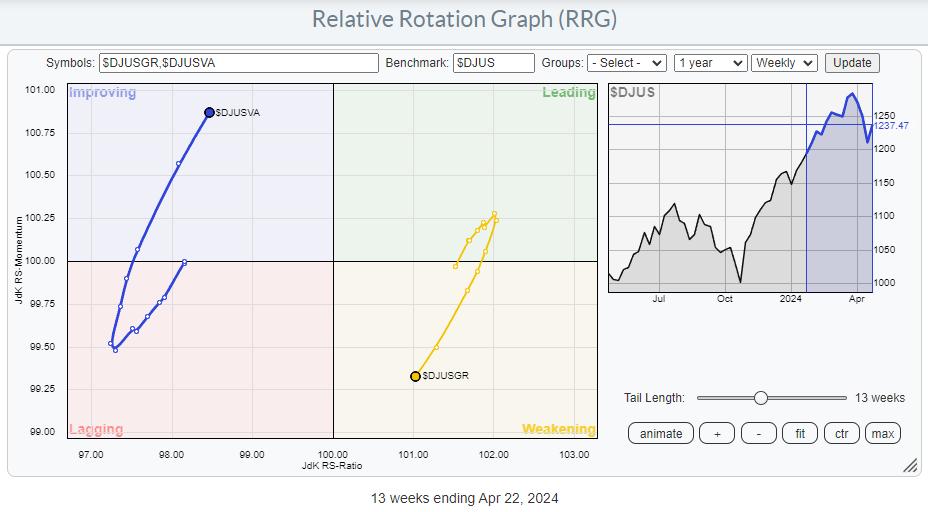

The weekly RRG above reveals the rotation for Progress vs Worth shares. The benchmark is the DJ US index. The current rotation clearly reveals the rotation out of progress into worth, taking form and choosing up steam. For now, Progress continues to be positioned on the right-hand aspect of the RRG, however the $DJUSGR tail is quickly heading towards the lagging quadrant at a damaging RRG-Heading.

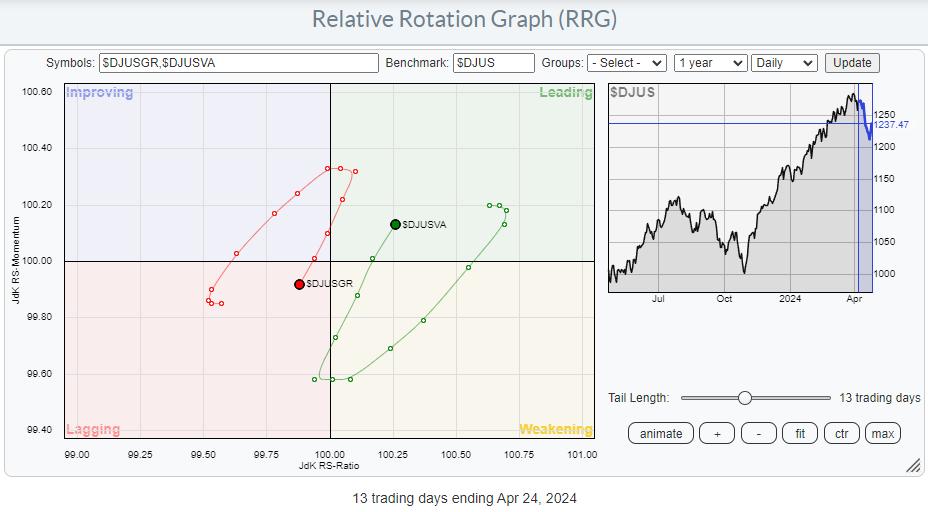

The every day model of this RRG underscores the desire for Worth shares.

The $DJUSVA tail dropped into the weakening quadrant after a rotation by means of main since mid-March and sharply hooked again up after someday contained in the lagging quadrant and is now returning into the main quadrant, supporting an additional strengthening for the Worth tail on the weekly time frame.

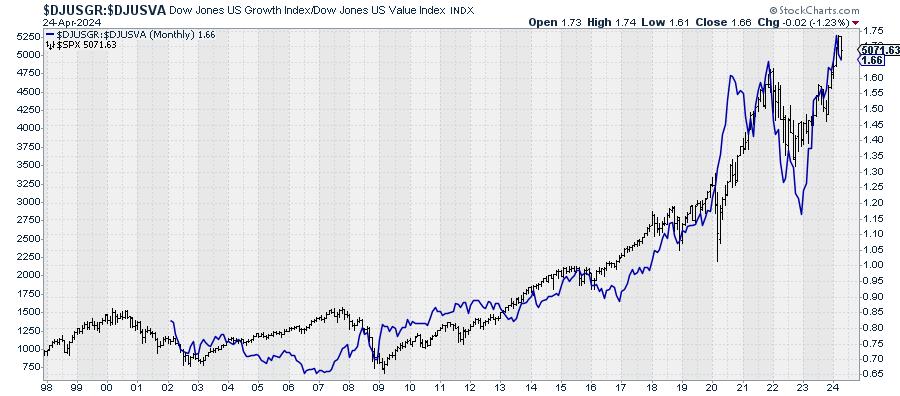

$SPX normally tracks the Progress/Worth ratio fairly good

Plotting the Progress/Worth ratio on high of the worth chart for $SPX reveals that they’ve tracked one another fairly properly over time. This can be a month-to-month chart, so we’re discussing long-term traits right here.

The principle takeaway right here is that the S&P normally does properly when the expansion/worth ratio goes up and fewer properly when the ratio strikes decrease.

With the RRG presently displaying a powerful desire for Worth shares, warning is warranted as this may be the precursor for an additional decline within the S&P 500 itself.

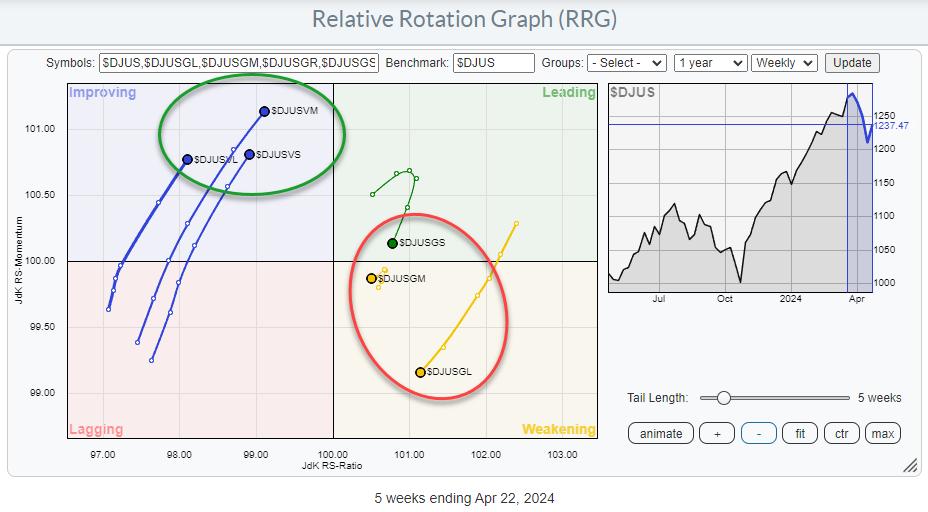

The desire for worth over progress reveals up throughout all dimension segments

After we break down the Progress and Worth segments into their respective dimension buckets, we get the RRG above. This reveals that worth beats progress throughout all dimension segments. Giant-, Mid-, and Small-cap Worth tails are all contained in the bettering quadrant and transferring at a optimistic RRG-Heading.

The expansion tails are barely extra divided, however all three are on a damaging RRG-Heading, with large-cap progress displaying the quickest deterioration. Mid-Cap is essentially the most steady, with its quick tail simply contained in the weakening quadrant. Whereas small-cap progress shares have rolled over contained in the main quadrant and are beginning to head decrease on each scales.

All in all, this underscores the necessity for warning concerning value developments for the S&P 500 within the coming weeks.

5%-10% draw back threat inside long-term uptrend

On the weekly chart, SPY discovered assist on the degree of the previous rising resistance line at round 494. Extra vital assist is discovered on the degree of the January-2022 peak at 480, and in case that breaks, the realm round 460 will present one other strong assist space. With the present longer-term development of upper highs and better lows nonetheless firmly in place, we have now to conclude that the uptrend continues to be in play.

However on the identical time, we have now to understand that inside that uptrend, a 5-10% decline is completely doable.

The extra detailed every day chart of SPY reveals that the decline from the current peak at 524 again to the low close to 495, which is one transfer decrease on the weekly chart, is already displaying decrease highs and decrease lows, which signifies that rallies now should be seen as up-ticks inside a downtrend till this construction adjustments once more.

The green-shaded areas characterize the assist ranges talked about on the weekly chart. New shopping for alternatives inside the long-term uptrend ought to begin to come up in these ranges.

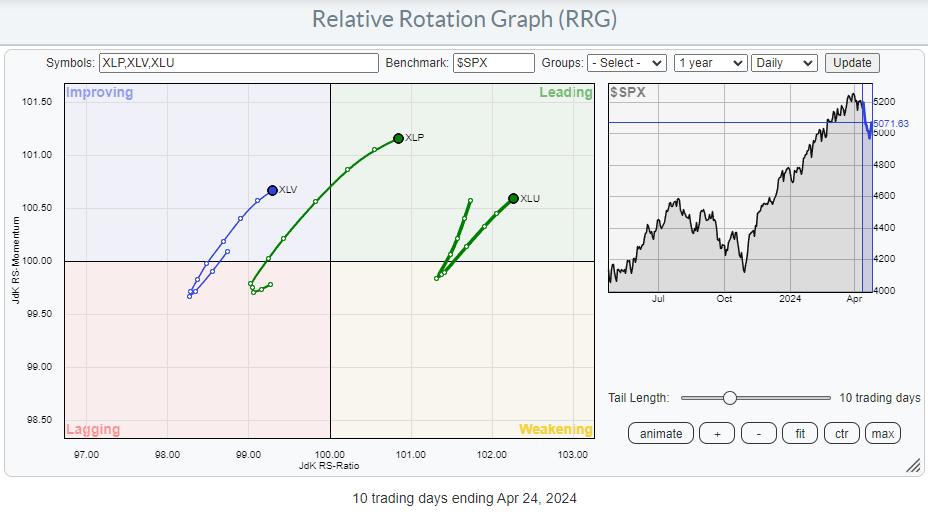

Rotation into defensive sectors confirms risk-off

Lastly, the every day RRG for defensive sectors reveals a speedy rotation into Well being care, Shopper Staples, and Utilities within the final two weeks of buying and selling, which confirms the necessity for warning within the coming weeks.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to every message, however I’ll definitely learn them and, the place moderately doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Be taught Extra